Is the digital dollar just the next step in the agenda to take us straight to communism? Digital dollars, digital wallets, pass through digital wallets and member banks? What does the March 23rd senate bill means for us?

In this article, I will explain the “banking for all act”, the government and Fed mechanisms and how it can all end as an Orwellian nightmare having no moral nor financial freedom.

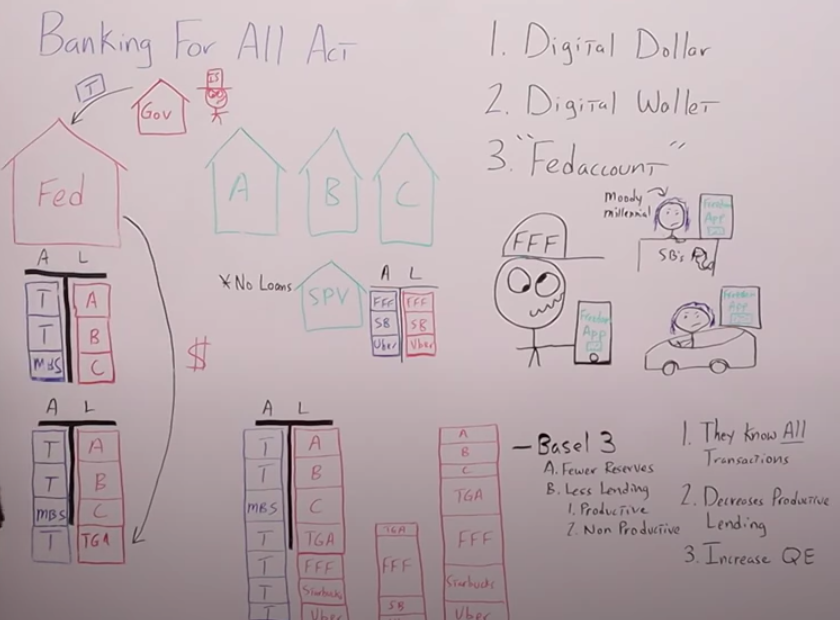

The “Banking For All Act”

Is the digital dollar just the next step in the agenda to take us straight to communism?

The digital dollar was introduced right at the height of the coronavirus in March of 2020. Probably no coincidence there. It outlines their objectives for:

- Digital dollar

- Digital wallet

- Fed account

I want to be very clear. These are their words, not mine. So, to dive into this deeper, let's go right to the bill that Mr. Brown introduced on March 23 of 2020 in the senate.

This act may be cited as the Banking for All Act.

I took that right off the bill itself so you can see that I'm not making it up.

I'm going to start with the definitions they provide in the article:

Digital dollars:

The term digital dollars means dollar balances consisting of digital ledger entries recorded as liabilities in the accounts of any Federal Reserve bank.

Digital dollar wallet:

A digital wallet or account maintained by a Federal Reserve bank on behalf of any person for the purpose of holding digital dollar balances.

Member bank:

Any national bank, state bank, or bank or trust which has become a member of one of the reserve banks created by the Federal Reserve.

Pass-through digital wallet:

Digital wallet or account maintained by the member bank on behalf of any person entitling the person to pro-rata share of the pooled reserve balances that the member bank maintains at any Federal Reserve bank.

They are doing it through a special purpose vehicle, and because I don't want to confuse you too much, I'm going to go over it in great detail with my whiteboard.

Later the article says:

In general, member banks shall open and maintain pass through digital dollar wallets.

Although the actual accounts are with the fed, notice they're saying maintain.

Including persons eligible to receive payments from the U.S. government

Payments such as stimulus or UBI. If we continue it says…

Each member bank shall establish and maintain a separate legal entity for the exclusive purpose of holding all assets and maintaining all liabilities associated with the past through a digital wallet. The assets of any entity described in subparagraph A, shall consist exclusively of a balance maintained in a master account at the Federal Reserve bank. And the liabilities or obligations of the entity shall consist exclusively of an equal quantity of balances maintained by holders of pass-through digital wallets.

In other words, you and I, the average Joe that downloads “the fed app” on their phone.

Another thing I want to point out is the following phrase:

The assets of any entity described shall consist, exclusively of a balance maintained at a master account at a Federal Reserve bank.

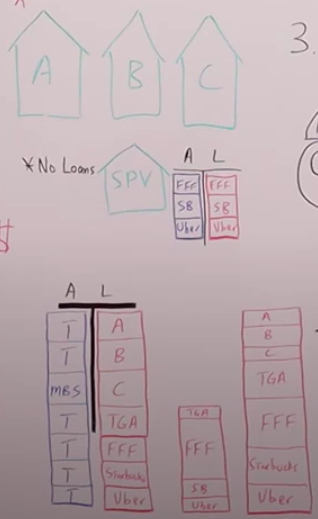

What they're saying is the assets of this special purpose vehicle will only contain bank reserves. Said another way, they won't contain loans. So this special purpose vehicle cannot lend money.

In the capital or liquidity regulations for this special purpose vehicle and how it interacts with the banks they say this:

The assets and liabilities of any legal entity described in sub paragraph A, that's the special purpose vehicle, shall not be deemed assets or liabilities of the member bank for purposes of any capital or liquidity regulations promulgated by the Federal or state banking authorities.

Such as Basel III.

Lastly, I want to point out that it also says:

All Federal Reserve banks shall not later than January 1st, 2021 make digital wallets available to all residents and citizens of the United States and to businesses domiciled in the United States.

Now, take a look at my whiteboard and let me explain all of this nonsense.

I would suggest you go through each detail and read that bill yourself. It's very quick, only about seven or eight pages. You can read it by clicking here.

Let's begin with the guy with the FFF hat I drew, in this case, he is your friend and family member, Fred. He's the one that loves the government and the fed.

Of course, he's going to be on board with having an account with the Fed because he feels it is very cool.

He's going to download his freedom app because he wants that stimulus check from the government, or more exactly from his Uncle Sam, who he loves because Fred, of course, values safety far more than freedom.

Remember the Banking for All Act includes businesses, so I have Starbucks on the right side of my whiteboard and Moody the millennial working behind the counter.

Moody, or should I say “They”, because I don't know Moody's preferred pronouns, is looking kind of disgruntled, as always.

We know Moody's not very happy to be at work, and is definitely pissed off at you for even walking through the front door.

But Moody downloads the merchant freedom app as soon as possible because Starbucks wants to get on the bandwagon.

Your friend and family member Fred takes his barcode, goes right to the merchant freedom app, scans the barcode, pays for his coffee, and Moody, disgruntled, makes that coffee for him as they kind of give that pissed off look.

Then Moody quits her job at Starbucks and starts working for Uber. But the exact thing happens, Uber has a merchant app.

We'll call it the freedom app because as Ron Paul says, whenever the government names something, it always has the opposite effect.

Let's back up a little and think about how this all starts with the balance sheet of the Federal Reserve.

Usually, prior to the Banking for All Act and prior to 2008, the Fed just had accounts for the primary dealer banks and the banks under the Fed's umbrella.

So what would happen when the Fed would want to increase the base money supply, is they would buy assets from the primary dealer banks, such as treasuries or mortgage-backed securities, or mortgage-backed sausages as I like to call them.

So, they buy these “assets” from the primary dealer banks by printing up additional base money, just funny money out of thin air.

It's literally them just adding digits to the accounts of whomever they buy the assets from.

In 2008, the Fed also added the TGA to its balance sheet. The TGA is the treasury general account, that's the bank account of your drunk, insolvent Uncle Sam and the government.

What happens now is the primary dealer banks or the banks under the Fed's umbrella will buy the treasuries from the government.

Then, the bank reserves or cash go into the TGA from the accounts of those banks of whoever bought the assets in the first place.

But then the Fed, through this shell game, will go ahead and buy them back from the banks. Those treasuries end up on the balance sheet of the fed and the brand new bank reserves get added to their balance sheet.

Just in summary, what happens when the Fed buys assets and increases the size of their balance sheet is it adds bank reserves to the system.

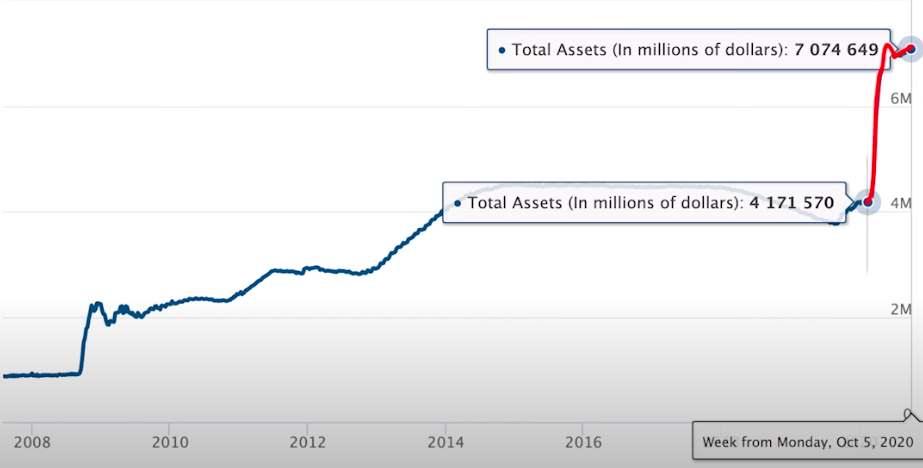

When they decrease the size of their balance sheet, which of course they never will, because they can't and we saw what happened when they tried in 2019, the whole house of cards almost came collapsing down.

They had to quickly take their balance sheet from $4 trillion right back up to $7 trillion.

It's just like Peter Schiff says, the Fed's balance sheet is the monetary roach motel. Once you take it to a certain level, or once you go in, you can never leave.

Now what this act is pushing us towards is a new system where not only the banks and the treasury have an account with the fed, but the average Joe as well.

Or in this case, the example we're using, as your friend and family member Fred Starbucks and Uber.

The fed's balance sheet now would look something like this:

Where the liabilities are the deposits held by the banking system, the TGA, and the entities that we discussed in the private sector.

Then, the assets would be the same. More treasuries and mortgage-backed securities. But, let's not forget the special purpose vehicle(SPV) that the Banking for All Act mentioned.

The banks you see on my whiteboard will only manage the digital wallet, the actual account will be held with the Fed.

The balance sheet of this special purpose vehicle would have the bank reserves held at the Fed, on the assets side, and on the liabilities, they would have the deposits of the private sector, in this case of your friend and family member Fred, Starbucks, and Uber.

But whatever assets or liabilities are managed by the special purpose vehicle, remember they're outside of the use or the balance sheet of the banking system. Think that through.

What happens if all the money or bank reserves that go into the TGA get distributed through stimulus checks to the private sector?

Well, the amount of currency, money, or bank reserves, would shrink in the TGA and it would increase in the accounts of the private sector, the average Joe, friend and family member Fred, Starbucks, or Uber.

My whole point is the accounts would change in size, therefore, that would prevent people like your friend and family member Fred from loving the freedom app so much.

They would be saying, “Listen, I want to take my money from Wells Fargo or BofA, and I want to move it right to my freedom app.”

In that case, the account sizes would change. Again, although the overall size of the Fed's balance sheet of the liabilities on their balance sheet would stay consistent.

The bank reserves or cash, would just move from one account to the other. So again, the only thing that's changing is the size of each account.

Now, let's connect the dots. If the entities in the private sector are moving deposits away from the banking system to the Fed, that means the bank reserves held by the banking system shrinks.

That means there are no more reserves or if there are fewer reserves, that means there's less productive lending for the real economy.

The lending for the private sector from the banking system, at least in a free market system is very productive because they're out there trying to find entrepreneurs, as an example, to lend money to.

These entrepreneurs create more goods and services at a lower price. That's making us all richer and it's improving the economy.

I'm not saying that they're doing this now because of the manipulation from all the central planners at the Fed and the government, but that's the way the banking system would most likely work if we eliminated all these crazy bailouts and things that distort the whole mechanism such as the FDIC.

This type of lending to entrepreneurs from the banks, creating additional money supply is far more productive than the lending from the Fed directly to the government.

Just so the government can spend that money through stimulus, putting it into the new fed accounts for the individuals in the private sector.

There are no additional goods and services created there. The only thing that's created is an additional money supply.

It doesn't make us richer. In fact, over the long run, it only makes us poorer because we get lazier.

It hollows out the manufacturing base and it takes us to where we are today, where we have this huge trade deficit and we have to rely on other countries to consume and maintain our standard of living.

The bottom line takeaway is that if the bank reserves go from the banking system to the balance sheet of the Fed in the accounts of the individual entities, that means there could be less productive lending moving forward.

Now a lot of you may be saying, “Well George, I get what you're saying, but there are no more reserve requirements so the banks can just lend to infinity. It doesn't matter.”

To a certain extent, that's true, but we have to remember there are regulations like Basel III that do restrict the amount they can lend.

It's based on the assets more so than the deposits, but I won't get into the minutia. The bottom line is, effectively, there are constraints through regulation that restrict the amount of lending the banks can do.

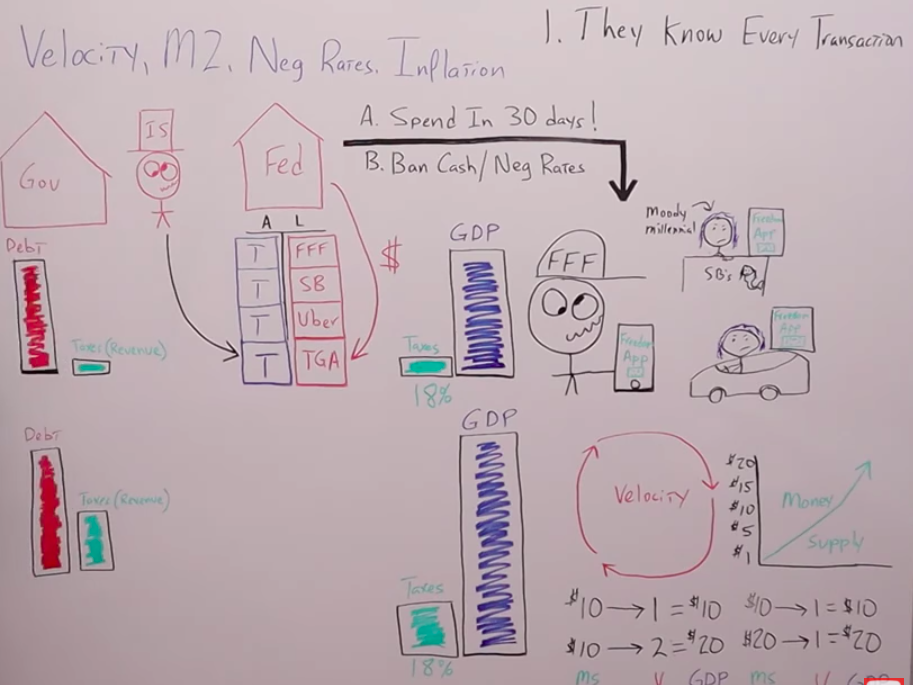

Again, the fewer bank reserves they have, theoretically, the less productive lending and more nonproductive lending. It is crucial we realize if we all have an account with the Fed, they will know every transaction. There will be no privacy whatsoever with banking.

They will basically have your bank statements… And if that sounds very Orwellian, very 1984 to you, trust me, you don't know half of it.

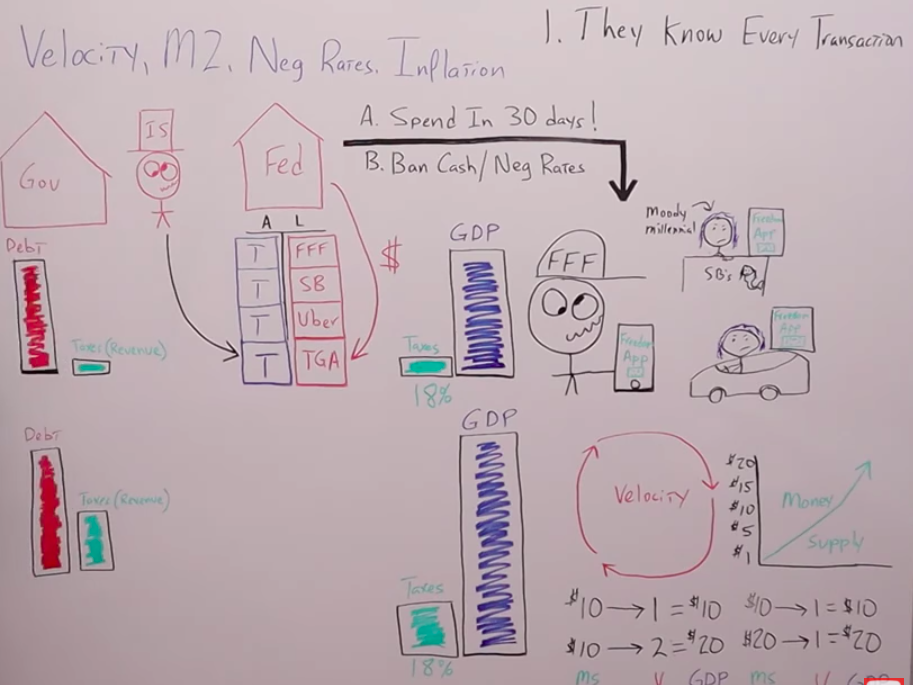

Velocity, M2, Negative Interest Rates, And Inflation

I just went over how the government will know every single transaction but the digital currency issue is not just about privacy, that's just where the story begins. It gets a lot worse.

This also gives them the ability to manipulate velocity, money supply, and the rate of inflation.

Why is this important?

Most of us get it, but I want to do a quick review.

The main thrust of this article is the last part. Trust me, this is just a quick review. This is something that I don't think anybody is talking about and if you put the pieces of the puzzle together, you see how this could take us right down the path to socialism and communism.

Let me explain it to you on the whiteboard:

On the left, there is the government with its debt, we know they are the largest debtor of all time. Your drunk insolvent Uncle Sam has been spending money like a drunken sailor.

-

But why is inflation important to the government?

-

Why do they want inflation?

We always hear about that, that the inflation makes the debt load less of a burden. But how does it actually happen? Let's go through the mechanics of it.

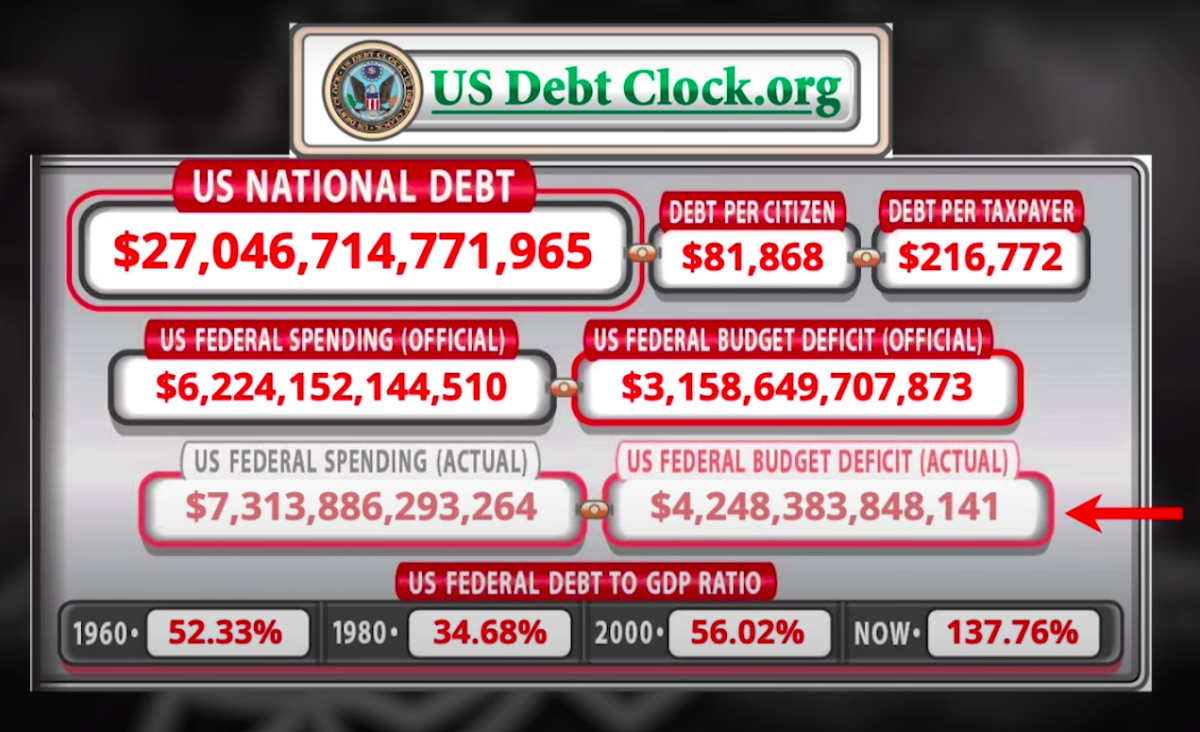

The debt is on the left side in red and the taxes or the revenue from the government is on the right in green. Our debt right now is over $27 trillion and growing.

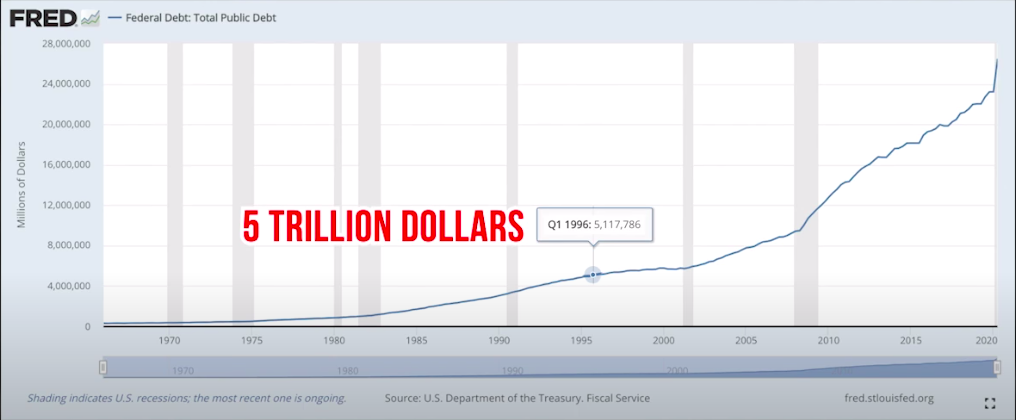

Just to give you some context, this year 2020, will add about $5 trillion in debt. It's about 4.2 trillion as you read.

If you take the combined total, the accumulated amount of debt from 1776 to 1996, 220 years, what do you think that adds up to? About $5 trillion. The exact same amount of debt that we will add just this year.

Really mind blowing numbers, but it shows you how screwed our drunk insolvent Uncle Sam is, and how badly they need inflation.

The Fed knows this and comes in and tries to manipulate the money supply and velocity, which they'll be able to do because of what I mentioned before in the Banking for All Act.

If we all have accounts with the Fed, then it would circumnavigate the banking system.

In order to create more money supply, it would be simple, you wouldn't need those pesky banks or anything, your drunk insolvent Uncle Sam would just have to sell the treasuries to the Fed, and the fed would just deposit that money, bank reserves or cash in the TGA.

Then, they spend it out into the economy through the fed coin, the freedom app, the digital dollar, or digital wallet.

This would directly increase the amount of currency units chasing the same amount of goods and services in the real economy.

Just to be crystal clear, right now when the fed prints money, they're just printing bank reserves.

Although that gives the banking system more balance sheet capacity to create more loans, which creates more money supply, there's still this transfer mechanism.

And yes, the government can come in and can do deficit spending and the fed can monetize that, but that's kind of messy. This way, it's just a direct injection into the economy. Which theoretically, the fed or the government could really micromanage.

It would be like at the monitor on the wall where they could just adjust it very easily.

Of course, this doesn't account for the Euro dollar system, but that's a completely separate article. We'll just assume the dollar monetary system is contained within the domestic economy.

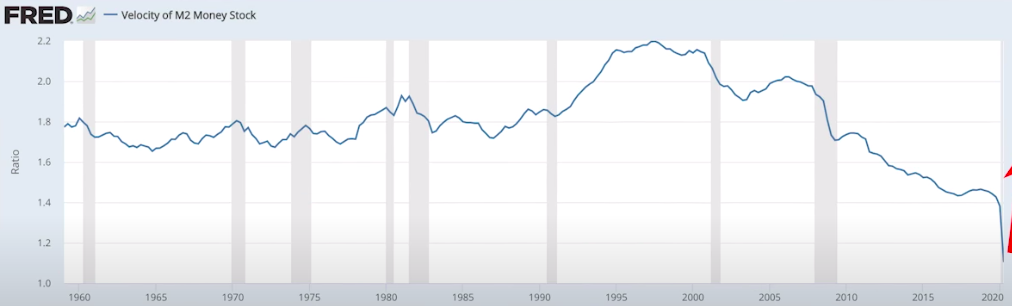

The bottom line is it would be much easier for them to control the money supply in the real economy, but let's think about velocity. First…

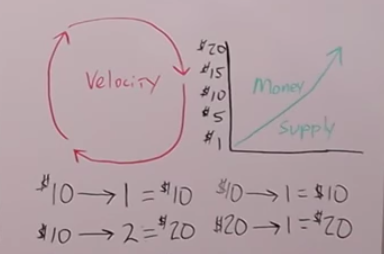

What is velocity?

Look at the red circle on the right side of the board, that's just how quickly the currency units go from one entity to the next entity in the real economy. It's how fast the currency units circulate.

There are two ways we can create inflation, we can increase the money supply or increase the velocity, which increases the nominal GDP.

It doesn't necessarily mean that we're creating more economic output or that our society or economy is richer, we're not necessarily increasing the standard of living.

In fact, we could be decreasing the standard of living, while the nominal GDP, not just for inflation, is actually going up.

Think about Venezuela. Their GDP went through the roof. If you just look at Zimbabwe, Weimar, and Germany's GDP in nominal terms, they would have gone up a million, probably a trillion times.

Who knows? But their society got a lot poorer as a result.

It's a very simple equation.

We have money supply, velocity and GDP, but let's just imagine we have $10 of total money supply.

If it circulates through the economy once, then nominal GDP at the end of the year is going to be $10. If they can increase velocity so that the same $10 circulates twice, well now GDP has gone up to $20.

Again, it doesn't necessarily mean that we've created more goods and services or that we are any richer.

Now, the same thing with money supply, if we start off with $10 and it circulates once, we have $10 in GDP.

Even if velocity stays consistent, if we increase the money supply to $20 and it still circulates once, now we have $20 in overall GDP.

Why is GDP so important to your drunk insolvent Uncle Sam?

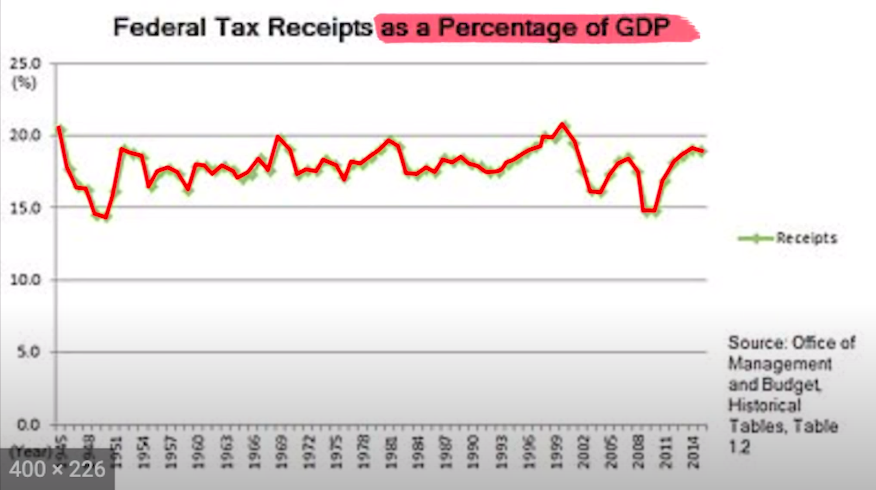

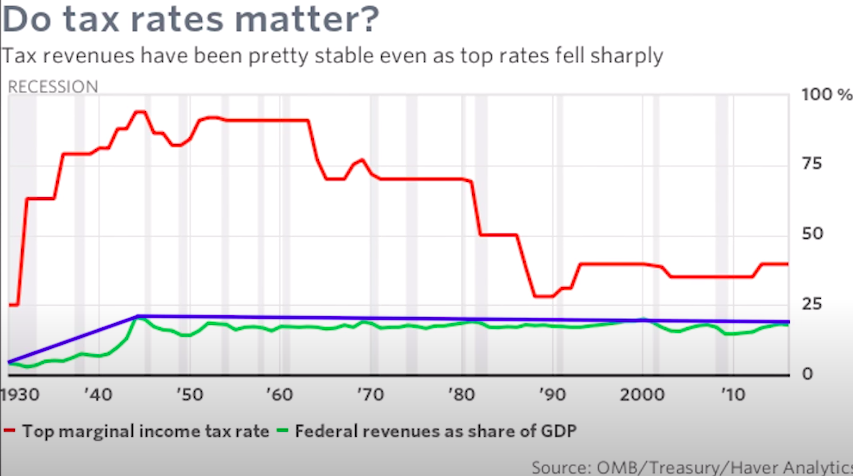

Because, what we've seen throughout history, is that tax receipts are pretty consistent as a percentage of GDP.

Whether or not the highest marginal rate is 90% or 25%, the amount of tax revenue received is about the same. Right around 18%.

So if you want to increase tax receipts, you have to increase nominal GDP.

We'd like to see GDP increase as a result of more economic output, more goods and services being produced in an efficient manner, making all of us richer.

But the government is going to take the easy way out, they're going to try to create inflation by increasing the money supply and velocity by doing things such as saying you only have 30 days to spend your new stimulus money that's on your freedom app or it's gone.

As soon as people get that UBI, they're out there spending it as quickly as possible. Another way they can increase velocity is through banning cash and negative interest rates, which has the same effect.

They increase the money supply and velocity and that makes GDP and tax receipts go up as a result.

Therefore, it bails out the government in the sense that their debt to GDP ratio goes down, and tax revenue goes up.

The government gets bailed out by the fed accounts, a digital dollar, and their ability to create inflation, while you and I get screwed.

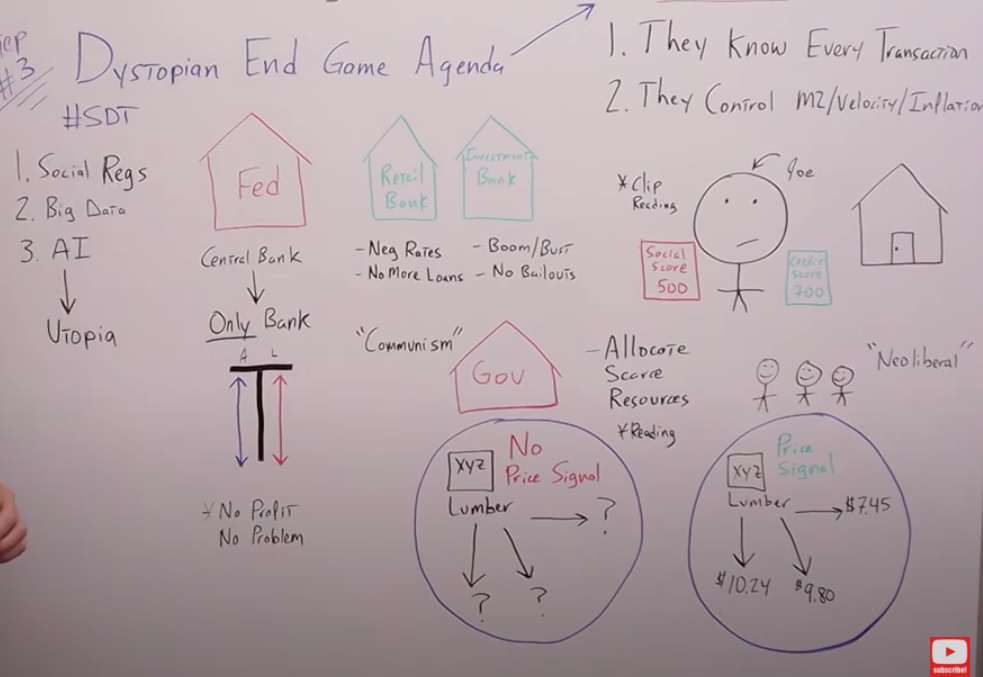

The Dystopian End Game Agenda

Can the digital dollar take us straight to communism?

I'll let you be the judge. We learned from the last two topics that if we all have accounts with the Fed they will know every single transaction.

That is a huge amount of data. Also, they have control over M2 money supply and velocity, therefore, of the rate of inflation as well. Let's take this to its logical conclusion, or what could happen as a result.

There's one thing that's safe to say. The politicians and the global elite want more centralized power and the number one thing they could do to have that centralized power would be to create a central bank that was the only bank. That's it.

What would happen if they take rates negative?

They reduced the amount of bank reserves and that eliminates the retail banking system.

With negative interest rates, they can't make money with their old business model of borrowing short and lending long pocketing the spread.

If we decrease the amount of bank reserves they have access to limiting the lending. And if we limit the lending and make it completely unprofitable, the banks all go bust.

You may be saying to yourself, “Well George, what about the investment banks? What about the Goldman Sachs and the JP Morgans. They're making all time high profits right now, even during the Coronavirus, while the retail banks are tanking, because they're going down with the real economy.”

But let's think this through, the Fed has contributed to this boom and bust cycle we now have in asset prices through lowering interest rates. They haven't gone negative yet, but they very well could.

This along with QE Infinity has created an environment where the investment bankers, the insiders, and the financial insiders are getting rich. This goes back to my article on the Cantillon Effect, by the way.

We know it creates this big boom and right now, we're in the everything bubble.

All of the financial insiders just lever up, they create quadrillions of derivatives because they know if it comes crashing down, it doesn't matter because the fed or the government will bail them out. So there's limitless upside and absolutely no downside whatsoever.

But, what if the Fed or the government comes in and decides, “Hey, we want to not only be the central bank, we want to be the only bank.” The retail banks have already gone under.

But, what happens if we go through the bust part of the boom bust cycle, and all the investment banks go to the Fed saying, “Hey, we need our bailout. We need our bailout. We're systemically important. We're too big to fail.”

The Fed basically gives them the finger. They say, “Sorry, guys. This time, we're letting you go out of business.”

All of a sudden we'd have no retail banks, no investment banks. We would only have a central bank.

Who would be in charge of lending?

Well, it's perfectly convenient. Because now, we all have accounts with the fed. Every single person and every single business.

Remember the Fed doesn't worry about a profit and loss. They have an infinite balance sheet because they simply print the bank reserves out of nowhere.

So, who cares if they don't get paid back on a loan they create? It doesn't matter. The next time the average Joe goes to buy a house, the fed, because they don't care about profit and loss.

They don't have to look at a credit score or anything that would tell them the ability of the borrower to actually pay them back. They could start looking at things such as a social score.

Let's say the average Joe has a reasonable credit score, actually a very good one at 700, but their social score, because they haven't worn a mask lately, goes all the way down to 500.

The central planners that are all about social justice look at average Joe's credit score and say, “Okay, that's okay.” But they look at his social score and say, “No way, we're not giving you that loan.”

Joe doesn't get his house because he was a bad person, and he didn't obey the rules. Therefore, he doesn't deserve the loan.

You know as well as I do all of these global elites want to move away from free market capitalism and from the emphasis being on economic growth and prosperity, the creation of goods and services.

They want to take that spotlight and put the priority instead on social justice. It's not me just saying it.

To show you exactly what I'm talking about, look at what everyone's favorite global elitist, Klaus Schwab has to say on the World Economic Forum's own website.

The headline pretty much says it all.

We must move on from neoliberalism in the post-COVID era.

If you haven't watched any of my videos on this, the World Economic Forum sees the pandemic as an opportunity to create what they call a great reset of the entire global economy.

The next question becomes…

What is neoliberalism?

Well for that, look at Investopedia's definition.

“Neoliberalism is a little used term to describe an economy where the government has few, if any controls on economic factors. This concept comes from ideas first introduced by Adam Smith in his classic 1776 book entitled An Inquiry into the Nature and Causes of the Wealth of Nations. As well as laissez-faire economics.

These economic policies are similar to those proposed by political groups referred to as libertarians. Neoliberalism advocates propose

- The reduction or elimination of most business regulation.

2.The government should be required to balance its budget. 3taxes should be low and simple to calculate over a very broad base of payers.”

So neoliberalism is exactly what we need to continue to grow the economy and get out of this recession/depression that we're in. We don't need less neoliberalism, we need more neoliberalism.

Let's go back to this social agenda that the global elite have. Further down the article, Klaus himself references one of my favorites, Milton Friedman.

He says, “The Nobel Laureate economist Milton Friedman believed the business of business is business. He didn't consider that a publicly traded company might be not just a commercial entity, but also a social organism.”

You can see what's happening here is they don't like neoliberalism because it gives the individual priority.

They're the ones that determine how goods and services are distributed throughout the economy. It's a bottoms up approach where Klaus and his cronies and the global elites all want a top down approach.

They want to make all the decisions and determine what we should do with our lives. They want to determine what is right and wrong. They think that we are too stupid to make those decisions on our own.

Therefore, we need to move away from this bottoms up approach that gives the power to the individual, and move more and more towards a centrally planned economy. In other words, communism. That's what they think.

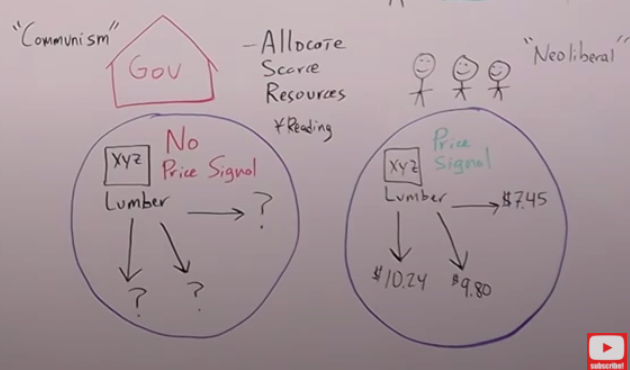

The problem the socialist, communist, Marxist, and central planners have is that communism doesn't work very well.

Why doesn't it work well?

There are several reasons. But the main reason is because there's no price signals. Prices in markets and in an economy are incredibly important.

Let's go through a very basic example to understand how this works.

Look at lumber company X, Y, Z. With no prices, this lumber company isn't going to know where to distribute all of the lumber that they're creating. All of these two by fours, two-by-sixes to create the homes.

Where if you contrast that to the economy on the right, that's run by individuals just like you and I, and that the global elites would consider “neoliberal”.

What happens is there are actual prices for things because there's demand. Because people are free to choose what they want to buy.

Therefore, if we have more housing that's being created on the $10.24 side, there'll be more demand for the two by fours than over the $7.45 , where those prices for the boards have gone down substantially.

The lumber company knows that they need to send more supply to wherever there's a higher price. Therefore, scarce resources get allocated in the most efficient manner possible.

Where the type of economy on the left also has scarce resources, but they don't know how to allocate them. It's the blind leading the blind.

Therefore, you waste all of your resources, and your economy collapses in on itself. It's exactly what happened in communist Russia.

I think the central planners are smart enough to understand this. So in their worldview, the only thing that's stopping them from achieving this utopian state is to solve the problem of price signals.

Or said another way, the information and the data required to allocate scarce resources efficiently.

If we read between the lines, I think we might see what they think a possible solution could be that might get them to their end game agenda which is this utopian state of communism.

Lets go back to the World Economic Forum's website to the article named:

AI, is here. This is how it can benefit everyone.

This is from September, 2020.

AI can be used to enhance the accuracy and efficiency of decision-making, and to improve lives through new apps and services. It can be used to solve some of the thorny policy problems of climate change, infrastructure, and healthcare. It is no surprise that governments are therefore looking at ways to build AI expertise and understanding.

The World Economic Forum's suggestion to these countries is to set up something called the center of excellence. My goodness, isn't this straight out of Orwell?

According to the website, the center of excellence is a way to increase ethical AI use in a country and build public support for it across the economy and the society.

Who determines what is ethical?

Of course, the central planners think they do. Here's where the pieces of the puzzle all come together.

The center could draw staff from industry, government, academia, and civil society using a multi-disciplinary and collaborative approach to provide advice on artificial intelligence and algorithm use for government operations.

In other words, we can use artificial intelligence instead of the price signals generated by free market capitalism to help us achieve this top down centrally planned socialist utopia.

How this could play out?

The fed or the central banks could eliminate all the other banks through negative interest rates, the boom bust cycle, and not providing bailouts. So the central banks become the only banks.

Because they have an infinite balance sheet, they don't care about a profit and loss. They can start issuing loans not based on someone's ability to pay it back, but through a social score.

The central planners can start to force upon us social obedience based on what they think is right or wrong.

Because they control the carrot that's in front of the horse. If you want to get alone, you need to wear the mask.

If you want to buy that house or that car, you need to ask every single person you meet what their preferred pronouns are.

Or if you want to start a business, it better fit our agenda and before the benefit of social good. The way we define social good, that is the key.

It starts with the social regulations but then all of the billions of transactions that occur in the economy are all going straight to the fed or the government, because we all have bank accounts with the fed.

They can analyze those transactions in real time, the ultimate big data.

Artificial intelligence and the algorithm can tell the central planners where to allocate those scarce resources with alternative uses.

They'll have all the data they need because all of our accounts are held at the fed.

You see how this works, it starts with the Banking for All Act, then it moves for the fed, eliminating their competition basically or all of the banking moving towards the fed.

Then, it transfers into a social priority, putting the carrot in front of the horse that in order to get what you want, you have to do whatever they deem appropriate socially. It's all in the name of social justice.

While this is happening, they're accumulating all of the data they need to implement artificial intelligence, plug the data into the AI. The AI spits out where the scarce resources should be allocated.

Boom, you've solved the problem of communism, you no longer need price signals, free market capitalism, private property rights, or personal freedom.

They've now created what is in their minds a socialist utopia.

-

Is their dystopian endgame agenda actually communism?

-

And will they try to achieve those objectives through centralizing power through the Federal Reserve, big data, and artificial intelligence?

I have no idea, I know the probability is above zero, but far less than 100%. There are no certainties. There are only probabilities.

This isn't a prediction. I'm not saying that this is going to happen.

What I am trying to do is walk you through a thought experiment, understand the incentives, and understand the objectives of these global elite who think a centrally planned society is superior to one where you and I make our own decisions.

Comments are closed.