How are most people viewing the banking system and money creation?

People see banks as intermediaries of a fractional reserve system.

Most people think money is created just with debt or fractional reserve banking, but that is completely wrong!

In this article, I break down Jeff Snider's years of research and market analysis in very simple and understandable terms. He is an expert on banking, the repo market, and the eurodollar system.

The reason it's crucial to understand how money is created and how the banking system really works is because it affects every aspect of the global economy.

Without an in-depth knowledge of how money is created it's impossible to determine the probabilities of inflation, deflation, or the next financial collapse.

This is part one of an educational series on my good buddy Jeff Snyder.

General View Of The Banking System

Let’s analyze how people see the banking system. I'll give you an example with a Bank called A and another one called Bank B.

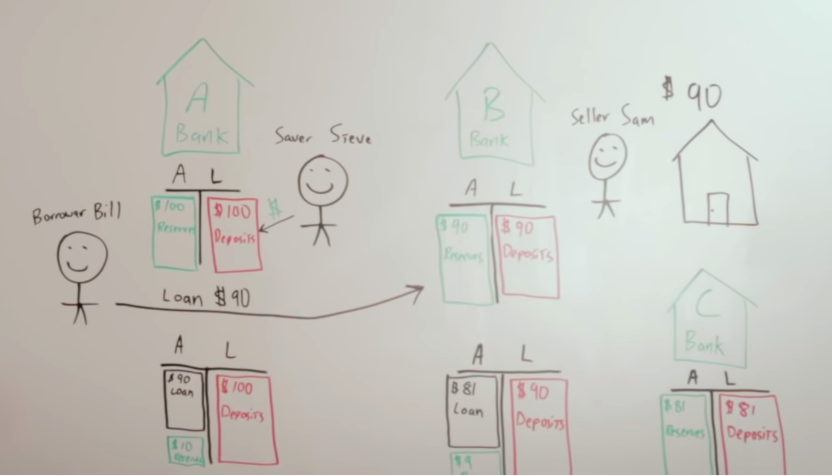

You can look at my drawing below so you can understand better.

Saver Steve (right in the middle) saved up $100. He deposited that in his bank A so the bank now has $100 in deposit. That is a liability on their balance sheet. They owe that to Saver Steve.

Those $100 become an asset in reserves that the bank can then lend out. If we have a 10% reserve requirement, a borrower that will be called Borrower Bill, can come along and borrow $90.

There is also seller Sam (on the right) who is with bank B and just happens to have a house that's worth $90. He says, “Borrower Bill, I will sell that house to you.”

So, borrower Bill takes out that loan for $90 and gives it to seller Sam. Taking a look into the bank's balance sheets, Bank A now has a $90 loan and $10 in reserves.

Their liabilities are still the same. The bank has $100 in deposits that they owe Savers Steve. Well, that loan goes over to Sam's bank account at bank B.

Now, bank B has $90 in deposits and $90 in reserves. Bank B has the $90 in deposit, they need to keep $9 in reserves for that 10% reserve requirement. They lend out $81 to a bank C. That becomes a liability and an asset for them.

Because of the fractional reserve banking, we started with a $100 in deposits, but after the loans, it ended up having $271 in deposits, which would multiply all the way up to $1,000.

You might be thinking, “Yeah, George, I get it. I understand that. I learned that in school and I've watched other YouTube videos.”

But keep in mind, the reason I am going over this is to tell you that this is not the way it works.

Look At Banks As Currency Creators Not Intermediaries

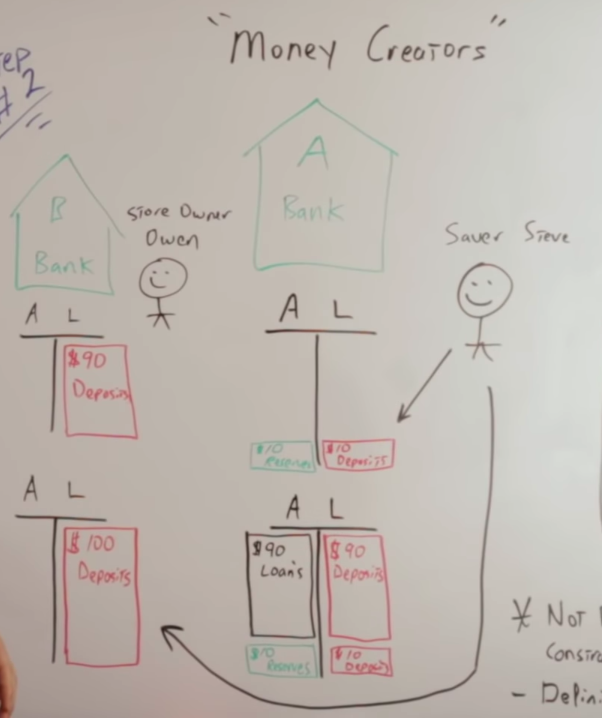

We've got to start looking at banks as money creators and not intermediaries.

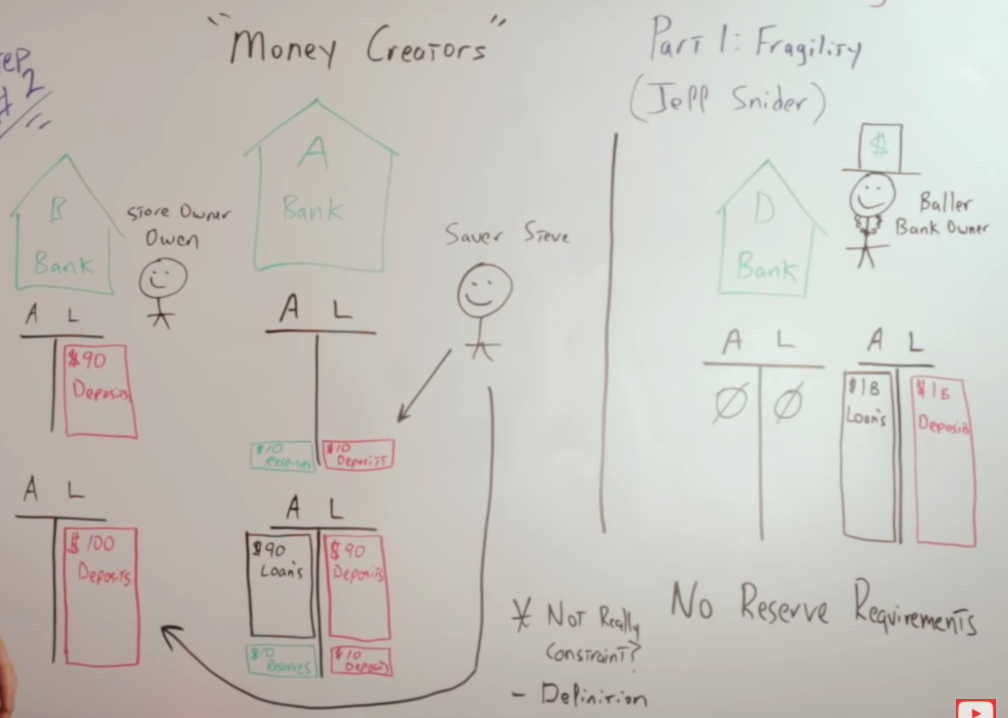

In the following chart, Bank A and Saver Steve are back, but this time instead of $100, he only has $10.

He deposits it into the bank, and that goes onto the liability side of their balance sheet. On the asset side, they have $10 in reserves, as shown in my drawing.

Instead of bank A lending out $9 and having $1 in reserves against that $10 deposit. Again, a 10% reserve requirement.

What they usually do in practice, is take that $10 in reserves and loan $90 against that, creating $90 dollars in new deposits.

To get a better understanding of this. Check out the Bank of England 2014 report on money creation.

Jeff Snyder and I discussed this report extensively during one of our long interviews. If you haven't checked that out, do so for sure by clicking here.

Jeff points out there are a lot of errors in the report. As far as the diagrams, I think they're accurate and give us a good visual representation of how money is created.

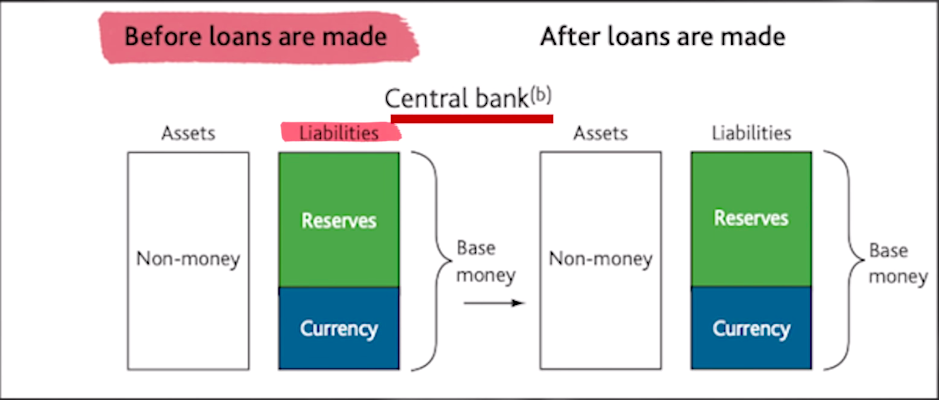

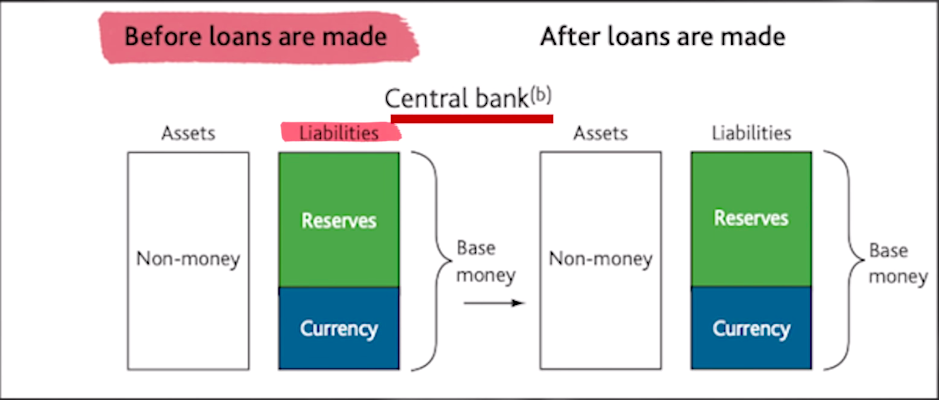

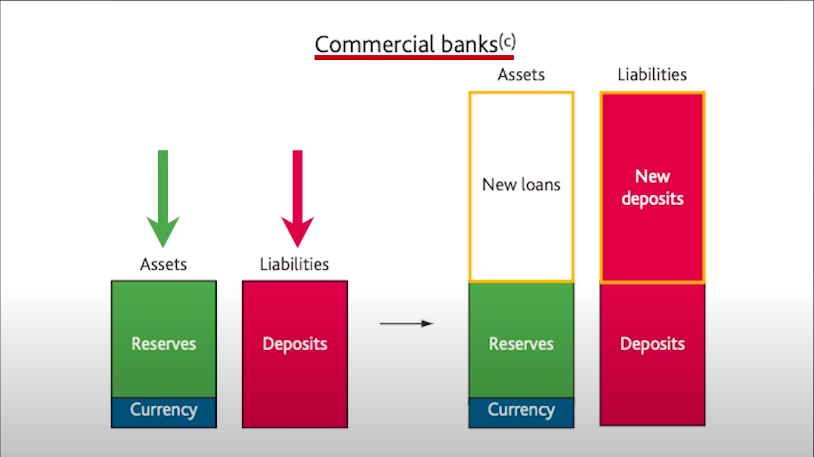

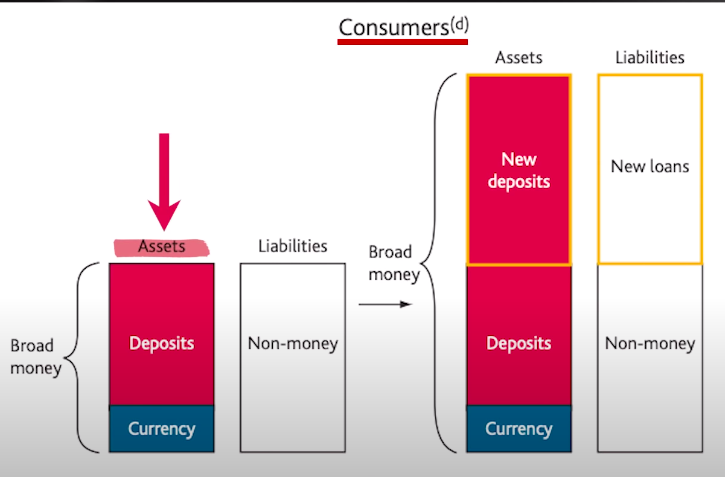

But, look at the balance sheet of the central bank, the commercial banks, and the consumers as an aggregate total.

Before the loans, the Central Bank has the reserves and currency on the liabilities side of its balance sheet.

The commercial banks have deposits and assets, and the consumers have deposits on the asset side of their balance sheet maybe along with some currency.

You can notice the deposits are on the asset side of the consumer's balance sheet but on the liability side of the commercial bank’s balance sheet.

The combination between the deposits and the currency is what gives us broad money.When the commercial banks lend money, this creates a new loan on the asset side of their balance sheet, and it creates new deposits to match those loans that are liabilities.

On the consumer's balance sheet, the new deposits created by the loans are assets and the new loans are liabilities.

Notice that the broad money has expanded and actually doubled simply by the commercial banks lending more money into existence.

This is why a lot of economists refer to bank deposits as fountain pen money created at the stroke of a banker's pen when they approve the loan.

This is why we need to start looking at banks as money creators and not intermediaries.

Additional Savings Don't Necessarily Mean Additional Deposits

You'll also hear academics and bankers talk about how additional savings doesn't really mean additional deposits.

I know that sounds a little bit weird, but here's what they're talking about.

Lest go back to the example I mentioned before, but this time imagine Steve saved $10, and put that in his bank account, Bank A.

While a store owner Owen, has $90 in his checking account in bank B, as shown in my drawing.

Because Steve saved $10 it doesn't necessarily mean that it's an additional deposit.

Because, if he would have spent the $10 at Owens store, then Owen instead of having $90 in savings, he would have $100.

The same amount of deposits we had before, but now it's in one bank account as opposed to split up between two bank accounts.

Of course, where I would disagree with how they're defining the word savings. They see it as just additional currency in a bank account. I see it, not as currency, but your excess productivity.

If you look at savings as excess productivity, and that's what expands your purchasing power, the pie of savings can continually get bigger and bigger if Steve and Owen are continually producing more.

We're not restricted to our savings by additional debt in the banks themselves.

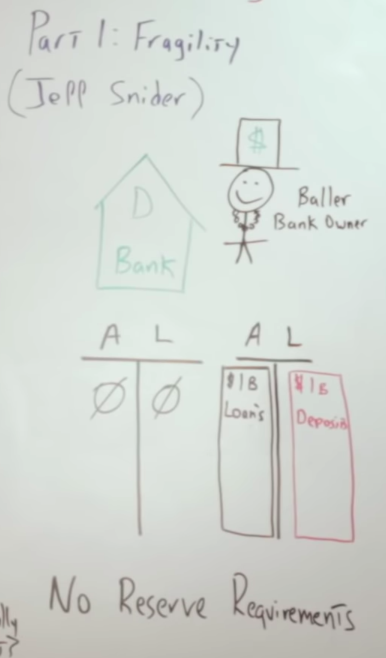

Banks As Currency Creators

Let's go back to how banks are currency creators. We have to define the two. I'm actually using money and currency synonymously and I shouldn't be doing that.

Banks A and B are currency creators, and the only thing limiting the amount of currency in the system is the reserve requirements and that's not even a constraint.

Think of an example where most banks don't have reserve requirements.

As seen in the drawing, Bank D is offshore and it is owned by Baller. Baller, of course, has an amazing top hat with a currency logo and a gold chain. Like Mr. T, he is loaded.

The reason he is so loaded and smiling is because his bank doesn't need any money in it.

The reason he is so loaded and smiling is because his bank doesn't need any money in it.

On day one, he has zero assets, zero liabilities.

On day two, he can create $1 billion in loans, therefore, $1 billion in deposits and electronic currency.

I want to point out that Baller the bank owner, can technically do this with $0, to begin with.

This is where we start talking about the Eurodollar system. Before that, I ‘ve got a special bonus for you.

What Happens In The Repo Market Stays In The Repo Market

Now, I'll give you a quick little explanation on the repo market and it's all going to tie in at the end of this article.

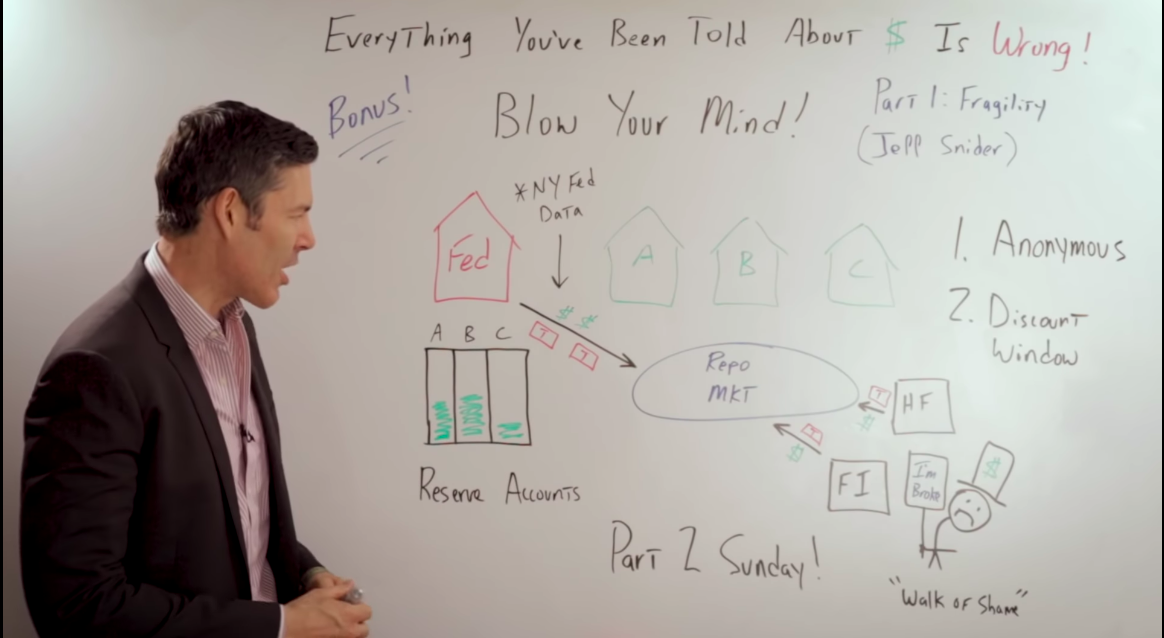

I'm going to put all the pieces of the puzzle together for you. In the image above, you can see the Fed and its primary dealer banks: A, B, and C. As we know they have accounts with the Fed, the reserve accounts.

The Fed has been injecting a lot of funny money into the repo market.

The hedge funds, financial institutions, or maybe some of the banks themselves have been taking that liquidity and they give the Fed collateral, mostly in the form of treasuries.

So, when we go to the New York Fed's website and see all that data, I think we're all assuming that data refers to the transaction between the Fed and whomever they are dealing with in the repo market itself.

Well, I was wrong!

I think all of you were wrong as well.

In my full-length interview with Jeff Snyder, he actually tells me that I was wrong, and he sets the record straight.

Jeff points out that the Fed really can't go directly into the repo market because a lot of the institutions that they're lending to, don't have reserve accounts with the Fed.

In other words, the Fed is basically the bank of the primary dealers.

The only thing the Fed can do is inject liquidity or cash into the primary dealer’s reserve accounts or any bank that's under the Feds umbrella.

If the bank, lending institution, or hedge fund is outside of the Feds umbrella, the only way the Fed can get money to the entity, is if they first give the money to the primary dealers.

So, all the data that we've been seeing on the New York Fed's website is not between the Fed and whoever is participating in the repo markets, it's between the Fed and the primary dealers.

The Fed gives them the liquidity, they give the Fed the collateral, and what they do with the liquidity is up to them.

The Fed is just keeping their fingers crossed that they go into the repo market but they might not. This serves a very convenient purpose for the Fed, in my opinion, a little too convenient.

Let me explain, the Fed is considered a lender of last resort.

If a financial institution gets into trouble like Deutsche Bank, HSBC, or any of the usual suspects, if they have the collateral, they can go to the Fed or the Central Bank and say, “We've got all this collateral. We're illiquid. We need money to stay in business.”

Then the Central Bank will say, “Okay, fine, here you go.” That's what the discount window was set up for.

The problem with the discount window is that it was public information. So any bank that went to the discount window to get money from the Fed was basically admitting they were broke. I call it the walk of shame.

They go to the Fed, it means that they're broke, the market sees that, and it's a self-fulfilling prophecy.

The Fed could never use the discount window the way it was intended to be used.

Why? Because it was public.

They needed a system to bail out the banks that were anonymous. What is the repo market now, that the Fed is giving the money directly to the primary dealers, and they are doing who knows what in the repo market?

Like Jeff Snyder told me in our interview:

It's just like Vegas. Whatever happens in the repo market stays in the repo market.

What they have effectively done is created a discount window for any of these financial institutions that are going bust that is completely anonymous.

Fragility 10X And The Euro Dollar System

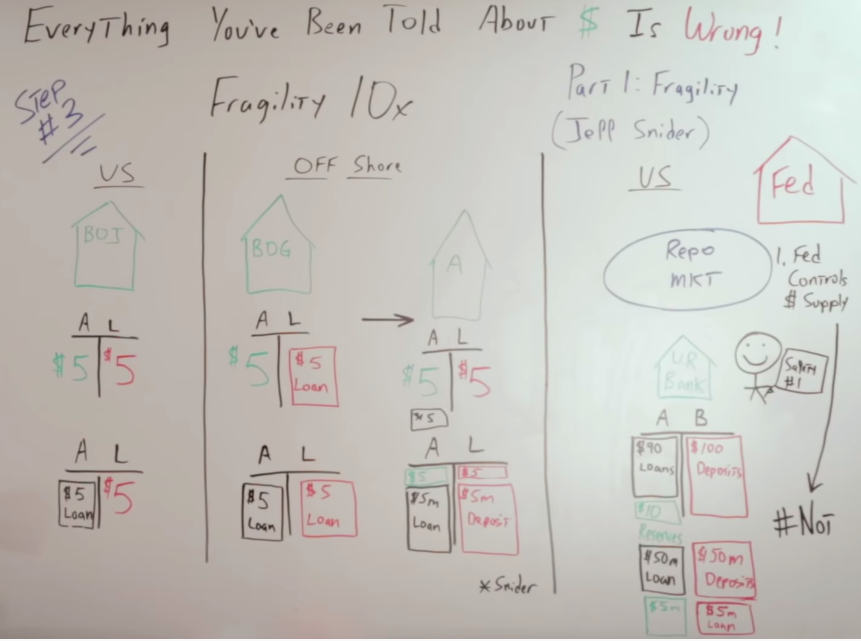

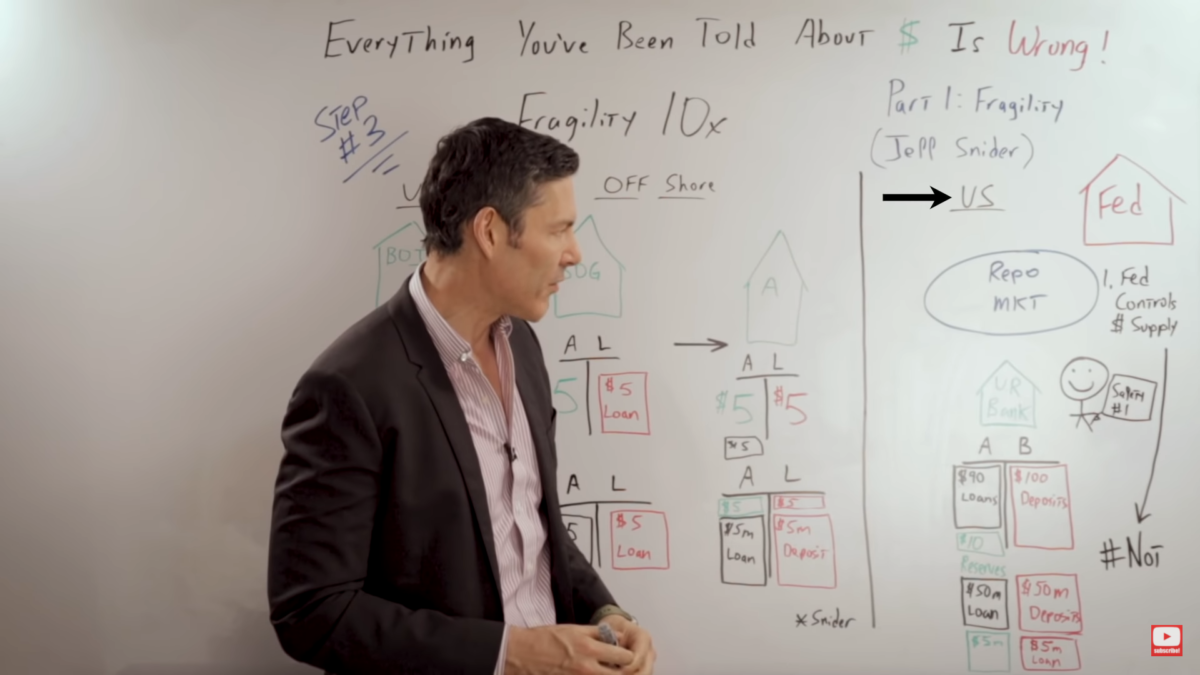

Fragility 10X. If you saw part one of my interview with Jeff Snyder, you saw that he used a $5 bill to illustrate how the Eurodollar system actually works.

In this drawing of mine, we have the bank of Jeff, the BOJ, not to be confused with the Bank of Japan.

So, in this example, they couldn't lend out any money because they were completely insolvent due to negative interest rates, but the BOJ, Bank of Jeff, does not have that problem.

So, in this example, they couldn't lend out any money because they were completely insolvent due to negative interest rates, but the BOJ, Bank of Jeff, does not have that problem.

He has $5 to lend. That is a $5 customer deposit. Along comes the BOG, which is the bank of George. That's an offshore bank. We'll say it's somewhere maybe in Colombia.

They need $5 so they go right over to Jeff, and say, “Jeff buddy, I need that $5 if you don't mind.” They say, “No problem.”

So, that $5 gets lent over to the Bank of George and then becomes a loan on the asset side of Jeff's balance sheet and liability on George's balance sheet.

George now has the $5, which he can go ahead and lend out.

Now, let's say there's a bank A, in Singapore, and corporation XYZ has a checking account there.

They say, “Listen, George, we need a $5 loan.” So, that loan goes over to bank A.

Bank A then has $5 as a liability, that is the checking account for corporation XYZ, and also has the $5 in reserves as assets.

Then George's balance sheet changes as well. Still have the same liability to its buddy, Jeff. But now instead of the $5, they have a $5 loan, that again, went to corporation XYZ.

Bank A knows that they're an offshore bank and they're not bound and restricted by those crazy reserve requirements.

They want to shoot for the moon, they want to boost profits as high as they possibly can.

They say, “We're going to go ahead and lend $5 million against that $5 that we have in reserves. We're really going to go for it. We think the market's strong and there is no downside whatsoever.” That also creates a $5 million deposit.

Before I go any further, I quote a tiny portion of my interview with Jeff Snyder, so you can read his description of how out of control this offshore Eurodollar system can actually get.

George Gammon: That would become a deposit for them on their bank's balance sheet. It would become an asset to the bank as far as the cash equivalent.

Then that process could just multiply over and over again, to where you'd theoretically have a limitless amount of $5 bills that had been created from that one $5 bill that you have in Florida.

Jeff Snyder:

That's essentially the point of the Eurodollar system, is that it's a bank centered system where what matters is, you and I are both banks and we both agree on the terms.

We don't care about this physical $5 currency. We only care about the numbers on our computer screens. That's all we care about. I credit you with what you think is a $5.

You accept that it's $5. Therefore, we're both good. Now you can do whatever you want with those $5 because they're on your books as $5. You have an offsetting liability.

Everything is accounted for according to global conventions. We're all good.

So, if you want to send those $5 to a bank in Singapore, because they have a better opportunity to use them someplace else, and you think it can make a better spread on the five, then fine.

You can electronically transfer those immediately to the bank in Singapore, and this $5 chain of liabilities grows and grows and gets bigger and bigger. Even though the original bill stays with me in Florida.

(End of the interview)

Now, going back to the example in the good old USA (the one I'm pointing at with the black arrow in the drawing). Here I have the Repo market, and you. Yes, that's you holding a sign saying: Safety is number one.

You are so excited because you know your bank has reserve requirements. So, they're not going to go bust because they're going to be prudent and play it safe.

But, going back to my first example, your bank has $90 in loans, $10 in reserves, and $100 total in deposits. 10% reserve requirements.

What happens next is you take out and look at the fine print, and say, “Wait a minute here. My bank also has $50 million in loans, $50 million in deposits, and they only have 10 bucks in reserves. How is that possible?”

Well, it's actually pretty easy. Your bank has an account with bank A.

Let's say they go through the repo market or they go directly from bank to bank.

But, the reason bank A created that loan or deposits for $5 million was to lend it to your bank. Your bank takes that $5 million, goes on to the asset side of their balance sheet as reserves.

They lend $50 million, and create $50 million of deposits based on that 5 million that they borrowed from bank A, which got that 5 million from the $5 they got from the BOG.

The BOG got that $5 from Jeff Snyder's back pocket. Now, you can understand why I called this part of the Jeff Snyder whiteboard series, Fragility.

Let's not forget that all these transactions that happen in the repo market, that could be going back and forth from the onshore to the offshore entities with the Eurodollar system are completely anonymous.

So, for your friend and family member, Fred, that keeps telling you, “Don't worry about it. The Fed has total control over the US dollar money supply.”