When trying to figure out whether or not the future is either inflationary or deflationary, bank deposits are what matter most.

And the bank deposits we are referring to are for everyday people, their businesses, and other entities in the real economy.

These bank deposits represent the purchasing power that is out chasing goods and services.

And understanding how this all works, gives you a better understanding of what happens next to the dollar, stocks, bonds, gold, and real estate.

Is QE deflationary?

Does Quantitative Easing (QE) pull liquidity out of the commercial banking system or not?

Two voices within Financial Twitter support deflationary QE: Brent Johnson and Steven Van Metre. They believe bank reserves can only be used to create additional loans by the commercial banking system.

To understand how QE plays out in the banking system, you need to keep these key terms in mind:

- Broad money: This type of money affects inflation or deflation and it circulates in the real economy to chase goods and services.

- Velocity: How fast money circulates within the economy.

- Goods/services: The number of goods and services that we have.

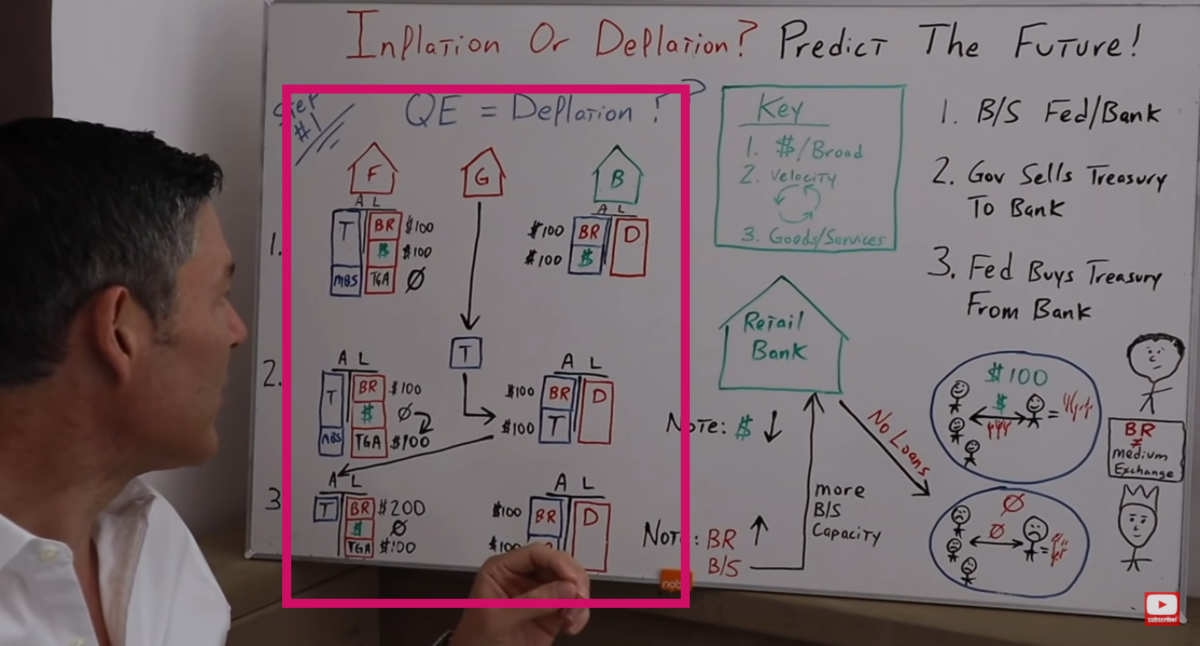

Now that you are aware of the key terms, take a look at how the balance sheet (B/S) of the Fed and the commercial banks work.

Inside the pink square, you can see the balance sheet of the Fed, the Government, and the commercial banking system.

The Fed’s B/S has assets and liabilities, where assets are treasuries and mortgage-backed securities, and liabilities are bank reserves ($100), cash ($100), and the Treasury General Account (TGA) with $0.

For the commercial banking system, cash represents an asset, but for the Fed, it's the opposite. Cash is a liability.

What usually happens is the Government issues a treasury, then sells it at auction because they need more money to spend.

A commercial bank will then buy the treasury from the Government which then goes to the bank's B/S as a new asset.

Then, the bank transfers the cash used to purchase the treasury into the TGA, which then goes on to the Fed's B/S.

After the transaction is done, the bank reserves held at the Fed are still $100, but they now have $0 cash, while the TGA has $100.

Now, on the asset side of the bank's balance sheet, there are still $100 in reserves and $100 in treasuries. The money supply in this transaction decreased because liquidity got pulled out of the system.

Why did the money supply decrease?

Money supply decreases because the $100 that went into the TGA is removed from the banking system and is no longer circulating within the economy.

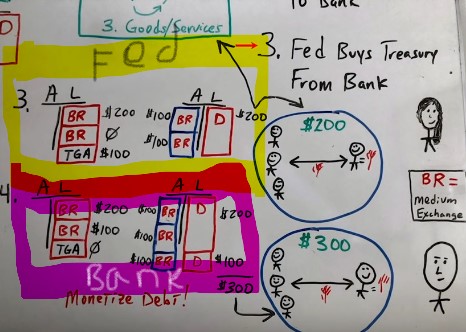

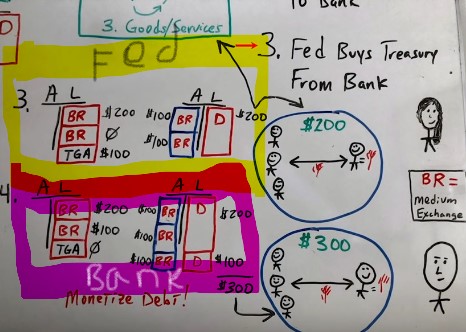

Afterward, the Fed buys the treasury from the bank, then adds $200 in bank reserves onto its B/S. This is where the Fed starts printing “money” or creating bank reserves.

There are $200 in aggregate total and bank reserves, but the bank has $0 cash and $200 bank reserves.

Note that the cash went down, but reserves have increased as well as the Fed's B/S capacity.

The banking system has swapped cash for additional bank reserves.

To increase the money supply circulating in the system by the same amount that it has decreased, the banking system needs to create an additional $100 in loans to have a wash.

According to Wikipedia, a wash is a series of transactions that result in a net sum gain of zero. An investor, for example, can lose $100 on one investment and gain $100 in another investment. That's a wash.

Ideally, the money supply in the economy would increase, not decrease or stay the same.

Johnson and Van Metre sustain that banks are lending loans here and there, but on net balance, people are paying off a lot more loans than there are being created.

At the very least, there is more liquidity being pulled out of the system through QE, than there is money being injected back into the system by retail banks creating additional loans for consumers, entrepreneurs, and businesses.

This is why they say QE is deflationary. Johnson and Van Metre see the dollar getting stronger and interest rates going negative.

Is QE Inflationary?

Two people at the Financial Twitter community hold this view: Lynn Alden (who is part of our Rebel Capitalists Pro team), and Luke Gromen.

The process is almost the same as the one explained earlier, but Alden and Gromen think bank reserves are a medium of exchange.

The cash on the bank's B/S is a bank reserve they can use to create more loans or buy financial assets, which includes treasuries the government issues.

That is a massive difference between the deflationary and inflationary perspectives.

We're going to focus on the deposits in the commercial banking system (pink square in the graph). It's important we focus our attention here because it is the money circulating in the economy that's chasing goods and services.

The Fed's liabilities (yellow square), be it bank reserves or cash, are not as important as the liabilities of the commercial banking system because these are not the deposits of the everyday person, or the people running businesses, nor any other entity in the real economy.

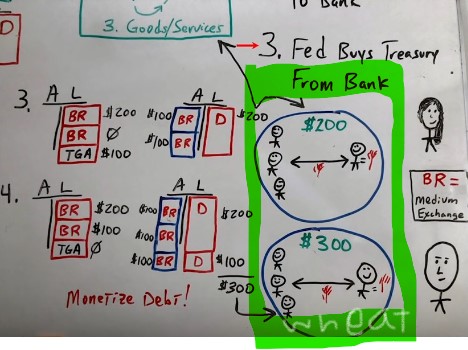

The deposits in the banking system are $200, but remember the TGA still needs to spend money by sending out stimulus checks of, let's say $100, to the average Joe.

For example, after receiving a stimmy, Joe deposits his check into his bank and leaves it there, with say, an additional $100 in deposits.

The TGA has given the same bank a liability, in the form of a deposit. So the TGA has to transfer an asset to the bank in order to back up that liability. The TGA then sends the bank $100 in bank reserves.

This means the deposits in the commercial banking system have gone from $200 to $300.

This is how QE can be inflationary according to Lynn Alden and Luke Gromen. They say the Fed is monetizing the debt.

Here's an example: If the economy starts with $200 e.g. to buy wheat, as you can see in the graphic above (green), now it has $300 to buy the same amount of wheat. Hence, the price of wheat would increase.

Again, the deposits of the everyday person, the people in the businesses, and the entities in the real economy are the ones that matter the most when trying to figure out if the future is inflationary or deflationary.

Bank deposits represent the potential purchasing power that's chasing goods and services.

If the amount of liquidity in the commercial banking system is the same, regardless of quantitative easing, then there is no deflationary pressure caused by QE.

Comments are closed.