Tesla Charts is a FinTwit and Excel extraordinaire with an extensive background in solar technology, and a Ph.D. in a related field.

In October 2016 he recognized something was going to happen when Elon Musk delivered his Solar City pitch, and since 2018, his mission has been to unabashedly serve the confirmation bias of Tesla bears, as he explains in his Twitter account.

In this interview, we discuss the current stock market mania and the big disconnect there is between the fundamentals and stock price of Tesla.

But not only Tesla. We also discuss Nikola, Hertz, and how the Fed and the SEC have enabled unprecedented fraud with these stocks.

Tesla Charts reveals mind-blowing insights around Tesla's boom, Hertz rental car scam, and the consequences to the SEC's permissive regulations. Don't miss them.

🚨🚨🚨

Episode #36 of TC's Chartcast with @DonutShorts is live!

Join us for a fascinating discussion on the housing crisis, regulatory capture, Wirecard, Tesla and more!

Find it now on all major podcast platforms!$TSLAQ $WDI

cc @georgia_orwell_ @evacuationboy @PollsTesla pic.twitter.com/jATn4u3VkZ— TC (@TESLAcharts) July 26, 2020

The Story Behind Tesla Charts

George Gammon: All right, guys. It gives me a great deal of pleasure to bring someone to The Rebel Capitalist Show that I've really looked forward to talking to.

He is a rock star on FinTwit. His name is Tesla Charts. If you're not following him, you definitely need to right now. Mr. Charts, welcome to The Rebel Capitalist Show.

Tesla Charts: Thank you so much for having me, George. It's an unbelievable honor to be on your show. I've been a loyal subscriber to your channel for a very long time.

I very much enjoy your videos and it's a bit surreal to be a guest on your podcast. So I really appreciate the opportunity.

George Gammon: I appreciate the kind words.

I've listened to you quite often on our mutual friend, Chris Irons' podcast, Quoth the Raven, and you're one of my favorite guests, for sure.

You've got a very interesting backstory as to how you got involved with this whole FinTwit thing and Tesla. Can you walk us through that?

Tesla Charts: Absolutely.

This is all sort of an accident and an unbelievable series of events in my life. I'm not a finance person per se. I come from the corporate world. I'm a scientist by training.

I have a Ph.D. in one of the hard sciences, and I spent a couple of decades in corporate America, both doing research myself and then ultimately leading a very large team of technology experts.

I came to the Tesla name at a change point in my career, I'd done well enough and had thought about doing my own thing.

I was leaving corporate America and I decided to start this Twitter account almost as an experiment. I decided that I would just start commenting on Tesla because for a couple of years, I'd studied the company.

My big realization that something was amiss with the company came back in 2016 when Tesla announced to the world that it had developed a solar roof technology.

I happened to have a lot of experience in that space. I didn't really know much about Elon or the company, then I watched him reveal this great product and it occurred to me that nothing that he was saying was true.

This is what I call a ‘realization'. When Elon steps onto your field and spews nonsense, you have to look at him differently.

I was anxious to see this new product and was curious about SPACs.

Then when he revealed it, I knew at the moment that it was almost certainly a fake product and wasn't real.

It's just one of those “change your whole life blow away” moments where, you see this person that's held up as this genius, innovator, technology entrepreneur, and you see what they're doing for what it really is.

You just can't look at him or the company or any of their other technology proclamations the same way, and I haven't.

For about two years after that life-changing moment for me, I had in the back of my mind that there's something very wrong with this company. I started studying it.

Then I was simultaneously observing the whole FinTwit phenomenon grow. I was a lurker on Twitter.

I have another passion in life, which is, I'm very passionate about data visualization and how to distill complexity into a really easy to understand chart that captures the essence of the underlying situation.

When I put those two passions together and I just started Tesla Charts almost as a joke, I just wanted to get involved in the FinTwit community at this changing point in my career.

Then started my own business and decided it might be useful to get to know some people on Wall Street. I threw my hat in the ring and started tweeting on Twitter.

In the beginning, the account predominantly was about looking through Tesla's financials and comparing what the media was saying about Tesla versus the underlying financial realities.

That captured the attention of some people on Twitter and the account grew.

But ultimately, the account exploded after Elon himself came at me on Twitter and brought a lot of attention to the account because he was upset with some of the things that I was tweeting.

The rest is history. Here I am talking to George Gammon.

Caring For Our planet Shouldn't Be A Money-Making Opportunity

George Gammon: I want to be very clear. Prior to your awakening, it's not like you were some climate denier.

As they would say, you were not some teenage hillbilly out there that's rolling coal with your buddies on any Prius that you can find at a local street corner in your diesel truck.

You were very green, I guess, for lack of a better word, but you were very interested in electric technology, electric vehicles and solar power.

I want to be very clear. There are a lot of people who think, “Oh, this guy's coming on. That he's just one of these rednecks that we see that just doesn't care about the environment.” That's not true.

Tesla Charts: No. In fact, I'd spent the better part of my career researching alternative energy technologies, including solar cells. I was very familiar with the solar roof concept.

It's a seductive proposed solution to distributed power. I also just happened to know from experience that it is a very difficult problem to solve.

So, when you hear that, none other than the great innovator and brilliant genius Elon Musk announced to the world that he has found a solution, you get excited.

I had a very positive impression of Elon and Tesla prior to that evening when I saw what I saw. Also for the record, the car that I drive every day is a Chevy Volt, It's a plugin hybrid electric vehicle.

I think it's a fantastic solution to the problem of distributed pollution from automobiles.

The vast majority of my driving miles are done on the battery, but if I ever run out of battery, I have a backup internal combustion engine which removes range anxiety. It's a great platform.

I'm disappointed that General Motors has canceled it. I drive what is effectively an electric vehicle. I'm very much pro-environment.

I do believe that capitalism left completely unregulated. It will fail to price in externalities of clean water, clean air, and the general wellbeing of the planet.

I do think there's a role for government in policing large corporations as they participate in our society, but actually it's quite the opposite.

I happened to know a lot about the technologies that are viable, environmentally friendly alternatives to the current way in which we live, and big proponents of them.

When you pervert those for your own personal financial gain, you actually do that entire vector a disservice.

Quite the opposite of being Big Oil. I come at this problem personally offended at people taking advantage of society's desire to generate more value from the ESG movement for their own personal gain.

That's what I see going on today in the market, which is a lot of the Wall Street money types, with this desire of society to do what they can to leave a better planet for their children and their grandchildren…

And they see that as just another moneymaking opportunity. I believe that's what's actually going on with Tesla.

Simple Ways To Contribute To The Planet

George Gammon:

-

What do you think the real opportunities are in this space?

Because for people who might be more interested in the fundamentals, and I'm not going to lump everyone together, but typically people who like to watch my channel are anti-Fed.

Anti quantitative easing, they like hard money, whether that's gold, silver, or Bitcoin. Generally, those types of people are less about hype and more about, “Okay, well, where's the profit?”

-

So within that space, where do you see real opportunities right now?

Tesla Charts: I think it starts with how do you actually impact the individual civilian with the carbon footprint/environmental impact on the planet.

Then all the true value that you might derive from that comes from there. It's very simple type things, like building a home with much more insulation, putting solar panels on your home.

Not necessarily in the form of a solar roof, but with a very good solid battery pack combined so that you can take advantage of the fact that the demand for electricity scales with the sunlight in your area.

For example, a plugin electric hybrid vehicle, in my case, the first 50 miles that I drive are done on the battery. I rarely drive more than 50 miles in a day.

I have personally eliminated 95 plus percent of my gasoline use while I still have a car that drives.

It has 350 miles of total range because the internal combustion engine that's a backup to it kicks in after 50 miles and it has 300 miles of range.

So, I can drive on a highway trip and not have to worry about getting recharged on the battery on the rare times that I do a highway trip just by filling up at a gas station along the way.

If you can cut 95% of your gasoline use and move most of it to the battery, you'd give up no other inconvenience relative to a full battery electric vehicle. I think that's a very sensible solution.

Tesla Charts: There is a legitimate environmental case for electric vehicles that is not very well articulated in the media, and that is the following.

Even if my electric vehicle is predominantly powered by electricity produced at a coal plant, it's a lot easier to collect the pollution at a central point in a coal plant, than it is to try to collect it from 200,000 vehicles spread all across the country.

So, the tailpipe is a more expensive solution to emissions, like knocks and other things that might come out of a typical internal combustion engine.

It's a lot easier to mandate that a coal facility, which is a point source, puts in scrubbers, does carbon capture and sequestration, and so on.

Preparing society for the point where we are willing to regulate coal plants because now we have all these electric vehicles out in the fleet is a very positive thing.

My skepticism of Tesla is not of electric vehicles, whether or not they are potentially a viable contributor to lowering the pollution of society overall.

If you asked me big to small installation in homes, lighting, LED versus traditional light bulbs, that's huge energy drawdown.

Basically, if you put white roofs on most of the facilities, you could substantially reduce our energy use across the planet.

There are so many more simple solutions to the problem than some of the more esoteric stuff that is being proposed today as being environmentally friendly.

I get offended when scientifically uninformed people are leveraging people's desire for a cleaner planet in a malicious way for their own enrichment.

That's where I came to this story. Quite the opposite of being a shell for Big Oil, I work for myself and I try to minimize my own carbon footprint, then I think deeply about technologies that might be viable.

If every single home on the planet was retrofitted with better insulation, we would radically reduce our carbon footprint beyond what's possible, even with considering big changes in transportation.

George Gammon: That's really interesting. I always get a kick out of people that say, “This guy's Big Oil,” or something like that.

I remember when I first started the YouTube channel, I'd have a few commenters here that would say, “Oh, this guy is from the deep state. Don't listen to this guy. He's a plant. He's a plant.”

I used to text the comments to my sister and we would sit there and laugh.

Tesla Charts: If I was connected to Big Oil and they were paying me, you think I'd have a Twitter account? I would just be home cashing my check. It'd be a break.

The Disconnect Between Tesla's Fundamentals And Its Stock Price

George Gammon: Exactly. Right now we've got some insanity going on in the markets with the valuations and what the retail, let's call them “investor”, using that term loosely, are buying right now.

I would consider a complete mania. I use Tesla occasionally in my videos, not really just to bash them or anything like this, because I don't understand it to the level that you do, of course.

I think their cars look pretty cool, they could be fantastic, I know they're amazing in the quarter-mile and I'm a big car guy myself. I love fast cars so I really appreciate what they do there.

I come at it from a standpoint, not necessarily that Tesla is a fraud, although I'd like to talk about that later, but more so that the price is just way out of whack with the actual fundamentals.

I know that you're a student of markets and you're a student of fundamental analysis.

Can you dive into why there's such a big disconnect or how large is the disconnect between the actual fundamentals of the business and the current stock price?

Tesla Charts: Sure. Prior to the last couple of weeks, one could have imagined that Tesla was the poster child for the disconnect between what stocks are trading for, as you like to say, price versus value.

I would say in the last month, we've seen Tesla as a piker compared to some of the things that are going on in the market today. We can get all that.

But, if you just isolate Tesla on a price to revenue basis, Tesla sells for about 30 times its competitors. There are only so many reasons why that can be.

If you just look at the revenue and profitability of Toyota or General Motors versus the revenue, the volume of cars sold, and the lack of profitability at Tesla, it is undeniably true that Tesla stock is one of the most overvalued securities in the history of the stock market.

Tesla's market cap enterprise value today is somewhere around the order of 200 billion. It's trailing 12 months revenue is on the order of 25 billion in shrinking, it's not a growth company.

We can talk about the myths around Tesla in a bit. Tesla sells roughly eight times revenue and for an automaker, that's an absurd valuation.

If you look at their peers, Honda, Toyota, General Motors, Nissan, they would all typically sell 4.3 to 0.6 times revenue.

Now, why do automakers grab such a low multiple? It's a terrible business. It's asset intense, it's a low margin, it's very cyclical, it's susceptible to recessions.

You have to spend an enormous amount of money on warranties and service because customers have come to expect excellence in all of their cars even if you're buying the entry-level models.

Rare is the automaker that earns its cost of capital across the cycle.

If the very best automakers in the world are selling at 0.5 times trailing 12 months revenue, why is Tesla selling at eight times trailing 12 months revenue? Basically order magnitude plus higher than its peers.

Well, it has to be that there's something different about Tesla. The Tesla bulls will tell you that Tesla is a technology company.

George Gammon: That's a data company. I hear that all the time. “You just don't get it, you bear, you just don't understand technology, you boomers.” It's all about data, Thomas driving robot-taxis.

In five years, none of us will own a car. Every car in the United States will be a Tesla all on their robot-taxi network, let's call it and all that money will be piling into Tesla.

They're like Google, or like Facebook. They're really a data company. They're not a car company.

The Reality Behind Tesla’s Boom

Tesla Charts: That's all nonsense. If I could leverage my net worth into betting against the reality of the projections, I would do it a hundred to one. we can unpack it.

First of all, there's more to the bull case than just that.

Actually the bull case starts with electric vehicles are the future, and Tesla will dominate. Because they have a huge headstart in batteries and electric vehicle drive trains.

George Gammon: He always talks about the charging network.

Tesla Charts: That's all nonsense too.

In order to execute a stock promotion scheme, and I don't mean that in the legal sense, you have to have a story. You have to sell a story.

You need a reason for why, as you said in your last video, which I loved, it's different this time.

If you're a Tesla bull, it's different this time. i.e.: Tesla shouldn't be valued like a Toyota, or a Honda, or a GM because electric vehicles are going to dominate and Tesla's going to dominate the segment.

Then when you mix in autonomous vehicles and data and all the other nonsense that they like to talk about, there's a different valuation that should be ascribed to the stock. That's how you end up at eight times revenue.

By the way, eight times revenue for a company that has never turned in annual profit, that loses billions of dollars a year, and that is actually shrinking in revenue, which we can talk about.

These are the myths of Tesla.

George Gammon: One thing I want to just interject really quickly there to take it back to a level that I think everyone can understand even if they're not sophisticated when it comes to analyzing financials and PEs and whatnot.

Back in the day before I retired, when I was an entrepreneur, I had experience buying and selling businesses, being in that world.

Not huge businesses, but just normal businesses, gas stations, a laundry mat, maybe a liquor store or a marketing business, other things like that.

Usually what we would look at is if a company was bringing down, let's say $500,000 in profit a year, you'd be willing to pay maybe four times that.

If they're bringing in, let's say one million to make the math easy, you'd be willing to pay about $4 million for that company that was bringing in $1 million profit.

Now, their revenue could be $10 million, but you're not going to give them a hundred million dollars. That is just complete craziness.

To take it down even further, that would be like buying a Circle K, let's say that's making a hundred thousand dollars in profit, but a million dollars a year in gross.

It'd be like paying $10 million for a Circle K on the corner. That's putting it into perspective.

Now, of course, the argument's going to be that in Circle K they're all geniuses and they're going to dominate all the other liquor stores by 2025. It's not a liquor store, it's a data company.

It's an autonomous liquor store, Mr. Charts. Get it right.

Tesla Charts: Yeah, the liquor just shows up at your couch. In fact, you don't even have to order because the neuro interaction between your brain knows exactly when you want to drink and it pours it for you.

George Gammon: It's the AI. It's got AI. The AI will determine when you want your beers.

Tesla Charts: There's also a blockchain play somewhere as well. In all sorts, you're a hundred percent right. Why would you pay more than a multiple of revenue for a company?

There's a couple of reasons why you might. There are legitimate reasons why you might. You would pay a multiple of revenue for WhatsApp if you knew that Facebook was going to buy it for $19 billion.

But broadly speaking, back to generalities, you would pay for a company well above its current annual revenue, let alone profit, if the following two things were true, it was growing incredibly fast and it was extraordinarily high margin.

If you could present to me a $1 million a year business that's growing at 75% and it has 80% gross margins, you could genuinely come up with a net present value valuation model that ascribes it a multiple of revenue that's worth paying.

Tesla is not growing. It hasn't actually grown quarterly sales since Q3, 2018, to any degree. It's going to shrink again big time in Q2, both sequentially and year over year. People will say, “Oh, well, COVID! I get it.”

But this is a company price for perfection, not for excuses.

They only have two production facilities, one in California, one in China. So yes, they're giving a share in Europe, but they don't have a plant in Europe.

Why is this company worth $200 billion? They can't service the market in Europe and Volkswagen and Audi and BMW are eating their lunch over in Europe right now.

I find it baffling that a company priced for more than perfection has a legion of backers that are more than willing to come up with lots of excuses for why the numbers are disappointing.

On top of that, they're not growing. They lose money. They're not a profitable business, they do lots of accounting tricks to show GAAP or non-GAAP profit once in a while.

But you can't find me a four-quarter period where the company has shown a positive GAAP profit in the 17 years that it's been around.

In fact, Elon Musk has not been the CEO of any company that has shown an annual profit ever.

George Gammon: Another thing I find fascinating, and I first noticed way before I retired, it was when everyone on Wall Street was using BlackBerrys.

I don't know when that was. 2010, 2011, something like that. I remember everyone that worked for me, at the time I probably had a hundred employees, everyone even all over the United States, everyone had an iPhone.

I mean, everybody. I remember looking at the stock, I think it was called RIM, and thinking to myself, how on earth has this thing not come down?

Then I went to New York, I went to Wall Street, not to the stock exchange but Wall Street there and I noticed all the traders, all the guys, and girls that were there, in the mix, they all had BlackBerrys.

It dawned on me. I'm like, “I'll bet you, all the hedge fund guys talk to one another.” The private equity or whoever’s doing the bulk of the buying, they all use BlackBerrys.

They're thinking that the price is cheap when in reality, nobody outside of New York or Washington DC is using them. I think it could be the same type of psychology with Tesla.

Because whenever I'm online, I see all the bowls tend to be in California, Oregon, Washington, and sure enough, if you go to California, yeah, everybody's driving a Tesla.

So, it's very easy to extrapolate that and say, “My gosh, everyone in the world is driving a Tesla. Look at my neighborhood. There's a Tesla in every single driveway.”

But what they don't realize is that if they go one state over or go into a farm town, or maybe another country, no one's even heard of Tesla. Of course not in the United States.

If you go to a country like Colombia, in fact, I'm here and I have another quick fun. They have a couple of days where they don't allow gas vehicles to drive on the road.

I remember I was jogging on that day and one of the cops had pulled over a Tesla and you don't see them here at all in Colombia.

The owner was having the hardest time getting out of the ticket because he's trying to explain to the cop that the car was actually electric and the cop didn't believe him. Because he didn't even know what a Tesla was.

Tesla Charts: Let me yes-end you.

Yes, I agree that if you're in California or you're on the East Coast and you're in a wealthy community, all you see are Teslas. You might be thinking that this is the future.

On top of that, what we're seeing on Wall Street is, it needs vehicles of a different kind to drive trading activity and take advantage of uninformed retail investors on Wall Street.

Elon is a CEO who's willing to play that game and so are some of the others. So, you have this nexus. By the way, I should say upfront, I've been dead wrong on the stock being short.

Tesla's been a terrible idea. I've lost money shorting Tesla.

All the people on Twitter who say stock price bro, to me are correct. I wouldn't recommend shorting Tesla. Nothing is investment advice.

I know what Tesla's worth and it's not anywhere near a thousand dollars a share, which is what it's trading hands for today on the stock market, I know what the value is.

The price I've gotten a hundred percent wrong. The value, I know I'm right.

What we're seeing today in the stock market, and maybe this is a way to generalize the conversation beyond Tesla is, there's this a very permissive environment for fast and loose rules I think, oversight by the SEC.

The Hertz Rental Car Scam

Tesla Charts: Things that you and I would never have imagined doing 10, 15 years ago are basically going on everywhere you look.

People are raising money on, “we're basically going to cheat retail investors out of their cash because we have the next big thing that we can sell and unload on the bag holders.”

Just like the Hertz situation itself. Could you imagine?

George Gammon: Yeah. Walk everyone through that, that might not understand the actual dynamics, what's going on there, does a transfer of wealth from the kids or whoever is buying the equity to the bondholders.

Tesla Charts: It's a long story, but I'll start it with what is Hertz? Hertz is a rental car company. We all know it. Business travelers know it.

The rental car business is hyper-competitive, asset intense, low margins. It's not really good business.

Hertz itself was acquired, reacquired, and levered up in these standard private equity-type corporate machinations that go on in what I consider to be dying businesses.

Long before COVID hit, Hertz was a low margin, very levered, struggling business that rented cars to travelers. When COVID happened, the business went away.

COVID has devastated a whole swath of businesses and has created a bunch of zombie companies that are still around trailing today because of the largess of the FED.

We can argue whether or not that's good for the long term. I think it's distinctly bad, but it is what it is. It's today's reality.

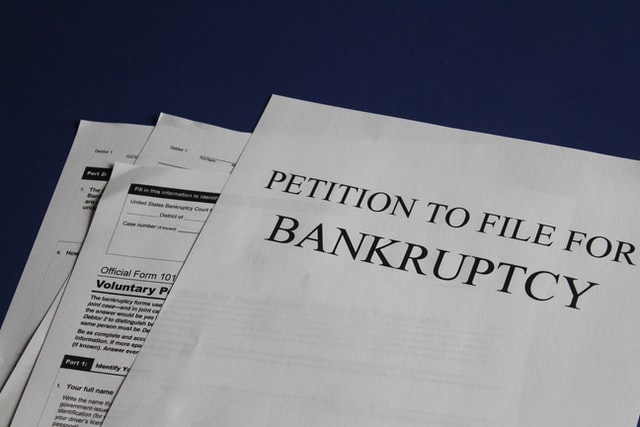

Hertz filed for bankruptcy. Why did Hertz file for bankruptcy? The predominant reason why Hertz filed for bankruptcy is the business was hemorrhaging cash.

It had all of these fixed costs and no revenue coming in. It was a bad business before COVID, it's a fiasco business post-COVID.

Hertz had a terrible balance sheet, it had something like $16 billion of debt tied to the assets of the rental fleet.

In other words, they had pledged the rental cars as collateral for loans to finance the business. That's very common, it's called ABS, asset-backed SECurities.

But they also had $4 or $5 billion worth of real debt, unSECured by anything in the business, that they couldn't make the interest payments on because the business went away.

Look, this is no fault to Hertz, COVID destroyed their business. This is what happens.

Tesla Charts: I suspect, even in a post COVID world, we're going to need a lot less rental cars because people aren't going to travel. Because they've learned Zoom and they've learned how to work remotely.

They've learned how to get things done without having to travel. So, Hertz did the normal, typical thing that happens when a company can no longer service its debt. It filed for bankruptcy protection.

Turns out most of the time when you file for bankruptcy, the stock goes to zero. Why? Because during the bankruptcy proceedings, all the bondholders have to get made whole before any old equity holders see a penny.

But in the Robinhood era, a bunch of day traders spending their Trump box, as we call it on FinTwit, have decided that they're going to buy and sell Hertz shares back and forth to each other.

Bid them up in what can only be described as a mania.

The Hertz debt holders, who are currently in bankruptcy court, seeing what's going on with the old shares that are almost certainly worthless, have petitioned the court to sell residual unissued shares.

From the old company to these people who have no idea what they're buying, to recover more money for the debt holders.

It's sort of nuance of Wall Street and I know your whole channel is about educating people about what actually happens on Wall Street and in finance. This is a real education for a lot of people. I think it's really amazing.

Regarding the new stock currently being sold by Jefferies, which is the investment bank that's leading the “at the market offering” of these unused Hertz shares, there's almost zero chance those shares are going to be worth anything.

And yet people on Robinhood are lining up to pay $2.50, $2, $1.80 for these shares that will eventually get zeroed out as part of the bankruptcy proceedings.

Here's the proof. You can buy a bond in Hertz today that has basically priority over that equity that's being sold for 45 cents. Before the equity sees a penny, that bond needs to be made whole.

I can look up on my Bloomberg Terminal right now, a Hertz bond, unSECured, it's selling for 45 cents.

I can look up on my Bloomberg Terminal right now, a Hertz bond, unSECured, it's selling for 45 cents.

If the equity had any hope, that bond would be selling for par or close to it, it'd be selling for a dollar, not 45 cents.

There are 4 billion of those notes and if you just look at the value that the bond market is ascribing to those notes, it would put a negative value on the equity of, say, minus $2 billion.

Tesla Charts: What's going on right now is, basically, in my opinion, I think it's totally wrong. I think it shouldn't have been allowed to happen.

The Hertz debt holders are legally overtly stealing money from uninformed retail investors.

Here's the analogy I would use. The way they get around it, the legal loophole they say is, “we don't yet know how the bankruptcy process is going to unfold and it's not yet certain that equity would be zero.”

Bankruptcy As A Way To Extract Money From The Market

George Gammon:

The question then becomes, if we go back over the last 20 years…

How many times has a publicly-traded company filed for bankruptcy and the equity not gone to zero?

Tesla Charts: It's rare. It happens. But not with a situation like this. It can happen where things change and circumstances are such that there's money left over for equity holders.

In fact, it's not uncommon for equity to get something. It's typically called nuisance value, to make everybody sign up for the final negotiated package and the new company is going to come out of bankruptcy with new stock.

You might get three, four, five, six, seven cents a share in nuisance value. But what's going on with Hertz is completely different.

Let me give it to you in an analogy that I posted on Twitter that I think will resonate with your audience.

I'm going to put my hand in this register and I'm going to grab as much cash as I can. It's not my cash. I'm a customer at a store. I'm at a home depot and they've opened the cash register.

I'm going to throw my hand in that register and I'm going to grab as many bills as I can. Then I'm going to walk out of this store.

Now, since I don't know for sure that I might not drop a couple of dollars on the way out, I can't say with certainty that I'm stealing or how much I've stolen.

That is effectively what's going on with Jefferies and the Hertz debt holders. They see idiot retail investors who don't know what they're doing.

They see the stock being bid up by the Davey Day Trader global types, all the people that follow them.

All of the high-frequency traders that are front running those trades and they say, “Hey, we have over here 247 million shares of Hertz that we never issued. The stock is trading for a couple of bucks a share.

Our whole might be $5 or $6 billion. But if I could sell that 250 million shares for two bucks a share, I could steal a half a billion dollars from idiots and give it to the bondholders.”

That's what they're doing and it's overt. It's right in their perspective that they issue today. It is historic, it is unprecedented, it is insane. I can't believe it's happening.

On the flip side, somebody else DM me, “Hey, the quicker this half a billion dollars gets pulled out a dumb money and into smart money's hands, the quicker we're going to resolve this mania.”

Because that's what they're doing.

George Gammon: Yeah. Capital always goes where it's treated best.

It's unfortunate, but that's why you see all these people who win the lottery, as an example, and two years later, they're completely broke.

It's no surprise at all. Just to be clear too, and correct me if I'm wrong, but it's not just Hertz, it's Chesapeake, it's J.C. Penney.

There are a few companies that have filed bankruptcy, let's call them the Robinhood types, or the Portnoy, Mr. Portnoy and his whole crew, they're piling into as well. Correct?

Tesla Charts: Well, Chesapeake is not yet filed for bankruptcy, but there's serious reporting that they intend to.

Many of the stocks that have either filed for bankruptcy or almost certainly will, have taken off. Which is really a perversion.

But actually, the Hertz precedent is really important. I put a tweet out that Xero has picked up and reposted over the weekend.

If I'm the board of Chesapeake and I have unissued shares that I've already registered with the SEC sitting on a shelf…

Why would I not sell all of those the day before I file for bankruptcy to get as much money as possible from people who don't know what they're doing?

Because in fact, I would argue, they now have a fiduciary to. The Hertz precedent has been set.

So, if I'm Chesapeake and I'm about to file for bankruptcy, and I have a billion shares that are sitting there, unissued, that I could take to the market and try to sell to uninformed retail investors.

Even if I got 10 cents a share for them, that's a hundred million dollars that I didn't have before.

Why would I just leave a hundred million dollars on the floor? The Hertz situation is, I think, a terrible precedent.

What you're going to see is board members on companies that should file for bankruptcy are going to view it as their fiduciary to extract every last penny from the market before they file. It's clear now. We have a precedent.

You can take shares of stock that you know in your heart are worth zero. You know that I'm not going to drop a dollar bill as I'm running out of the home depot after putting my hand in that register.

I might. It's theoretical. It's possible. So we can't say with certainty whether or how much I stole. But for all intensive purposes, every dollar bill I grab out of that register is stolen.

The literal interpretation of the law, the loophole that Hertz found because of this Robinhood, David Portnoy frenzy around the Hertz stock, I think is a terrible precedent.

George Gammon: It goes back to the Fed too.

Tesla Charts: Of course.

George Gammon: It just goes back to the Fed and unintended consequences. We're all human beings, and I don't care how many Ph.D.s are at the Fed.

Let's just assume for a moment their intentions are good.

They just cannot see the second, third, fourth, fifth, sixth effect of keeping interest rates at almost zero for 12 years and taking their balance sheet to seven trillion.

What I mean by that is, if they're taking interest rates this low, then you can't get a return anywhere. So these businesses go further and further out the risk curve.

They buy back their shares, they do all these things and the retail investor, buys the dip. We got a Fed put. That's what creates this environment.

I want to focus on the symptoms, but I also really want to focus on the cause, which in my opinion, is the Fed and of course, unintended consequences.

Consequences Of The SEC's Permissive Regulations

Tesla Charts:

Let me yes-end you, again. It's not just the Fed. It's an incredibly permissive regulatory environment that originates at the SEC.

To circle back to what we started with, which is Tesla, if Elon Musk can fake a buyout offer on Twitter that didn't exist during the trading day, keep his job as CEO and be heralded as a genius and the stock doubles from there, I also believe it's not just the Fed.

It is Jay Clayton and the SEC basically saying there are no rules.

You can fake a buyout offer on Twitter. Then you could go on CBS and tell the world that you do not respect the SEC. He was on 60 Minutes. Elon Musk was. I'm not going to follow my settlement.

I'm going to flip the bird to the SEC. The SEC used to be an institution that corporations, hedge funds, and money managers alike feared. That's no longer the case. I believe it's not just the Fed.

The Fed is certainly necessary, but not sufficient. You couldn't have what's going on with Hertz today if you also didn't have a very compliant SEC that basically said, “Fraud is okay. Fraud creates alpha. It's a casino out there. Every person for themselves. We're not going to protect the little guy.”

For the SEC to not intervene and even just invent a reason to intervene to slow down this Hertz fiasco, tells me just how permissive the environment is.

If you don't have the fear of the police, defunding the investment policy effectively, the SEC is funded, but they're not doing anything.

Like just last week, the SEC busted some guy in California for making $137,000 of illicit profits by buying a company, promoting it on some message boards, and then selling it into the strength.

But we're allowing Hertz to go and steal effectively a half a billion dollars or more from retail investors to give it to bondholders, lawyers, and everyone else, consultants in the bankruptcy case.

That half a billion dollars is going to get wiped out in the fees and the vultures that have circulated Hertz. It's insane.

But the SEC proudly tweeted 10 days ago about how they busted some guy in California for making 137 grand a day trading in his personal account.

I don't think that that guy who made 137,000 should be let off the hook. I would never do it. I don't approve of it. But is this what the SEC is doing?

Tesla Charts:

When you just look at the orderly permissive regulatory environment in the current administration, combined with free money, ZIRP absurdity, zero interest rate policy, no dip can't be bought.

Even today as we're recording this, the market went down 5%, 6%, 7% the last couple of days. The Fed comes out and says they're going to buy corporate bonds in the market rallies.

No stocks are allowed to go down. The Fed plus a very permissive SEC leads to some of the shenanigans that we're seeing. Including, I think, picking off the pockets of retail investors by the Hertz debt holders.

George Gammon:

-

What do you think about the attitude of the SEC right now being tied to the fact that over the past 10 years?

Especially in the last 10 years since the Fed has gotten into quantitative easing, our economy has become so financialized. Luke Gromen says this very well.

The economy now is the stock market. Meaning that if the stock market goes down, it has a huge impact on spending and the actual real economy.

Because of these distortions in the real economy and the financial economy….

-

Do you think the Fed, first and foremost, and then maybe the SEC, understand that we have to prop up the stock market because if the stock market comes down, the whole house of cards, the whole economy comes crashing in?

They're like, “Listen, normally we'd go after this guy, we'd go after that guy, but right now we can't because we have to put the greater good of the economy ahead of the law.”

A hundred percent. In fact, if you just take that further for social, I agree completely. If stocks go down, pension funds tip over.

Cities and municipalities are already struggling with COVID, if you can't collect rent from your tenants as a commercial building, how can you pay your local and state taxes?

George Gammon: I was going to say, and taxes, Mr. Charts, the thing that really gets impacted on a recession or depression are taxes.

Tesla Charts: Municipal bonds, pensions. Do you think the Chicago Teachers Union pension is in any good shape right now?

If stocks go down, it is the down roll that knocks everything down.

To an extent, I can sympathize with the Fed and the SEC for the stance they've taken.

For example, when the SEC settled with Tesla, I think Jay Clayton set a terrible precedent.

Which was basically, we can't really sanction Elon for committing, what I think is one of the most overt and consequential examples of securities fraud in the history of the stock market, faking a buyout offer in the middle of the trading day on Twitter.

We can't really go after Elon because that would tank Tesla's stock and that would hurt Tesla's shareholders.

George Gammon: Well, and teachers' unions.

Tesla Charts: Yeah. The government owns it and blah, blah, blah. What a terrible precedent!

What you've effectively said when you've done that, is you've given a green light to criminals, fraudsters and to people that are smart enough to see that the Fed and the SEC can't do anything but enable my fraud.

Of course, I'm going to take full advantage of it. I'm going to press my bats. I'm going to borrow money, lever up, and put all my chips in the middle.

Because the only thing you have to do to make sure that the Fed or the SEC protects you is become too big to fail.

George Gammon: Yeah. Not even too big to fail, too important from a standpoint of the general public or the local union to fail.

If you're a fraudster, then all you have to do is just go to CalPERS and just entice them any way you can to invest in your company. Then you just reap and pillage.

Tesla Charts: It's a hundred percent. It's not even that hard, George. All I have to do is convince enough retail people to buy it. It is the ultimate perversion of capitalism.

I'm on Twitter, I see all kinds. I see the political left, the political right. This isn't capitalism.

This is a rumination of capitalism through cronyism. It's a mix of corruption, criminality, and cronyism that I worry is the beginning of the downfall of the entire system that we've benefited from and that we love.

Part of my passion for starting Tesla Charts and for being involved in Twitter and the privilege of talking to people like you is, there are real voices out there who'd say, “This is wrong. This isn't going to work.”

In the long run, the crowd is going to show up for all of us with guiltings, if we don't get this right. The disparity in wealth in this country is disturbing. I'm a relatively wealthy person. You're relatively well off.

We both have lives and jobs that have persisted through COVID. I'm very blessed. I worked very hard. I'm very proud of my accomplishments in life.

But at the same time, I also know that I'm very privileged and I'm worried about the pillaging and the reaping of everybody in society for the benefit of the very few.

Even if I'm one of the beneficiaries. This is not sustainable. This is not healthy. This is not going to last.

George Gammon: Yeah. What's terrible about it is, the only tool the Fed has at their disposal will exacerbate the problem of social unrest.

Because if the social unrest is number one, food prices going up, let's say, and then the wealth inequality.

If the only tool you have is quantitative easing in ZIRP or NIRP, then it just gets worse and worse. Therefore the social unrest will most likely get worse and worse.

SPAC And Nikola: Red Flags To Keep An Eye On

George Gammon: Before we go down that rabbit hole, I want to go back and talk about Nikola, because this is a company that I didn't even know exists until I don't know, maybe two weeks ago, something like that.

I couldn't believe it. I was stunned. First and foremost, I couldn't even believe their name.

Like, are you kidding me? Really? You're going to blatantly rip off Tesla. It's like you're not even trying.

You're obviously looking at Tesla, seeing all the retail that piles money into that name, and then just riding on their coattails to try to bring in as much money as you can, and then cash out after six months.

Then who cares? You got a great story maybe. If they were a serious company, don't you think they would have tried to come up with a little bit of a different name?

I know that's not very analytical, but my goodness. Tell us about this company.

Tesla Charts: Nikola has been around for a long time. They've been on my radar for a long time. Trevor Milton is the CEO.

I think there's a deeper story here, George, and I appreciate the opportunity to express it with you and maybe hash it out a little bit.

The first thing you need to learn about Nikola is how they come to the market. The traditional route of a startup with ambition, with new technology?

Nikola is a startup company that desires to build long haul trucks, truck to trailer, 18 wheeler type trucks that are powered by hydrogen gas, fuel cells, alternative technologies that are clean.

It's a fair sort of classic thing, if we were to go back to our earlier discussion about environmental impact, if you could solve emissions from long haul trucking, you would do a significant benefit to our overall global warming carbon footprint.

That sort of impact on the planet. But I don't think that's what they're trying to do. Anyway, the traditional way you would do it is you would do an IPO. You would do a roadshow.

You would put together a prospectus, do your roadshow on Wall Street. The banks would say, “Okay, this is what we think we could take you to the market at.” And so on.

Nikola didn't do that. The way Nikola became a publicly-traded company last Monday was through a reverse merger into what's called a SPAC. I don't know if you've discussed SPACs on your podcasts before.

George Gammon: No idea what that means.

Tesla Charts:

SPAC is a special purpose acquisition company that exists to go find targets to buy and then become publicly traded.

One of my favorite accounts on Twitter that I follow is Muddy Waters and he exposed a bunch of Chinese reverse merger frauds 10 years ago. They're still on the stock market today.

The old way that you would do this is you would go find some dormant company that's bankrupt but still listed on the pink sheets.

You would reverse merge into that company. Suddenly you're listed on the pink sheets.

You would get an auditor to sign off on your accounting, and then you would apply to be listed on the NASDAQ or the New York Stock Exchange.

You would get an auditor to sign off on your accounting, and then you would apply to be listed on the NASDAQ or the New York Stock Exchange.

You might find some old, dormant sports bra company that doesn't exist anymore. You would reverse merge into it as George and Tesla Charts Battery Co and then get listed. We'd publicly trade.

We'd get our financials signed off. Then we would apply for listing on the QQQ or the New York Stock Exchange.

That's a very fishy way to do it and lots of people outsource this out.

They know that generally speaking, there's a high correlation of fraud type stock promotion schemes and reverse mergers that try to get listed by skipping the IPO.

Wall Street invented SPAC, a special purpose acquisition vehicle as a country club blessed version of the reverse merger scam.

Now, the vast majority of SPACs aren't scams. I'm not saying that Nikola is a scam.

I'm just saying if Nikola did a traditional IPO like WeWork tried to do like Uber did, like Lyft did, it would be a different story.

Now, they didn't. They basically merged with a SPAC. Now, why is that?

George Gammon: What would their motivation be to do that?

Tesla Charts: To get listed quickly. So, the SPAC is already trading. Until last Monday, the company that is now Nikola was VTIQ.

That was the symbol. It was a special purpose acquisition company set up and funded by the likes of BlackRock, Larry Fink, and all of these ESG crowd that are looking for stocks to basically promote as being environmental, social, and governance qualified.

I like to refer to ESG as environmental and socially gullible because they're not actually achieving the mission, but they have the perception of it.

Nikola merged with a SPAC called VTIQ. They changed the name and the ticker to NKLA and that's what's trading on the stock market today.

In doing so, the previous shareholders of Nikola before that merger are sharing the pie with the VTIQ shareholders of the SPAC long before this entity combined.

If you were truly sitting on what you think is the breakthrough technology that's going to revolutionize the world and impact the environment…

Why wouldn't you just take the time to go through an IPO?

Do it your own way and keep all the pie for yourself. So right away, there's a bit of a red flag.

Now, again, I don't want to cast dispersions on SPACs generally, but it is an atypical way in which startup companies become publicly traded.

I'll be happy to come back on and talk to you about it more in detail as you learn about it after this conversation, but broadly speaking SPACs are also procyclical.

What does that mean? You tend to see more of them at the end of bull markets because everybody that's informed knows that the music's going to stop pretty soon.

We got to get these things onto the market as quickly as possible.

If you have a way to quickly become publicly traded, and on top of that, circumvent the traditional disclosures and the hardcore assessment that you might have to do.

If you're going to be an IPO, for example, if WeWork had gone to market via a SPAC as opposed to trying to do the traditional IPO, they might've made it. They didn't.

They exploded on the launch pad and now SoftBank is sitting on all of these losses.

The bubble was burst because the S-1 of the WeWork IPO exposed really what the business was and it didn't get past even cursory inspection.

None of that happened with Nikola, because Nikola reverse merged into a preexisting entity that was already trading on the public stock markets and became NKLA by basically changing the name and the ticker of a preexisting publicly traded company.

Tesla Charts: The SPAC that bought Nikola went public less than two years ago.

These SPACs have a very interesting attribute to them, which is, if they don't find a target to buy, they have to give their money back to investors, in a certain period of time.

Usually two years or 18 months or some standard period of time.

If Tesla Charts and George SPAC Co went public and we raised $200 million from investors to say, we're experts in YouTube, financial media-oriented podcasts, and we want to go acquire the next Joe Rogan, we would get $200 million, we'd have to put it in basically the equivalent of an escrow account.

Then we've got two years to go find the next Joe Rogan. So, we might say, we're going to go buy QTR. We're going to merge into the private company that is QTR.

Then George Gammon Co takes a TCGG, it is going to merge into QTR and we're going to start training on the New York Stock Exchange as QTR.

We're going to sell the future revenues of QTR sponsors using the Joe Rogan camp as a potential future story.

Then all the investors of both QTR and TCGG are going to basically have access to the public markets without having to have QTR going through the traditional IPO roadshow.

That's what's happened with Nikola. I know it's a bit complex. I don't want to dive too much into the details, but that nuance is really important to explain, I believe, in part what's going on with Nikola.

George Gammon:

-

How much did that special purpose vehicle, for lack of a better term, pay for Nikola?

Tesla Charts: Well, it was a merger, so it was sort of a cashless transaction. Basically the two entities combined the working capital of both companies.

The ownership of the new entity is a negotiation between the two sides.

But, the Nikola shareholders and the VTIQ shareholders, in this case, combined forces and then became Nikola the training vehicle that we're now seeing trading on Wall Street today.

There's even more nuances towards it. Like, for example, there's a huge arbitrage because there's Nikola warrants that trade today publicly N-K-L-A-W that seem to trade at a significant discount to Nikola.

Even though you can, in a very short period of time, exchange them for Nikola's shares. This is a whole new frontier. It's blowing up. It's procyclical.

It's the kind of thing you see at the end of a bull market per year video on the sort of 2020 stock market and the signs of a mania.

What you're seeing is, all of the smart money sees that the music is stopping and they're looking for their shares. A SPAC is a great way to find that share really quick. It's the way I look at it.

That's how they got to the market. WeWork failed, blew up on the launchpad. Nikola didn't because they had a preexisting vehicle that traded on the stock market that they reverse merged into.

They called it Nikola and now it's exploded. If you invested in a SPAC, the VTIQ SPAC, the price you paid for that stock is $10, Nikola's trading for 66, 67 today.

So already, although they can't sell because they have a lockup period, you're looking at a 600 to 700% return on your money.

Why wouldn't you be interested in investing in a SPAC if you knew that they could pull off a merger, especially if the company has ESG credentials?

If you know all of that in advance, why wouldn't you just decide that you have ESG credentials, create a story around it, sell it to Wall Street. Everybody gets on board.

We're going to go ahead and fleece Robinhood one more time.

George Gammon: Yeah. It's like putting dot-com at the end of your name in the late '90s.

Tesla Charts: Or crypto, three years ago. It's the same thing.

George Gammon: Okay. Let's go into the company.

-

Do they have revolutionary technology? I read somewhere that they have four employees.

Tesla Charts: I think they have more employees than that. I would preface this by saying, I've spent far less time studying Nikola than I have Tesla. I'm not an expert.

But I see the very same behavior of Trevor Milton and Elon Musk.

George Gammon: Well, there's nothing to study with Nikola. They don't even have a product.

-

What do you study, Mr. Charts?

Tesla Charts: You study the behavior of the CEO and what he has learned. This is back to the problems with a permissive SEC and loose monetary policy combining to reward stock promotion.

I see Trevor Milton on Twitter today picking fake fights with shorts, just for polarity, just to be out there. He's going to be on, as we're recording this. I'm not sure you know. You probably don't.

I'm turning around and I'm looking at Mad Money on my TV here and guess who the guest is on Mad Money tonight.

George Gammon: Oh, you're kidding me.

Tesla Charts: No, I'm not kidding you. This is a classic” I'm going to replicate the playbook of Elon Musk”.

I can't say that all the other attributes of the two companies are the same, but Nikola has no revenue.

Undiluted had a value of over $20 billion today. Never mind. No profit. Like you said in your video, no revenue.

George Gammon: Yeah. They don't even have a product. They don't have a car. They don't have a truck. They don't even have a concept to show people.

Tesla Charts: Well, they have prototypes.

George Gammon: Oh, do they? Okay.

Tesla Charts: But they don't have a factory. They don't have a manufacturing agreement that I know of. I could be wrong, but I'm pretty sure they don't. What they do have is a story.

They have a story and they have a ticker, and the ticker traits.

If you have a story and you have a ticker, and you're willing to say things that most respectable business people wouldn't say, given their inherent respect for securities laws and potential risk of enforcement against you, you can make a lot of money.

If you're an investor in the SPAC, all you need is a CEO willing to do that. None of the investors in the SPAC or the investors in Nikola are taking any chances. It's just the CEO.

He sold into the IPO, basically, into the merger agreement that gave birth to Nikola. He took some money off the table, which is unusual.

George Gammon: Oh, I thought you weren't allowed to do that. There was a lockup period.

Tesla Charts: Well, you're not allowed to sell bankrupt shares. Do you know what I mean? If you disclose what you're doing and people say, “That's fine with me,” then are you not allowed to?

Traditionally, you wouldn't be allowed to monetize any of your stake until after the IPO and everyone had a chance to see your company, et cetera. But that's traditional.

We're far beyond that, in fact, perversely, we're rewarding nontraditional behavior because everybody wants to get on board. The Titanic might be sinking, but I've got a really good seat, at the orchestra.

He did sell into the IPO and he even commented on Twitter. He has a story, but it's just the sign of the times.

So, all you really need today is a symbol that trades on Robinhood and the ability to become a story stock that the Robinhood types and Davey Day Trader on Wall Street bats get behind. Then the mania takes care of itself.

Worse than that, I think what we're seeing is there's a real story here. We could talk about Davey Day Trader, and Nikola, and Hertz because they're all related.

Tesla Charts: What we're seeing is the retail influx of day traders that have hit the market, which is utterly procyclical and top tick. In the history of stock market manias, it's always that.

As you so brilliantly laid out in your video. But it's worse than that, it's magnified by the fact that Robinhood is selling its order flow to high-frequency traders.

There's a reason why high-frequency traders are paying 10 times the cost of traditional order flow at Robinhood. It's not because they're charities. It's because they see extraordinarily high value in what Davey Day Traders army is shoving their money at today.

Tesla Charts: Now, there's some suspicion that maybe they're actually overtly front running trades. I don't think that's necessary.

If you just knew in advance what the next Robinhood mania stock would be, you'd make a killing.

But if I could have told you, when Hertz was at 40 cents a share that the Davey Day Trader capital's going to pick Hertz to be the next thing that everyone falls into and you quietly built a position in Hertz, you'd be rich today.

George Gammon: Right. Most people don't realize. They think they're getting free trades. Like, “Oh my gosh, this is a miracle. We're getting free trades.” You're not getting free trades.

Tesla Charts:

With every social media platform, if it's free, you're not the customer. You're the product.

George Gammon: That's all right. Great. Well said.

Tesla Charts: All of the Robinhood traders are the product that Robinhood is selling to the citadels of the world.

There's a reason why the citadels of the world are paying top dollar for that order flow and it's not innocent. It is a nefarious explanation. It is de facto, money being extracted from poor to wealthy people.

If I look at the overarching synthesis of all of your videos, it's a cry for help that says the explosion of wealth inequality in our society is net bad, even for the wealthy, and this needs to stop.

Everywhere you look, it's a perversion of capitalism. It's cronyism. It's criminality. It's fraud. Whether overt or blessed by the regulators, none of it ends well.

I love the country, you love the country, I count us both as patriots. I'm an immigrant to the country. I'm so passionate about it.

I started Tesla Charts because of what I saw, what I thought was substantial wrongdoing.

To be totally fair to Elon, it pales in comparison to what we're seeing in the rest of the market today in this mania blow off. He's nowhere near the worst actor anymore.

In fact, in some ways, he probably figures he's too early to the game. He IPO-ed the traditional way back in 2009 or whatever it was. He didn't reverse merge into a SPAC. He has factories.

Nikola has none of those concerns. You don't have to worry about closing your factory if you don't have any.

George Gammon: Yeah. He's got all these headaches, how he's going to put out these fires, employees, COVID. Why deal with it?

Tesla Charts: Yeah, if you can just make up a story and you're worth $30 billion at one point on nothing. Well, I would argue that all the people that think they're benefiting from that are fooling themselves.

This is a terrible thing that they're doing and it's going to affect everybody. Most of them, actually, if you press them are patriots. They love America, they may be immigrants themselves.

They're self-made people. They enjoy their wealth. They probably give a lot to charity. They view themselves as good people.

They need to stop and think: “Do I really need that extra $10 million or a hundred million dollars or a billion dollars?” If it comes at the expense of the complete and utter destruction of the capitalist society that we built, that works so well for so many people for so long.

It is terrible what's happening today. I get it, “stock price, bro, I'm dead wrong. You're a gold bug. “I get it. It's wrong. It's immoral. It's not a great way to live.

Life is about more than just money and we are all collectively going to pay a price for what's going on in the market today, and I believe it firmly in my soul.

What To Do If You're Looking For A Good Return Over Time

George Gammon: I would go so far as we are.

If you look at the writing and the looting, this is the price we're paying for the financial shenanigans that have been going on for the last 20,15,10 years.

It's only going to get worse if the economy continues to deteriorate and if asset prices, the stock market, continues to go up and food prices continue to go up, the cost of living goes up.

That's not a good combination at all. I know you've been very generous with your time. I appreciate it.

I want to have you try to wrap things up in what you're doing with your own portfolio to position yourself in a way that's most prudent over the longterm, and then maybe some takeaways for the average Joe and Jane.

That said, Mr. Charts, you've said a couple of times here, that you get some feedback or some pushback on Twitter with people giving you a hard time because you've been on the wrong side of Tesla.

For those types of people, I want to try to articulate my view on that just as quickly as I can. For me, that's like being at a blackjack table and someone right next to you has a 19.

You tell them, “Listen, I would stay on a 19.” and they're like, “Oh, what are you talking about? You're a gold bug. You're just an Austrian. You're too worried that the Fed's got my back.”

Then that person hits and gets a two. Did they make the right decision or the wrong decision?

Well, I would argue they made the wrong decision, even though they won the hand and got a blackjack.

If that person gets up, they spike the ball in your face, George, in your face, Mr. Charts, “Look at this. If I would have listened to you, I would have missed out on all of these gains.” Well, that's correct.

But over the short term. Over the long term, mathematically, they are going to go bust because they're going against the probabilities.

Even though you might've been on the wrong side of the trade with Tesla for the last two years or whatever you call it.

If you're always betting on the probabilities, assuming you're not doing it with your entire portfolio, and you've got multiple bets out there, over the long run, you're going to be far ahead of the person that's just rolling the dice every time.

Tesla Charts: Absolutely. Lots of unpack and it's something I've given a lot of thought to, and I appreciate the opportunity to discuss it.

First of all, I would never give investment advice, I'm not a registered investment advisor. My situation is unique from everyone else who's listening, all of those disclaimers upfront and now to the side.

I'm in a different situation than the average person. I had a very successful career in the corporate world. I have means.

I have some degree of wealth that I've accumulated through my own hard work, good luck, privileged, some might say. However you want to describe it.

I have enough money that if the current environment persists, I don't really need to worry about working and I'm very thankful for that. Very grateful for that. I grew up very poor. That wasn't always the case.

I worked very hard. I'm proud of what I did, I'm proud of the money I've accumulated. I have a family that I love. I have business partners that I care deeply about.

But by and large, I'm in a position in life where I'm much more concerned about wealth preservation than I am about wealth accumulation.

To the extent that your audience is probably pretty well off and many of the listeners might be in that position.

I'm personally very interested in accumulating real assets and things that do well in an inflationary environment as a hedge.

So, even if inflation never shows up and the inflation boogeyman doesn't happen, and by some miracle that constant unrelenting expansion of the M2 money supply never manifest itself in Christ, I'm okay to buy a little insurance against that.

My analogy would be, I pay for home insurance every year, and every year that my house doesn't burn down, I'm not unhappy.

Tesla Charts: I have a pretty large investment in multiple year-out LEAPS in gold, GLD, FIZZ.

You can't buy opposites on FIZZ, but I own a lot of FIZZ. I have some call ops on GLD and I own a ton of gold physical.

I own a ton of real things like, I own my home, land, a lot of Rolex watches because I'm a big watch fan.

I happen to think watches are a great hedge against inflation because there's a ton of value on a small amount of weight.

Rolexes are universal and they're desirable in the same way that art is and paintings are. I'm not in art and in paintings because I don't know the space, but I know watches really well.

So I have an allocation of my net worth towards real assets that are in of themselves hedges against inflation.

George Gammon:

-

What do you think of Bitcoin?

Tesla Charts: I'm not in Bitcoin. I don't understand it. One of my rules is, if I don't understand it, I can't buy it.

Gold has been 5,000 years money and that's good enough for me.

To me, buying electrons and some key that I might lose is far less comforting. But again, I'm in a position where I've accumulated enough, especially relative to how I grew up.

Then the second part of that coin is, I've created a life where I can be happy all day at a very little cost.

My biggest advice to people who might be listening, that maybe have accumulated some wealth, is the best NPV investment you could make is creating a life where you're happy and it's cheap.

You don't need to live in New York City or Singapore or London to be happy.

There are all kinds of great places to live in this country where it's very cheap to live, especially with high-speed internet, Bloomberg Terminal, Zoom, Skype video as we're talking to each other right now.

You're in Colombia. I'm in the Midwest flyover country in the US. We're friends now. We've talked to each other like we're in the same room. I don't need to live in Manhattan to be happy.

The biggest investment you could make to preserve your wealth is to create a life where you are happy all day at minimal cost.

That actually is a very deeply philosophical question, which is, what do I need to be happy? I get to see my kids every day. It's the reason I left the corporate world.

I could have stayed in the corporate world on autopilot and become much wealthier than I am today. What's the cost?

I have dinner with my kids every day, I see my wife every day. I travel much less, I get to be Tesla Charts to interact with people like you.

I host a great podcast, TC's Chartcast, with my business partner, Georgia Orwell. I've never been happier. What's the value of that?

To me, my own personal portfolio is hedged against inflation with some income-producing investments, but predominantly real assets.

Then most importantly, controlling my budget so that I can be as happy as I can be without having to worry about keeping up with the Joneses. I drive a Chevy Volt, it cost me $26,000.

I've had it for a year and a half and I've put 8,000 miles on it. I'm going to drive that thing until it gets to a hundred thousand miles and it's going to cost me nothing.

I don't need the expensive German sports car to show up the neighbors. I got a car that I like to drive. It's cheap and I'm happy.

I got a finite amount of time on this planet so my strongest advice to your listeners is what is your return on time? That's the only asset that we can't get any more of.

George Gammon: For sure, that's exactly why I retired in 2012. Your story is very similar to mine. On that note, in the interest of time, we'll go ahead and leave it there.

Mr. Charts, for any of my viewers or listeners who want to find out more about what you do, I know you're kind of incognito, but where should they go? Should they just follow you on Twitter?

Tesla Charts: The easiest way is to follow me at @TESLAcharts. I should say, I think because I'm effective, there's dozens of fake Tesla Charts account. Make sure you're following the real one.

It's the account with 28,000 followers, not any of these fake accounts.

The project I'm most passionate about, and if you don't mind maybe I'll give it a little commercial, is the podcast that I do, TC's Chartcast. We're through 30 episodes together. My cohost is Georgia Orwell.

George Gammon: I love the name.

Tesla Charts: Our sound engineer is Evacuation Boy. We have an in-house poet, Polls Tesla. TC's Chartcast is my real passion project.

Think of it as NPR for short-sellers, skeptics, and hard money Austrian types. It's inspired by QTR, our mutual friend, Chris Irons.

If Chris is a bit more blue in his podcast we're the more long-form, sophisticated, intelligent discourse and there's a space for both of us and Chris. I've been on Chris's show for a long time.

I'm very grateful for him and the support he's shown our podcast. But TC's Chartcast, find it on Apple iTunes and all of the major platforms. You won't regret it.

It's a podcast for our guests and we've had a great lineup of guests and it's one of the funnest things that I do. I appreciate the opportunity to give it a little pitch on your show.

George Gammon: Absolutely. Guys, you got to check it out. Mr. Charts, thank you again. I cannot wait to do this in the future.

Tesla Charts: Anytime my friend, I appreciate it.