Market Expert Equips Us With Insights During This Time Of Crisis

Jason Hartman, founder and CEO of JasonHartman.com, and a famous real estate investor shares the latest market update and its details.

If real estate is in one of your top priorities for investing, this interview is a must-read. We discuss commercial and residential real estate, the market’s cross currents and its cycles, foreclosures and Airbnb business.

He builds us up with incredible intel and even advice to make our next move.

The Rebel Capitalist show reaches 100,000 subscribers

George: All right, guys, it gives me a great deal of pleasure to bring someone back to the Rebel Capitalist Show.

A good buddy of mine, and one of the top real estate experts in the entire United States.

His name is Jason Hartman. Jason, welcome back to the Rebel Capitalist show.

Jason Hartman: Thanks George, it's great to be here and great to talk to you again.

I want to first off congratulate you. You are now over 100,000 subscribers and your great work, it didn't take long for you to be at the top of the heap and get really, really recognized.

The word is getting out and you're teaching a lot of people what's really going on behind the scenes with these out of control central banks.

Now more than ever, to infinity and beyond they've self-proclaimed that, that's the policy, so it's crazy.

George: Well, we're really excited about it, it's been fun. I've got some great editors.

I've got to give them most of the credit, but we've got a long way to go.

Like I said, when we did the little live stream for the 100,000, the next goal is to get to a million subscribers.

With the team I have, I think we can do it if I don't screw things up too badly.

Jason Hartman: You're so humble. Come on, your content is fantastic.

Yeah, but you have a good team for sure and the editing is great.

The production's great, but your content is just second to none so thanks for doing it.

George: Speaking of that content, let's dive right into it here.

2020 Real Estate Market Update

George: As most people know, I'm in Medellin, I'm outside of the United States.

Especially now with the Cerveza Sickness, I haven't been back to the US in a long time and you are the real estate guy.

You've got your finger on the pulse of everything that's going on.

A lot of my viewers are very interested in the United States real estate market for obvious reasons.

I want to just kind of hand it over to you to give us an update as to what's going on the broad market, maybe specific markets, the mortgage market, and interest rates for sure.

Jason Hartman: Absolutely. Absolutely.

Well, looking at a macro view first, retail spending has pretty much collapsed in an economy where 70% of the S&P 500 is consumer spending.

This is hugely significant. Obviously, you've been profiling the oil market on your show.

This is all connected with real estate in a huge, huge way.

We would be remiss if we didn't talk about how retail spending saw its steepest decline in seven decades.

It just plunged, it's unbelievable what's happened, but the necessities held good.

Obviously people still need groceries and toilet paper, so huge spending there obviously.

But it goes to show you that the basic necessities are the key, and that's what I want to stress about real estate.

It's really a tale of three markets, linear markets, cyclical markets, and hybrid markets, and with real estate necessity housing is going to do quite well.

Our business is pretty much unchanged.

Investors are still buying properties at a rapid clip. Just looking at our last month's performance, I've got to say, and hopefully, this will continue, but business has been fantastic.

People are attending our webinars. They are buying properties and a few are concerned and scared and have fallen out.

I actually did not expect it to be this good. It's beat my expectations.

So, good bread and butter housing, if you live in that type of property, you're in good shape.

The basic entry-level type housing below the median price in whatever your given market is, that's still very much a need.

But, the high-end markets, another story completely.

George: Just to clarify for the viewer…

-

How would they go about finding out what the average price of a house is in their market?

-

Is there some website or some charts or something that you could refer them to, or maybe on your website?

Jason Hartman: Yeah, there are lots of charts about that.

And remember…When you look at the United States real estate market, the Case-Shiller index, the most widely quoted, only profiles at least their main index, the one that's talked about, is 20 markets.

15 of those 20 markets, George, are cyclical markets, meaning they're high priced markets.

They're markets that go up and down like a rollercoaster if you're looking at a chart.

They're markets we would not recommend, that we would not invest in, so three-quarters of that cyclical markets.

The linear markets, which we like, the boring markets, the ones nobody talks about, those are the vast majority of the world and of the country geographically, but they're not talked about very much.

When you look at markets like Little Rock, Memphis, Indianapolis, Atlanta, these markets are quite solid and they're holding just fine. Housing affordability has increased dramatically a lot.

You want to be below the median price in any given market.

As for where to find that, there are tons of charts. Unemployment skyrocketed, last month we saw incredible, incredible stats we've never seen before.

It took kind of a few weeks to get to where we think we will get past where most of those jobless claims, and I think most of them are behind us now.

The big piece of that has now been recorded, and we'll continue to see further claims, but most of them have now been documented.

We kind of know how bad it's going to be and we've seen stimulus maximus as we've talked about. It's just crazy.

The Rent Side Of The Real Estate Equation

Jason Hartman: One thing that concerns me greatly here is inequality.

A lot of people have been talking about that long before we had a pandemic.

I think it is going to be exacerbated dramatically by this because the digital workers, the knowledge workers, they're mostly working, and thriving, or at least surviving through this phase.

They can work at home. They can work remotely, but the lower tier of the spectrum mostly cannot work and they will be very hard hit.

That again tells us that basic necessity level or what's sometimes referred to as workforce housing, is going to fare pretty darn well, and demand will increase through this situation.

George: Okay, so just unpack that for a moment.

We've got a high unemployment rate.

We've got more people that have the ability to work from home, but we've got the inequality factor, which would be those people who aren't willing to work at home.

Maybe the more blue-collar, they're really struggling.

Aren't those people, the individuals that would be purchasing those basic homes?

Jason Hartman: Well, they might be purchasing them, but we don't really deal with the purchase side of the market very much.

George:

Oh, you're looking at the rent?

Jason Hartman: We're looking at the rental side.

So there's a lot of rental demand for that type of housing, that's what we're really interested in.

Our investors buy them and a lot of those are knowledge workers who are not out of work, so they keep investing.

But, when you think of the rental market, you're going to catch a lot of people moving down the tier.

As far as the sales, we don't know yet what percentage, this data will be out soon, but there's quite a lag in real estate.

How many of the purchases going on now are renters versus owner-occupied, homeowners?

Again, we have to wait for those stats, we don't have them yet. It's too early to tell.

Just my opinion is, it's moving more toward the investor side of the equation, more investor activity.

George: Right.

But you're still seeing some substantial demand for sales?

Jason Hartman: Oh yeah.

The real estate market’s cross currents

George: Even though we're having this, and the economy is really struggling…

I mean, what's going through my mind is:

- Real estate takes a long time to move.

- Real Estate takes a long time to go up.

- Real Estate Market takes a long time to go down.

If I just think back to 2006 when we hit the peak, it didn't bottom out until 2012.

I'm looking at all of these cross-currents and I'm trying to decide…

If prices go down in the United States, could they go down a lot faster?

Or are there so many of these cross-currents that are pushing prices up that it'll kind of stabilize it with a gradual down recline or maybe a gradual uptrend in housing prices?

Because of a lack of supply? How do you see all those cross-currents playing out?

What I'm thinking about is the unemployment rate, and how does that affect rents and prices…

Also, you've got to ask yourself:

-

Is it a linear, cyclical, or one of these hybrid markets that you're referring to?

Then also you've got the investors back in 2012, like BlackRock that just bought up everything.

-

Are they going to potentially liquidate and how does that affect the game?

And, also with Airbnb. All these guys go out and leverage up to buy 40 or 50 properties.

-

How does that play into the mix? I mean, this is like one of the best macro puzzles of all time.

Jason Hartman: You expressed it perfectly well, it is a macro puzzle, and there are even more distortions and cross-currents than you mentioned of course.

-

There are forbearance programs for mortgage payments.

-

There's the rent strikes that are going on in properties where renters are getting together and are forming unions, mutiny strikes against the landlords.

That's why we like single-family homes so much better than apartment complexes because our renters aren't talking to each other. Okay?

And they can't form a strike because they're all dispersed individually and lot of cross-currents no question.

-

There are the government and the central banks, and that's just any government, any central bank, not just the US Fed or the US government.

When they keep interfering in the market(the government and the central banks), you have no price discovery because they just won't let it happen. We have become so intolerant of any pain whatsoever that it's just a big government, Uncle Sam to the rescue.

So, hard to tell, hard to answer that question.

For my bet, a long time ago George, I was saying, way before the pandemic, this was many years ago.

I was saying Airbnb has not been through a recession, so be careful.

Then about a year and a half ago, I was on a radio show in Georgia, I was doing the interview and I remember saying on that radio show that I'm going to create a new commandment.

I have all these commandments for successful investing, we're up to 22 now of the 10, 10 is now 22. Commandment number 21, at that time, I said was thou shall avoid manias, thou shalt avoid manias.

Because Airbnb was a mania, and I just never really bought into it in any significant way.

What Will Happen To Airbnb businesses?

Jason Hartman: Taking vacations is optional, that's not a requirement for human life.

As soon as the economy hits the skids, that optionality is going to go away, people aren't going to be able to afford vacations.

Now, with the pandemic, it's even worse, because everybody's afraid to get on an airplane.

Everybody's afraid to stay in someone else's house that might have germs and viruses, so it's a bigger problem than it was.

If you look at what's going on with the Airbnb market, it has just collapsed, collapsed, collapsed.

Now that said, I do think that as tourism comes back a little bit, the cruises and the airlines will be the last component of tourism to come back, because those are super danger zones.

There's no way you can distance in an airplane and you can't on a cruise ship.

If people can afford to, and want to take some kind of vacation and have a getaway, Airbnb markets where people can drive to them and have a truly different experience than they have at home, will actually benefit from the decline in airline travel and cruise ship travel.

The destination-oriented Airbnbs, where you have to get on a plane to go to them, that's bad, those are going to suffer greatly.

Cruise ships will suffer greatly.

But some of the benefit will accrue to sort of localize road trip oriented Airbnb and resort vacations, where people can have a different experience, and get away, so to speak, without getting on an airplane or a cruise ship.

So that's kind of a distinction.

We have one Airbnb market in our network for short-term rentals, which is St. Augustine, Florida.

You can have a very legitimately different life experience driving from Atlanta or Orlando to St. Augustine.

That is a real vacation for you, and you don't have to get on a plane.

You don't have to get on a cruise ship or anything like that, so those are actually still doing pretty well.

We've seen a little bit of movement. We've seen bookings become longer and fewer of these short-term getaway bookings, longer booking periods.

It's kind of interesting that you did ask about Airbnb so I wanted to mention that.

But, on the flip side of the Airbnb market, and this is important to the cyclical market, in the luxury real estate market, lots of people bought and leased expensive high-end homes to put them on the short-term rental market.

Those are just collapsing like crazy, that's just a bloodbath.

George: Right, and I think you can get the numbers to make sense.

If your RV ratio is two or three because you're renting it out nightly, as opposed to monthly, you can take what would otherwise be a property that makes no sense whatsoever.

To the standpoint other than numbers.

Jason Hartman: Right, it would never, yeah.

George: You can turn it into something that might make sense and just barely eke out that positive cashflow.

Boy, if you can't rent that out nightly, you've got big problems.

Jason Hartman: Let me tell you, something folks, some people rented those properties and did what I call rental arbitrage.

Now we are defaulting on their leases, so the landlord now doesn't know what to do.

The landlord is probably in a temporary forbearance program with their lender now, or at least they're thinking about asking for it.

They're going to start defaulting, and the foreclosure rate on those luxury properties is going to skyrocket. That's my prediction.

It's still too early, we haven't seen that in the statistics, but I'll predict that.

Now, to add insult to injury as the saying goes, it's even worse if you're in a high-density living environment.

If that short-term rental property was in a big city …

George: In San Francisco, New York, something like that.

Jason Hartman: Yeah, San Francisco, New York, and Vegas.

I don't care whether Airbnb is legal or not in those markets, because they vary, but people have been doing it anyway. Regardless.

The market exists, and if you've got a luxury condo in Toronto, Montreal, Vancouver, New York, San Francisco, downtown Seattle, downtown San Diego, downtown LA, in any of these markets.

You know Chicago, Miami, whatever, those are just going to collapse George.

There are going to be a lot of lease defaults, foreclosures. It's going to get ugly and it's going to be ugly for a while in that market.

See, that's the thing. I'm so glad you pointed out to your viewers and your listeners George.

You can never talk about the real estate market as one singular entity. It's always the tale of at least three markets. And now, we normally would say linear, cyclical, and hybrid, but we've also got to add high density versus low density.

That's another new distinction we've got to add to that.

How Will The market cycles Playout?

George: Well, I was going to ask you.

You're talking about prices crashing in these markets that are high density with these luxury condos or apartments.

You've been doing this for so long, you've got so much experience. You've seen these cycles play out over and over and over.

Jason Hartman: Not like this one.

George:

-

How long does that typically take Jason, for that cycle to happen?

-

Let's say condos in Toronto, New York or San Francisco, how long does it take them to go down in price?

-

Does it happen quickly, in a few months or does it take years?

Jason Hartman: It takes a while and that's a great question, George.

The thing that determines that question is the capitalist phenomenon of price discovery. When you have price discovery or market clearing, that's when the cycle recovers.

So here's why I can't answer that question.

First of all, broadly, real estate moves much more slowly than the stock market or the commodities market.

It's slower than that, but how long does it take?

Well, it depends on the foreclosure laws in that given market, and they vary state by state.

They even, to a lesser degree, vary city by city or county by county because, for example, in California, my former home state, the Socialist Republic of California, as I like to call it.

In the socialist Republic of California, the foreclosure laws are actually pretty favorable to lenders.

Technically you can have someone out of your property, who isn't paying you within 111 days.

There's a 90 day period where they can redeem and catch up on their payments.

Then another 21 day period where they have to completely repay your loan in order to keep the property. It's almost irrelevant because it never happens.

That's the technical law, but the political climate is such that they make it hard to foreclose.

If you can't foreclose and sell that property at auction, you don't have any price discovery.

George: The government might bail everybody out.

Jason Hartman: Yeah, that's the distortion. It's very hard to tell.

Now in places like Florida where I live now, in New York where you have the foreclosure system, where people have to go and basically sue somebody to foreclose on them, that system takes much longer.

Last time during the great recession or the global financial crisis, we saw people in Florida, New York, and in Illinois, living in their house for free. For two or three years they haven't made a payment! And you have no market-clearing. You have no price discovery, it's a mess.

The best thing you can have is a quick system where you can get these people out.

Put a new borrower in there that is paying, half-price discovery and the market will heal very quickly.

But when the government makes it hard to do that, it's just a long drawn out painful process.

What Happened During the 1920s depression?

George: You know what just came to mind right there?

The depression of 1920 and '21 compared to the depression of the 1930s.

Jason Hartman: Right, yeah, and you know a lot about that.

Little depression nobody talks about, the early 20s did have a depression.

George: That's when they let the market clear, it's the exact same as you just outlined with your real estate example.

Where you've got one state where they say, “Let's just rip the bandaid off,” and you get that price discovery right away.

You get kind of a V-shape recovery usual, and then you've got the other states that just make it slow. They draw it out.

You've got all this red tape, bureaucracy, you get the court system involved, and it just drags on and on and on and on.

At the end of the day, it might be better for the person living in the property, but for society as a whole, it's a lot worse.

Jason Hartman: Worse, yeah.

George: The exact same thing happened in the 1920s, early 1920s, where they just ripped the bandaid off, price discovery, boom, V-shape right back up.

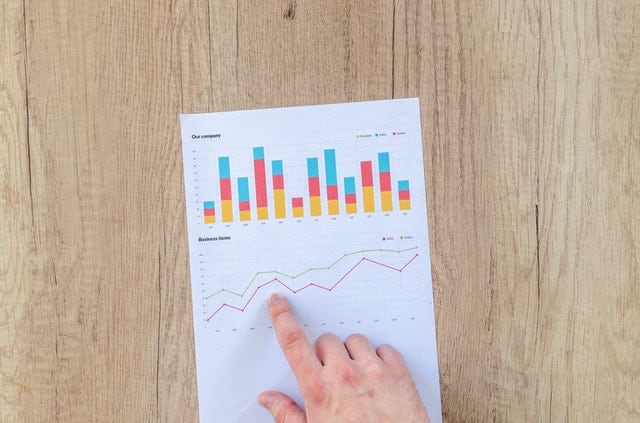

Also, I was looking at some charts just off on a tangent here yesterday, for deflation.

I would challenge any of the viewers right now to look up a chart of deflation going back to the year 1900 or even further back, if you can find one.

You'll notice that the deflation of 1920, '21 was worse, it was worse than the initial deflation of the early 1930s.

It's just in the 1930s the government got involved, red-tape bureaucracy, it drags on and on and on where, again, going back to the early 1920s, they ripped the bandaid off, price discovery boom, V-shape, you're good to go.

The Difference Between Judicial and nonjudicial foreclosure

Jason Hartman: Yeah, absolutely.

Now, just to wrap maybe this part of our discussion up, so listeners have a reference, let me give it a name, it's judicial foreclosure or nonjudicial foreclosure.

The judicial as the name would imply means you have to go to court and it's a lawsuit.

You have to sue the borrower for a foreclosure that's basically a judicial.

A nonjudicial is the faster kind where you don't have to go to court.

There's a separate foreclosure process, which of course can be like anything, disputed in court, but usually, it's not, and it doesn't end up in court.

George: I want to go back to the prices and I know there are so many different markets within the United States.

Let's just take it quickly back to 2008, 2009. The crash that was going in the markets, as a whole, bottomed out in 2012.

If I'm hearing you correctly, the markets where there's this judicial process, the prices probably bottomed out a lot later.

In the markets where they had a nonjudicial process, the prices bottomed out a lot faster.

Maybe if I'm someone watching this saying, “Well, I think Jason and George are crazy, I think the market's going to go down a lot faster,” they could take it a step further and figure out if their local state is judicial or nonjudicial and factor that into the equation.

Jason Hartman: Yeah, that's a very fair statement George, looking at that.

Sadly, because even though the laws are there, they don't always follow them.

Man, that's the distortions that we're talking about, it's just absolutely crazy. Yes, that is an indicator.

The other indicator, related to that, is you want to be investing, and for the last 16 years we've been saying this, so this is not new information.

You want to be investing in landlord friendly states, and you want to be avoiding tenant-friendly states.

Almost without exception, a state that has got a conservative bent, even if the governor is a liberal at the time, the overall zeitgeist of the state, like take Texas for example.

Texas is a conservative state historically. California historically is a liberal state, and so a liberal state is going to be tenant-friendly and a conservative state is going to be landlord-friendly.

This is not a hard and fast rule, but generally speaking.

Then there are local overlays to these things, but we're just taking a broad view here.

You want to be in a landlord-friendly place, someone who's friendly to your cause as a landlord. If the tenant's not paying you, you can get them out, have price discovery, as we talked about with foreclosure, and get a new tenant that will pay.

George: Yeah, I know you're pressed for time Jason.

I appreciate your generosity here with your time and your experience

Jason Hartman: Oh my pleasure.

2020 Real Estate Investing Advice

George: But just to wrap things up, if you had to give one piece of advice to just a normal homeowner right now, owner-occupant that was just maybe in the market to sell or buy.

Then an investor that's considering purchasing or selling.

What piece of advice would you give to each one of those individuals?

If you've got a higher-end property, and if you're in a cyclical market, and if that property is a high-density property requiring elevator usage, I would worry a lot.

George: You'd sell?

Jason Hartman: I would totally consider selling.

If you're not in a position to sell it, refinance it and pull cash out of it.

One of the other things that's happened just recently is the HELOC's, Home Equity Lines of Credit, they're just going away.

Like Wells Fargo and Chase both did away with them, they won't give you a HELOC loan now.

The difference is you don't necessarily need a HELOC, you can do a complete refinance of the property.

If you can pull cash out of the property, get control of the equity of that property, sell it, or pull cash out. Those properties are going to suffer.

If you don't have much equity in that property, by the way, one more thing, don't worry too much because it's your lender's problem more than it is yours.

George:

That would be advisable for both groups, either the owner occupant or the investor?

Jason Hartman: Or the investor, yeah that applies to both.

If you have an entry-level type of property that could be considered workforce housing, if it's in a linear market, like most of the country, not the high flying markets, not the expensive markets, but a linear market like you'd find on my website at jasonhartman.com, you're probably okay.

Now, the thing I might say, if you own that property free and clear or if you have a lot of equity in it, also refinance it.

Those properties you could probably keep, they're probably in good shape.

Right now that price point as we talked about on the last episode I think I did with you George, if they're 250,000 or below, you're probably in pretty good shape.

Make sure you have a low-interest rate and hang onto the property.

I think you're going to sail through this pretty well. I didn't say perfect, because we don't know what's to come, but I think you'll be okay.

One other index that's kind of interesting to look at for your listeners is what's called the Mortgage Credit Availability Index.

I know you've been on his show and I have to, Mark Moss, is someone you know and you follow.

A Thread – 0/6

IN A REAL ECONOMY, Businesses earn money to cover expenses by providing goods and services,

But today, the new age economy wants us to believe anything is possible, Free lunches? Sure!

Our leaders on both sides think we can skip the earning and go straight

— Mark Moss (@1MarkMoss) April 8, 2020

He talked about this recently on one of his episodes, but the MCAI is pretty interesting to look at.

One of the things that's telling us is that mortgage credit availability has declined.

That's sort of an overall index of how easy is it to get a mortgage? That's what it really answers.

It's not about interest rates, it's about ease of ability to qualify.

That index has declined, but where it's really declining is in the jumbo mortgage market.

Meaning the larger loans, those vary by area, but a jumbo loan is a larger loan for a more expensive property. That market is quickly collapsing.

The Mortgage Credit Availability Index for the conventional or conforming loans, it's also been hurt but not as badly, even though we're in this rate in this climate of incredibly low-interest rates.

So, higher-end properties, again, worry, you should be worried. Lower end properties, they're very necessary. If you're renting them, you can catch people coming down the economic ladder. They're probably pretty stable overall. I think you're in pretty good shape.

George: Yeah.

Now just as far as the jumbo loan out of curiosity, does the price that one would consider, the banking system considers a “jumbo loan”…

Does that differ from state to state and city to city based on the cost of living?

Or is it just a broad, this is what it is?

Jason Hartman: No, no, it does vary. It does vary.

In some areas it'll be like, I don't have the numbers offhand, it'll be like 500 and something thousand dollars.

Now, remember that's loan amount, not purchase price, loan amount.

The purchase price might be 10% or 20% higher than that, so that's the loan amount. In some areas, it goes up into the 700 thousand, so it depends on the area. It does vary.

George: I mean, 700,000, even if it was at that level like in California and places in LA, I mean that's still like a starter home.

Jason Hartman: Well, true, but remember that's not the price of the home, it's the amount of the loan.

If you put $100,000 down, it would be up into the eight hundreds, but still you're right, it's cheap for those areas.

Many people get what they call ultra jumbo or super jumbo loans, where they're borrowing $4 million and putting down a million so you're right.

George: I was just thinking, I mean, if the industry as a whole, meaning the mortgage industry is really frowning upon these jumbo loans…

Jason Hartman: They're scared. They're worried.

George: … and a higher percentage of jumbo loans like in the state of California, just looking at that I would say, okay, that's a lot more bearish for California than it would be for Kansas or Iowa or something like that.

Where a lot smaller percentage of the overall housing stock were these jumbo loans.

Jason Hartman: Absolutely right. You nailed it and not only that.

What you'll find is that the entire borrowing relationship in these high flying areas, along the California coastline or the expensive Northeastern market or South Florida, or Seattle.

All of these expensive markets, these cyclical markets, the borrowing relationship, the borrower versus lender relationship, already long before we ever talked about pandemics, and pandemic investing, was tenuous.

Those people were scraping to afford those houses in the first place.

Now, that has become compounded and is even more tenuous with what's going on in the world.

George: Yeah. All right, well, we've got to leave it there Jason. I appreciate it.

For all of my viewers or for any of my viewers who want to find out more about what you do, where should they go?

Jason Hartman: Jasonhartman.com. Just my name, and we've got lots of info there.

My podcast is available on any of the places where you get your podcast, just type Jason Hartman and you'll find it.

George, thanks for having me. Again, congratulations on eclipsing the 100,000 subscriber mark, good job.

George: All right, thanks, buddy. I can't wait to do it again.

Comments are closed.