Robert Triffin predicted that the country with the reserve currency, at some point, would lose it due to the Triffin's Paradox.

Are we getting there? Is our manufacturing as a country that important to preserve this status? Will this lead to an economic collapse? How can this affect our daily life?

In this article, I explain how it all started, how the United States became the reserve currency country, what's happening today, and if it's actually moving towards what Triffin predicted.

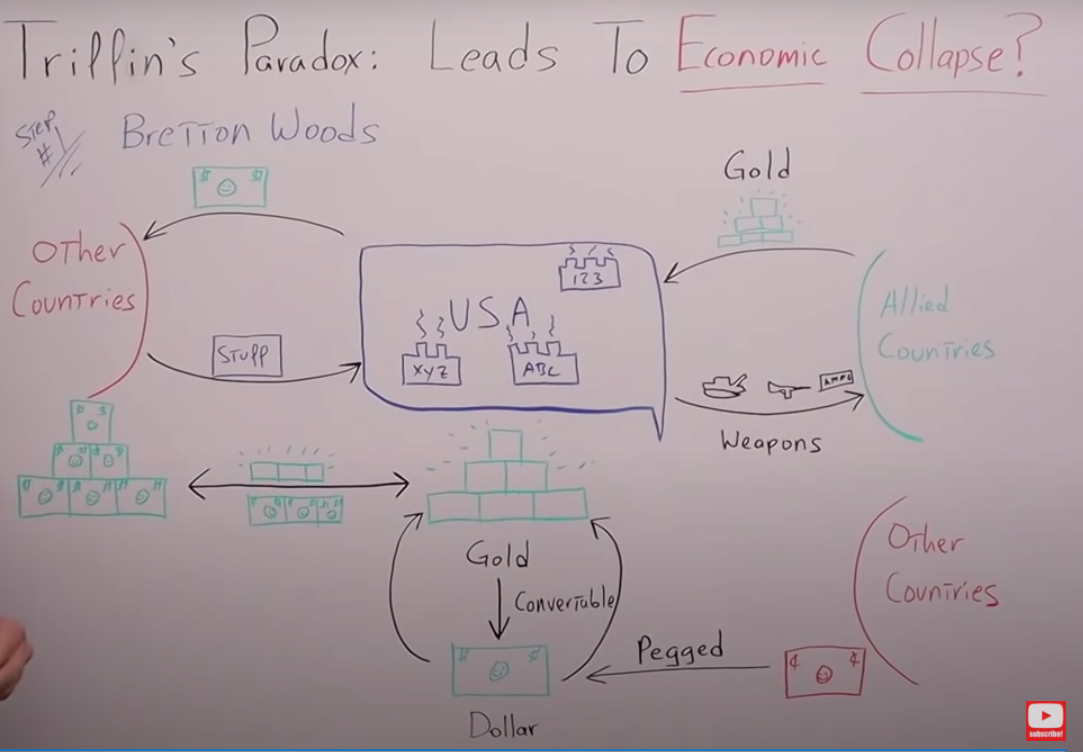

Bretton Woods System Of Monetary Management

Let's begin by understanding Bretton Woods and how the dollar became the world reserve currency in the first place.

To dive into this deeper, here are some pieces of an article from Investopedia that mentions exactly what happened in 1944.

- The United States entered World War II well after the fighting had started. Before it entered the war, the United States served as the allies main proprietor of weapons, supplies, and goods. Collecting much of its payments in gold. By the end of the war, the United States owned the vast majority of the world's gold.

- In 1944, the Allied countries met in Bretton Wood, New Hampshire to come up with a system to manage foreign exchange that would not put any country at a disadvantage.

- It was decided that the world's currencies couldn't be linked to gold, but they linked to the U.S. dollar, which was linked to gold.

- The central banks would maintain fixed exchange rates between their currencies and the dollar. In turn, the U.S. would redeem us dollars for gold on demand.

- As a result of the Bretton Woods Agreement, the U.S. dollar was officially crowned world reserve currency backed by the world's largest gold reserve. Instead of gold reserves, other countries accumulated reserves of U.S dollars.

This is crucial to the story because the United States then began deficit spending like only our drunk insolvent Uncle Sam can, in things like the Vietnam War and the Great Society.

The demand for Treasury securities—coupled with the deficit spending needed to finance the Vietnam War and the Great Society domestic programs—caused the United States to flood the market with paper money. With growing concerns over the stability of the dollar, the countries began to convert dollar reserves into gold. The demand for gold was so high that President Nixon was forced to intervene and de-link the dollar from gold, which led to floating exchange rates that exist today.

In other words, the modern-day fiat currency system was born, 1971.

What happened?

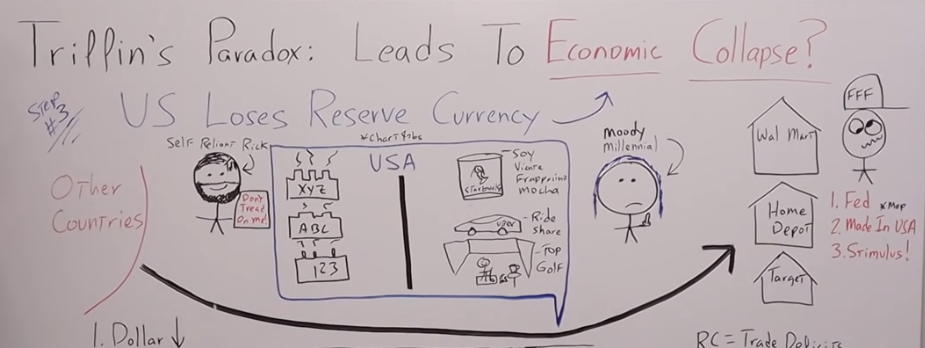

Look at the following whiteboard.

Prior to World War II, the United States had all of the manufacturing you see in the middle of the whiteboard. Factory XYZ, ABC, and 123.

They were cranking out a lot of stuff. As a result, we were able to supply all the allie countries with what they needed to fight the war: Tanks, guns, and ammunition, or whatever else you use to fight a war.

As payment, a lot of those countries gave the United States their gold. So, at the end of the war, the United States had accumulated a huge pile of gold. So we, by far, had the most gold.

In 1940, before Bretton Woods came in with a new monetary system, they looked at all the gold and said, “Okay, the United States has all the gold so we're going to make the dollar redeemable or convertible into gold.”

If you take your dollars and go down to the nearest bank or the Fed, they'll give you the equivalent amount of gold.

If there's this 35 to 1 relationship, then what the other countries said was, “Okay, listen, we don't have any gold, but if we just peg our currency at a fixed exchange rate to the dollar, it's basically the same thing.”

The problem with that is after World War II, our manufacturing base really started to decline.

We could get away with this because there was all this artificial demand for dollars outside of the United States because we were the world reserve currency.

But other countries started producing the stuff that we were making prior to World War II and exporting it to the United States so we could consume.

What did we give them for those goods?

The dollars that we print out of thin air, all of the currency units. So the other countries started stockpiling the dollars.

But at a certain point, they say, “Wait a minute here. This doesn't make a lot of sense. We don't want all of these IOUs from the United States government that's running these huge trade deficits, we want to redeem our dollars for gold.”

Then, they said: “Hey, United States, here are some dollars, you give us the equivalent amount in gold” or at a 35 to one exchange rate.

And because of that, the gold reserves of the United States went down further and further until Nixon has to step in and say:

“Whoa, whoa we can't do this anymore. We are no longer going to allow you to redeem your dollars for gold as we promised you way back in Bretton Woods. We're going to break our promise to the world from now on, we're going to be on a global fiat monetary system.”

During this entire process, an economist by the name of Triffin came in and said, “Yes, I get it. It sucks. All these countries are taking your gold because you don't have any manufacturing, but you're not thinking this through. Yes, it's bad right now, but you don't know half of it. This could actually lead over the long run to economic collapse.”

Triffin's Paradox

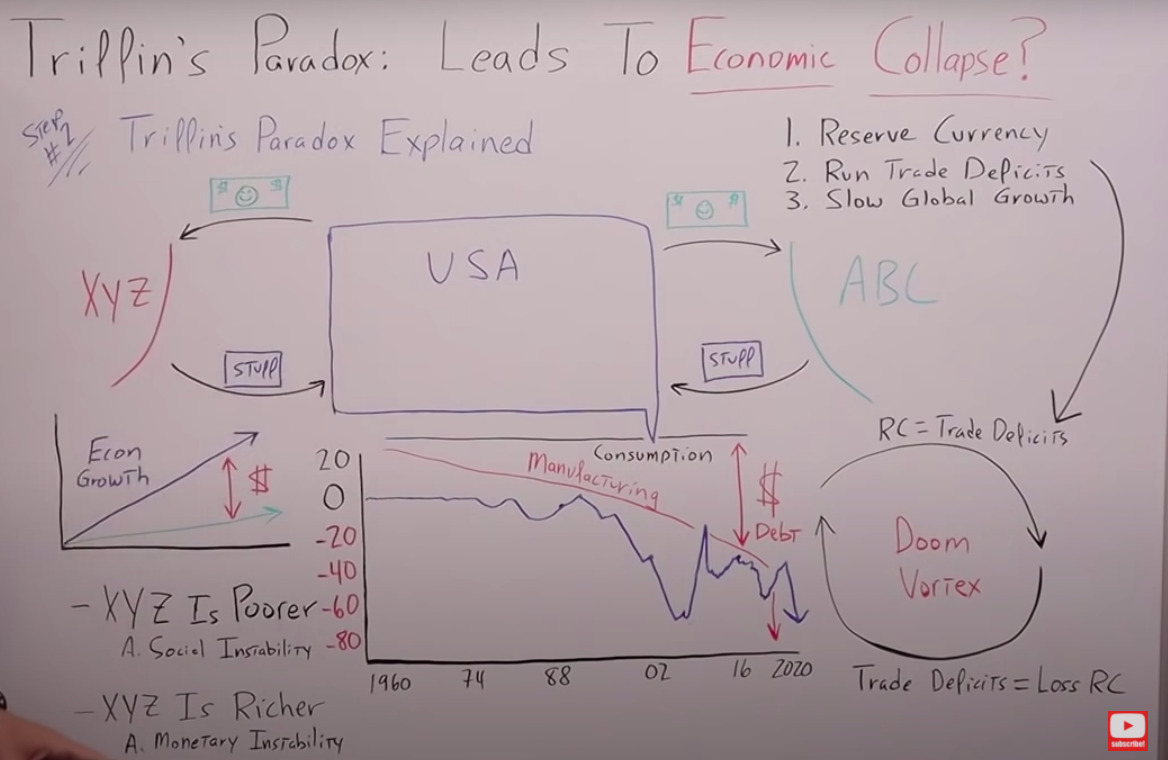

The country with the reserve currency has to run trade deficits, that's the way this works.

In other words, the country with the reserve currency has to export its currency outside of its domestic economy. If it doesn't do this, it slows global growth, potentially creating social instability.

This is the paradox: If the country runs large enough trade deficits, this can create instability in the currency itself. To understand this better, let's go right back to the internet.

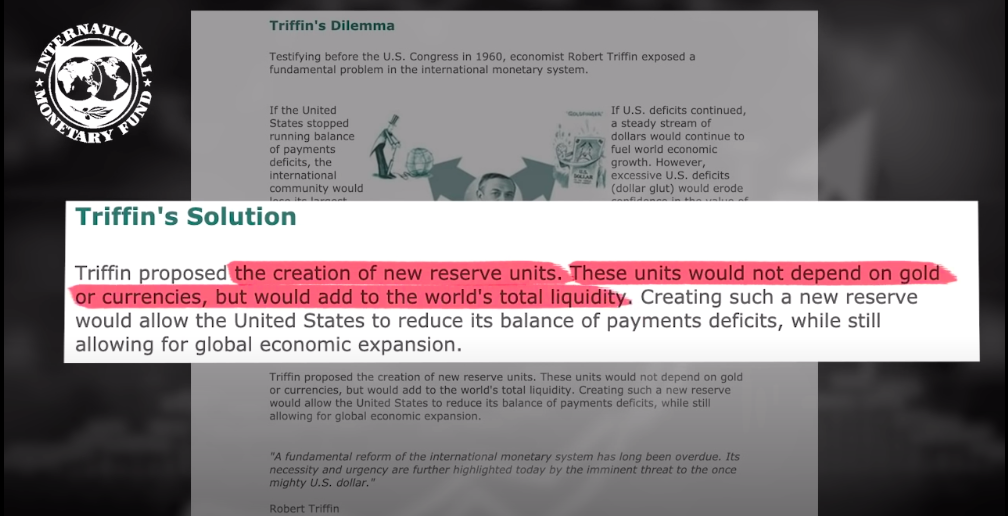

The following is a description of Triffin's Dilemma or Triffin's Paradox straight from the IMF.

Testifying before the U.S. Congress in 1960, economist Robert Triffin exposed a fundamental problem in the international monetary system.

If the United States stopped running balance of payments deficits, the international community would lose its largest source of additional reserves.

The resulting shortage of liquidity could pull the world economy into a contractionary spiral leading to instability.

This is the social instability I was referring to earlier, but…

If the U.S. deficits continued, a steady stream of dollars would continue to fuel the world economic growth. However, excess U.S. deficits, (dollar glut) would erode confidence in the value of the U.S. dollar. Without confidence in the dollar, it would no longer be accepted as the world's reserve currency. The fixed exchange rate system could break down leading us to instability.

It can not only lead to instability, but it can also lead to foreigners owning a lot of US assets, such as the gold that they started taking prior to 1971 and today U.S. treasuries, real estate and stocks.

It also hollows out the manufacturing base of the country that has the reserve currency status.

As an interesting side note, Triffin's solution to his dilemma or his paradox was to create a whole new reserve currency, one that wasn't tied to any individual country.

This was basically the genesis along with Bretton Woods to the IMF, the World Bank, and the SDR we have today.

The way this works is the U.S. having the reserve currency has to export all of those dollars to facilitate global growth.

If they have to export all of these dollars, they have to import a lot more stuff than they export. So this reduces the manufacturing base. That's key. We're going to focus on that.

The dollars leave the United States, they go to country XYZ and ABC. These countries export all of this stuff they manufacture to the United States so we can consume and maintain our level of consumption if not increase it.

Here is an example:

The way this works from a monetary standpoint is let's say we have a country's potential economic growth going straight up.

That's represented by the blue line, but if they're not getting enough of the currency units they need to create more and more loans, then there's going to be a delta.

There's going to be a gap between their potential economic growth and their actual economic growth.

The gap is just created by a lack of access to the reserve currency. This makes country XYZ in this case, poorer, which leads to the social instability we were referring to earlier.

If the United States runs this big trade deficit, XYZ is a lot richer, but this leads to monetary instability.

Remember when I mentioned that manufacturing started to go down as a percentage of GDP, and that all of these other countries were collecting the dollars to redeem them in gold?

Now, all of a sudden, the United States doesn't have enough gold to function or print more money for all of these social programs that they have.

Another way to think about it is just a very simple doom vortex. We'll call it the reserve currency doom vortex.

What happens is the reserve currency has to run trade deficits, but if it runs trade deficits, it loses the reserve currency status.

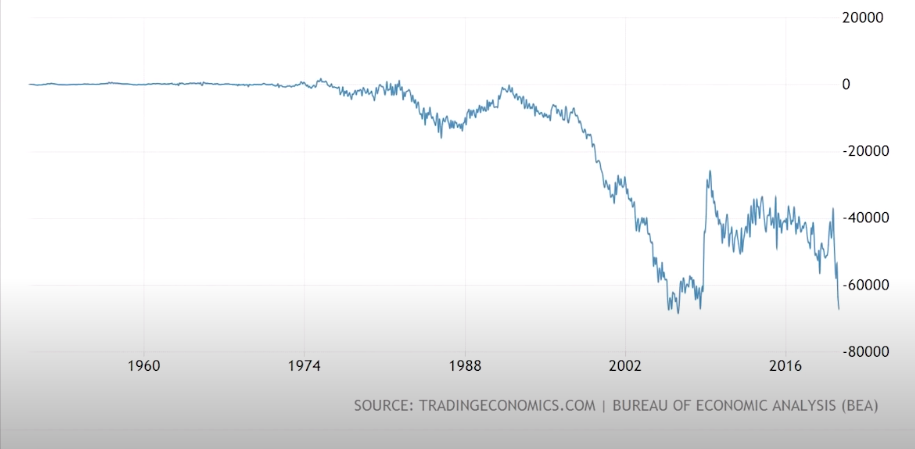

That's it in a nutshell. This is another chart I want to go over.

It starts in 1960 and goes all the way to 2020. This is the trade deficit of the United States.

On the right, it goes from a negative $80 billion and all the way up to a positive $20 billion. Unfortunately, zero is way up. There's a lot more negative than there is positive.

Meaning recently we've had a heck of a lot more trade deficits than we've had surpluses, that's for sure.

The trade deficit started off in 1960, very consistent, not too much ups or downs, but when it got to the 1970s it dipped down a little bit.

What was happening is our manufacturing at that time really wasn't being hollowed out, we were just manufacturing less as a percentage of global GDP than we were, especially during World War II.

That's what prompted the foreigners to start redeeming their currency units, the additional currency they were gathering for gold.

But in 1974, it went down and back up a little. Then it started this downward trajectory taking it all the way to 2002, where it bottomed out and we were running trade deficits of $60 billion-plus per month.

It spiked up a bit prior to the GFC, but then it came crashing all the way down to an all-time low where we are today in 2020 with the coronavirus.

The key takeaways from this chart are not only that our trade deficits are massive, but if Triffin was correct, the doom vortex is taking us closer and closer to losing the reserve currency status.

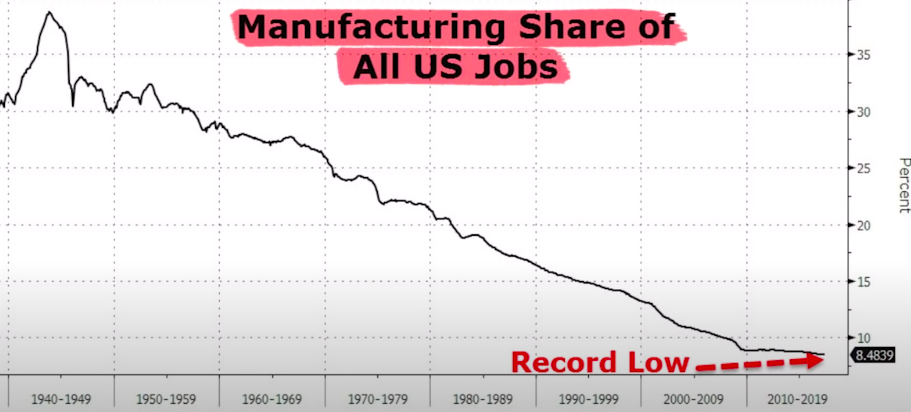

But our manufacturing has gone down. Initially it was going down just as a percentage of global GDP, but since the mid-1970s even compared to our domestic economy, it's really tanked.

Now, there's a little, if anything, that we actually produce here in the United States.

But if you think about this… Our level of consumption has stayed the same if not actually increased. How on earth can we increase our consumption if we produce less and less goods and services?

The answer is the gap has been facilitated by money printing and taking on more debt. This is why I say the United States economy is built on three things: Asset prices or asset bubbles, more and more debt, and confidence.

If we don't have one of those three things, the house of cards comes crashing down because fundamentally our economy is very unstable.

What Happens If The United States Loses The Reserve Currency?

Is this leading to an economic collapse as Robert Triffin said?

Is this leading to an economic collapse as Robert Triffin said?

Remember the doom vortex I drew.

Again, the reserve currency country has to run these trade deficits and Triffin believes that the trade deficits in and of themselves bring us closer to losing that reserve currency status.

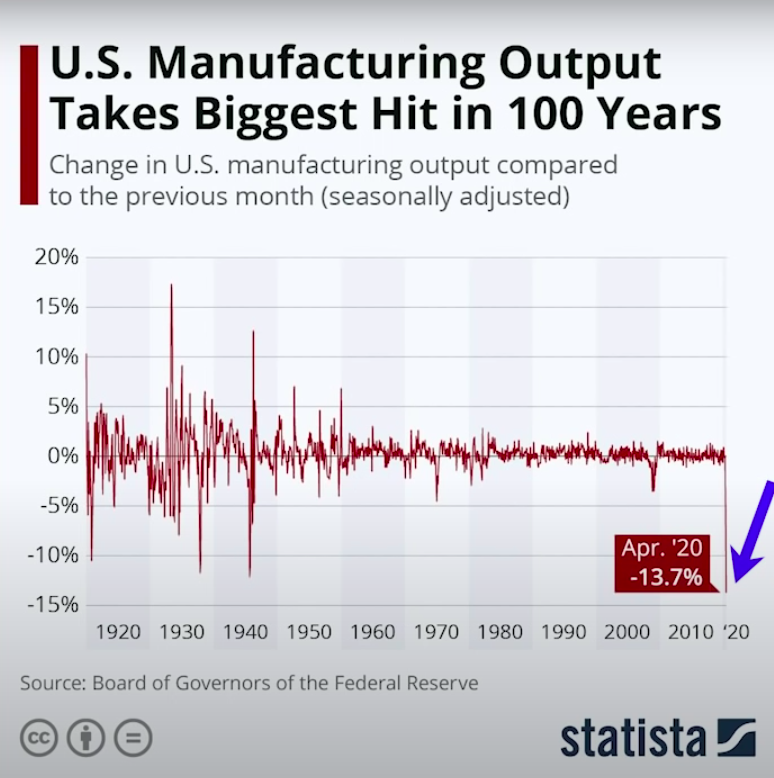

The manufacturing in the United States, and this isn't debatable at all, has fallen off a cliff, where now we make very few of the goods that we actually consume here in the United States.

Our consumption has gone up, the manufacturing has gone down, and remember the gap has been filled with just money printing and taking on more and more debt to consume.

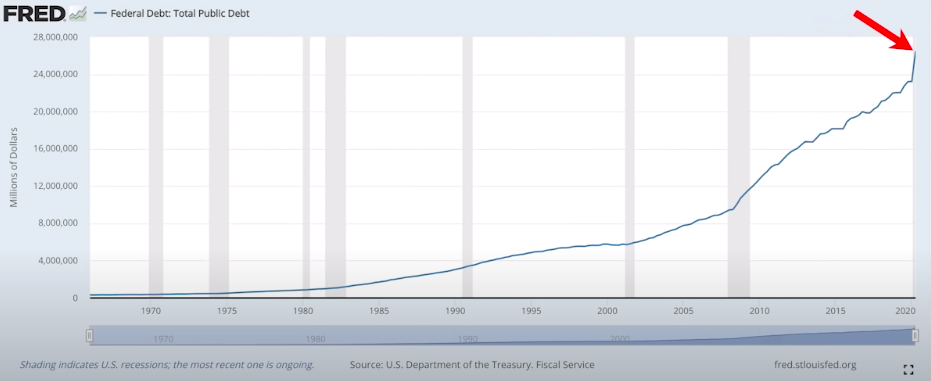

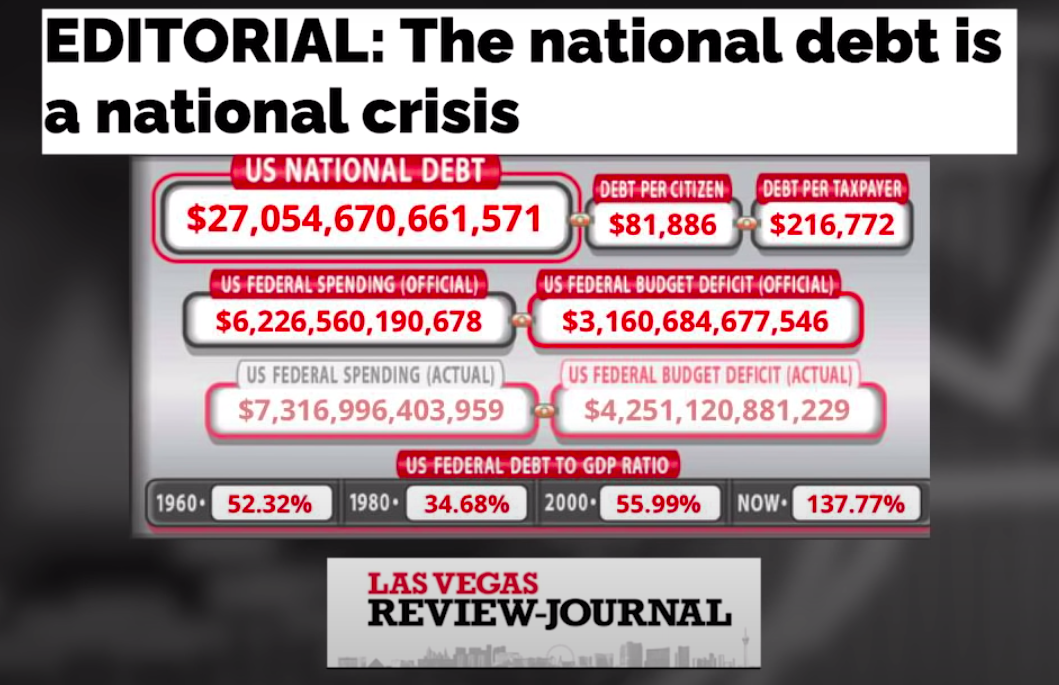

Right now, sovereign debt, consumer debt, and corporate debt are at an all-time high. Look at the images below.

Instead of getting out there, rolling up our sleeves, working, and making stuff, we're sitting back being lazy and just printing up the money or charging it to the credit card.

It's not just me talking about how the manufacturing outlook for the United States is grim. Look at some headlines that just recently show how our trade deficit is at all-time highs.

Meaning we're producing less stuff and consuming more foreign stuff than we ever have at any point in our history.

As a result of having the reserve currency, we've gone from being a country of manufacturing that manufactured so much during the 1940s, and that we actually accumulated 70% of the world's gold.

We were producing so many goods that we just got all the money. We were the largest creditor nation of all-time.

Now, according to the Los Angeles Times we're the largest debtor nation. Before 1974, starting in 1971 we had a good sized manufacturing base.

We created a lot of goods right here in the United States, but now we don't create any goods.

The things that we create are services like Starbucks, where you can easily go get a soy Venti Frappuccino Mocha and look at the millennial guys walking around right now.

I'm sure they're getting that with extra soy. You can also get a ride in Uber, lot of ride sharing that's for sure. Or you can go down to your local Topgolf, get some beers, and hit some balls into a net.

That's all fine and dandy, but we don't make any stuff that we buy at Walmart, Home Depot or Target. We have to rely on other countries to make all of that stuff for us. The cheap goods that we can buy on a daily basis that improves our overall standard of living.

We can see this playing out if we look at a chart of manufacturing jobs as a percentage of the overall job market in the United States.

It just goes straight down to where we are today at all-time lows.

From a society standpoint, we've gone from being like the guy I drew on the left, Self-Reliant Rick, who rolls up his sleeves, gets things done, hates large government, and wants to be left alone. He's holding this sign that says don't tread on me.

We've gotten from a society of Self-Reliant Ricks to a society of Moody the millennials, on the right. They are always pissed off and disgruntled of course, so Moody's giving us the bird.

You notice that with millennials nowadays, especially women. They're always giving everyone the bird. Every single picture they take on Instagram, it's always them flipping you off for some reason as though that's some badge of merit.

Basically we've gone from rugged individualism and self-reliance to being disgruntled all the time and relying on government for everything.

Now, you may be saying to yourself, “Okay, George, I get it. I get it. I understand what's going on here. We're not manufacturing as much, and that's creating a structurally flawed economy? But what's the big deal? If these foreigners are willing to take these green pieces of paper, we're giving them and we can sit back and just lounge around and not have to work as hard. Isn't that benefiting us? Isn't that improving our standard of living?”

You would be correct until we get to a point where Triffin's Paradox kicks in. We get into the doom vortex and those foreigners no longer want those green pieces of paper.

Then, all those dollars outside of the United States start flooding back into the U.S. driving prices sky high. The value of the dollar goes down, goods and services, the price goes sky high.

But remember consumption is over 70% of GDP.

If next time you go to Walmart, the prices are double, triple, quadruple, what do you think that does for the consumption level of the average Joe that doesn't have $500 in his savings account?

Consumption would fall off a cliff and if consumption falls off a cliff, unemployment goes up. So that takes us right into a stagflationary environment with high rates of consumer price inflation and structurally high unemployment.

But wait… there is more.

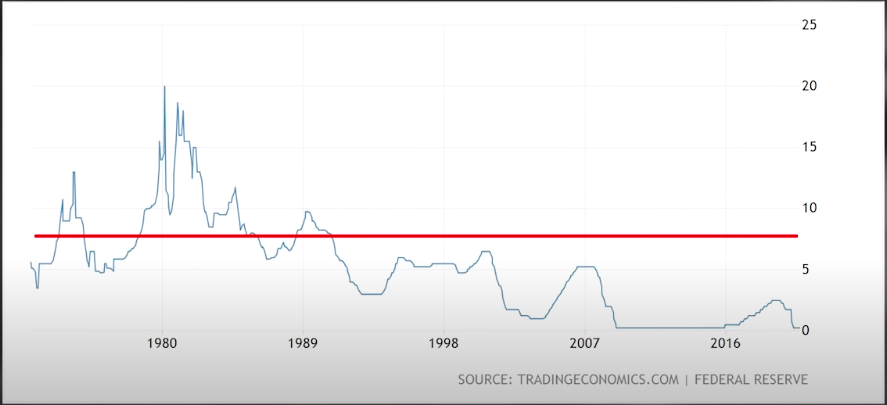

If we have stagflation, what is going to happen to interest rates?

They're most likely going to go up very high.

Keep in mind, right now, we have so much debt in our society at a sovereign, consumer, and corporate level that we can't even handle 1% or 2% interest rates let alone normal interest rates at 5%, six, or 7%.

So we have another doom vortex that's created. The destruction of the economy is creating higher inflation, which creates higher interest rates, which destroys the economy even further.

I'm sure a lot of you reading this right now realizes this is the most likely endgame.

When you tell your friend and family member, Fred, they always say things like, “Oh, don't worry about it. You're wearing a tinfoil hat. The Fed will always bail us out.”

Let's think this through. If we have high rates of inflation, therefore interest rates are starting to go up, the last thing the Fed can do is print more money.

They can't monetize the debt because that will exacerbate the problem. They can't fix the yield curve because that will exacerbate the problem of inflation, and that will destroy the economy even further.

The Fed will be completely impotent, they will have painted themselves into a corner where they have no tricks up their sleeve. They have no tools in the bag all they can do is stand back and watch it unfold.

The next rebuttal you always hear is… Even if this does play out and the dollar collapses, that won't be a problem because we can just bring all that manufacturing back to the United States.

It'll be just like the old days where we make all the goods we consume, but what your friend and family member Fred isn't realizing is that now, we have way more regulations than we had back prior to the 1980s.

The regulatory environment is so stifling that I don't think personally you're ever going to see manufacturing coming back to the United States to a great degree.

You have to put yourself in that position. If you have a billion dollars, are you going to want to take that billion dollars to build a factory somewhere in California?

Of course not because you know you can't pick that factory up and move it somewhere else. If California comes in, puts a target on your back and jacks your taxes up to 90% or puts a wealth tax on you or who knows what they'll do.

I think most people that haven't been entrepreneurs before, so they underestimate the incentive power of regulation and taxes.

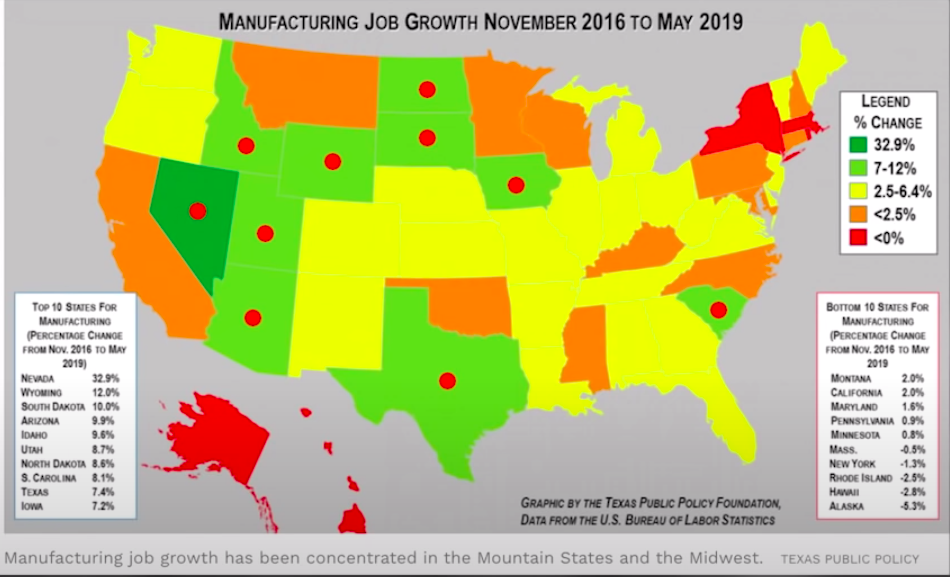

Here is a map that illustrates the point beautifully.

You can see that states that have low regulations overall have a lot of manufacturing, and it's the opposite in states that have very high regulation such as Californi, where they have very little manufacturing.

Moving forward, if the regulatory burden for the entire United States becomes more and more draconian, which I think it will, manufacturing is less likely to come back.

Then finally, I'm sure your friend and family member Fred is saying, “Well, we have no problem because we can boost consumption because the government, our drunk insolvent Uncle Sam can give us some more stimulus checks.”

Look at what's happened over the last couple of months. According to Des Moines Register the income of the average American has actually gone up because of all the unemployment benefits and stimulus checks.

But the problem with that is just like our initial issue with the Fed printing money, the only way the treasury can send out these stimulus checks is if the Fed monetizes the debt.

If they monetize the debt, that exacerbates the inflation problem, and it makes things even worse. Once you get to a certain point, you've crossed the Rubicon there is no going back.

You go straight into inflation and the economy has to de-leverage. In other words, the economy will collapse.

So have we already crossed that Rubicon or will we not get there for 5 years, 10 years, even 20 years? Let me know what you think in the comments below.

Comments are closed.