You definitely need to sit down and buckle up for this one. Hyperinflation could collapse the economy and steal your purchasing power!

But if you understand how it might happen, you can take steps now to make sure you’re prepared. Even if it never happens there’s no downside to having a Plan B.

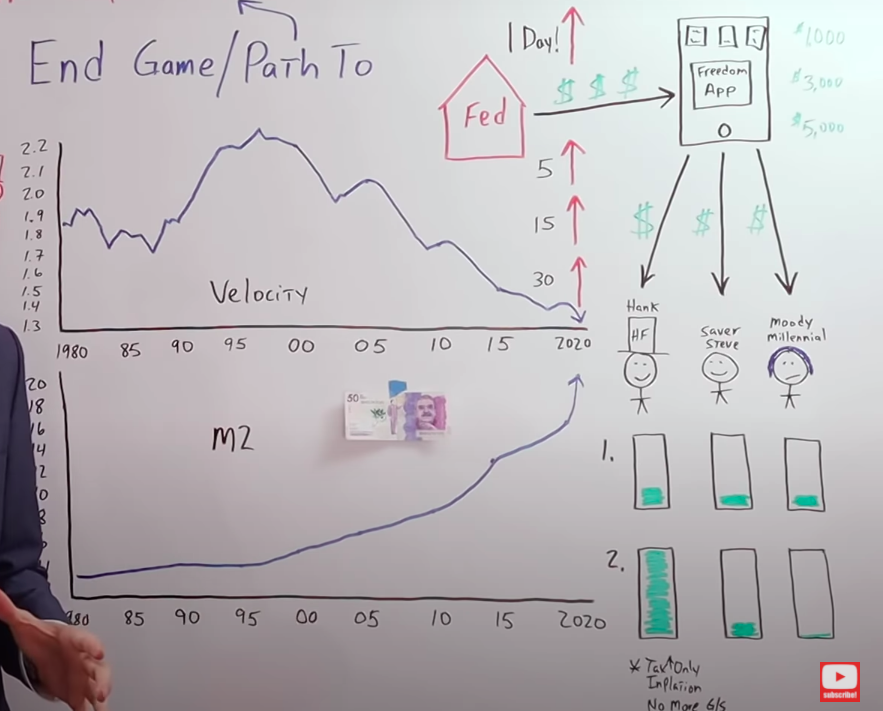

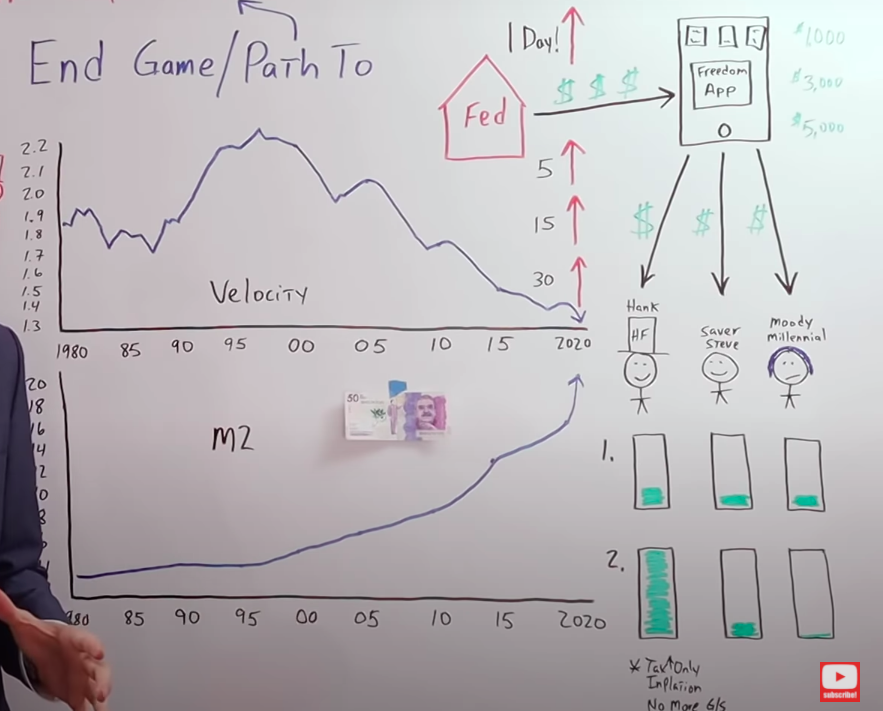

In this article, I'll explain our government's debt problem, the importance of M2 money supply and velocity, and how I think we can get to an endgame with the Fed.

The Government Debt Problem

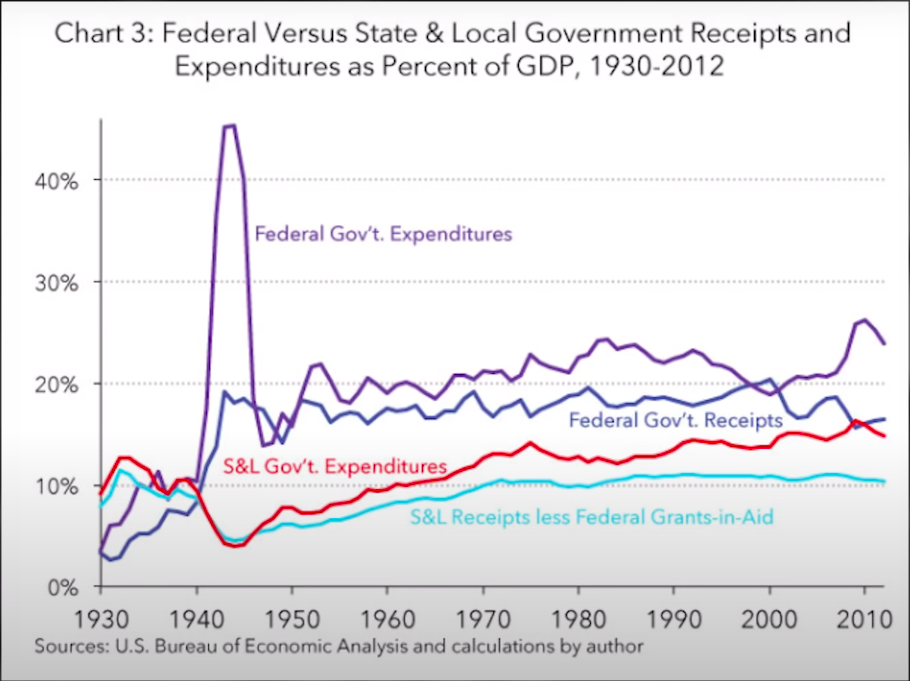

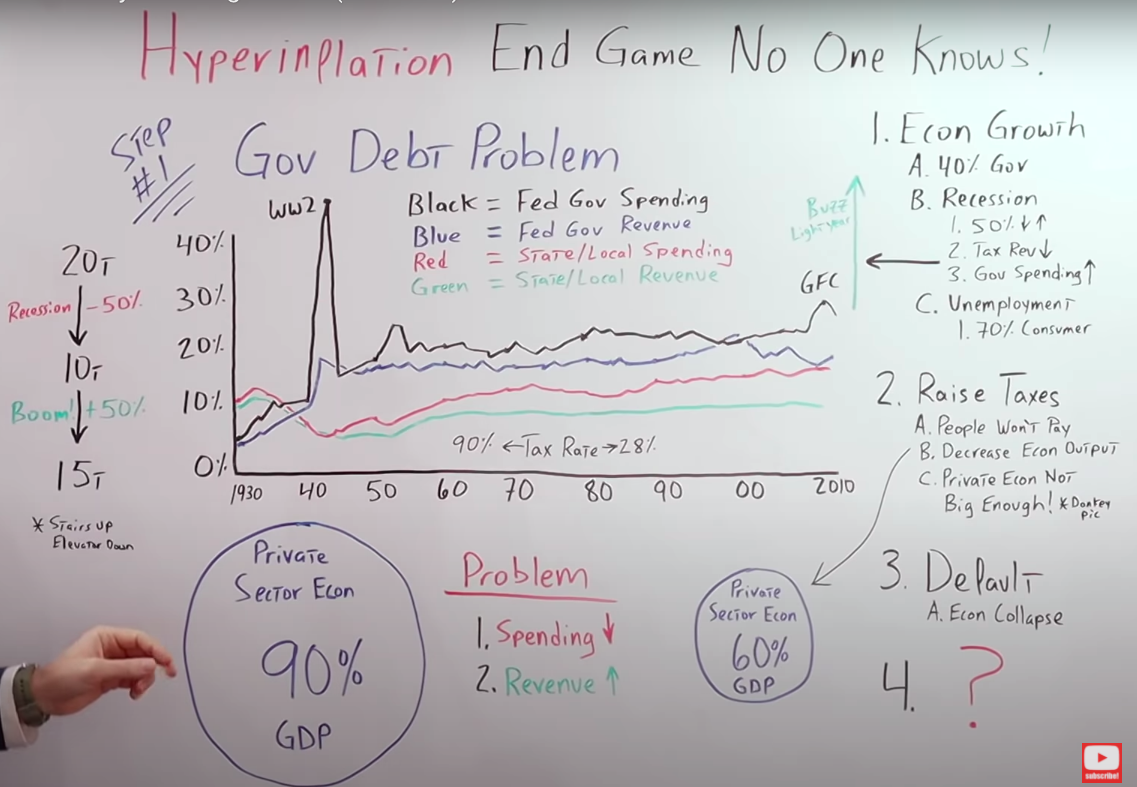

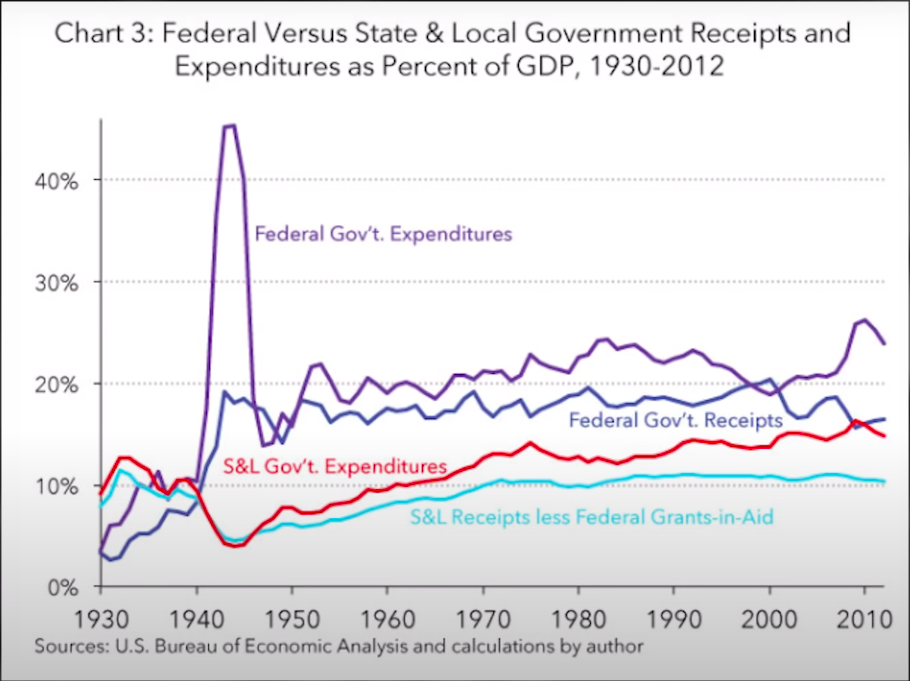

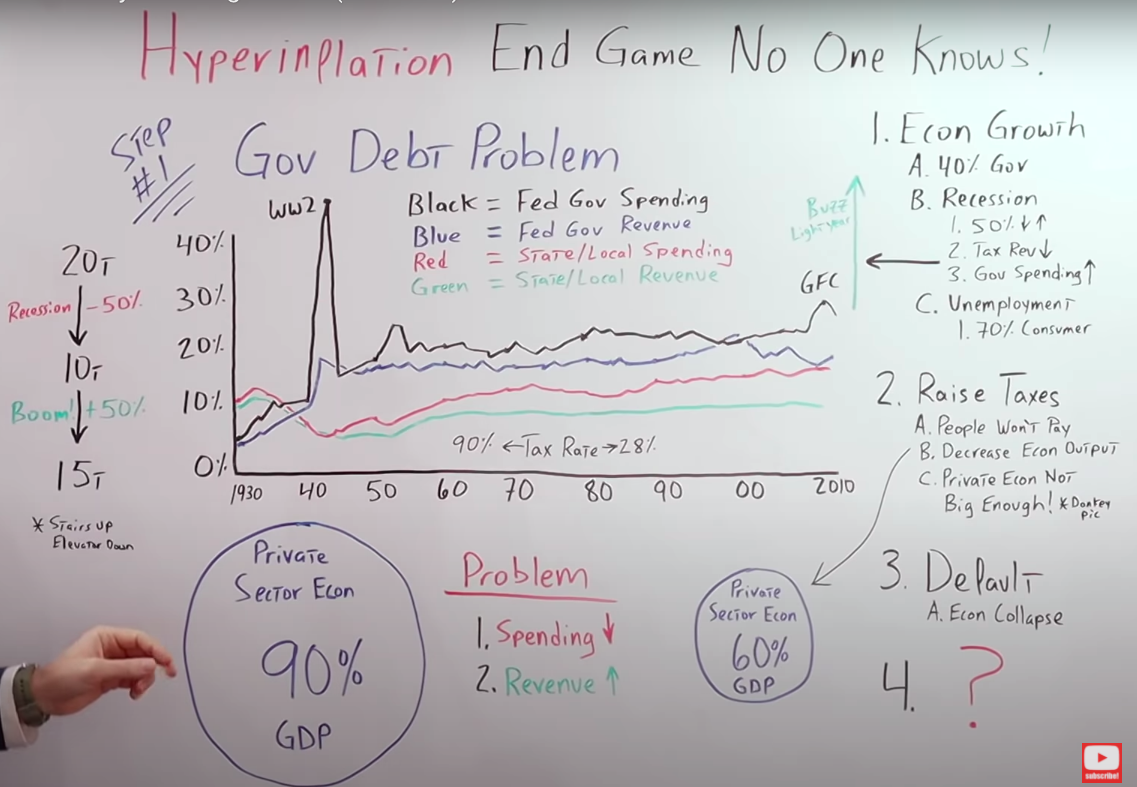

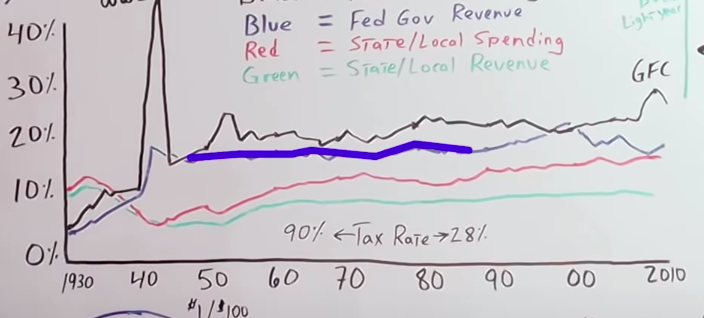

Let's first go over the government debt problem. Here is a chart of government spending and revenue to GDP.

It starts in 1930 and goes all the way to 2010, but I'll take it beyond 2010 later on. On the left, it goes from 0% to 40% of GDP.

I also drew it on my whiteboard so I can explain it better.

The black line is the federal government spending, the blue is federal government revenue, the red one is the state and local spending, and the green one is the state and local revenues.

Starting in 1930, the federal government spending was right around 3-4% of GDP. Wouldn't that be nice if we could go back to those days?

But, it went up. It skyrocketed, World War II happened, and then it came back down. It flat-lined all the way until it reached the GFC. Notice that it went up substantially.

We need to understand that in the last 10 years that we have had this Keynesian mindset, the government and central banks with quantitative easing, artificially low interest rates, and stimulus packages.

And because of that, if we go into a recession/depression, the government spending will go through the roof.

The blue line represents the federal government revenue. In the beginning, it went up slightly, then, it flattened with a little bit of an uptick in the late 1990s because of the internet boom, but it came back down.

The main thing I want you to notice with this chart is the blue line is always under the black line, all right? In other words, the revenue is always lower than the government spending. It's the exact same thing in the states.

States spending started off in 1930 around 10% of GDP. It went back down in World War II, but then it came up. It flatlined. Notice the green line is always under the red line.

Basically over the past 80 or 90 years, government spending has always been higher than the government revenue they're collecting in taxes. That doesn't end well.

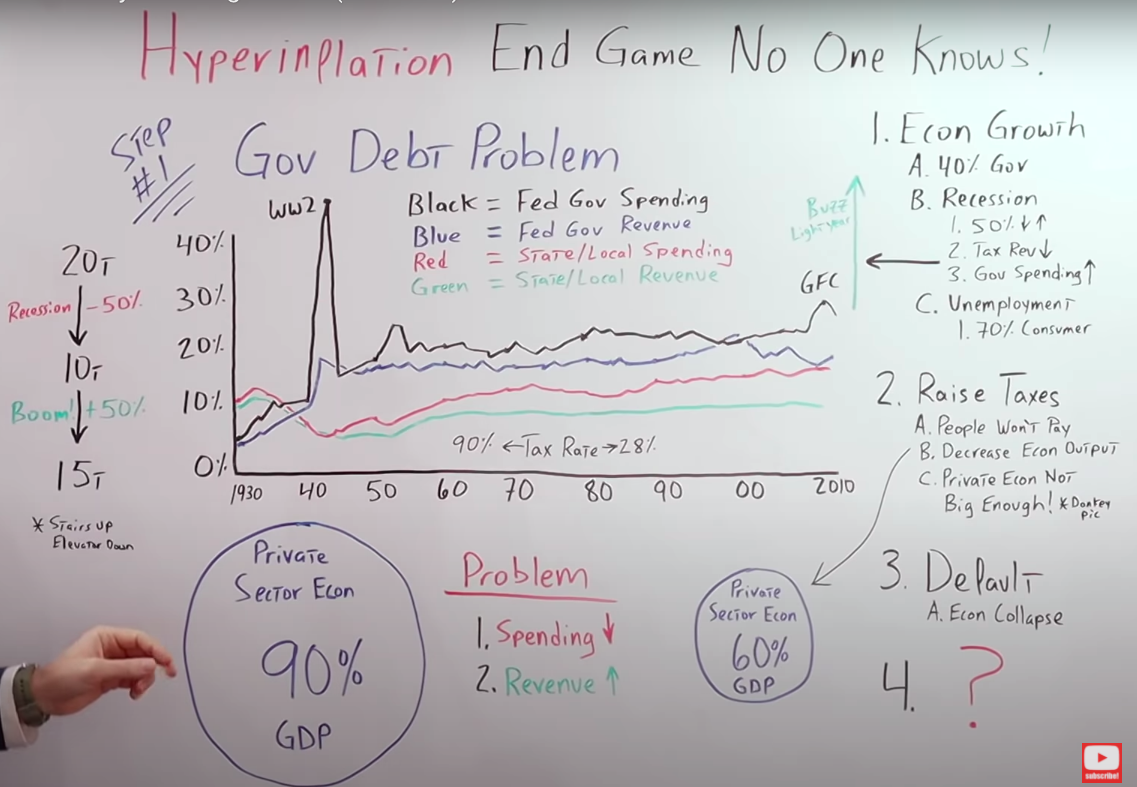

It's easy to understand what the problem is. The solutions would be to either decrease spending or increase revenue.

But we can go ahead and cross option number one right off the list because there's no way they're going to decrease spending. That's for sure.

How would they increase revenue?

The first thing would be growth. What most people don't realize is the size of the private sector compared to GDP has shrunk dramatically. Think about this.

Back in 1930, the private sector was about 90% of GDP, just imagine it as the large circle on the board.

But now, in 2020, it's even worse. Back in 2010 when you combined the state and local spending with federal spending, government spending as a total was about 40% of GDP. In other words, the private sector was only 60%.

The size of the private sector, in other words, the engine for economic growth has continually shrunk over the years. So now we're trying to squeeze more blood out of a smaller and smaller turnip.

This is why it would be very difficult for us to achieve the economic growth needed to actually service the staggering amounts of debt.

Let me just explain this in a slightly different way. I'll take it to an extreme to make sure we are on the same page.

Let's think about an economy or a government that had $1 debt, and an economy that was generating $100 a year. The economy would only have to grow by 1% to satisfy the debt.

But if we have an economy, or if we have a government that has $100 in debt and the economy, the private sector only produces $1 a year, think about how much that economy has to grow to satisfy that amount of debt.

Do you see it?

It's far easier when the economy, the private sector is a larger portion of GDP.

For another thought experiment, we can just think about this… If the private sector was 100% of GDP…

How easily could that grow to pay off debt compared to if the private sector was 0% of GDP?

Obviously, if it's at 0%, it doesn't produce anything. It doesn't generate any tax revenue.

If the starting point is the private sector accounting for 100%, the closer you get to the private sector being 0% of GDP, the harder it becomes for growth to even service the existing debt, let alone pay it down.

Now we're past 2010. We're going into a recession/depression with the coronavirus.

What's going to happen to tax receipts?

They're going to completely plummet.

What happens to government spending?

It goes through the roof. With all these trillion-dollar deficits and stimulus packages, government spending is going to go Buzz Light year, to infinity and beyond.

It's the exact opposite of solving the problem.

Government spending, instead of going down, goes straight up, and government revenue, instead of going up is going straight down.

The problem is not getting better. It's going to get a whole lot worse. My main point is if we're going into a recession or a depression, there's no way we can get any economic growth by definition.

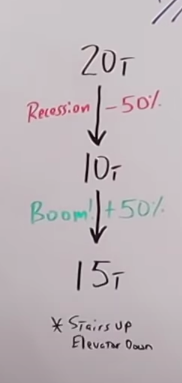

Another thing is most people never really consider that if GDP goes down by a certain percentage, it has to go back up by a higher percentage to get to the same high watermark.

I'll give you an example.

If we start at $20 trillion in GDP, because of a recession/depression, and go down by 50%. Now we're at $10 trillion.

If all the Keynesians get in there and do all their quantitative easing, artificially low-interest rates, and stimulus. Let's say we have this artificial boom. So GDP goes back up by 50%.

We don't go back up to $20 trillion, because now we're at $10 trillion. But, if we increase by 50%, now we're only at $15 trillion.

We're still $5 trillion lower in GDP than when we started, although we increased by the same percentage that we went down, to begin with.

I'm sure right now your friend and family member, Fred, is saying” Yeah, George, I get what you're saying, but we could always just increase taxes. Let the wealthy pay their fair share.”

But look at the data and see what actually happens when you increase the highest marginal tax rate.

Going back to our chart, you can see tax revenue has pretty much stayed the exact same all the way to the late 90s.

We then have to look at tax rates, the highest marginal rate, and most of us know that back in the 50s and 60s, it was 90%. Throughout the mid-80s, it dropped down to around 28%.

Again, during the timeframe marked by the blue line, we have a 90% highest marginal rate. During the 60s to 90s, we had a 28% highest marginal rate, but you'll notice the tax revenue coming into the government really doesn't change at all as a percentage of GDP.

Why?

Because at a certain point, people just won't pay it. They'll figure out a way around.

Even if they were willing to pay the taxes, it doesn't matter, because if you increase the tax burden on the private sector, you're going to be decreasing economic output, and if you continue to decrease economic output, no matter how high you raise the taxes, you're just exacerbating the problem.

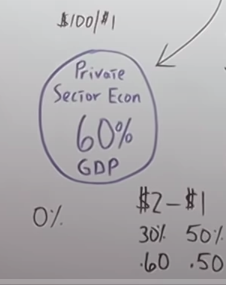

Let me explain it to you.

If we start off with the private sector economy generating $2 at a 30% tax rate, you're generating 60 cents in revenue.

But, if you increase taxes, the GDP of the private sector or economic output goes down to $1. Even though you increased the taxes to 50%, you're still only getting 50 cents in revenue. We started with 60 cents, and now we're down to 50 cents, although taxes were increased.

I actually found a picture online that I think illustrates this beautifully. The gentleman in the picture represents the government, the donkey represents the private sector, and just like when you increase taxes.

When you increase the burden, the donkey has to pull and it's going to get slower until it gets to a certain point when it stops altogether. Just like the private sector economy.

If you burden it with more and more taxes, it's going to get slower and slower until it gets to a point where, just like the donkey, it stops altogether.

The third option would be the default. Of course, this creates an economic collapse that would be equivalent to Armageddon, so they're definitely not going to do that.

What's our fourth option?

I think you already know it. It would be inflation, or even better for the government debt load, hyperinflation.

The Importance Of M2 Money Supply And Velocity

We know the only way out for the government and their massive debt problem is through inflation.

So, how do they get from point A to point B?

Let's explore M2 and velocity a little further so we can get our heads around it and start connecting the dots.

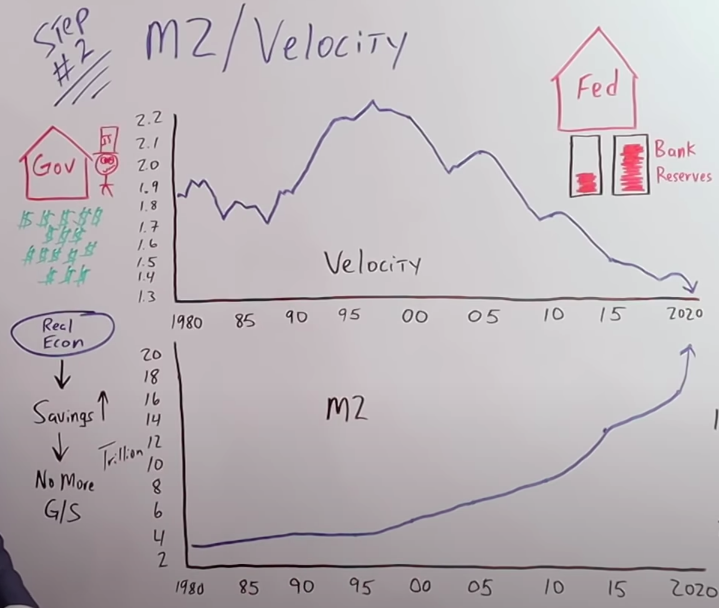

Here is a chart of the velocity of M2 money supply going back to 1980.

It actually goes back further, but I wanted it to match up with the M2 money supply. This is a recent chart. On the left, it goes from 1.3 to 2.2. That's how fast it turns over.

In 1980 it was right around 1.9, then it went down a little bit but came way up for the .com bust, the internet. We really had the money circulating throughout the economy.

Then was the recession and they started doing quantitative easing, dropping interest rates artificially low, and the velocity went down to where it is today in 2020, at an all-time low.

It was at an all-time low prior to the coronavirus but now it's tanked even further.

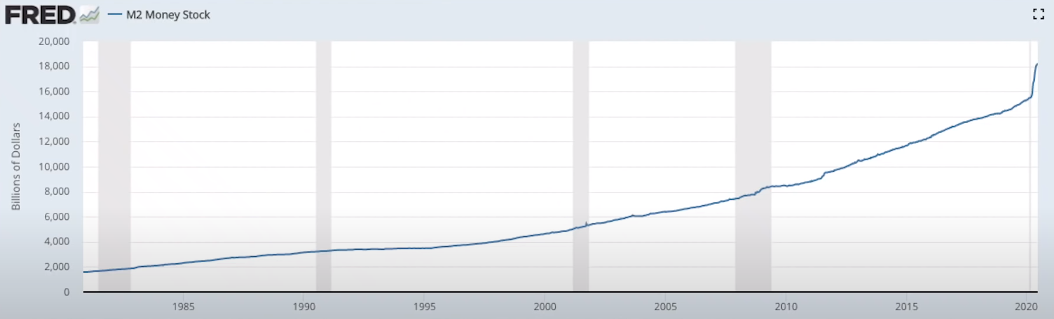

This chart on the left, it goes from $2 trillion up to $20 trillion.

In the beginning, it was pretty consistent, all the way up until today, with the coronavirus, where it basically went vertical.

The question becomes:

How has the money supply increased this much, and why has velocity decreased by that much?

That's the key. If velocity would have stayed the same as it was in the 1990s, and they would have increased the M2 money supply this much, we definitely would have got some serious inflation, if not the hyperinflation.

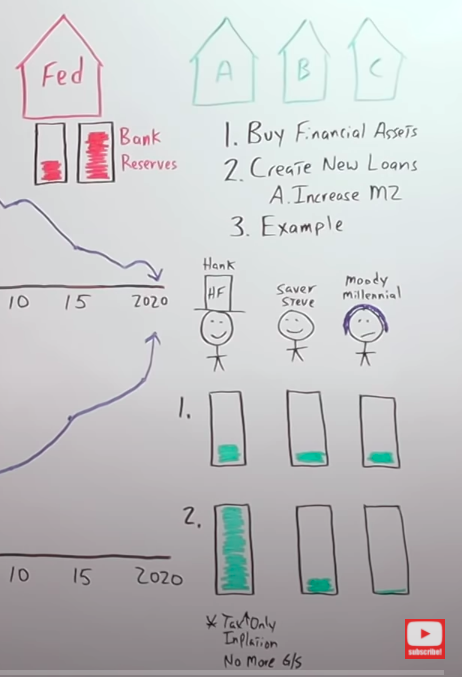

To understand this, it goes back to the Fed and the primary dealer banks, the banks under their umbrella.

The Fed can come in through quantitative easing and increase the bank reserves. They can double, even quadruple the bank reserves.

And it doesn't really matter because the commercial banks actually have to take action for these bank reserves to do something.

If the commercial banks don't take any action, the bank reserves just sit at the Federal Reserve and don't really serve a purpose at all.

There are a couple of main things they can do:

1.Buy financial assets with these bank reserves, then the bank reserves are just transferred from one bank to the next and swapped for other financial assets.

2.Create new loans because as bank reserves increase, the capacity of the bank's balance sheets is expanded.

In other words, it gives them more freedom and flexibility to create additional loans. If they create new loans in the real economy, that increases the M2 money supply.

A lot of people struggle with this concept, so let me give you an example that hopefully will paint a clear picture.

Let's say I gave you a million dollars right now, but the stipulation is you couldn't spend the million dollars.

The only thing you could do with the million dollars is lend it out and keep the profit. If you lose money from lending it out, then you go bankrupt.

But even if you have the million dollars in your account, it's just like the bank reserves. Unless you can find a productive way to create additional loans that will bring you profit, the million dollars don't matter because you can't access them.

You can't really do anything with it. It's the exact same way with the Federal Reserve when they create bank reserves for the primary dealer banks, the commercial banks, and the banks under the Fed's umbrella.

That's the best example I think I can give.

But, I want to be very clear. I'm not saying the banks lend out the bank reserves. They just use them as a backstop for additional loans.

With the example I gave, it's just much easier to understand if I said I'm giving you a million dollars that you can actually lend.

Again, it goes back to this problem the Fed has with velocity, and they don't really have total control over the money supply.

-

Why does the velocity go down?

-

Why have we seen it go from this peak in the mid-1990s and continue to go down as the Fed does more quantitative easing?

One possible explanation could be that when the primary dealer banks create new loans, now because they think there's a Fed put, they're only creating new loans for the financial economy.

Let's think this through with the following example.

There are three participants, Hedge Fund Hank, Saver Steve, and everyone's favorite, Moody the Millennial with their blue hair.

Anyway, the banks go to Hedge Fund Hank and say, “Hank, we will give you all the money you need to speculate in the markets and go into the repo market.”

Hedge Fund Hank's bank account goes from size 1 on the left to size 2. Saver Steve really doesn't do anything, so his bank account stays the same, and Moody the Millennial spends money really quickly. As soon as they get that paycheck, boom, it's gone.

They're not saving a dime and their bank account has actually gone down.

The only velocity of money, the only circulation we have is through Moody the Millennial, because Hank has so much money he's only spending a small fraction of it on rent, his car insurance, and food.

You have this scenario where the M2 money supply increases dramatically, but the velocity of the money supply slows down.

You may be saying to yourself, “George, there's a simple solution. All we have to do is raise the taxes on Hedge Fund Hank, and we can distribute the money over to Moody the Millennial. They'll go out and spend it with more velocity. Problem solved.”

But what you're not thinking through is that transfer of purchasing power doesn't increase the amount of goods and services in the real economy.

In fact, it'll most likely shrink the number of goods and services available, which would increase inflation that much more.

What you're really doing is you're not screwing over Hedge Fund Hank, even if he did pay the taxes. What you're doing is you're screwing over Saver Steve, because the inflation hurts him just as much, if not more than it would benefit Moody the Millennial.

You now understand why it's really hard for the Fed to directly control the M2 money supply. It's almost impossible for them to control velocity.

If you're really paying attention you may be saying to yourself “But George, the M2 money supply in 2020 has gone completely parabolic. It's almost going vertical.”

-

How is the velocity going down if the Fed isn't really controlling this vertical increase of M2 money supply?

-

How is it growing?

-

Why is velocity decreasing even faster?

Look at my drawing on the left.

The government comes in with your drunk insolvent Uncle Sam and spends money like it's going out of style.

They're raining it down onto the economy through stimulus checks and massive amounts of deficit spending.

That's why you're seeing M2 go up. When the government spends money on the economy, it goes directly into the M2 money supply.

It's very different from the Federal Reserve just creating these bank reserves, where they have to depend on the commercial banking system.

They're creating deposits in the real economy, but what's really happening is they can't control behavior. So the savings rate has gone through the roof. That's slowing velocity down, while M2 is going parabolic.

The main takeaway from all I have said up to this point is, the government has to have inflation, but in order to get inflation, they have to increase velocity, and neither the Fed nor the government has control of that velocity.

What I Think Its The Fed's Planned Endgame

This is the path to inflation or even hyperinflation. I think the Fed and the government could take us all down in the future and this is how it would work.

This is the path to inflation or even hyperinflation. I think the Fed and the government could take us all down in the future and this is how it would work.

The Fed comes out with their own coin, we'll call it the fed coin. Which is a wonderful invention that will put money right into your back pocket. Helicopter money and UBI. It's the freedom dividend that you deserve.

What does Hank, Saver Steve, Moody the Millennial and you sitting at home reading this article have to do to get the fed coins? You have to download the fed app.

As you know, whenever the government gives something a title, the end result is always the opposite of whatever the title is.

This is The Fed app, but we're going to call it the freedom app because it gives you your freedom dividend. With it, the Fed can get money supply directly into the real economy.

They don't have to worry about that crazy banking system. All you have to do is download your freedom app to your iPhone, and every single month, the Fed sends you, Hank, Steve, and Moody, a thousand dollars.

You could be saying to yourself, “George, but we could take the thousand dollars. Maybe we could deposit it into our bank account and you'd have the same dilemma”.

My point is they can't control human behavior. Individuals could save the money, and velocity could continue to go down, and the government won't get the inflation/hyperinflation they need to reduce this massive debt load.

But… Since they're downloading it to the app, what the Fed and the government now have control over is how fast the individuals receiving the fed coins spend the money.

Since this is all digital, what the Fed or the government could do is say, “Yes, guys. We're giving you a thousand dollars, but you have to send it within 30 days, and if you don't, poof. It's gone. It's no longer on your freedom app.”

That increases velocity because people now have to spend it in a certain amount of time or they lose the purchasing power.

Then you start to see inflation tick up, and the government loves that. But, let's say inflation isn't high enough for the government… Yet, they're still spending more money than is coming in somehow.

All they need to do is send you 3,000 Fed coins per month instead of 1000, and then what they could do is say, “Now we're sending you 3,000 fed coins, but you only have 15 days to spend it.”

That increases velocity even more, and if that's not enough inflation, now you only have five days to spend it.

If that's not enough, if they really want hyperinflation, boom, done deal. We'll give you 5,000 fed coins but you only have one day to spend them.

For all you people reading this article right now saying, “Well, my gosh, I would love to have 5,000 fed coins or $5,000, whatever they're called, wired directly to my bank account.”

But one thing I want to remind you is that the number in your bank account doesn't necessarily equal purchasing power.

As an example, look at the bill I pasted on the whiteboard, it's from Colombia. It's a $50,000 peso note. But its purchasing power? About 12 US dollars.

It doesn't matter how many zeros are on this random piece of paper. It doesn't necessarily give you purchasing power, and it would be the exact same with the 5,000 fed coins.

I can assure you that if the government goes this route with the fed coins, the freedom app, and then increasing velocity to bail out your drunk insolvent Uncle Sam, the number in your bank account may increase, but we'll have an economic collapse.

Your purchasing power will also collapse just like it did in Germany, Zimbabwe, and Venezuela.

Comments are closed.