Is money printing set to explode? The short answer is yes. I don't even think most people understand the magnitude of how much it's going to explode.

But, what I find is most people really don't understand what money printing actually is. They really don't even understand money, loans, QE, or helicopter money.

So before you can figure out how money printing is going to affect your financial future, you have to understand how the Fed monetizes its debt.

I'll explain it to you in seven simple steps in the form of a series of articles named: Is money printing set to explode? This is part 7 of 7.

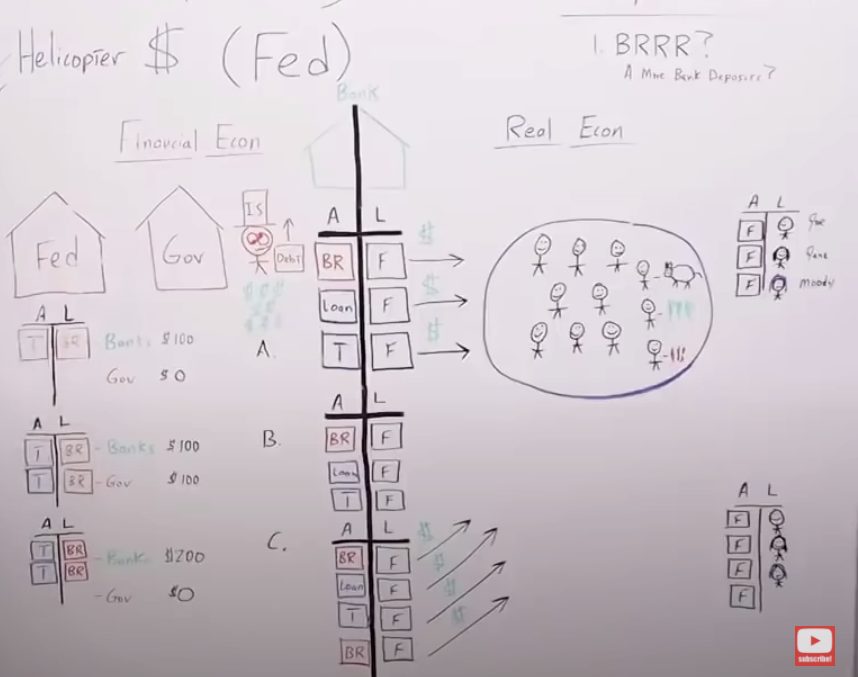

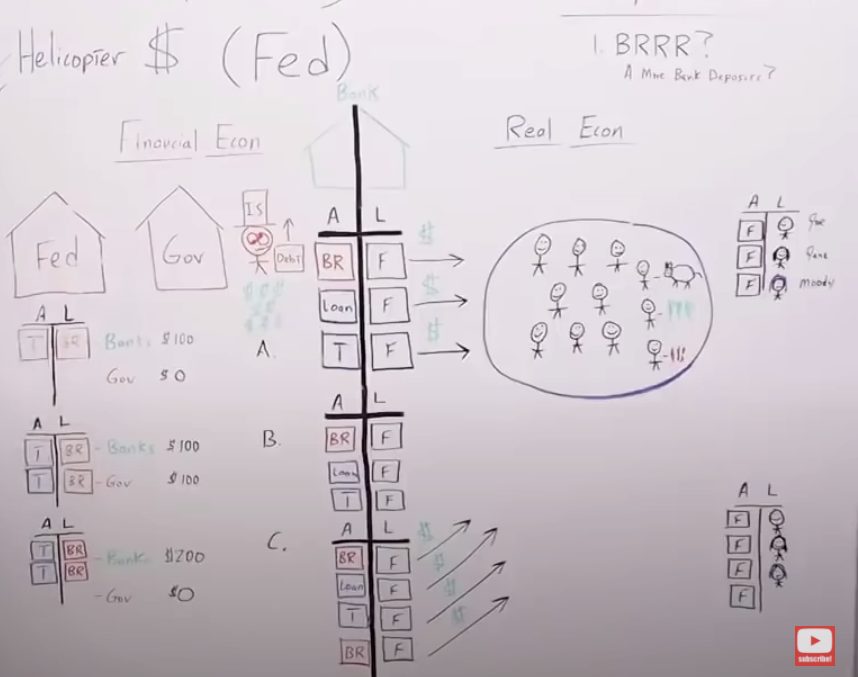

Helicopter Money Involving The Fed

-

Is money printing set to explode?

-

What is it and how does it work?

This final segment in the series: This is debt monetization.

You always hear about debt monetization and might not understand what it is, but here's exactly how it works. I'll give you an example.

It starts with the Fed's balance sheet having treasuries and bank reserves. Let's say they have $100 in bank reserves for the commercial banking system.

The commercial banking system and the government have their bank accounts with the Fed just like you have a bank account with Wells Fargo or Bank of America.

And your drunk insolvent Uncle Sam has to buy votes and the best way to do that is send stimulus checks to millennials. In this case, to everyone's favorite, Moody the Millennial.

So, in a shell game with the primary dealer banks, the Fed basically buys the treasuries directly from the government. The government issues them, and they go onto the Fed's balance sheet. That's step B.

And the Fed just prints up funny money, just bank reserves, or electronic digits in an account, and adds a $100 to the government's account.

But the government needs to spend that money because Sam has to buy votes. So, he sends a stimulus check to Moody and deposits it in his account.

Moody deposits the check into his account, and that creates an additional liability for the commercial banking system or an additional deposit.

Therefore, the government has to transfer those bank reserves back to the commercial banking system, so they have an asset to match up with the additional liability that was created by Sam sending the stimulus check to Moody and Moody depositing it into his bank account.

Let's go through this one more time to make sure it's clear.

The government issues the treasury at auction because they need to get some reserves in their accounts so they can send Moody a stimulus check.

The Fed buys the treasury with additional bank reserves that they just print up funny money out of thin air, just digits in the account.

So, they add $100 to the government's account to purchase the treasuries, and those treasuries go onto the asset side of their balance sheet.

When the check goes out, Moody deposits it into the bank, then the government transfers the bank reserves that the Fed gave them, to the commercial banking system.

Now the commercial banking system has an additional deposit, an additional liability, but they also have an additional $100 in bank reserves.

Additional assets to match up with the $100 of additional liabilities that they received by Moody depositing the check.

More currency units have been created in the real economy chasing the same amount of goods and services. Helicopter money with the Fed or when the Fed monetizes the debt is definitely money printing.

In technical terms, the broad money increases, the M2 money supply goes up, and the base money increases, which would expand the balance sheet capacity of the banking system allowing them to create additional loans if they see people that can actually pay back the loan, or if there's demand in the real economy.

And that would increase the broad money and M2 money supply even further than the process of the Fed just monetizing the debt and your drunk insolvent Uncle Sam sending out those stimulus checks.

As you can see, this process definitely creates the most potential for future price inflation.