This article is reliable evidence supporting Milton Friedman when he said nothing is so permanent as a temporary government program… Don’t let the Fed convince you of things that are not true and hurt your portfolio. Read this blog post to ask the right questions and get more insights on deficit spending and stimulus.

This article is based on a format from my new Youtube channel Rebel Capitalist, where I post two or three times a day and do quick news stories that I think are relevant to the community.

That's personal liberty, freedom, entrepreneurship, investing, macroeconomics, and helping you build wealth and thrive in a world of out of control central banks and big government.

I dived into an article from MarketWatch called “Fed has been successful at convincing markets it will be more dovish down the road, Bernanke says.”

This goes back to what Jeff Snider has been saying for years: the Fed is in the game of expectations policy. They don't have much direct control over the markets because the only thing they can do is print bank reserves as the system is set up now.

Of course, we all know that the system could change in the future to where they could turn those bank reserves into legal tender. The way the system is set up now, that's the only thing they can do.

The Fed has to rely on the commercial banking system to leverage that excess balance sheet capacity, give loans to financial institutions, then go into the market, drive prices higher, and then bring in the retail investor.

Let me translate that for you.

Central banks are impotent, but the Federal Reserve has convinced everyone that it isn't and that there is a Fed Put, and it has succeeded at expectations policies where other central banks have failed.

Now keep in mind, and this is something that Jeff has told us and pointed out many times, that they can't even get to their 2% inflation target.

How are they going to overshoot it?

I know a lot of you are saying that “George, the CPI is a lot higher”. I agree real-world prices are going up more than 2% per year, but this is just based on their measurement.

Based on that CPI measurement, they can't even get it up to 2%, let alone increase it above 2% or let it run hot the way they measure it, so…

How should we expect them, or how can we expect them to achieve these objectives when they haven't been able to achieve them over the past 10 years?

I would argue that no major central bank has when you include the ECB and the Bank of Japan, but somehow the market sees them or is now taking their word at face value.

Then the Fed goes on to say that it's going to be even more irresponsible to try to, and so…

Why are they doing this?

They're trying to get people to take more risks, go into risk assets because they're worried about inflation.

The Fed thinks that inflation equals real growth. But as you know, that's not the way it works! We can get inflation and have negative, real growth, just like the 1970s. Therefore, all you have to do is get inflation, and you'll also get growth.

That's complete nonsense when you look at it in real terms, which is what we should be concerned with. Just look at all the growth they've had in Venezuela or Zimbabwe, tons of nominal growth, but the society is dirt poor, and the economy collapses as a result of all that growth.

When?

They said that they're not going to lift the rate above zero for years.

So how can we tell?

Look at how much different 2020 was based on what we thought it was going to be in 2019. I mean, think about that.

Could anyone have predicted what we've experienced in 2020?

Yet for some reason, we're supposed to assume we know what's going to happen two and three years down the road and that the Fed is going to be at zero or they're not going to be at negative.

Who knows?

It's just bizarre that we would put so much confidence in central planners when they have failed miserably at their own goals so many times in the past.

Of course…

What's he going to say?

I don't think it's the Fed's monetary policies that made a big deal. I think it's the government's fiscal policy.

Primary dealer banks are seeing inflation coming down the road, not because of what the Fed's doing, but because of what the government is doing in tandem with the Fed, spending money out into the economy and the Fed monetizing it.

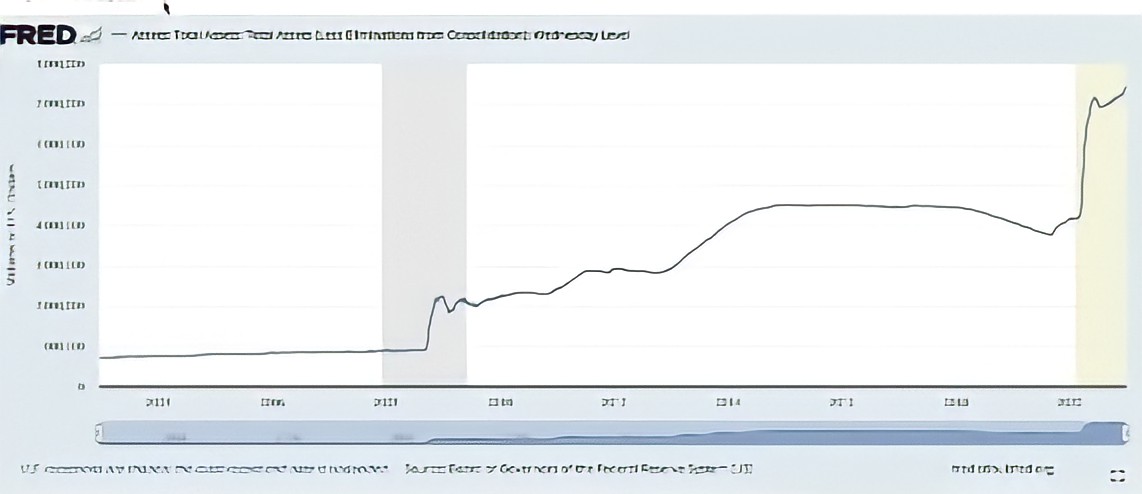

Another chart I went over is the Fed's balance sheet as of January 4, 2021, at 7.3 trillion.

You can see it went parabolic and then straight up to the right. It's increasing quite substantially. In any other timeframe, we'd be freaking out about this, even this mild rise that is visible here.

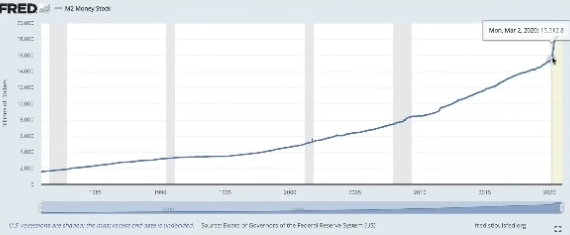

What is interesting is when you compare this to the M2 money supply graphic above. I know a lot is going on in the shadows, but notice how there's all of a sudden a correlation between the Fed's balance sheet and what's happening with M2 or broad money, at least the way it's measured.

The previous Fed balance sheet it's all over the place. Suddenly, in 2020, there is a pretty tight correlation, which would imply the Fed is monetizing the treasuries the government is producing by deficit spending.

This translates directly into an increase of currency units in the real economy, bank deposits that are out there chasing a smaller amount of goods and services.

Why?

Because of Covid-19, we have supply chains breaking down and people being paid to stay home and not go to work.

How can we expect there to be the same amount of goods and services when people are being paid to stay home?

In my opinion, that's going to be permanent, whether it's UBI or some form of that in the future, continued stimulus, whatever they want to call it.

We have to see this, and I hate to use the word stagflation because we don't know what's going to happen in the near term. It's impossible to know what's going to happen within a year or two.

However, I think in three years to five years, with our current actions, the misallocation of resources, and malinvestment, how can we not have structurally high unemployment with a reduced amount of goods and services and an increased amount of currency units?

I understand that a lot of that is predicated upon the commercial banking system creating more money supply, but most likely they are going to change the system so the Fed or the Treasury can get around the commercial banking system and turn bank reserves into legal tender.

They're going to have control over M2, and they're going to sit there and just crank up the printing press. Then we would have true money printing by anyone's definition.

Back to the MarketWatch article, if you just looked at that headline number or you're watching this on CNBC or Bloomberg, you'd say, “Oh my gosh, wow! The U.S. Economy it's not that bad. It's very resilient. Look, these lockdowns didn't do a thing.” Or “What we did to combat Covid-19, not a big deal. I mean, shoot, the economy is only down by 2%.”

Right, GDP was down by 2%, but the government had to spend $5 trillion in deficits spending. In other words, they had to misallocate $5 trillion worth of resources (present and in the future) in our economy to only have GDP nominal GDP go down by 2%. That's a better way to say it.

Consider what GDP would have looked like if we wouldn't have taken on an additional five trillion in debt, the same amount of debt the government accumulated in the first 220 years of its existence from 1776 to 1996. If we would not have done that, then GDP would have quite literally been $5 trillion lower than it was.

-

Where would that put us? A negative 20?

We are looking at a depression that would have been bigger, most likely, than what we saw in the Great Depression in the 1930s if it wasn't for the government coming in and spending stimulus money into existence.

My point is Stimmy didn't fix the economy. It goes back to that example of the heroin addict that I have used in my previous articles. Just because you come in and print more money for the heroin addict, that doesn't make them any better.

It makes them worse because they're going out and buying more heroin that's getting their body and their mind addicted to the drug. All we're doing is creating an environment where we're injecting more heroin into the economy, making it more addicted to the stimulus.

That's what we're doing, and it’s not a win, it’s losing. A massive fail where you're going to have to pay the fiddler.

The essence of this writing can be summarized like this:

- Unless the system changes, the only thing the Fed can do is print bank reserves. It is all about expectations policy.

- What the Fed is doing now with the government (deficit spending and monetizing debt) seems to be increasing M2 money supply substantially. At least it’s in front of us and not in the shadows.

- In the longer-term, since the government -to prop up the economy- has built its economy on stimulus, we will continue with massive deficits year after.

The debt-to-GDP just this year went from 100 to 130 (as an example). What is it going to be next year, 150, 175? Pretty soon we're going to be close to Japan.

The difference, I expect, is we're going to turn those bank reserves into legal tender, so…

How does that play out for your portfolio? How does that playout for the dollar?

How does that play out for commodities long-term?

This is what you should be thinking through, in my opinion.

Comments are closed.