Could we see an 80% Market Correction in 2021?

According to macro analyst and Rebel Capitalist Pro, Lyn Alden, an 80% market correction is unlikely.

However, there are plenty of stocks that could crash hard if such an event were to occur.

If you've been following our emails lately, then you already know that Lyn is flashing the check engine light for Quarter 3 of this year.

Something is up with the data

Nothing is certain in this World except death and taxes. So it's no wonder that smart people like Lyn, analyze data, and work off probabilities.

According to Lyn, the probability that a liquidity event in 2021 could happen has increased.

Nothing is certain, however.

For one, common sense tells most of us who are paying attention that too much euphoria is in the air with respect to asset markets. Right?

Especially strange, when you consider how the big governments of the world have nearly destroyed the global economy through the mishandling of the pandemic.

The S&P 500 is more expensive than the dot.com bubble

In terms of valuation, the S&P 500 is either the most expensive it has ever been, using metrics like the buffet indicator (market capitalization vs GDP). Or it's the second-highest it's ever been, using metrics like cyclically adjusted price-to-earnings ratio. Both compare the S&P to the dot.com bubble.

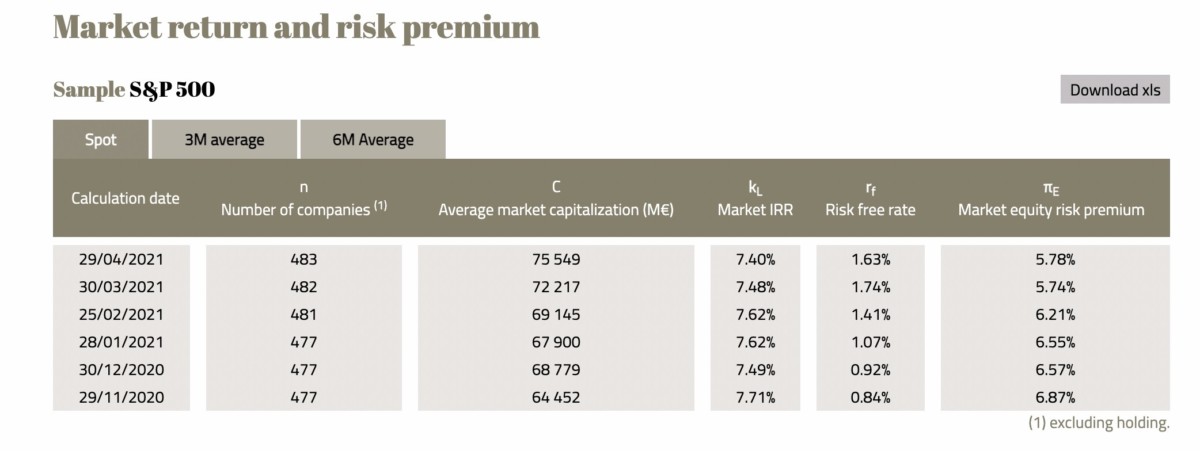

equity risk premium

On the other hand, if you look at equity risk premiums, which is like comparing stock valuations to bond valuations, you'll see that the S&P 500 is roughly average.

As the stock market goes in 2021, bonds are relatively more expensive. Which explains why so much capital has poured into stocks instead of bonds. Stocks are the cleanest dirty shirt in the closet right now.

Investors are willing to put up with stock market volatility in the expectation that they will outperform bonds over a ten-year period.

Why Waiting For A 2021 Market Crash Is Bad For Investing

Are you sitting on the sidelines, waiting for a market crash? If so, then you are guilty of timing markets. Timing markets is something that day traders and amateur investors do. It's not a strategy for making money.

How to avoid timing markets

The professionals are not sitting on the sidelines, nor should you. Lyn Alden for example does individual stock selection. Some of the stocks she is buying are cheaper today than they were five years ago. They are high quality and poised for growth.

individual stock selection

The picks Lyn is recommending to her premium subscribers and Rebel Capitalist Pro members have been doing well over the last twelve months, but historically, they have been in a decade-long consolidation.

So despite the frothy stock market, not all stocks march in lock-step with each other. Sectors are constantly rotating in and out of favor, due to the underlying stocks rotating in and out of favor.

Buy sectors That Are Not In Bubbles

Take a look at commodities right now. They've spent the last 10 years getting punished, and now, as we head into a massive inflationary environment, we're seeing sector rotation into commodities.

Avoid Meme Stocks

The darlings of the internet. Things like Tesla, Dogecoin, even Bitcoin, are things the hive mind has been sounding off on over the past 12 months. These are the assets at most risk.

Chris MacIntosh sold his Bitcoin position

It's not that he doesn't believe in blockchain technology, it's that he knows Bitcoin is in a massive speculative bubble, and he's already seen massive gains. He's been holding since 2014.

Chris's base case is pretty simple and makes sense. Why risk capital in a massive speculation like bitcoin, when there are plenty of investment opportunities poised to outperform bitcoin this year? It's pure risk management.

We're not telling you to sell your bitcoin. This is not investment advice. Just know that Chris manages other people's money and he's making a prudent decision to protect their wealth while moving on to new ideas. For now.

Watch The Video Above For More Stock Market Crash Intel From Lyn

Seriously, this blogpost under serves everything that Lyn Alden has to say in the video above. Watch it.

If fear and uncertainty have you sitting on stockpiles of cash, waiting for the stock market to crash, then you are doing it wrong.

It's a hard pill to swallow, I know. But you are guilty of trying to time markets, which goes against every successful investor in history. You won't win this one.

Instead, learn to become selective. Study individual stocks that have taken a beating over the last ten years. Looks at commodities, look at emerging markets, look at energy.

Do you need investing help?

If you're finding yourself driven by fear, hoping the market will correct, then the best thing you can do, is tag along with Lyn Alden, George Gammon, and Chris MacIntosh for a couple of months, inside Rebel Capitalist Pro.

Every other Tuesday, Lyn releases her premium macro newsletter and delivers a live q&A for members. The video clip above is from such a live q&a. She provides guidance. So does George Gammon and Chris MacIntosh.

George has his own private member live q&a every Sunday and so does Chris. Chris is every Thursday.

You have the power of two professional macro analysts and George Gammon at your fingertips for less than $100 per month.

You have no excuses.

Lyn Aldens Stock Portfolios

As if premium research and live q&a weren't enough, Lyn provides you access to her portfolio allocations inside Rebel Capitalist Pro.

You don't even have to research your own stock picks. Just mimic what Lyn is doing, and pay attention to when she adjusts her allocations (which she tells members about), and you'll do better than sitting on the sidelines.

Conclusion

In summary, will we see a deep market correction in 2021? Will the stock market crash, or the housing market crash, or maybe even the bond market?

Nobody is a fortune teller, but the best people in the business are not sitting on their hands waiting for something that may or may not occur this year. Nor should you.

Lyn is flashing warning signs for Q3, but there is still time and she is watching the situation closely.

Chris MacIntosh is heavily invested in assets poised for monster growth if such as correction is to take place. Both analysts invest in good companies.

If they do take a hit, the hit should be short-lived because they invest in quality. In their eyes, a bear market correction is an invitation to buy more quality, like March 2020.

If you haven't checked out Rebel Capitalist Pro yet, then sign up for a 7-day trial for only $1.

What do you think? Will the stock market crash in 2021? Let us know in the comments.

Comments are closed.