What is a Commodity Supercycle?

The commodity supercycle is a term used to describe a long-term cycle of rising commodity prices that can last for several years or even decades. This cycle has reliably played out over the last 100 to 125 years.

This phenomenon is driven by various factors, including increased demand from emerging markets, supply constraints, and infrastructure investment.

The current commodity supercycle is believed to have started in 2020 after a period of low prices and oversupply in many commodities.

Copper and gas are expected to be major beneficiaries of this new supercycle as they play critical roles in infrastructure development and the transition to cleaner energy sources.

While commodity producers stand to benefit from rising prices during a supercycle, consumers may face higher costs for goods and services that rely on these commodities.

As such, it's essential to understand the impact of commodity supercycles on the economy.

Commodity supercycles have been observed throughout history, with notable examples including the post-World War II boom and the China-driven boom of the early 2000s.

These cycles can have significant effects on global trade patterns, inflation rates, and economic growth.

As we navigate through this new supercycle, it's important to keep an eye on key indicators such as supply levels, demand trends, and infrastructure spending. By doing so, we can better understand how this cycle will impact producers and consumers.

The year 2023 has brought about concerns of a global economic recession as well, which ties into the current commodities supercycle. However, Wall Street and repo market legend Zoltan Pozsar has predicted that this upcoming recession will be different.

He said we have entered a long-term commodity supercycle that won't end until 2030 or even 2035. This article will delve deeper into this theory and understand its implications.

Understanding the Duration and Profits of the Commodity Supercycle

Commodity supercycles are a fascinating phenomenon that have been observed in the global economy for centuries. These cycles typically last for an extended period of time, spanning several years or even decades.

During this time, prices for various commodities rise and fall in tandem, driven by factors such as global demand, supply constraints, and geopolitical events.

For investors who are able to identify the right commodities to invest in and time their trades effectively, commodity supercycles can potentially yield significant profits. However, it's important to note that predicting the duration and profitability of these cycles can be challenging even for experienced investors.

One example of a commodity supercycle occurred between 2002 and 2011. During this time, prices for commodities such as oil, copper, and gold rose dramatically due to increased demand from emerging economies like China and India. This led many investors to pour money into these markets, hoping to reap significant profits.

However, not all investors were successful during this period. Some made poor investment decisions or failed to time their trades, resulting in substantial losses properly. This highlights the importance of conducting thorough research and analysis before investing in any commodity market.

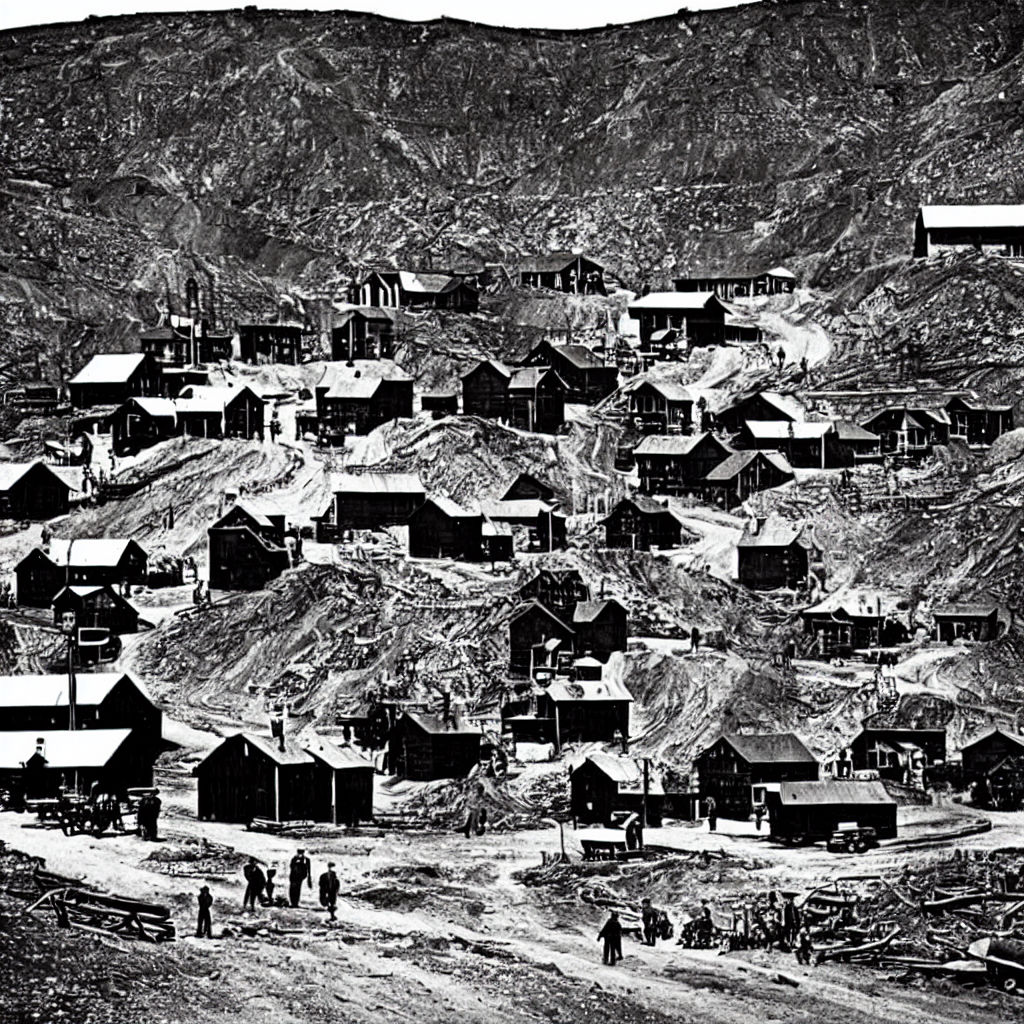

Another example of a commodity supercycle occurred in the late 19th century when gold was discovered in California and Australia. This led to a massive increase in global gold production which drove down prices until around 1896, when new discoveries became scarce leading up until World War I, when prices skyrocketed again due to increased demand from war efforts.

It's worth noting that while commodity supercycles can be lucrative for some investors, they are not guaranteed to occur on a regular basis.

In order to successfully invest in commodity markets, it's important to conduct thorough research and analysis before making any trades. This includes understanding the factors that drive supply and demand for various commodities and keeping up-to-date on geopolitical events that may impact prices.

Investors should also consider diversifying their portfolios by investing in a variety of different commodities rather than putting all their eggs in one basket. This can help reduce risk and increase the likelihood of long-term profitability.

Strategists' Insights on a Young Commodity Supercycle

Goldman Sachs predicts a new commodity supercycle driven by demand growth and supply shortages. The investment bank sees the potential for stocks in the sector to expand as prices rise. This prediction is based on the expectation that economies around the world will recover from the pandemic, leading to increased demand for commodities such as oil, natural gas, and coal.

Coal prices have already surged this year due to strong demand in Asia and supply disruptions. In fact, coal prices have risen by more than 80% since last year. This has been driven in part by China's economic recovery, its need for energy, and supply cuts in Australia and Indonesia.

Oil and natural gas prices are also expected to benefit from the post-pandemic economic recovery. As countries reopen their economies, there will be an increase in travel and transportation which will lead to higher demand for oil. Natural gas will also see a boost as it is used for heating and electricity generation.

However, some strategists warn that geopolitical risks such as war could disrupt supply chains and push prices higher. For example, tensions between the US and Iran could lead to disruptions in oil supplies from the Middle East which would cause prices to rise.

Investors should consider adding exposure to commodities to their portfolios to benefit from potential growth opportunities. Commodities can provide diversification benefits as they tend not to be correlated with traditional asset classes like stocks and bonds. They can also act as a hedge against inflation since commodity prices tend to rise when inflation is high.

In addition, commodities can offer attractive returns over the long term. According to Goldman Sachs, commodity investments returned an average of 11% per year between 1970 and 2020 compared with 9% for equities.

However, investing in commodities does come with risks. Prices can be volatile due to weather patterns or political instability, making it difficult for investors to predict future returns accurately.

Despite these risks, many investors are turning to commodities as a way to diversify their portfolios and protect against inflation. This trend is expected to continue as the world recovers from the pandemic and demand for commodities increases.

The Future of the Commodity Supercycle: Zoltan Pozsar's Analysis

Analysts like Zoltan Pozsar predict that the commodity supercycle will continue in the near future, with some forecasting a decade-long boom.

The COVID-19 pandemic has disrupted supply chains and caused a surge in demand for raw materials, which has contributed to the current commodity supercycle.

Many experts believe that commodity demand will remain high as countries recover from the pandemic.

Analysts are optimistic about the future of the commodity supercycle, particularly energy, because of China's re-opening. China is one of the world's largest consumers of commodities, and its economy has been slowly reopening since covid lockdowns. This trend is expected to continue, which could lead to sustained demand for energy.

Another factor contributing to the commodity supercycle is inflation. As prices rise across various economic sectors, investors turn to commodities as a hedge against inflation. This increased demand for commodities could help sustain higher prices over an extended period.

However, not all analysts are convinced that the commodity supercycle will continue indefinitely. Some argue that the transition to renewable energy sources will impact demand for traditional commodities such as oil, leading to a decline in prices in the long term.

The shift towards renewable energy sources is already underway and could have significant implications for oil prices in the long run.

On the other hand, others argue that this shift towards renewable energy will create new demand for metals and minerals used in batteries and other technologies. These metals include copper, nickel, lithium, and cobalt, essential components of electric vehicle batteries. This new demand could sustain or even increase commodity prices over time.

Geopolitical tensions between major oil-producing countries could also impact oil prices and ultimately affect the trajectory of the commodity supercycle. For example, tensions between the US and Iran or Saudi Arabia could lead to supply disruptions, which would cause oil prices to rise.

Zoltan believes that this recession will be different because of three reasons:

- Persistent Consumer Price Inflation – Zoltan points out that the cure for high prices usually is high prices. However, the price signal that used to exist in the past, where the response to high prices was more production, and ultimately, the result of that was lower prices, that feedback loop is broken today.

- Geopolitical Situation – Since Russia invaded Ukraine, we have no longer had what they call a peace dividend. The situation with Russia, China, India, all the BRIC countries, and the West is likely to become more volatile, and the more volatile it becomes, the more we have this bifurcation in the global economy, and that means higher prices.

- Emerging Market Situations – These countries are likely to implement protectionist policies, and this would impact whether we see lower or higher prices moving forward.

Economic Supercycles: An Example of How They Work

Economic supercycles are long-term economic growth and decline patterns that can last for decades or centuries. These cycles are driven by a variety of factors, including changes in technology, shifts in global economic power, and fluctuations in commodity prices. Understanding these cycles is crucial for investors, policymakers, and businesses alike.

One example of a current economic supercycle is the shift towards green infrastructure and renewable energy sources. This shift has been driven by concerns over climate change and the need to reduce carbon emissions. As a result, industries such as solar and wind power have experienced significant growth in recent years.

However, it's important to note that economic supercycles are not always predictable or easy to understand. They can be influenced by a wide range of complex factors, including geopolitical events, technological breakthroughs, demographic changes, and more.

The History of Economic Supercycles

Economic supercycles have been observed throughout history. One example is the Industrial Revolution in Europe during the 18th and 19th centuries. This period saw significant advances in manufacturing technology, which led to increased productivity and economic growth.

Another example is the post-World War II boom in the United States. This period was characterized by strong economic growth fueled by government spending on infrastructure projects such as highways and airports.

In both cases, these periods of growth were followed by periods of decline or stagnation. For example, the Industrial Revolution eventually led to overproduction and falling prices for goods such as textiles. Similarly, the post-World War II boom was followed by a period of inflation and slow growth during the 1970s.

Factors Driving Economic Supercycles

Many factors can drive economic supercycles. One key factor is technological innovation. New technologies can lead to increased productivity and efficiency in various industries.

For example, advancements in computer technology have revolutionized industries such as finance, healthcare, and manufacturing. Similarly, the development of renewable energy technologies has led to significant growth in industries such as solar and wind power.

Another factor that can drive economic supercycles is shifts in global economic power. For example, the rise of China as an economic superpower has significantly impacted global trade patterns and commodity prices.

Fluctuations in commodity prices are another key driver of economic supercycles. Commodity prices can be influenced by a wide range of factors, including supply and demand dynamics, geopolitical events, and weather patterns.

The Green Infrastructure Super Cycle

One current example of an economic supercycle is the shift towards green infrastructure and renewable energy sources. This shift has been driven by concerns over climate change and the need to reduce carbon emissions.

As a result, industries such as solar and wind power have experienced significant growth in recent years. According to the International Energy Agency (IEA), renewable energy sources accounted for nearly 72% of new power capacity additions worldwide in 2019.

This trend is expected to continue in the coming years. The IEA projects that renewable energy sources will account for nearly 90% of new power capacity additions through 2025.

However, there are challenges associated with this transition. One challenge is the intermittency of renewable energy sources such as solar and wind power. These sources are not always available when needed due to changes in weather conditions.

To address this issue, researchers are exploring new technologies, such as battery storage systems that can store excess energy generated by renewables during times of high production for use during periods of low production.

Analyzing Whether the World is Entering a Commodity Supercycle

The recent surge in commodity prices has sparked a debate about whether the world is entering a new commodity supercycle.

Commodity markets have been on an upward, albeit volatile trajectory, since the second half of 2020, with prices of industrial metals such as copper and nickel hitting multi-year highs.

The global economic recovery from the pandemic-induced recession, especially in China, the world's largest consumer of commodities, has been driving up demand for raw materials.

At the same time, the energy transition towards renewable sources is also boosting demand for metals like copper that are essential for building green infrastructure.

However, supply-side constraints are also contributing to the rise in commodity prices.

Production disruptions caused by COVID-19 outbreaks and logistical issues such as port congestion have led to shortages of some commodities like iron ore and semiconductors.

In addition, geopolitical tensions and trade disputes between major economies could further disrupt global supply chains.

So, what exactly is a commodity supercycle? It refers to an extended period of rising prices across various commodity sectors due to sustained demand growth outpacing supply growth.

Historically, there have been three major commodity supercycles:

- One in the late 19th century driven by industrialization;

- another in the post-war period fueled by reconstruction efforts,

- and a third in the early 2000s, driven by rapid industrialization in emerging markets like China.

The question is whether we are witnessing a fourth supercycle or just a short-term price spike. The answer lies in analyzing historical trends and market fundamentals.

One key factor to consider is global economic growth. A sustained period of strong economic expansion would increase demand for commodities across various sectors such as construction, manufacturing, and transportation.

However, if growth falters due to factors like inflation or geopolitical tensions, it could dampen demand for raw materials.

Another factor is inflation expectations. Rising inflation can be both positive and negative for commodity markets. On one hand, it can signal a robust economic recovery and boost demand for commodities. On the other hand, it can lead to higher interest rates and a stronger US dollar, which would make commodities more expensive for buyers using other currencies.

In addition, supply-side factors such as production capacity, inventories, and technological advancements can influence commodity prices. For example, advances in mining technology could increase the supply of certain metals like lithium used in batteries for electric vehicles.

So far, the current surge in commodity prices has been driven by a combination of demand-side and supply-side factors. The question is whether these trends will continue or reverse course.

Some analysts believe that the energy transition towards renewable sources will be a major driver of long-term demand growth for industrial metals like copper.

According to a report by Goldman Sachs, copper demand from renewable energy projects could rise from 3% currently to 16% by 2030. This would require significant investments in new mines and smelters to meet the growing demand.

Others argue that the current boom is unsustainable due to high levels of debt and overinvestment in some sectors like oil and gas. In addition, rising interest rates could dampen economic growth and reduce demand for commodities.

Key Takeaways on the Commodity Supercycle and Its Implications

The commodity supercycle is a long-term trend of rising commodity prices driven by global economic growth, urbanization, and industrialization.

It is characterized by a sustained period of high demand for commodities, which leads to higher prices and increased investment in production capacity.

The current commodity supercycle is being fueled by the post-pandemic economic recovery, supply chain disruptions, and climate change policies.

The post-pandemic economic recovery has led to a surge in demand for commodities such as oil, copper, iron ore, and agricultural products.

As countries reopen their economies and resume normal activities, they require more raw materials to fuel their growth. This has put pressure on global supply chains that were already strained due to the pandemic-related disruptions.

Supply chain disruptions have also contributed to the current commodity supercycle. The response to the pandemic has caused delays and shutdowns in production facilities around the world, leading to shortages of critical inputs such as semiconductors and fertilizers.

These shortages have pushed up prices for these commodities and created bottlenecks in various industries.

Climate change policies are another factor driving the current commodity supercycle. Governments around the world are implementing measures to reduce greenhouse gas emissions and transition to renewable energy sources. This has led to increased demand for metals such as copper, nickel, lithium, and cobalt that are used in electric vehicles (EVs), wind turbines, solar panels, and energy storage systems.

The commodity supercycle has significant implications for mining, agriculture, energy, and transportation industries. Mining companies are benefiting from higher prices for metals such as copper, gold, silver, zinc, and aluminum. Agricultural producers are enjoying higher prices for crops such as soybeans, corns wheat due to strong demand from China's food industry amid African swine fever outbreaks affecting pork supplies there.

Energy companies are experiencing a rebound in oil prices after last year's slump caused by oversupply issues exacerbated by COVID-19 lockdowns worldwide. Transportation companies are facing higher fuel costs, which could lead to higher prices for consumers.

The commodity supercycle also affects countries that rely heavily on commodity exports. For example, countries such as Brazil and Australia that export iron ore and coal have benefited from higher prices, while those that import these commodities, such as China and India face increased costs.

Investors can benefit from the commodity supercycle by investing in commodities directly or indirectly through stocks or ETFs.

Direct investment in commodities such as gold or oil requires specialized knowledge and carries significant risks due to price volatility.

However, investors can gain exposure to commodities through stocks of companies engaged in mining, energy production, agriculture, or transportation.

ETFs and mutual funds that track commodity indices offer another way for investors to gain exposure to the commodity supercycle. These funds invest in a basket of commodities or related stocks and provide diversification benefits.

The commodity supercycle also poses risks for investors. Price volatility is one of the main risks associated with investing in commodities. Commodity prices can fluctuate widely due to various factors such as weather conditions, geopolitical tensions, supply chain disruptions, and changes in demand patterns.

Geopolitical tensions can also affect commodity prices by disrupting supply chains or causing trade restrictions. For example, sanctions on Iran's oil exports have recently led to higher oil prices.

Environmental concerns are another risk associated with the commodity supercycle. Extracting natural resources from the earth can have negative impacts on the environment such as deforestation, water pollution from mining waste runoff into rivers affecting aquatic life downstream areas where people depend on fishing activities for their livelihoods, air pollution caused by burning fossil fuels leading to respiratory illnesses like asthma among others; soil degradation resulting from overuse of fertilizers leading to reduced yields over time if not properly managed.

Governments and businesses need to adopt sustainable practices and invest in innovation to mitigate the negative impacts of the commodity supercycle on the environment and society.

This includes developing new energy production, transportation, and agriculture technologies that are more efficient and less polluting.

The Significance of the Commodity Supercycle

The commodities supercycle is a phenomenon that has been observed over the past few decades. It refers to a period of sustained high commodity demand and prices, which can last for several years or even decades. This cycle is driven by factors such as rapid industrialization, population growth, and urbanization in emerging markets.

The significance of the commodities supercycle lies in its impact on global economic growth and development. As commodity demand rises, so does investment in resource extraction, infrastructure, and related industries. This can create jobs, boost trade, and drive innovation in areas such as renewable energy and sustainable agriculture.

For example, during the 2000s commodities supercycle, countries like Brazil benefited from increased demand for their agricultural products. The country's soybean exports to China grew by 1,000% between 2000 and 2013. This helped Brazil become one of the largest agricultural exporters in the world.

Similarly, African countries with significant mineral deposits have experienced an increase in foreign investment during commodities supercycles.

For instance, due to rising global demand, Zambia's copper exports increased by more than four times between 2002 and 2011.

However, the commodities supercycle also poses challenges for policymakers and businesses alike. Fluctuations in commodity prices can lead to volatility in financial markets and inflationary pressures.

Moreover, reliance on resource extraction can create environmental risks and social tensions, particularly in developing countries where resource wealth is often concentrated in the hands of a few.

One challenge that policymakers face during a commodities supercycle is managing inflationary pressures caused by rising commodity prices. Inflation erodes purchasing power leading to higher costs of living which may be difficult for low-income households who rely heavily on basic goods like food.

Another challenge posed by the commodities supercycle is environmental degradation resulting from resource extraction activities such as mining or oil drilling. These activities are often associated with negative externalities such as pollution, which may cause health problems among the local population.

Furthermore, resource extraction activities often lead to social tensions, particularly in developing countries where resource wealth is concentrated in the hands of a few. This can lead to conflicts over land rights, displacement of indigenous people, and other forms of social unrest.

Despite these challenges, the commodities supercycle presents opportunities for policymakers and businesses alike. For instance, governments can use revenues from commodity exports to invest in infrastructure such as roads and schools, which can help boost economic growth and development.

Moreover, businesses can take advantage of rising commodity prices by investing in related industries such as renewable energy or sustainable agriculture. For example, during the 2000s commodities supercycle, there was an increase in investments toward renewable energy sources such as wind and solar power.

How to Benefit from the Commodity Supercycle: Investor Tips

As we have discussed, the commodity supercycle is a long-term trend that can offer investors significant profits. However, investing in commodities can be risky and requires careful consideration of market trends and economic indicators.

Here are some tips for investors looking to benefit from the commodity supercycle:

-

Diversify your portfolio: Investing in a variety of commodities can help spread risk and increase potential returns. Consider investing in both hard commodities like metals and soft commodities like agricultural products.

-

Monitor supply and demand: Keep an eye on global supply and demand trends for different commodities. This information can help you make informed investment decisions.

-

Stay up-to-date on market news: Follow news outlets that cover the commodity markets closely, such as Bloomberg or Reuters. This will keep you informed about any changes in prices or market conditions.

-

Consider investing in commodity ETFs: These investment vehicles allow you to invest in a diversified portfolio of commodities without having to buy individual contracts.

-

Be patient: The commodity supercycle is a long-term trend, so don't expect immediate returns on your investments. It's important to have a long-term investment strategy when it comes to commodities.

-

Work with professionals: If you're new to investing in commodities or want professional guidance, consider working with a financial advisor who specializes in this area.

By following these tips, investors can potentially benefit from the commodity supercycle while minimizing risks associated with this type of investment.

Potential Impact of a Global Economic Recession

While it's true that commodity prices have been on an upswing and that supply constraints are a factor, the demand side of the equation could be significantly impacted by a global economic recession. As consumers and businesses tighten their belts and cut back on spending, demand for commodities could decrease, leading to lower prices.

Additionally, the current geopolitical landscape is volatile and could further impact the supply and demand of commodities. While emerging markets may continue to grow, protectionist policies and other factors could limit their impact on the overall commodity market.