All that glitters is not gold.

Didn't you know we are in a bubble?

Now you do. So sit back and read this article to find critical information about retail, SPACs, and the questions you need to ask yourself to become a better investor and build wealth.

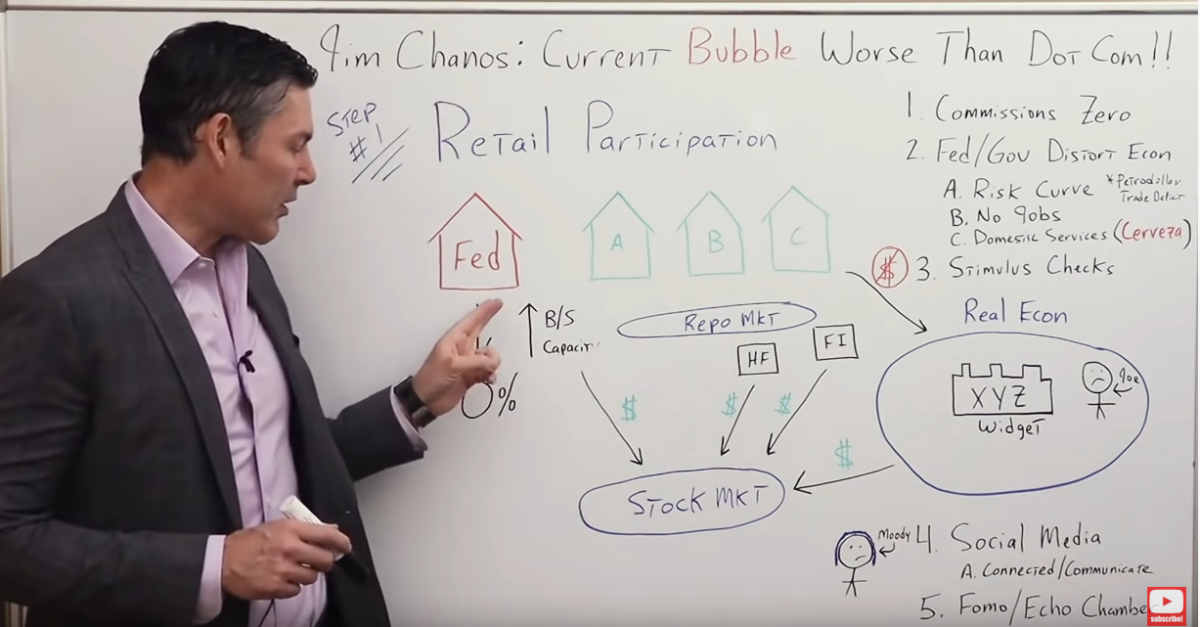

The Role Of Retail In The Current Stock Market Bubble

Jim Chanos, an American investment manager, president, and founder of New York City-based, Kynikos Associates said:

Current stock market bubble is even bigger than the dot-com bubble of the late 1990s.

How has retail participation affected the current stock market bubble, and how has it dramatically increased since the end of 2019?

- Commissions for brokerages dropped down to zero.

- The Fed and the government have distorted the economy, which has pushed people further out the risk curve as interest rates are minimal. Because of this, people can't get a return with bonds, treasuries (the “safe-haven asset”), or in their savings account.

It also creates an economy with hardly any good-paying jobs. Young people today look out into the job market and they don't see a way for them to get ahead and become rich just by working hard. The petrodollar and the trade deficit of the United States have played into this.

In addition to that, Covid-19 has disproportionately affected the United States from the standpoint of our heavily reliant upon domestic services economy. That's where a lot of our jobs are, especially for young people.

So, if we go into a shutdown of the entire economy, that's going to affect those young individuals that could be looking at the stock market as a way, or their only way, to get ahead.

This is how it works: The Fed comes in, drops interest rates down to 0% by quantitative easing to buy bonds, treasuries, mortgage-backed securities from the commercial banks under the Fed's umbrella.

This increases the balance sheet capacity for the banks, allowing them to lend even more than they could before and creating more money supply, but they're not going to do it unless the risk/reward makes sense.

Could banks take that excess balance sheet capacity and lend it to XYZ Corp or the Average Joe to start his own business?

They could, but it doesn't make sense because the economy is so distorted.

They're not stupid, they see what's going on with the Fed and know they've only papered over the problem. Instead, they take that balance sheet capacity and go into the repo market. It ends up in the hands of the hedge fund managers and the financial institutions.

A lot of the excess balance sheet capacity of the commercial banking system increases the purchasing power for hedge funds, financial institutions that take that and go into the stock market.

They drive prices higher while at the same time, the retail investor is participating more as they can't get a return on what little savings they have. Oh, but wait. There is more, of course.

Now you throw into the mix stimulus checks and it takes the bubble into overdrive. As an example of this, I included a Tiktok video transcription I saw on my good buddy Grant William's Twitter feed:

“How to turn your $600 Stimmy into 13,000? Stocks to invest in 2021. The first one is Blink, BLNK. The gas station of electric vehicles. Last year, their stock price was just $1,89, and today it sits at $42, 75. That's a 2,161% growth. The next one is Square, SQ. Last year, their stock price was $63, and today it stands at $217. That's a 240% growth so far. Lastly, we had Tesla, TSLA. Last year, their stock price, and this is taking into account the stock split, was at $86,05. And today it stands at $705,67. That's an over 700% return. Investing in any one of these three companies will bring you large returns. For more fun and finance, and daily live trading, join me for free on my Discord.”

(End of transcript)

For a moment, I want you to imagine you're a millennial or a young person, or maybe even one of my characters, Moody, the millennial. Your job prospects are looking very grim in the real economy.

Not just because the Fed has distorted everything, created mal investment and a misallocation of resources, but also because of Covid-19 shutdowns.

So, you're getting $600 or $1,200 in Stimmy, and of course, you're going to try to parlay that and take a flyer as you're playing with the house's money. You're going to try to create $13,000.

Once you get those $13,000, you're going to do the same thing and go for $100,000 or $200,000. Why? Again, it's the only way in your mind that you can get ahead.

Then social media comes in. If you go back to the transcript of the TikTok video, the investor is not telling you to buy things when they're cheap and sell them when they're expensive.

She's pointing out how expensive things are, implying how rich you would have gotten if you would have bought those things earlier. This is an insane amount of FOMO.

We have to realize that with social media today, we're more connected and we communicate much more with each other. This wasn’t possible during the dot-com bust.

In my opinion, social media is exacerbating the current stock market bubble. When you combine a very poor outlook for an opportunity in the real economy, stimulus checks, social media, FOMO, this echo chamber that we now live in with Facebook, Twitter, Instagram, and the fact that 52% of adults aged 18 to 29 are living at home with their parents. It only makes sense.

They're taking the stimulus check right into their Robinhood account, and buying whatever has gone up the most over the past six months or year, according to what all their friends are saying on TikTok.

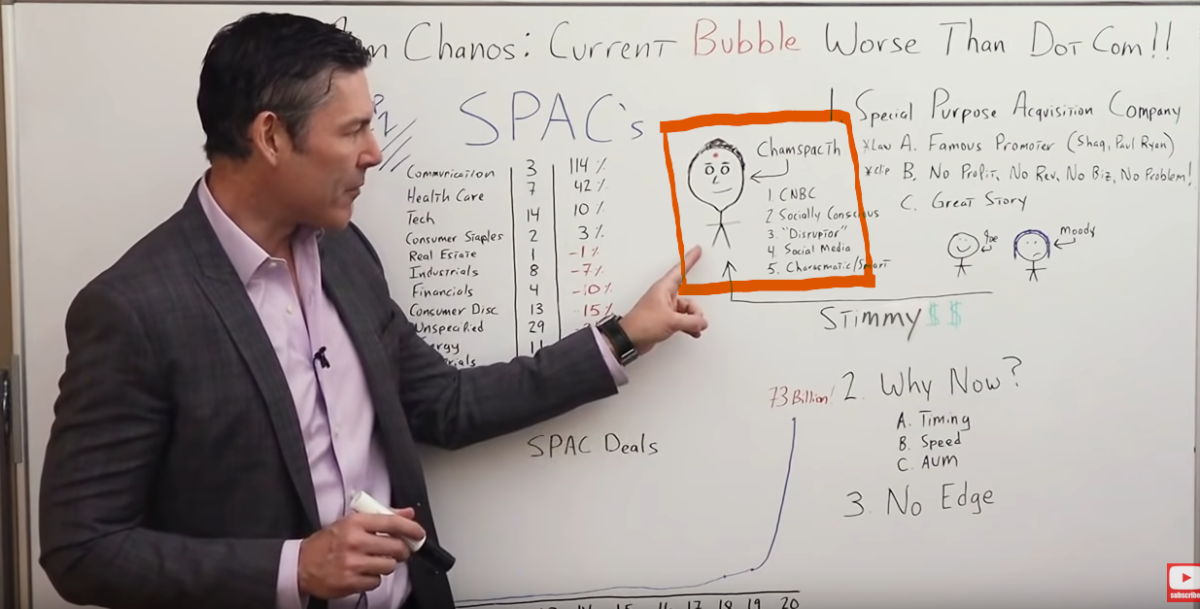

What You Need To Know About Special Purpose Acquisition Companies (SPAC)

This is the second example Jim Chanos gives as to why the current stock market is in even a bigger bubble than it was in the late 1990s.

What is SPAC?

I'm sure you've heard it on CNBC and Bloomberg, but you might not understand technically how it works. Any good SPAC (Special Purpose Acquisition Company), or the successful ones, always have a real famous person promoting it.

They're the head or they're the main investor, the hedge fund manager if you will. Technically, they're called a sponsor. Recent SPAC sponsors have included none other than Paul Ryan and Shaquille O'Neal.

I heard Shaquille O'Neal and Stan Druckenmiller have about the same investment skillset. We shall see, but the reason very famous people promote SPACs is because the law is much different.

Usually, when there is an IPO, the head or the CEO of the company, can't go out and talk up the stock before it goes public. There are restrictions there. With a SPAC this is not a problem.

The company head can go out on CNBC, Bloomberg, social media, and talk it up all they want. Perfect for individuals who have special skill sets, maybe not in investing, but in sales.

My concern with SPACs is that most of them are just a shell company. Often they don't even have a business plan. It's just a vehicle that's set up to solicit funds from retail investors to supposedly go out and find a primo acquisition target.

Most SPACs don’t have any profit or revenue. They don't even have a business, but that is no big deal. Why? Because they have a great story. To understand the technical components of how SPACs are set up, I examined a clip from CNBC:

“SPACs are shell companies with no actual commercial operations but are created solely for raising capital through an initial public offering, or IPO, to acquire a private company. This is done by selling common stock, with shares commonly sold at $10 apiece. And a warrant, which gives investors the preference to buy more stock later at a fixed price.

Once the funds are raised, they will be kept in trust until one of two things happen:

- The management team of a SPAC, also known as sponsors, identifies a company of interest, which will then be taken public through an acquisition, using the capital raised in the IPO.

- If the SPAC fails to merge or acquire a company within a deadline, typically two years, the SPAC will be liquidated, and investors get their money back.

But what's the difference between a SPAC IPO and a traditional one?

There are several ways a private company can go public. The most common route is through a traditional IPO, but it's subject to regulatory and investor scrutiny of its audit financial statements.

An investment bank is usually hired by the company to underwrite the IPO, which usually takes four to six months to complete. This involves roadshows and pitch meetings between company executives and potential investors to drum up interest and demand in its shares.

And not all IPO's succeed. Coworking space company, WeWork, withdrew its high profile IPO in 2019, amid weak demand for its shares after massive losses and leadership controversies were revealed. Their track records depend on the reputation of the management teams. By skipping the roadshow process, SPAC IPOs also typically list in a much shorter time.”

(End of transcript)

You may be scratching your head right now and asking yourself, “George, why would anybody take their hard-earned money and invest it into a shell entity that might not even have a business plan, let alone any revenue?”

It all goes back to a great story, and the total addressable market size. As an example, I created a character called Cham Space, he is a specialist when it comes to SPACs.

Cham Space is from India, he is always on CNBC and has all the right buzzwords to collect as much money from the market as possible. He has a lot of assets under management, and for a good reason.

He is socially conscious. Everyone sees him, or maybe he's branded himself as a disruptor. And boy, is that a buzzword, we need to disrupt everything right now. The food service, vehicles, house flipping, property management.

Is there anything that you couldn't generate a billion dollars from by saying that you're going to disrupt the XYZ industry?

I don't know.

Cham has a fantastic presence on social media, he is charismatic and intelligent.

Why on earth would you not want to give your money to an amazing individual that will make you rich?

Even though he doesn’t have a business plan or a business that generates revenue or profit, you can put your blind faith in him and you'll be all right.

Of course, my two other characters, the average Joe and Moody, the millennial, buy this hook line and sinker. They take their Stimmy checks from the government and give them right to Cham Space so he can find his next acquisition target with a fantastic story.

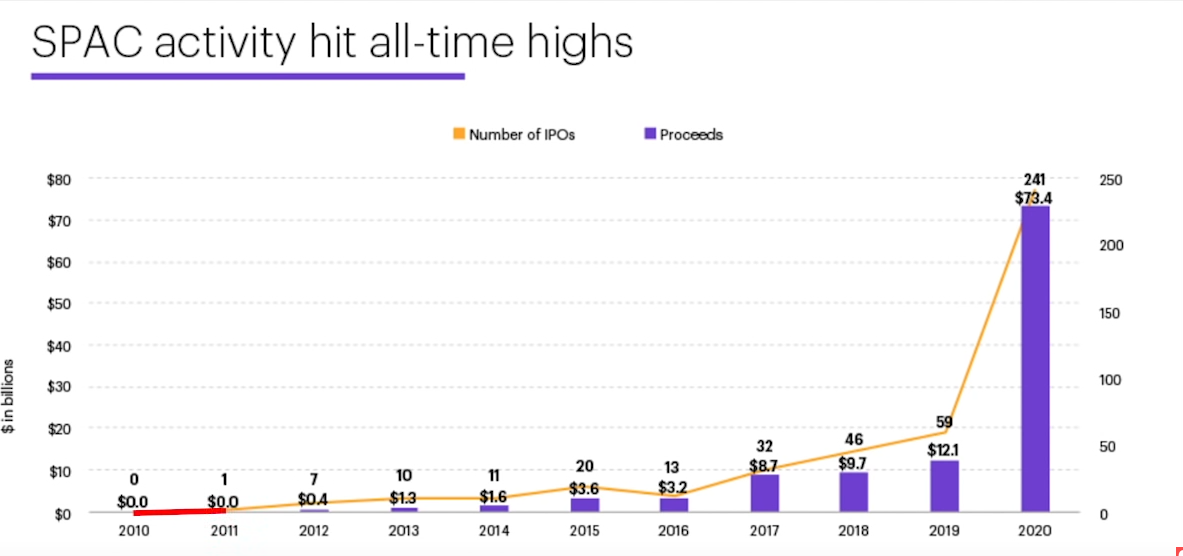

The chart above starts in 2010 and goes to 2020. On the left, it goes from $10 billion to $80 billion. This is the amount of SPAC deals that were done per year. In 2010 and 2011 there were zero SPAC deals done, so, $0 were generated.

During 2012 and 2013 the chart went up a bit. Then in 2015 a small bump and deals went back down. In 2018, it got around $10 billion. A year later up to maybe 11 or 12. But then in 2020 $73 billion were raised for special purpose acquisition companies.

Whenever I see charts like this that are going parabolic, you have to ask the reason why. And often it's because we're in a bubble. But you may be saying yourself, “Well, George, that's because they're making all of this money, and guys like Cham Spacth have such an awesome track record that my goodness, he's going to blow away the market returns every single time. He is the next Stan Druckenmiller, but he's even cooler because he's socially conscious.”

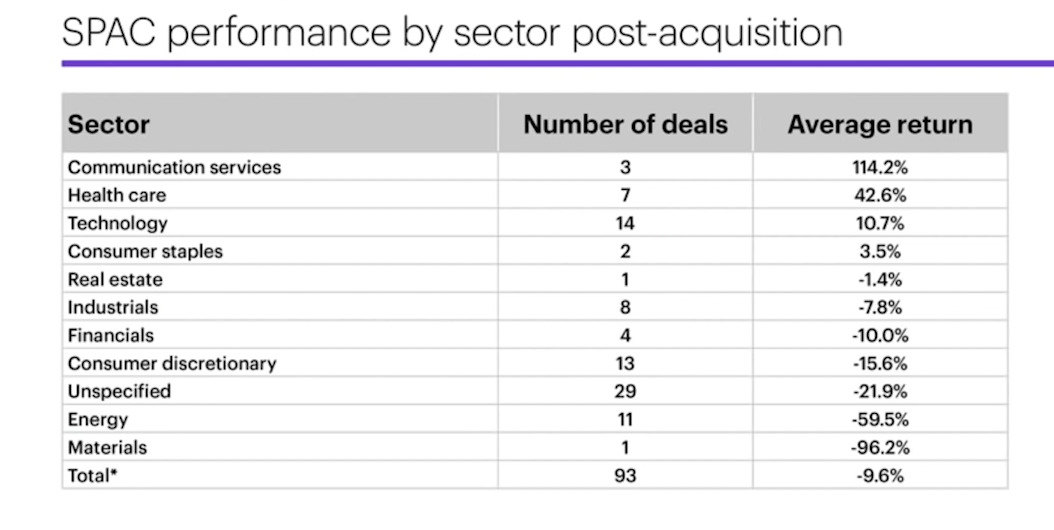

I checked out the numbers. The table below contains data from recent SPACs that have gone public and their returns, it goes from communication down to materials.

It started well with 114%, 42%, and 10% of average return respectively. Then it dropped down in the majority of sectors to -96%. I'd like to stress the unspecified SPACs, meaning, “Don't worry about what we're going to invest in. Just give me your money.” That was 29 of the total 93, for a total loss of 21%.

The total of deals had an average return of -9%. Those shockingly bad returns don't surprise me. Why? Because they don't have an edge.

Let me tell you a quick story. I was recently in St. Bart's for a couple of months visiting my good friend, Hugh Hendry, former hedge fund manager, definitely a legend in his own time. That is for sure.

I was able to meet a lot of interesting people, hedge fund managers, investment bankers, and people in finance, in macroeconomics. After inviting them a couple of beers and asking them to come on my show, The Rebel Capitalist show, they'd simply look at me, smile, and say, “Absolutely not. No chance.”

I would always say, “Why? You've done all these amazing things. You have an incredible track record. You're friends with guys like Jim Rogers and Stan Druckenmiller. You'd be great for my show.”

They looked at me in the eye and said, “George, anyone that has an edge in the markets today, doesn't want to tell anybody else about that edge.”

In other words, if you see someone on CNBC or Bloomberg, 95% of them are there because they know they don't have an investment edge, the only edge they have is in sales.

The way they make money isn't necessarily about taking the money they have under management and increasing the amount of money return on investment. It's more so about assets under management. The more they can get, the more money they make, regardless of what happens to their fund.

For instance, If you have an individual that has a billion dollars under management, they'll make a 2% management fee, regardless of how much money the fund makes or loses. That's $20 million a year.

If the fund makes money, that's just a bonus. It's like owning a call option where you're being paid $20 million a year. Once we understand that, it becomes obvious why we see a chart like the previous one.

Those people see there's froth in the market, the frenzy that has been created by the government and the Fed. The frenzy of the retail investor trying to buy more risk because they think it's their opportunity to get rich with the house's (government’s) money.

People like Cham Space want to take advantage of this, they might not have a business that can be taken public right now, so they create a SPAC at the top of the market and take it public as quickly as they possibly can because the process is much faster than a typical IPO, to maximize on their assets under management.

I think it's critical we all understand how the game is played before we try to participate. For more insight on the SPAC insanity and a specific example of an open door, I reviewed a clip from one of my favorites, Jim Chanos:

Keith McCullough: There is a lengthening list, to your point, just under the numbers of issues out there where it's just… I don't know what else to say. CNBC tracks these people out and they pump and dump on their book. I don't know about the dumpsite, but there's certainly the pumping going on.

Jim Chanos: Well, to talk about SPACS, you also have to marry that with the other concept that's driving the narrative side of the stock market, and that's TAM, Total Addressable Market because a lot of the more egregious SPAC stories are TAM stories, right? There's no profitability, but there is this monster market that if their algorithm, their piece of software, whatever it is that's got people excited works, that it's just a ridiculous amount of money that they can capture from these giant markets.

Think about WeWork, which never got public, disrupting the subleasing of office space. Think about Lyft and Uber, which had a TAM, a monstrous TAM when they went public of disrupting all types of transportation. And now you're getting to kind of the absurd stuff. We always look for companies where the business model itself is inherently and structurally unprofitable, but they try to dress it up as some sort of network-effect TAM story.

Consider a recent SPAC by a well-known promoter that is now in the house flipping business. They've taken a company that will digitally buy your house, and built a story around this, and merged it into their SPAC. Now, we have companies already doing this. Zillow, which is publicly traded, has a house flipping business and it loses money on every house and makes it up on volume. And when you have business models that have discrete money-losing aspects to that, that have no network effect, mainly you lose money on every widget, but make it up on volume, you have a bad business.

(End of transcript)

I'll be the first person to admit that when it comes to stocks or macroeconomics, I'm merely an amateur. But when it comes to real estate, I'm an expert. If you want my deep dive of Open Door from the standpoint of an expert real estate investor that has bought and sold countless homes, check out my new YouTube channel.

Having An Edge: A Must

I think we can all agree that we are in a big, fat, ugly bubble, to use a quote from Donald Trump himself. I have gone over the retail problem and the SPACs. Now I want to highlight what you can learn from this bubble, and how you can become a better investor, so you can build wealth and thrive in a world of out of control central banks and big governments.

Okay. We know the Fed is dropping the interest rates down to zero, which pushes people further out the risk curve.

What does that mean?

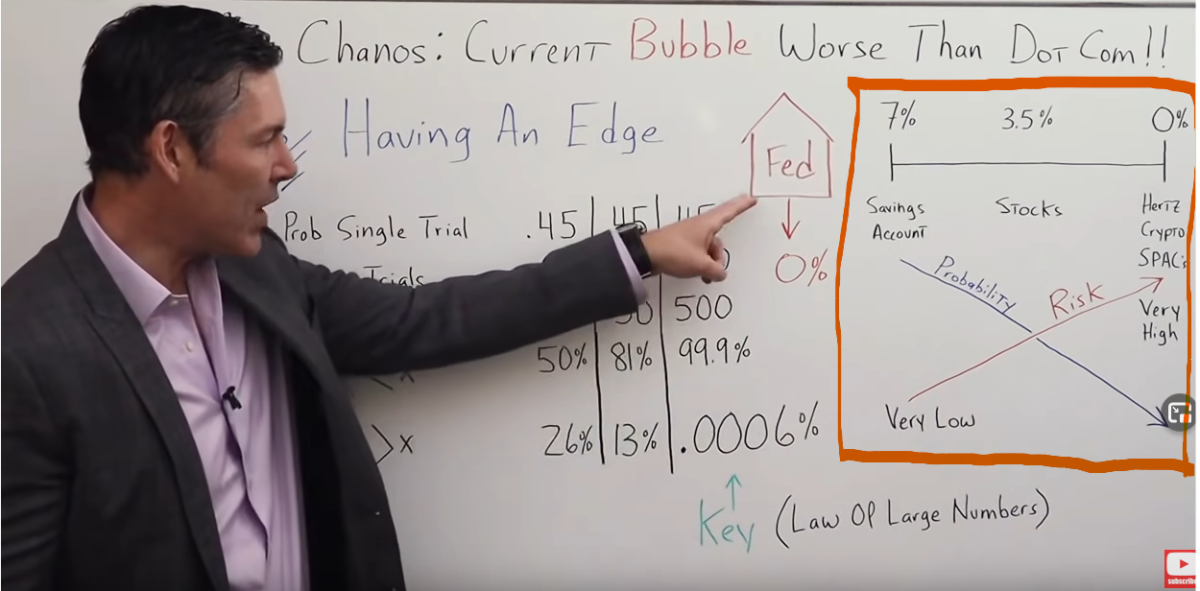

The whiteboard image above displays a line representing interest rates historic norm gradually going down from 7%, to 3.5% and 0%, where the Fed has tried to keep interest rates for the majority of the past 12 years.

In normal times, you could go into a savings account and collect 7% on your money. You would be taking a very little risk. Then the Fed dropped rates down to 3.5%. Now you need to take more risk to get the same 7% return.

You'd probably have to go into stocks, as an example. You still might be able to get that return, or maybe even a better return, but you'd be taking far more risk, and the probability of the outcome you desire would gradually decrease as the risk is going up.

This takes us to where we are today. Where now, instead of stocks, we have people that have to go into companies that are flat out bankrupt, like Hertz, or they have to go into cryptocurrencies, and I'm not talking about Bitcoin, and the main one.

I'm talking about all the crazy altcoins that I see young millennials trading till 3:00 and 4:00 in the morning. And of course, SPACs, which have a very low probability of making money.

Again, as the interest rates go down, the risk taken to achieve the same results has to go up, and the probability of winning goes down. Now let's assume the probability of you making money on a specific investment is 45%.

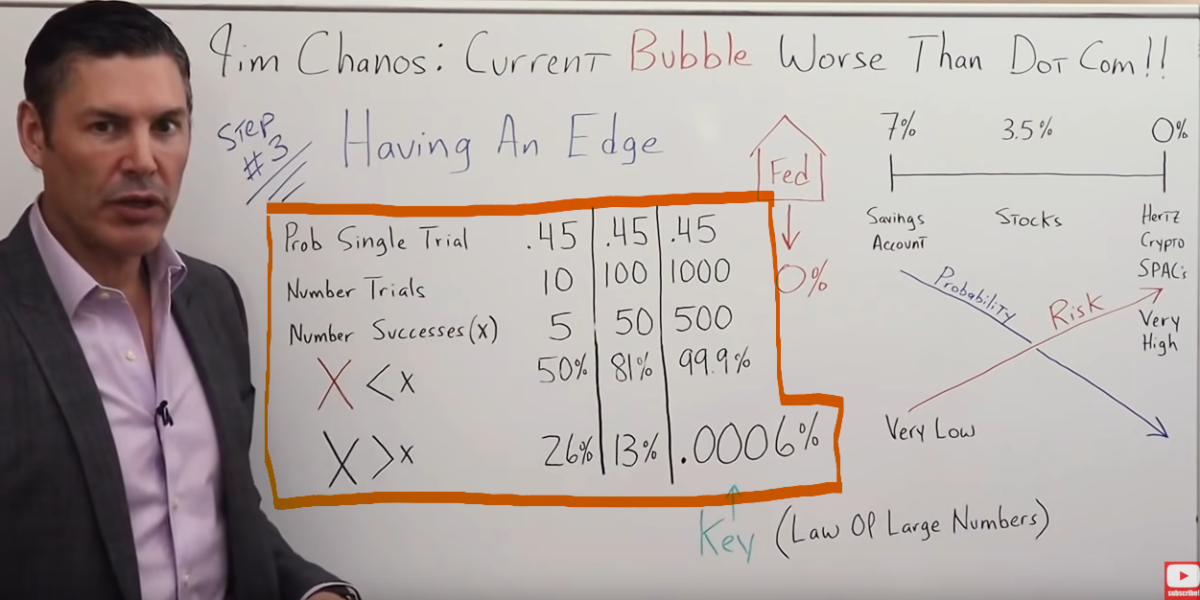

I plugged this into one of my favorite tools, a binomial calculator. That, in and of itself, should show you how much of a nerd I truly am at heart.

With a 45% probability of a single trial, the number of trials (times you toss the coin or make a specific investment or trade) 10, 100, and 1000. The number of successes (break-even point), t at 50%. So, that can be five, 50, and 500.

If we only make 10 investments, our probability of losing money overall is right around 50%. And again, this assumes that initially, we have a 45% probability of winning. Our chances of making money are 26%.

Once we go up to a hundred spins, a hundred investments or trades, if you will, our probability of losing money is 81% and making money, 13%. If we go up to 1000, the chance of losing money is 99.9% and making money 0.0006%. This is the key.

If you don't have an edge, a mathematical edge, the law of large numbers is against you. The more you play the game, the greater probability that you lose. If you have a mathematical edge on the other hand, the longer you play the game, the greater chance that you're going to make money and come out ahead.

In today's world of the everything bubble, where the Fed is forcing retail investors to take more and more risk, the probabilities of them making money are always decreasing.

As prudent investors, we have to ask ourselves:

“What is our edge? Do we have a mathematical edge?“

I would take it a step further.

To have the mathematical edge, you have to have an advantage over the majority of the other participants in the market.

If you're buying Hertz or SPACs or some ICO…

What advantage do you have over everybody else that's watching CNBC?

Because if you don't have one, then chances are, over the long run, you're going to go bust.

What's my edge for George Gammon?

That's why I like to buy things cheap and sell them when they're expensive. I like to buy things when everybody else hates them. They don't want anything to do with it. And I like to sell things when everyone else is jumping on the bandwagon and wants to buy.

-

What is your edge?

-

Do you even have an edge?

Remember, if you don't know who the sucker is at the poker table, it's most likely you.