The United States economy is completely built on a thought abstraction, through fiat currency.

In case you're wondering… It's definitely time to sit down, buckle up, and pour yourself that stiff drink.

In this article, George explains why Fiat currency has value, how central planners work, and how this might all end if we continue down the path of excessive money printing and debt.

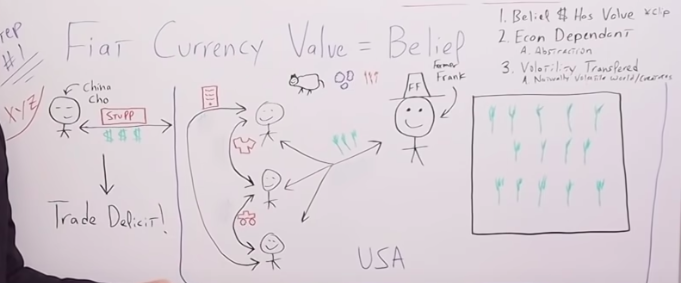

Fiat Currency Value = Belief

Fiat currency value equals belief. Let's think this through.

What gives Fiat currency value?

There's only one thing that gives fiat value. We collectively must believe that it has value.

To explore this concept further, here is a transcript from a recent interview with three of George's favorite macro insiders: Chris Cole, Grant Williams, and Bill Fleckenstein.

Chris Cole:

Does money even exist?

It doesn't exist if it's not tied to gold, it's purely a thought abstraction.

It's only worth something because we collectively believe it is.That's kind of interesting. We are dependent on thought abstractions.

In this sense, when we look at what thought abstractions are… We can see that nation-states exist because we believe in it. Money exists because we believe in it. Political parties exist because we believe in it, reality becomes these thought abstractions become reality.

Chris Cole points out that if the only thing that gives Fiat currency value is the fact that we believe it has value, the Fiat currency in and of itself is simply a thought abstraction.

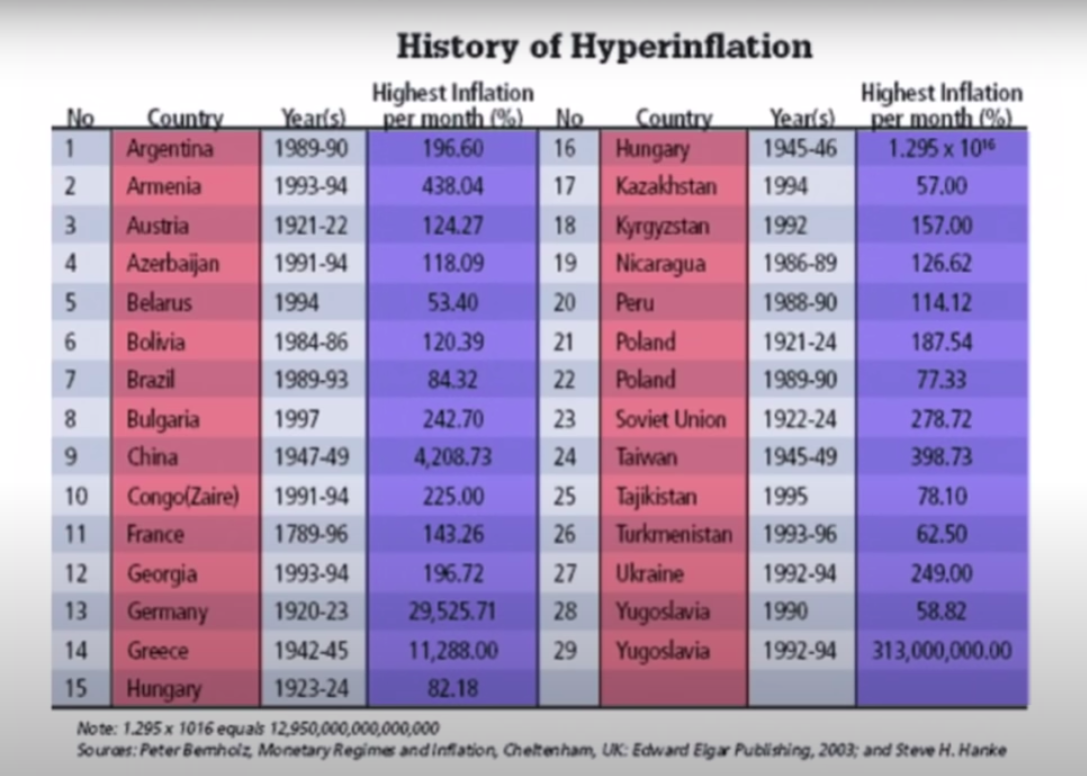

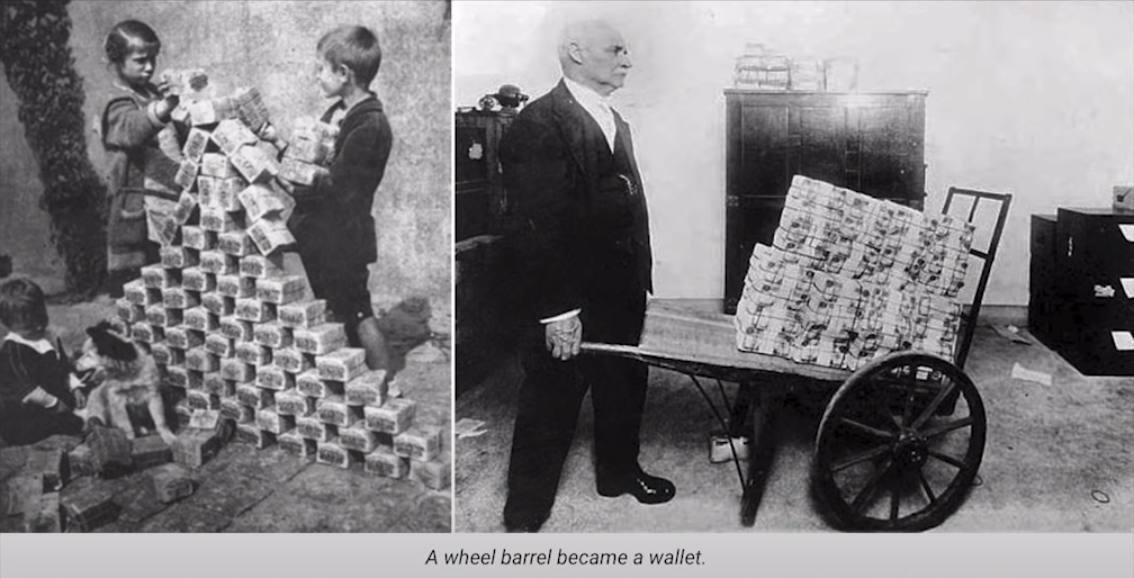

Our whole economy could be built around this thought of abstraction that we know can deteriorate very, very quickly. Look at a chart of past hyperinflations.

These are great examples. When the group of individuals using the currency lost belief, the currency lost value.

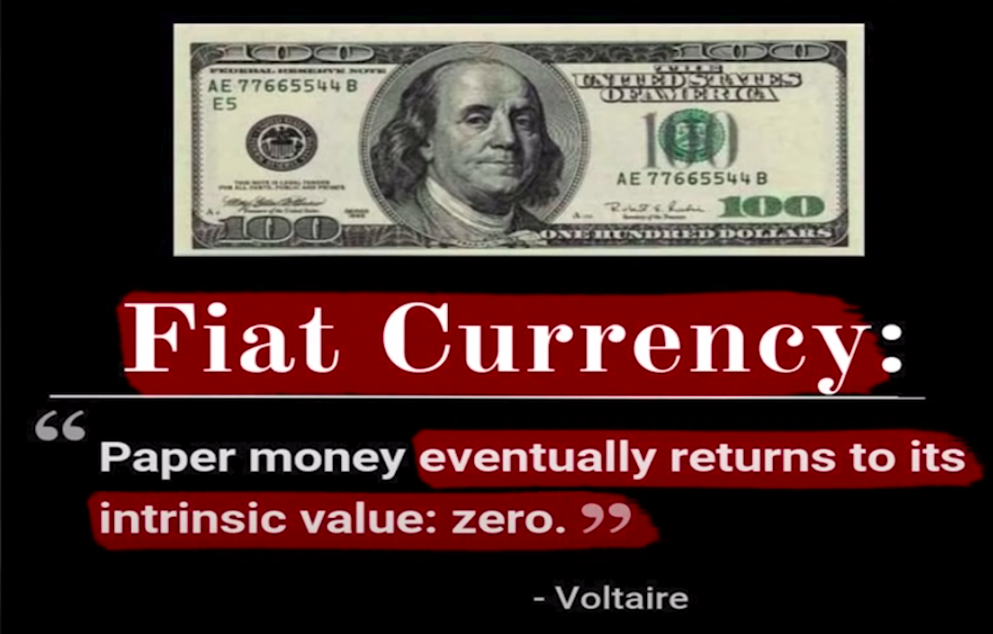

It always goes back to that famous quote from Voltaire:

All Fiat currency eventually goes to its intrinsic value, and that is zero.

How does this directly apply to the United States?

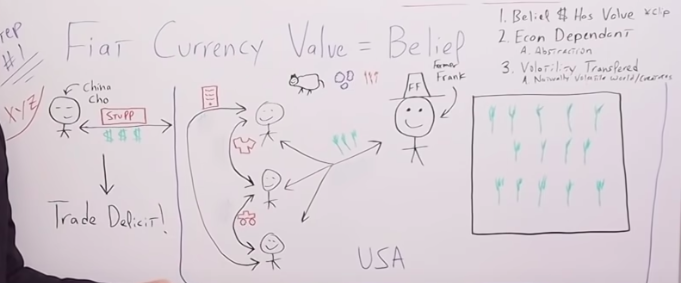

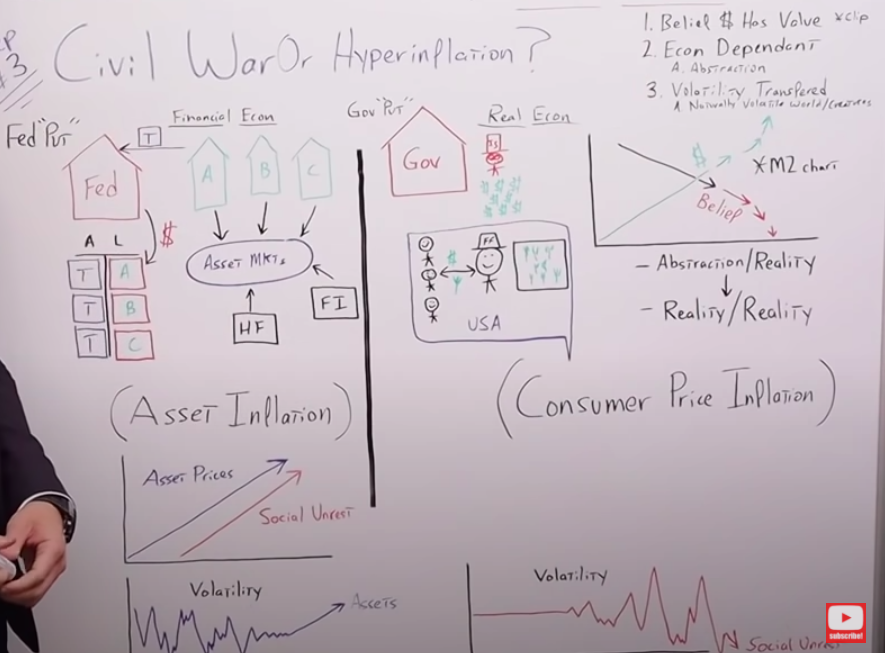

To illustrate, look at this beautiful drawing of the United States and our economy.

It starts right in the middle with farmer Frank, the little guy with the hat. He has a plot of land and he grows corn.

He supplies so much corn that it goes to all the citizens participating in the economy.

The way they make money is by trading goods and services back and forth to one another.

So, the individual at the bottom of the image imports cell phones and sells them to the person near the top. The person receiving the cell phones happens to imports clothing which they sell to the person in the middle.

The guy in the middle imports model trucks and sells them also. So it goes back and forth, but notice the only thing that's being produced in the United States is corn.

You may be asking yourself, “Okay, George, where are they getting the cell phones, shirts, and model trucks from?”

They're importing them from, not the average Joe, but average Joe's Chinese cousin, China Cho. He's on the left upper side of the board.

So, China Cho makes all of the stuff in his country called XYZ. He makes cell phones, shirts, model trucks and exports them into the United States.

What he accepts in return are the thought abstractions, Fiat currency. Why? Because China Cho has the same belief that those currency units actually have value.

If none of the four or five individuals believed the green pieces of paper had value, the green pieces of paper would not have value.

You may be saying to yourself, “okay, yeah, George, I get it. But that's pretty much every country that uses Fiat currency.” Not necessarily.

But…

Because the United States is so dependent upon imports, we don't produce much of anything in the United States.

We sell goods here, at Target, Home Depot, and Walmart, but all of those goods are produced overseas. In other words, we consume far more than we produce.

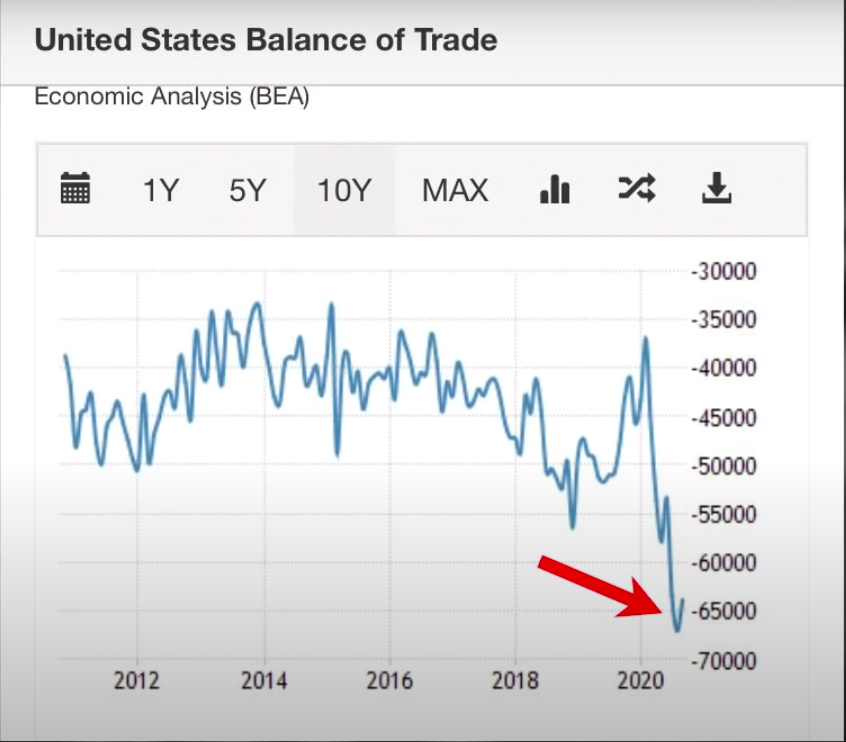

You can see that in the annual trade deficits, year after year, which by the way are growing substantially.

My point is the United States economy is completely built on a thought abstraction.

If we imagined a very simple economy without any fiat, then there would be no Fiat currency units floating around to give to China Cho. Therefore we wouldn't have cell phones, shirts, or model trucks.

The only thing we would have would be corn.

What would happen to the standard of living if goods and services went away and all we were left with was the one plot of land that produced corn?

Obviously, the standard of living would plummet and so would the economic output.

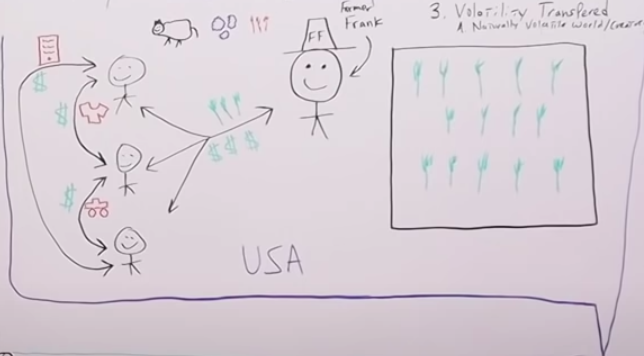

Let's contrast this idea with a different type of economy that has more manufacturing, and that actually produces more of the goods it consumes.

Imagine the guy on the top raises cows, the next one grows cotton, and the one on the bottom grows wheat. Farmer Frank is still producing corn.

If we eliminate Fiat currency or the dollar from that equation, would it really be a big deal?

No.

The only thing Fiat currency does in this example is make transactions more convenient. Where in the first example, fiat currency is a thought abstraction, the simple belief that the green pieces of paper have value is producing economic output all by itself.

- The first concept to understand is that our entire economy is dependent upon a thought abstraction.

- The second concept to really think through is volatility cannot be destroyed. It can only be transferred.

Chris Cole:

You can not destroy volatility because of risk. You can only transmute it in form and time. And so what they've done is they've distributed one standard deviation risk into tail risks.

Chris Coles suggests decision-makers have socialized risk and privatized gains. And as a result, we are now taking on risks that can't be fathomed right now.

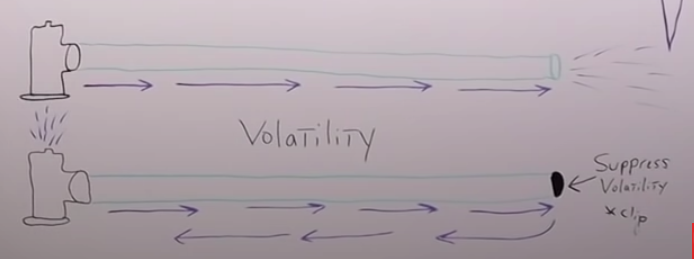

The way George likes to imagine this concept is to think of forcing water into a hose, as you can see in the image.

Look at the first hose and fire hydrant. Imagine you crank it up, and the water flows through and shoots out the other side. Pretend the water, in this case, is volatility.

If we cap the end of the hose, trying to suppress the volatility, as you can see in my second drawing, the volatility of the water doesn't go away. It builds up more and more pressure until at a certain point, the volatility is released. It's just released somewhere else.

The fire hose turns on, the volatility comes out the other end, but we cap the fire hose to suppress the volatility.

The water still shoots through it, gets recirculated building up more pressure and comes shooting out the top of the fire hydrant. The water hasn't gone away, the pressure hasn't gone away, it's just been released in a different location.

I know right about now, the MMT troll guy came in and said,

“George, you're crazy. What gives the dollar value is the fact the government requires us to pay our taxes in those dollars.”

Well, boy, that is a brilliant observation, but I would say that so does Venezuela. So did Weimar, Germany, and Zimbabwe.

There's nothing unique about the fact that a government requires its citizens to pay their taxes in the local currency.

There's also an argument that there's so much dollar-denominated debt that in and of itself creates demand for those dollars. This is true, but only to a certain extent.

Again, in Germany, Venezuela, and Zimbabwe…

Did they not have debt denominated in their local currency?

Of course, they did, but you get to a tipping point where so much currency is created, regardless of how much is required for taxes or to pay down the debt, you have this tidal wave of money printing that completely overwhelms every other factor.

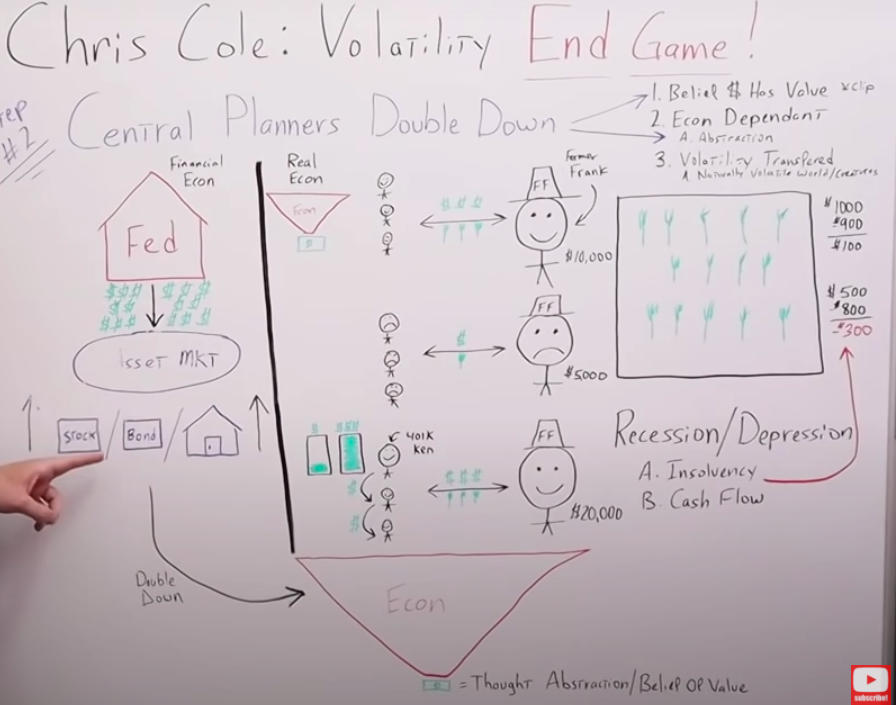

Central Planners Double Down

Central planners double down on building the entire economy on a thought abstraction, and a belief that the medium of exchange in and of itself has value.

Look at farmer Frank in his plot of land where he is growing corn. He sells corn to individuals in the real economy.

The economy is doing okay, so everyone is happy. The price of farmer Frank's land right now is $10,000, but the economy itself is very unstable.

I see it like this inverted triangle that's trying to balance on a little piece of paper and the little piece of paper could be gone at any moment.

But farmer Frank is cash flow positive, and he's bringing in a thousand dollars worth of revenue and his expenses are only $900.

So, he has a hundred dollars worth of profit. Yet, we have a recession, a depression maybe, and farmer Frank can't sell as much of his corn.

Now he's only selling one piece of corn because none of the people in the country have money. They're all unemployed.

Now, his revenue is only $500 and his expenses are $800 and are relatively fixed. He's losing $300. So, the price of his property goes from $10,000 down to $5,000.

This means farmer Frank is in big trouble but along comes the federal reserve and the central planners.

They say, “Hey, what we'll do is just print up funny money in an effort to raise asset prices or the asset markets in general. That involves stocks, bonds, and housing, and what we'll do is increase asset prices. People will have more wealth, we'll create value out of the medium of exchange, and then people will spend those currency units into the economy and that will fix the insolvency problem or the cash flow problem we had originally.”

To dive even deeper, here's another segment of Chris Cole's podcast.

Chris Cole:

Can the medium by itself create value, or does value exist independent of the medium?

There are two schools of thought here. One is the school of thought that as someone who has a CFA designation, I grew up believing in, which is that value is independent of the medium and intrinsic to the asset.

That's Warren Buffet and Seth Foreman. That's this idea that the bid and ask don't represent value any more than a Magritte pipe represents a real pipe, or painting a pipe represents a pipe.

Prices might fluctuate, but those prices are independent of the intrinsic worth.

Now, there's the second realm of thought, which says the value is generated from the medium.

In this sense, liquidity is the sole determinant of value defined by that constant bit and ask price.

As long as constant liquidity is supplied with a narrative, value is created. And that's true, whether the TOPA is corporate debt, the success of Elon Musk, or a factor premium in the market. It doesn't matter as long as liquidity is flowing.

There was a belief that argued that wherever that liquidity flows, it alone creates value. And what we saw in March of 2020, this year, it was a solvency crisis.

It's a continuation of the solvency crisis that started in 08′ and we saw correlation breakdowns. We saw basis trades blowing out. We saw all of these major problems, but I think what's really interesting is that they can't deal with the solvency issue.

So, what global policymakers did is they printed $20 trillion to try to create value out of the medium to fool people into solving a credit insolvency problem with excess liquidity.

(End Of Transcript)

How this works is the Fed creates funny money out of nowhere and bank reserves, and those bank reserves expand the balance sheet capacity of the primary dealer banks.

This flows into the hedge funds, the financial institutions, and it makes asset prices rise by lowering interest rates in the real economy.

Stock prices, bond prices, and housing prices go up. The Fed and the central planners are doubling down on the thought abstraction and building the entire economy around it.

We go from having a little bit of instability to a massive amount of instability, but the average Joe, doesn't see this. Farmer Fred doesn't understand what's happening to the economy.

They don't see the tsunami that's forming underneath the surface of the water. Look at 401K Ken at the bottom, he is super stoked because the prices of the assets in his 401k have gone up and up.

He thinks he's getting a lot richer, so he spends his money on the economy, which gives more cash to other people. So other people now have cash in their back pocket to go over to farmer Fred and continue to buy the same amount of corn they were buying.

Because of all the funny money creation, they have temporarily fixed or tried to fix an insolvency problem with liquidity. This is what Chris Cole was referring to, in my opinion, don't want to put words in his mouth.

But one thing he said explicitly is the creation of funny money, in a way, has created value in and of itself because the price of farmer Fred's property has gone from $10,000 up to $20,000.

But you have to ask yourself the question…

-

Has value been created?

-

Has the cashflow insolvency problem been solved or has it gotten even worse?

Farmer Fred's property doesn't produce any more corn. The ability for these individuals in the real economy to buy the corn from farmer Fred didn't come as a result of their labor or additional production that they created.

It only came as a result of the Fed creating more electronic units of measurement on their balance sheet, also known as bank reserves.

And all of the financial engineering that we have to try to get asset prices to continually go up and up, regardless of what's going on with the underlying fundamentals.

Chris Cole said it beautifully:

Fundamentals are dead

Meaning it doesn't matter how much corn farmer Fred can produce anymore.

The only thing that matters is how much liquidity is being pumped into the system.

The more liquidity that's pumped into the system, the bigger the triangle gets. And you have to remember it is built on a thought abstraction alone.

The only thing our entire economy is built on is the belief that the medium of exchange in and of itself actually has value.

This is what the central planners are doubling down on every single time they come up with more quantitative easing or more stimulus.

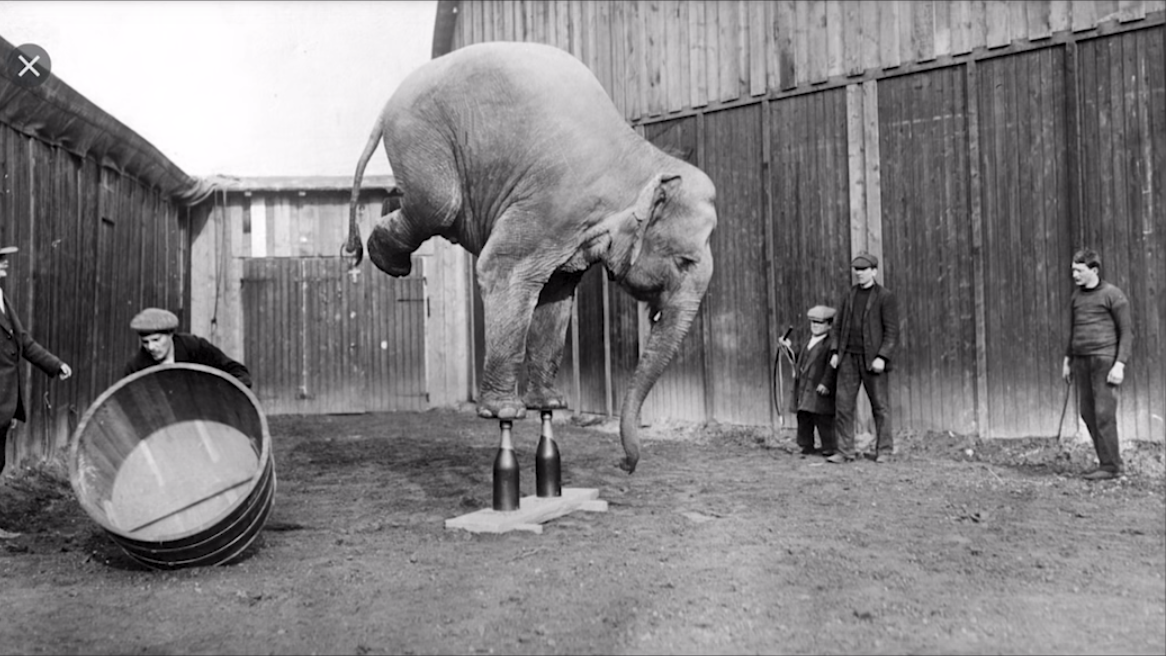

It's just like the old elephant in the circus that they train to balance on a couple of bottles.

Only in that case, at least the bottles where something tangible, what we're doing is we're trading our elephant or the economy, to balance on something that isn't even real.

Civil War Or Hyperinflation

Now it is officially stiff drink time, that is for sure, sit down and buckle up. Let's get right into it. I know a lot of you, a lot of the friends and family members of Fred are saying, “Oh, George, you're just exaggerating your fear mongering.

There's never going to be a civil war or any type of serious amount of inflation in the United States. We have the world reserve currency.”

But, please, come to your own conclusions as to what you think the probabilities are after we discuss this point.

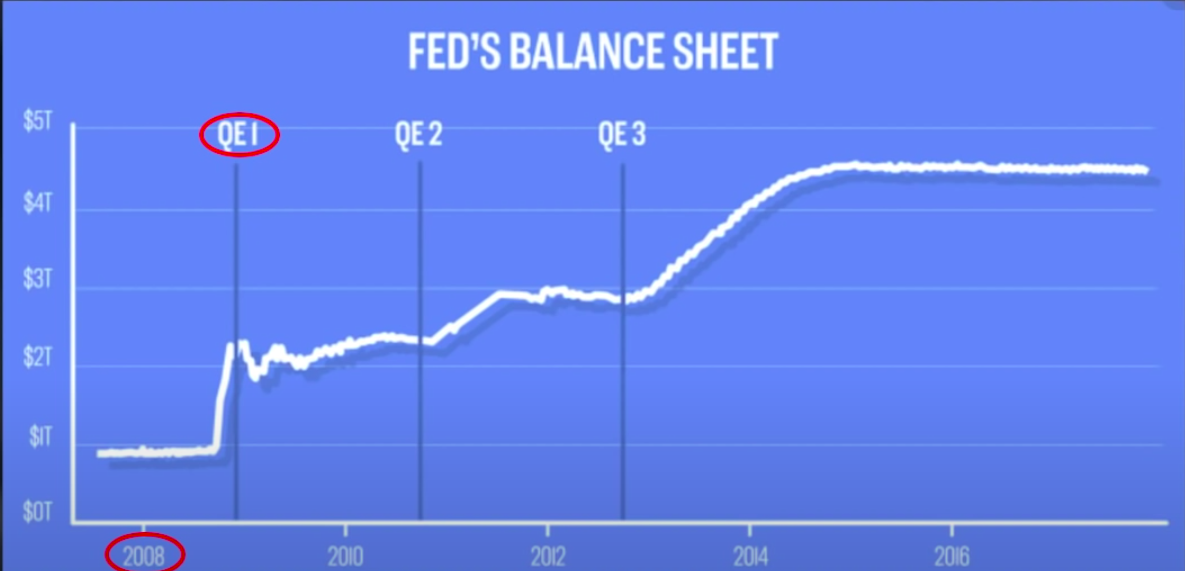

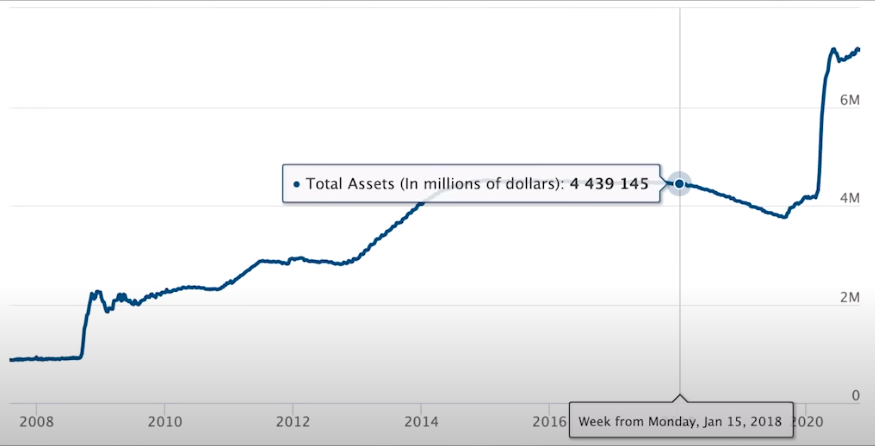

We've gone from a Fed put to a government put. What I mean by that is back in 2008, the Fed came in with quantitative easing money, printing, or whatever you want to call it.

Even if it was just a psychological effect, it increased asset prices.

When they're buying treasuries and mortgage backed securities from the primary dealers and the banks under the Feds umbrella, they're increasing the balance sheet capacity of those banks to create additional loans for the hedge funds financial institutions.

And there was a lot of private money flowing into the markets as well.

The bottom line is with the Fed put, the treasuries or assets are going onto the Fed's balance sheet, they're creating more and more bank reserves.

That's giving balance sheet capacity to the banking system. The hedge funds, the financial institutions lever up.

The average Joe sees those piles into the market with his Robin Hood account, and assets, stocks, bonds, and real estate, as we said before, go up and up.

But, very little of the inflation leaks out into the real economy. We have asset inflation, but we don't necessarily have consumer price inflation to the same extent.

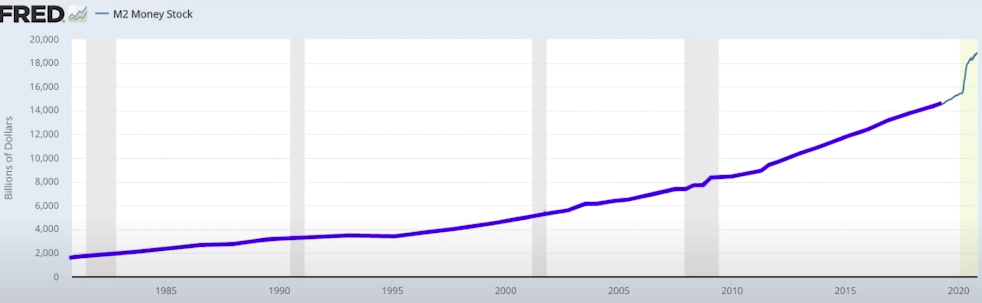

I would argue the CPI is definitely understated, but we didn't get hyperinflation from the fed, taking their balance sheet from $800 billion prior to the GFC, to over $4.5 trillion in 2018, and now in 2020, up to over $7 trillion.

You may say to yourself, “Okay, George, we'll find it's worked so far. I saw what you're talking about in the last point.”

Why don't we just keep doing this?

Because we have to take these scenarios to their logical outcome. As asset prices increase so does social unrest, because not every person owns assets.

If you're part of the unfortunate few that doesn't own assets, the likelihood you ever will, decreases the higher the asset prices go up.

In other words, you lose hope. If a human being loses hope they take extreme measures. Let's go back momentarily, and think through this from a standpoint of volatility.

Remember, Chris Cole tells us that volatility can't be destroyed, it can only be transferred.

If the Fed through quantitative easing or funny money is reducing what is naturally volatile, stock markets go up and believe it or not they go down. At least they should.

If you try to eliminate that volatility and smooth it out toward the only thing that asset prices do, it just gradually goes up.

In this controlled enviromentes, the volatility has to come out somewhere. So, where is it going to come out? Through social unrest. Prior to this financial engineering, we had social unrest but it was relatively stable.

What we've seen is the more the central planners try to micromanage everything and eliminate the volatility from asset prices, the more social unrest goes up, and gets more and more volatile. There's an inverse relationship between the two.

The more the Fed tries to fix a solvency problem with more liquidity, or the more they try to create value from the medium of exchange, the more social unrest we are going to have and the closer we're going to come to a civil war.

It's not just me saying this, it's not that Austrian crazy guy, George. It's also the pros, just like Chris Cole.

Chris Cole:

I do know one thing, though, if they keep doing what they're doing, which is just trying to inject liquidity to solve the solvency problem, further exacerbating the income disparity, we run this 10 standard deviation, 20 standard deviation risk of a breakdown in democracy.

I told that to the New York Times back in 2017. I'm not scared of the left tail, I'm not really scared of the right tail.

I am scared that they take this experiment and keep going and they create a tail risk that you cannot hedge, which is complete civil unrest.

We are now beginning to see that, and that's your real risk of the political risk.

That's also how it can end. You can have a war where you can have a, you can have a social revolution.

(End of Transcription)

But remember, we've gone from trying to prop up the economy with a Fed put, to a government put. The objective is the same: Create more liquidity to prop up asset prices or to paper over all the fundamental problems, the structural issues, with the actual economy.

But the transfer mechanism is a lot different. As we have seen the liquidity stays within the financial economy, but when the government tries to come in and create liquidity through UBI, stimulus checks, infrastructure spending, the Fed has to monetize the debt.

Meaning the Fed has to buy all those treasuries you're drunk insolvent Uncle Sam is issuing in order to spend all the funny money into the real economy or create more bank reserves, more currency units chasing the same amount of goods and services.

It goes back to the fact that all of this is predicated upon our collective belief there's value in the medium of exchange, that those green pieces of paper actually have value themselves.

If we think about value, going back to our simple economy, where a farmer Fred is producing corn, and the individuals are using that corn to put food on the table, just because there's additional currents units floating around doesn't mean that there's more wealth that's created.

It doesn't mean there's more consumption or value, and sooner or later, it's just like Wile E. Coyote running right off the cliff where he stays suspended in air until finally, he looks down and realizes there's nothing there and he falls all the way down.

I've seen it a million times in those cartoons and it's the exact same. At some point in time, society realizes the emperor has no clothes.

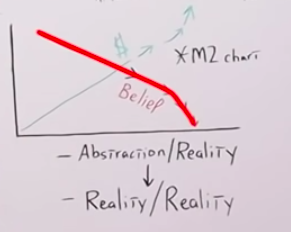

We can think about it this way with a simple chart.

As money printing increases, the amount of currency units chasing the same amount of goods and services goes up at a certain point to prop up the entire economy.

If the economy revolves around this belief system, we have to create more and more currents units. It becomes exponential, but as the curve becomes exponential, the belief that the currency itself has value, starts to deteriorate faster.

This too becomes exponential, but instead of going up, it's going down. This is where we get into a hyperinflation type of scenario.

This too becomes exponential, but instead of going up, it's going down. This is where we get into a hyperinflation type of scenario.

When we go from an abstraction being reality, to reality actually being reality is when the US dollar, the US economy, the whole house of cards comes crashing down. It's not a matter of if, it's a matter of when.

I want to be very clear, I am not here saying that the United States is going to go into a civil war or we're going to have hyperinflation.

What I am saying is if we continue on this path of trying to build our entire economy on a belief system, something that isn't real and doesn't exist, sooner or later, the outcome has to be civil war or hyperinflation.

We know the chances the central planners continue down this path is above zero.

What's the probability, exactly?

I'm not smart enough to know. I'll let you be the judge.