Billionaires like Stan Druckenmiller and Jeff Gundlach give a dire warning to the average investor like you.

If you have a 401k, an IRA or your portfolio is set up in one of these 60/40 bond equities, you really need to pay attention to this article, because you could be on the brink of disaster.

Don't get too worried, don't pour yourself too many stiff drinks yet, because I'm going to try to give you a solution at the end of this article. But first, let go through the stock market bubble, the bonds hyper bubble and I'll conclude with the 60/40 scam.

Believe It: We Have A Stock Market Hyper Bubble

Let's start with the stock market being in a hyper bubble, and if you don't believe me, check out these charts.

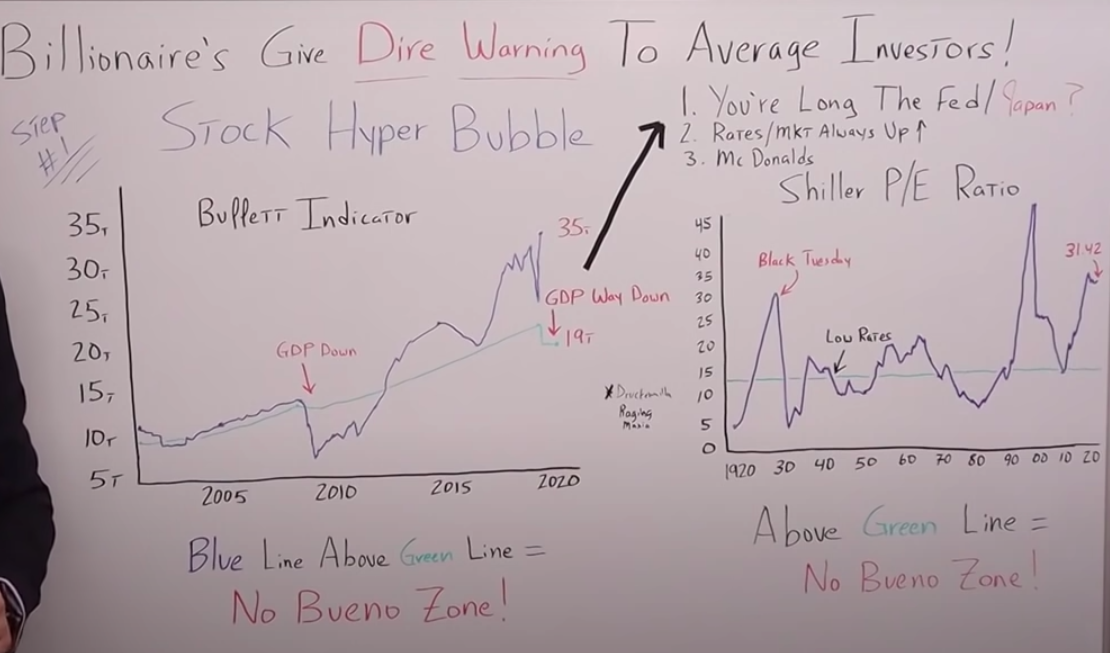

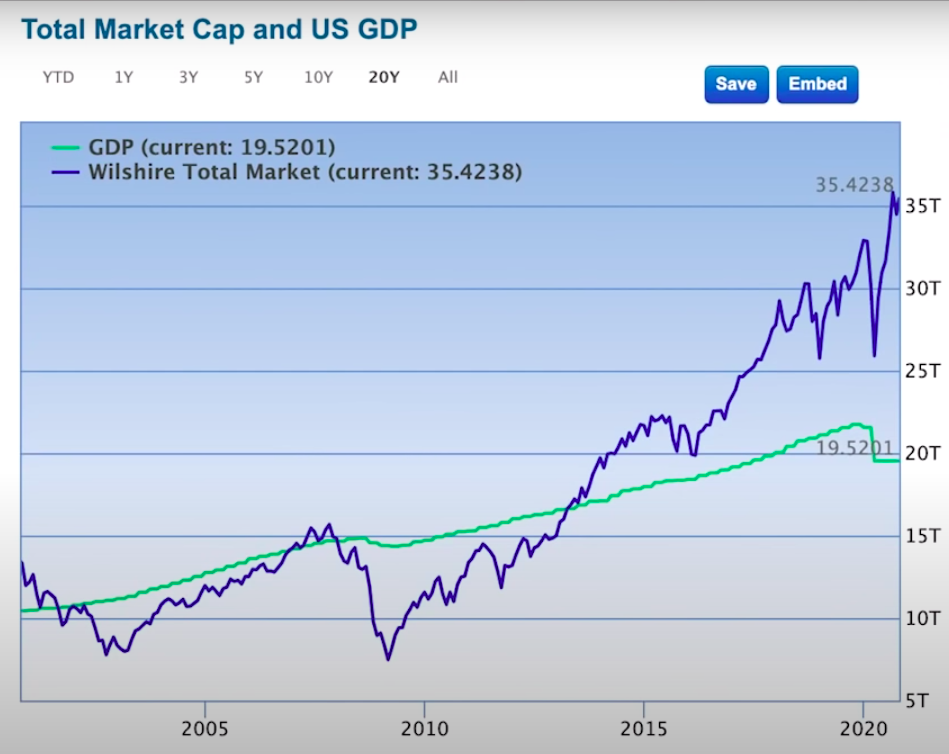

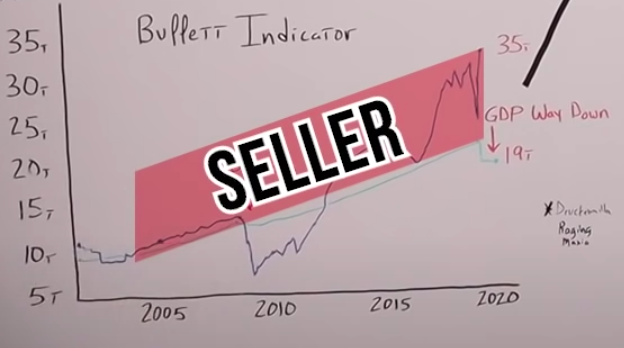

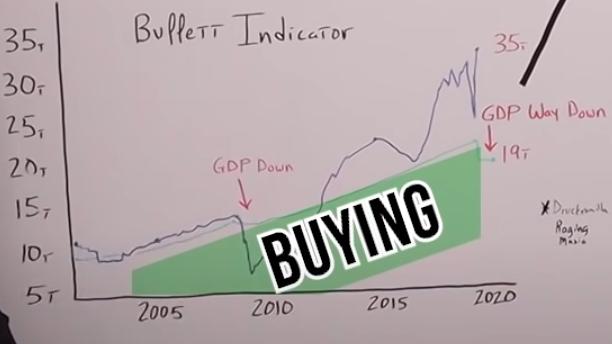

On the left is the Buffet Indicator or the Market Cap to GDP.

This is a really important chart that I've used in my past articles because it's just going to complete extremes.

The chart goes from the year 2000 all the way to 2020, and on the right side, it goes from $5 trillion up to $35 trillion. The blue line indicates the market cap of the stock market.

You can see in the GFC it came crashing down by over 50%.

Since then, it has moved straight up to where it is today in 2020 with the coronavirus and all the stimulus packages, QE Infinity, committing to a trillion dollars a day in repos and the deficits of the government going through the roof.

The stock market, the market cap is all the way up to $35 trillion.

Here I compared it to the nominal GDP for the United States. Look at the green line. It started off pretty consistent. They go up in tandem.

Around 2007 was the first time that it just slightly dipped down. I want you to notice that when the GDP dipped down slightly, during the GFC, the stock market went down by 50%.

Fast-forwarding to 2020, nominal GDP has gone up gradually to the point where it was prior to the Coronavirus, because, as we all know, GDP has fallen off a cliff. Far more so than it did back during the GFC.

While at the same time, the stock market has gone parabolic.

There's a total divergence between the real economy and the financial economy.

Even if you take the chart all the way back to the 1970s, you'll never see a point where GDP goes down and the stock market goes up.

If you think about it, it makes sense because the stock market should be a reflection of the real economy, but now it's not even close.

Think this through, your friend and family member Fred, or maybe even you, trying to rationalize being long stocks in your own mind and saying: “Well, the stock market always goes up, and interest rates are low, therefore, it makes sense.”

What you're not realizing is you're not going long on the stock market. You're going long on your 900 Ph.D. buddies at the Fed. You're going long on central planning and socialism.

Let that sink in for a moment. You're not going long on Home Depot. You're not going long on Apple. You're not going long on Microsoft, Google, Facebook, Netflix, nor Tesla.

The only thing you're going long on, betting on, is your friends at the Federal Reserve.

The rebuttal is, “Well, the Fed put has always worked in the past, so why wouldn't it work in the future?” Well, here is a chart of the stock market in Japan, going back to 1990.

They've done QE, bought stocks, ETFs, and bonds. They own almost 60% of the JGBs ( Japanese Government Bonds) and look at what happened to their stock market.

I'm not saying that stocks can't continue to go up, but just using the rationale that I'm going to buy stocks because there's a Fed put in central banks or central to the economy is not a good argument.

If you continue to make decisions like that over the long run, you're going to get burned.

You might be rationalizing this by saying, “Well, interest rates are at an all-time low, if interest rates are at zero, theoretically stock prices could be infinite and they'd still be cheap.”

You always hear that nonsense on CNBC. But what those people forget is that going back to the 1940s, interest rates were almost as low, and yes, they were manipulated back then, but they're being manipulated right now. Same thing.

Look at where the CAPE Ratio was, the PE ratios were right around 15, where now, in 2020 they're almost at an all-time highs, if you exclude the dot-com bust.

Just to say that stocks should be at nosebleed levels because interest rates are so low, again, is not a valid argument.

What the average investor needs to do is remember this: You're not buying a stock, you're not buying a piece of paper. You're buying an actual business.

The next time you go to hit the button that says, “Buy” in your brokerage account, whether you're buying Apple or Facebook or Google or whatever, just replace Apple or Facebook with an actual McDonald's franchise.

If your profits or revenue in your McDonald's was dropping by 20%, 40%, you are hemorrhaging money, but your broker came to you and said, “Hey, I have great news, I just did an appraisal on your McDonald's and because interest rates are so low, you could sell it for more than you bought it for.”

You'd look at your broker like he has gone crazy. You'd say, “I don't care what I can sell for. I bought this thing for cash flow. I bought this thing to make money, and right now it's losing money so fast it would make your head spin.”

The only thing you care about is the fact your McDonald's is losing money. That's what matters.

When you're looking at these things, always look at them as though you're buying a business, you're buying something that is supposed to make a profit and make you money, regardless of what the bid is for that little piece of paper in something called the stock market.

It's not just me saying this. Here is a transcript of a clip from one of my favorites, Stan Druckenmiller, where he's calling the current stock market, “A raging mania.”

Stan Druckenmiller: I think the merging of the Fed and the Treasury, which is effectively what's happening during COVID, sets a precedent that we have never seen since the Fed got their independence, and it's obviously creating a massive, massive raging mania in financial assets.

As you just pointed out, Joe, it has not spilled over the main street.

I would just say that I hear a lot of people on the air applauding Jay Powell saying he saved the world. Guys cheering him on, remember the Maestro in 2005 and how that worked out.

Right now we're in an absolute raging mania. We have commentators on your network encouraging companies to do stock splits companies, then go up 50%, 30%, 40% big market cap companies on stock splits.

As Andrew pointed out early in your show today, that creates no value, but what if the stocks go up. I have no clue where the market's going to go in the near term.

I don't know whether it's going to go up 10%, I don't know whether it's going to go down 10%, but I just want to remind people that there is no valuation support, because we dropped 10%.

That hasn't mattered, because we're so far outside of the valuation realm with the Fed doing what they're doing, that it doesn't matter.

But I would say that the next three to five years is going to be very, very challenging.

(End Of Transcript)

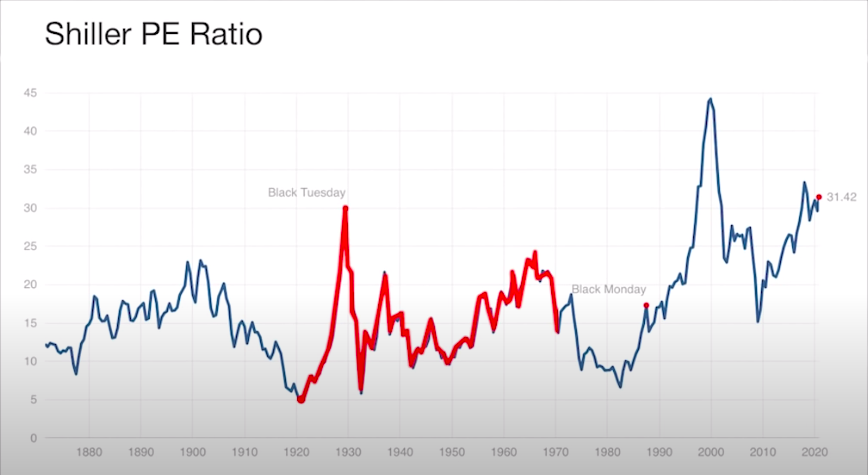

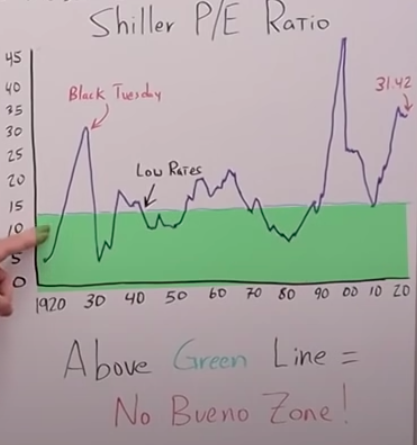

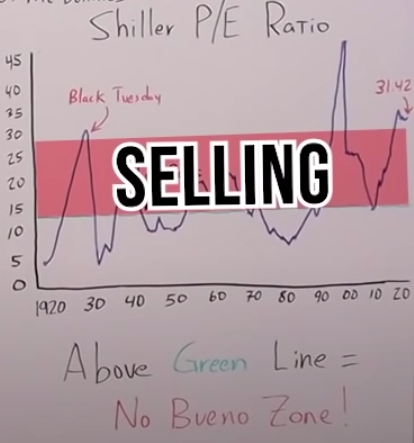

Look at another one of my favorite charts, the Shiler PE Ratio or the CAPE Ratio.

This is the price to earnings ratio of stocks. The one you just saw goes from 1920 all the way to 2020, but this chart really goes back to 1880, it's a fantastic chart.

On the left, it goes from a zero multiple up to 45. In 1920 it was right around five, and then it goes straight up through the twenties to Black Tuesday. Then of course came crashing down.

It went up and down but it stayed very close to the historic trend line. It bottomed out in 1980, where stocks were incredibly cheap, and then it went straight up, parabolic to the dot-com bubble.

It crashed, came back down to its historic trend line, and now it's gone straight up to where we're at: 31.4.

The good news, or the bad news, for those of you who own stocks right now is you have something to compare it to. We've been at these price levels before.

For example, during Black Tuesday, right before the Great Depression. Personally, I like to keep it simple. When we're below this green line, I like to think about buying.

When we're above the green line, I like to think about selling, or I like to outright sell. You can see how far above the green line we are right now. Definitely in the no bueno zone.

The same type of thing holds true for this chart.

Whenever the blue line, which is the market cap, is above GDP or the green line, I want to be a seller because we're in the no bueno zone. But if the green line is above the blue line, I want to think about buying. That means stocks are cheap.

But let me be clear, there is nothing about the stock market that's cheap right now. It is in a massive hyper bubble. If I owned an SNP500 Index Fund right now, I would be extremely concerned.

Bonds Are In A Ludicrous Hyper Bubble

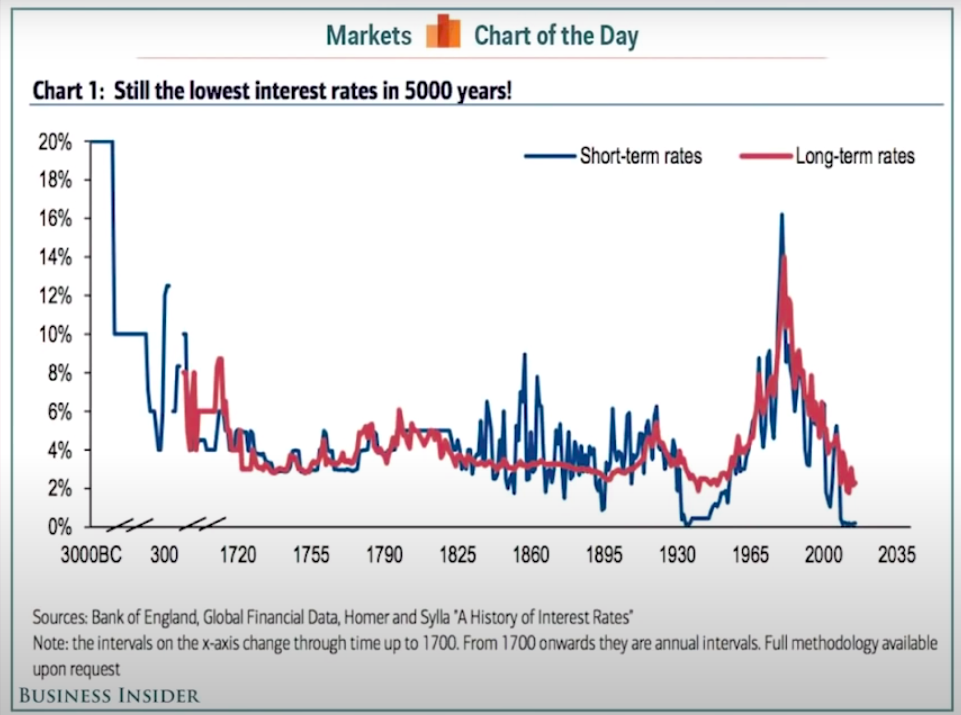

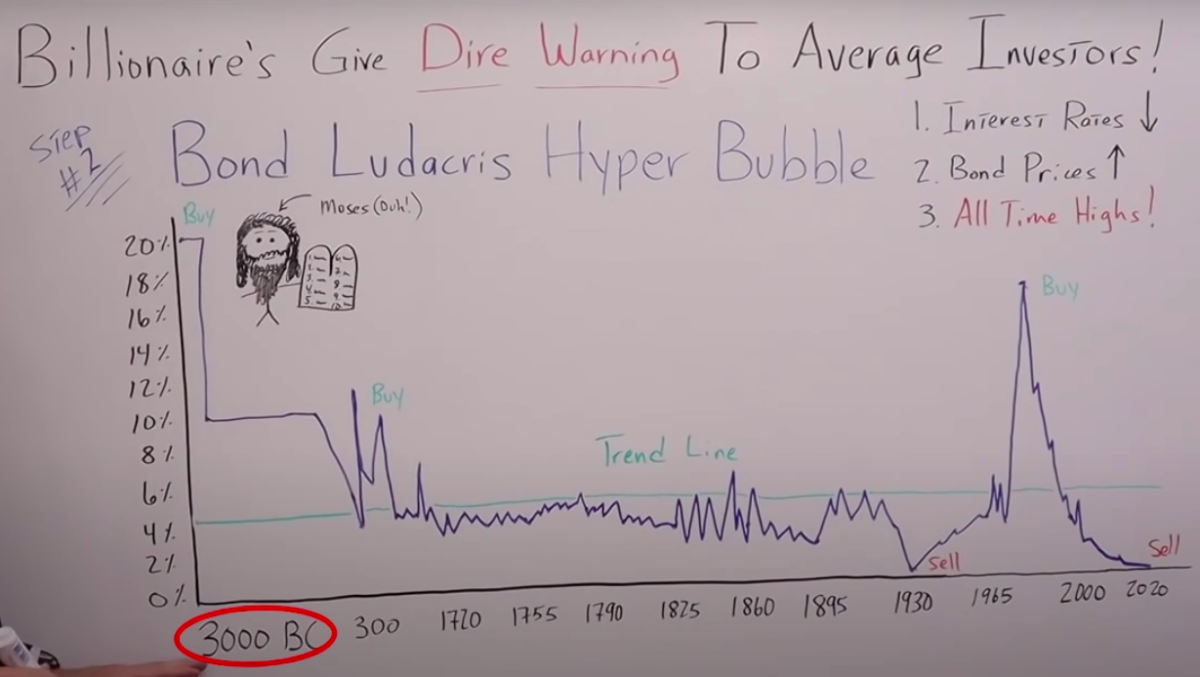

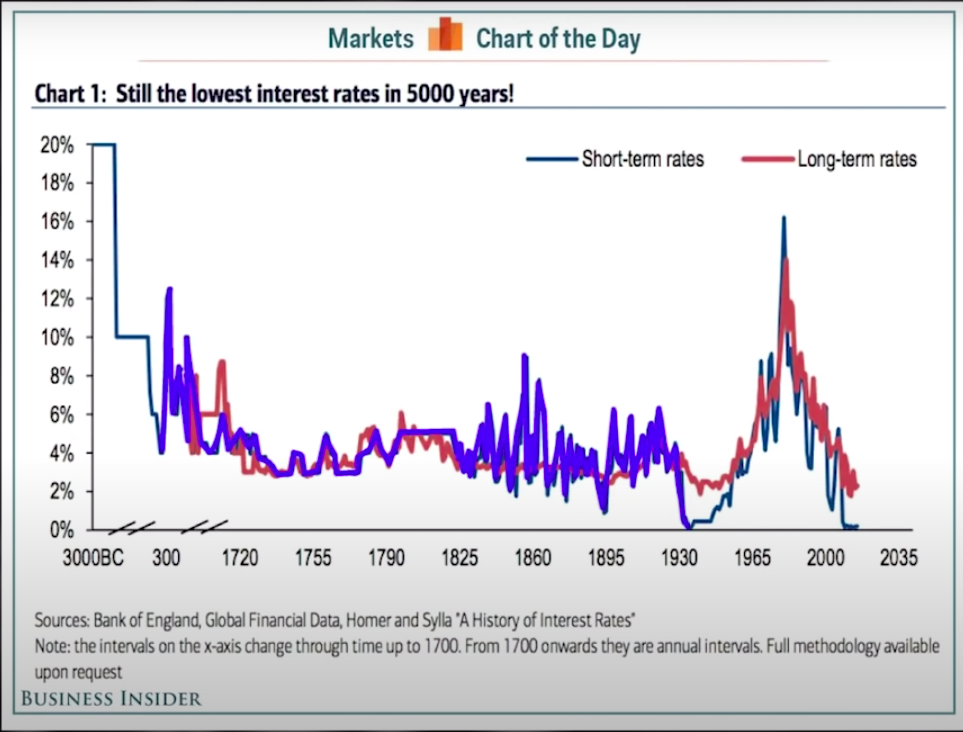

If the stock market is in a hyper bubble then bonds are in a ludicrous hyper bubble. And yes, that is a technical term. Check out this chart.

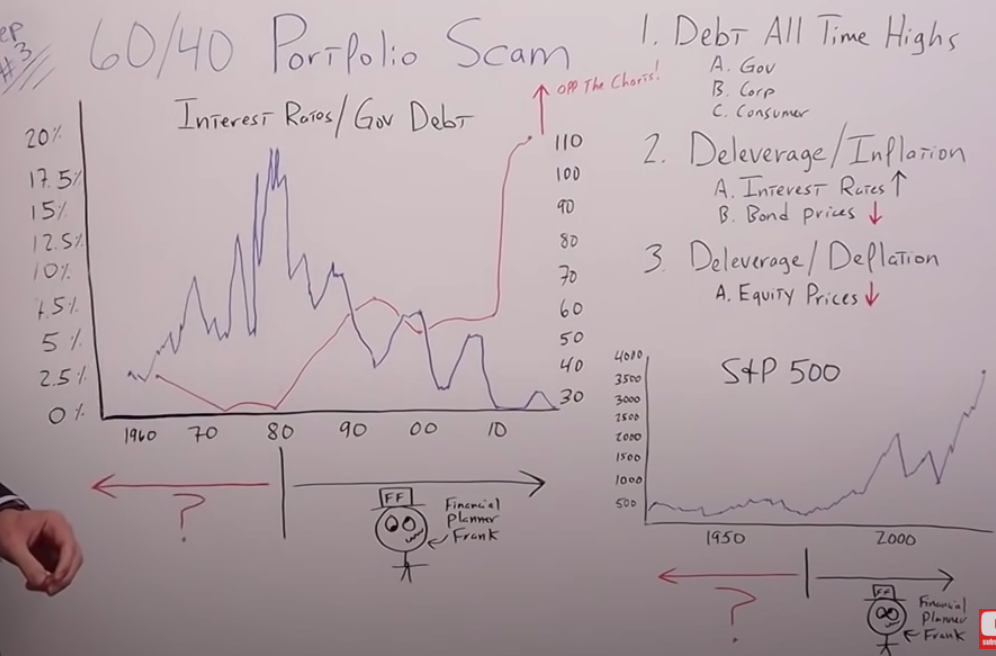

I drew the same chart on my whiteboard so I can better explain everything.

This is really all I need to prove my point, it goes all the way back to 3000 BC.

I didn't even think they had interest rates back then, but they did, they were at 20%. We could have done extremely well to buy bonds when they were at 20%.

Obviously that's what Moses was doing with his 10 commandments. You have to have a lot of respect for a guy that can break things down numerically.

Moses was definitely buying bonds when they were at 20% and then Pharaoh Powell came in and dropped rates down because he was trying to stimulate the economy, most likely to build pyramids, who knows another central planner, by the way.

Then, in 300 AD they got kind of choppy, but then they leveled out, and it pretty much stayed the same all the way until we got to the 1930s when it came crashing down because of course we had the Fed trying to drop rates to get us out of the Depression.

Then world war II, they were suppressing rates. We all know what happened when we went off the gold standard in 1971, stagflation and interest rates going all the way up to over 16%.

Later, Volker puts the kibosh on inflation and interest rates came all the way down to where they are today 2020 at 5,000 year lows.

Let me remind everyone that's reading right now, there's an inverse relationship between interest rates and the price of bonds. So the lower the interest rate goes the higher the prices of the bonds are.

Let me say this another way.

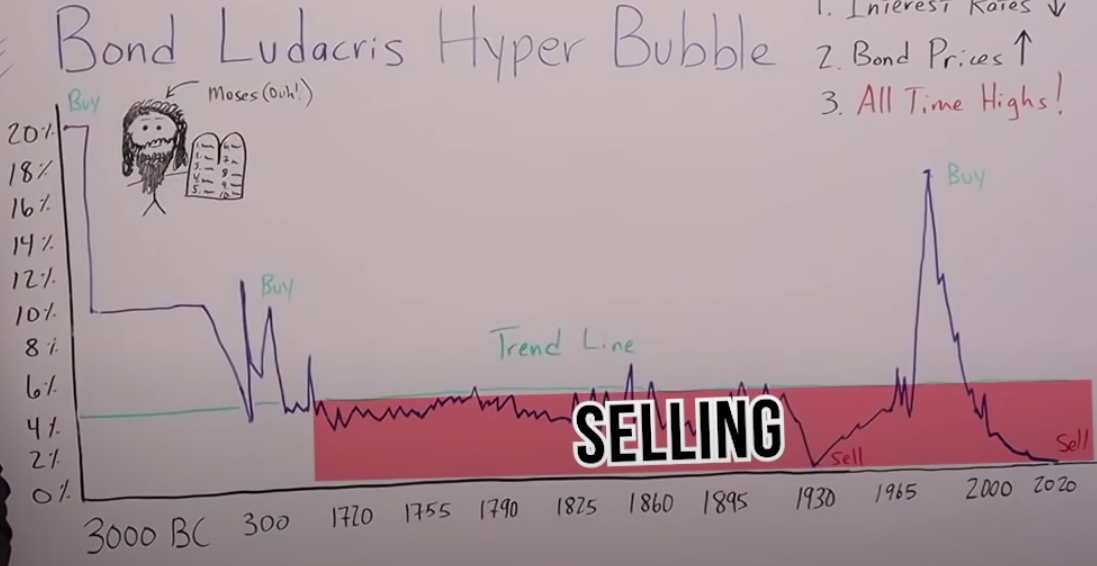

If we're at an all-time low in interest rates, that means bond prices are at all-time highs and not just all time highs, they're at 5,000 year highs. That is what I call a ludicrous hyper bubble.

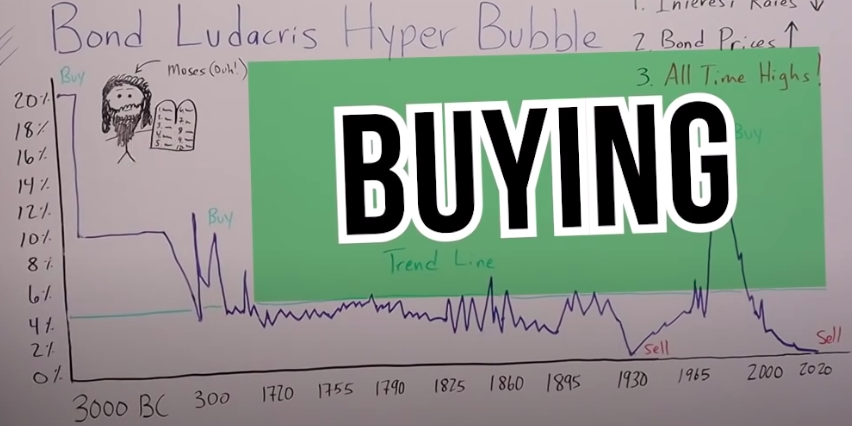

Just like the other charts, look at the red line right across at about 4% or 5%. When bonds were over this line, that's when you wanted to think about buying.

When they're under this line, especially in the 1930s, and in my opinion, now 2O2O, when we're even lower, you want to think about selling those bonds.

Meaning we're low in interest rates, but extremely high in the actual price of the bond.

I know a lot of you go back and forth listening to my good buddies on FinTwit, like Steve, the Bond King, Brent Johnson, Luke Gromen, and Lyn Alden.

They have different views on this, in fact, Brent and Steve might think it's a good time to actually buy bonds, but you have to realize when you're reading my articles, I'm answering a completely different question.

I'm not here to say that bond prices won't continue to go up. Just like housing prices continue to go up from 2004 to 2006, or stock prices continued to go up from 1998 to 2000.

I am answering a different question. I'm not here to say the prices are going up or down. The only thing I am saying is that prices are at all time highs, therefore, in my opinion, we're in a bubble.

All those people on FinTwit are far smarter than I will ever be, so I'll let the pros debate on where prices are going. For me and my formula, just keeping it simple, stupid, if they're under the green line, I'm going to be a seller.

And right now they're as far under that green line is we have been in the last 5,000 years. It's not just me talking about the risks in the bond market. It's also billionaires like Jeff Gundlach.

We are talking about how volatile it can be right now and how prices are at an all time high. They're in this hyper bubble.

Here is another transcript, this time is from a clip of Jeff Gundlach talking about the bond market's red flags.

Jeff Gundlach: Junk bond markets and interest rate markets were experiencing really persistent and elevated volatility. It just kept throwing things at it to make the volatility stop.

And of course, when investors use the word, “Volatility,” what they really mean is, “Down.” It means prices are going down a lot.

The Fed came in because there was a total seize up in the credit market system around the world, but for us relative to the Fed in the United States.

I've been in the market for 35 years and I've seen all kinds of crises, including that I was right at the front lines during 2008, 2009 during the global financial crisis, which really hit the securitized asset sector.

What we experienced in the last part of March was far worse in terms of market conditions in the investment grade corporate bond market, emerging markets, and certainly in the junk bond markets, far worse than the very worst day in March of 2009.

Literally, in 2009, you could get a bid, you didn't like it, the prices were in a free fall from the day before on the really ugly days, or maybe 10% or 15% price moves to the downside in a single day.

But in March of 2020 , there was no bid. There were actually situations in large swaths of the fixed income market where you simply could not sell assets.

(End Of Transcript)

It gets even worse when you layer over the risks of what we have now with the Coronavirus. Back in April and March 2020, some of the bonds actually went no bid. That means there was no buyer at any price.

This further illustrates my point that if you're going long on stocks, or if you're going long on bonds, you're really going long on the Fed and central planning.

The 60/40 Portfolio Scam

I know if you have a 401k, a Roth IRA or a financial planner, your portfolio will most likely look very similar to this:

It's a 60/40 stock bond split. This is what everyone in the industry says you should be doing with your money. They say, “This is the safe way to invest your money,” but here's the scam.

Imagine your financial planner Frank comes in with fancy charts, going back decades, showing how this portfolio always works: The 60/40 split.

But what they don't tell you is those charts only go back to 1981, and since 1981, interest rates have been going down the entire time for almost 40 years.

The SNP has gone from this low point, right around 1981, all the way up to an almost high today around 3,500.

So, you can see the game financial planner Frank is playing. Yes, he shows you these charts, but they only go back to 1981.

If you ever ask him or her, “Well, what honors happened prior to 1981? If my memory serves me right, there was a bond market prior to 1981. There were interest rates, we just saw a chart where it went all the way back to 3000 BC, and there was definitely a stock market.”

But your financial planner Frank will say, “Oh yeah, don't worry about that. Those charts don't matter.”

They'll just sweep it under the rug and say “Nothing to see here just look at these charts from 1981 to 2020. Let me cherry-pick data to prove my point so you'll give me your money, and I can make fees regardless of whether you make or more likely, lose money.”

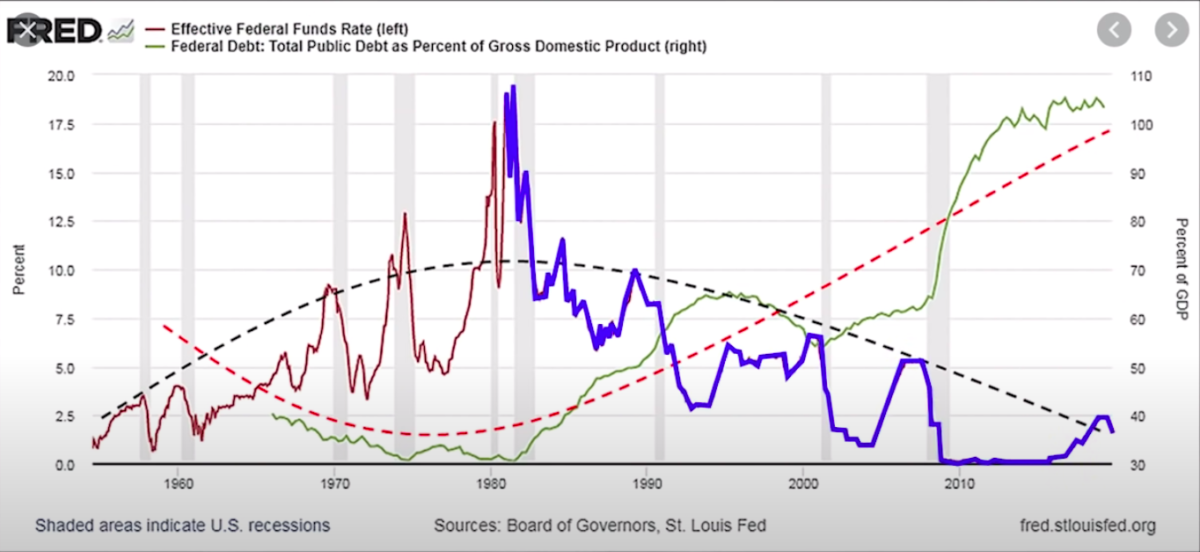

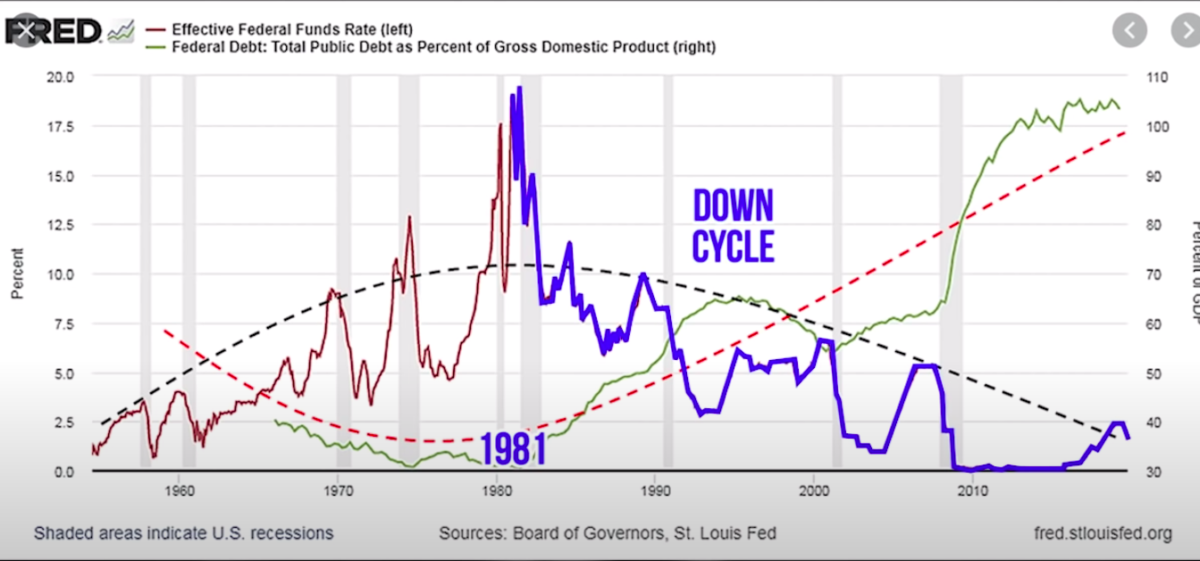

Look at these charts more specifically to really drive home my point. This is a chart, again, of interest rates compared to government debt.

The blue line represents the interest rates, and the red line, government debt as a percentage of GDP.

It starts in 1960 and goes all the way to 2020, now extended it a bit. On the left, it goes from 0% interest rates up to 20%.

On the right, it goes from 30% debt to GDP, up to 110%. The blue line applies to the numbers on the left while the red line applies to the numbers on the right.

From 1960, all the way up to 1981 interest rates went up in an upward cycle. From 1981, it went all the way down in a down cycle, as I mentioned earlier, and the debt to GDP went the opposite direction.

You can see this long-term debt cycle that Ray Dalio and Chris Cole always reference. From 1960, it gradually went all the way down, it bottomed out in 1980 or 1981, and then it went right back up to where we are today, at an all time high.

This interest rate chart only went to about 2012, so I added the fact that now we're down at 0% interest rates, and the debt to GDP, now with the Coronavirus, is quite literally off the charts.

It's not 110%. It'll most likely be at 130%, 140%, who knows where we'll end with all the deficit spending the government's doing now and will do into the future.

I'm going to go over the long-term debt cycle more extensively in just a moment, but before we do, look at a chart of the SNP500, going back to about 1920.

I don't know why there are only two years on those charts: 1950 and 2000. This is adjusted for inflation.

Again, like your financial planner Frank points out, we bought him out in 1981 and it does nothing but go straight up. That's what they always say, “Buy the dip, buy the dip, and you'll be fine.”

But what would have happened if you would've bought the dip prior to 1981.

Stocks always go up, right? Wrong. From the mid-1920s and all the way to the beginning of the 1980s, that's almost 60 years, stocks adjusted for inflation were flat. They didn't go up at all.

The question then becomes, “What if you would've had this magical 60/40 portfolio that all of the salespeople are trying to tell you is the best thing since sliced bread”

To explore that further, let's go right to Chris Cole's paper, the allegory of the hawk and serpent.

The classic 60/40 equity fixed income risk parody, and passively managed portfolios suffer from recency bias and are highly reliant on assumptions derived from a once in a century bull market in stocks and bonds. While such portfolios perform during secular booms, (1947-1953,1984-2007,2010-2019) they have an Achilles heel; namely, they struggle in periods where interest rates are at the zero bound.

Quick FYI, right now in 2020, we're at the zero lower bound.

They also struggle when inflation is rapidly rising,(the United States in the 1970s). During these periods, the fixed income leg offers little in the way of capital appreciation, or worse yet becomes correlated to risk assets, meaning it becomes correlated to equities and stocks. In these regimes, a traditional portfolio faces weak performance or significant losses.

What Chris is talking about are these long term debt cycles like the one I showed you, where interest rates are going up and debt is going down due to inflation.

Or the opposite of that is when interest rates are going down, and the debt is not only going up, but it's going through the roof, and off the charts.

Since it's cyclical, at some point in time, it's got to reverse and go the other direction. We have to have a de-leveraging and get all that excessive debt out of the system.

I'd like to remind everyone that right now debts are at an all-time high. Government, corporate, and consumer debt, are all at record high levels.

The question isn't if we'll have a de-leveraging. But, when will the de-leveraging occur, and will it be an inflationary de-leveraging or a deflationary deleveraging?

If you're on FinTwit or you read these articles, you know that's really the back and forth. Are we going to get inflation or are we going to get deflation?

There are very few professionals that argue that we're just going to stay in this mode of debt continuing to go up while interest rates continue to go down.

At some point, it has to give. So…

How does that affect the 60/40 portfolio?

If we have an inflationary deleveraging, that means that interest rates go up. If interest rates go up, what happens to bond prices? They go down. Therefore, the safe part of your portfolio gets crushed.

What happens if we have a deflationary deleveraging?

If we have deflation, that means most likely stock prices go down.

The part of your portfolio that's supposed to give you the capital appreciation you need to retire also gets crushed.

I think a lot of you reading this right now, most likely because you have this 60/40 portfolio are probably rationalizing this…

“George, but if we had inflation, then stocks would most likely go up and therefore I'd have a little bit of a hedge. If we have deflation, then bond prices most likely go up, so on that side, I have a hedge as well.”

But, what you're forgetting is during the 1970s, when we had significant inflation, and that's by the government's own numbers, we had a huge bear market in stocks from 1972 to 1974.

Also with bonds, how much lower can they get? We're already at the zero lower bound.

Can they go negative? Possibly.

I'd also like to point out that U.S treasuries going negative aren't the same as Japanese or German bonds. It is a completely different ball game because you're basically buying a long-dated dollar, which is the world reserve currency.

You'll notice when they ask Jerome Powell about negative interest rates that he always says, “No, we don't want to go there. We don't want anything to do with negative interest rates.”

He's adamant about that. The reason is that he most likely understands that if our benchmark treasury, such as the 10 year goes into negative territory, that could potentially collapse the entire global financial system.

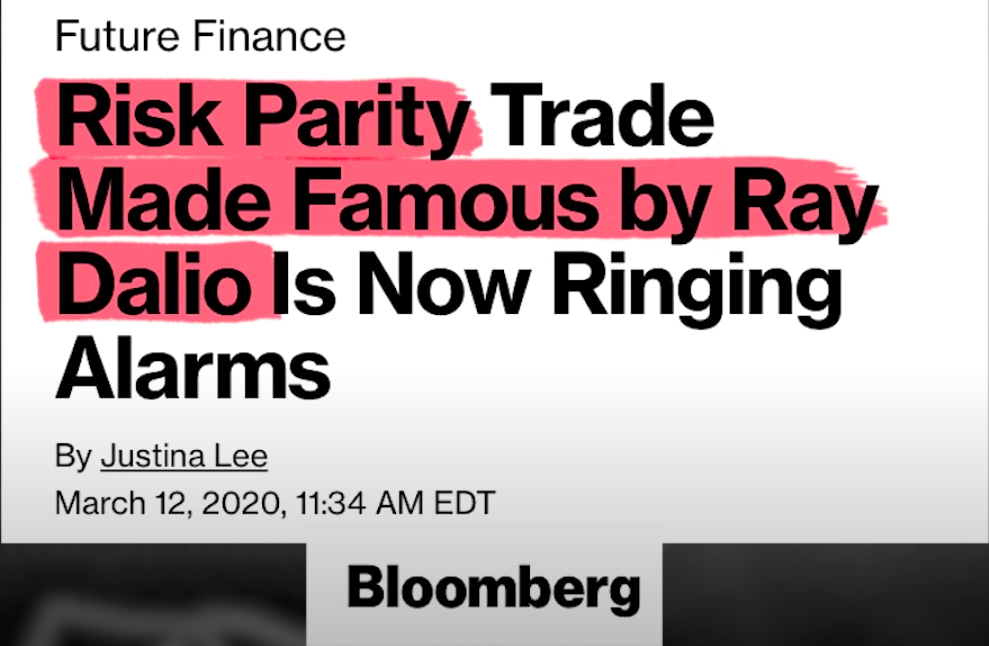

For further evidence that this 60/40 portfolio is getting riskier. Look at what I found on the internet.

Ray Dalio actually uses a version of this 60/40 portfolio called, “Risk Parity.”

It was made famous by Dalio, but he has suffered significant losses since the Coronavirus started, and now interest rates are at the zero lower bound, to combat the Coronavirus, according to the Fed.

But as Chris Cole's research shows us, that means that the risk parity or the 60/40 portfolio moving forward will most likely underperform dramatically.

Here's another headline from Fortune:

The losses continue to pile up for hedge fund King Ray Dalio.

They say in their article that his “Flagship fund Pure Alpha was down 18.6% for the year… The hedge fund's worst performance in a decade.”

This other article from the Washington Post that speaks directly to the Average Joe and Jane that has this 60/40 type of portfolio set up.

If Ray Dalio isn't making money now, neither will you.

Seeking Alpha gets right to the point with this headline:

60/40 is dead

And the rationale makes a lot of sense:

With the 10-year Treasury yield under 1.5% and stocks at record highs, investors need to check their return expectations at the door.

This was prior to the economy imploding due to the Coronavirus.

Seekingalpha also says:

The traditional 60 stock 40 bond portfolio at current valuations is no longer capable of supporting most investors' retirement and long-range liabilities.

Even the big banks are pointing out the dangers of this strategy. According to the financial times:

The golden era of risk parody when both bonds and equities rallied may be over, Morgan Stanley analysts warned.

Risk parity was a brilliant idea 20 years ago, but there's no more juice to squeeze out. He said, “It's in a dangerous position now.”

I couldn't agree more.

-

What can you do to protect yourself?

-

How can you avoid all these pitfalls that we're talking about with this 60/40 risk parity portfolio?

What I'm doing is trying to buy things when they're cheap and sell them when they're expensive.

What's cheap right now?

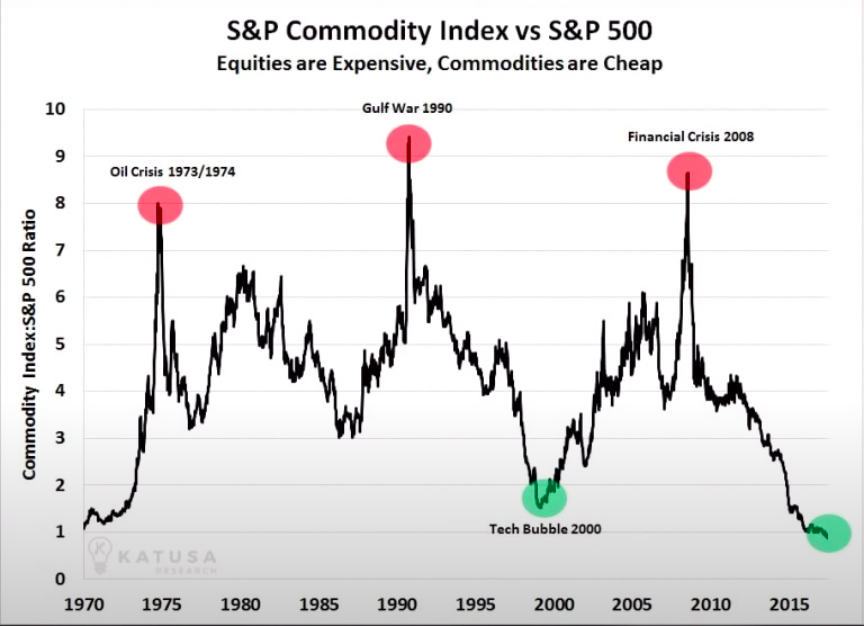

Commodities.

If you look at this chart of commodities, compared to stocks, commodities are at an all-time low going all the way back to 1900. That's what I call cheap.

I like to set up my own portfolio with a 10/80/10 split.

- 10% for insurance. For me, that's physical gold.

- 80% for investments, and I define that like things that pay me to own them.

- 10% for speculative assets. Which don't necessarily pay me, but I have tremendous asymmetry, a lot of upsides, and very little downside.

But, I think the very best thing that you can do is check out the online community I created called Rebel Capitalist Pro.

Obviously, I'm a little biased, but what I did when I set this up was create a product that I would want to use myself. I thought, “Okay, well, how do I learn?” Well, first I want to get research from the best in the business.”

That's why I went right to Lyn Alden and Chris Macintosh. This online membership site has their research included in it.

Then I said to myself, “Okay, well, I'd like to read their research, but it also liked to ask them questions directly.”

So, what I did was include live stream Q and A's for members only where you can ask your questions to Lyn, Chris, or myself.

I'm also a firm believer that you are the sum total of the five people you spend most of your time with. That's the power of this online community. Yes, it's great that you can ask the pros, these questions.

You can ask me questions directly on the live stream Q&A's.

And yes, it's amazing that you have this research at your disposal, but what I think is even more powerful is that you're surrounded by these like-minded individuals that you can share and learn with. All of us together can take our investing to the next level.

We can increase our financial and personal freedom, and right now we have a special offer, where you can try out Rebel Capitalist Pro for a dollar. It's a great deal.

I know I'm biased, of course, because this is the product that I wanted for myself, but give it a try, I really think you're going to love it.