Today's conversations seem to start with the Fed's Money Printing and its consequences on interest rates, assets, and the dollar.

Ray Dalio recently shared, during an interview with Bloomberg, which I will quote now and then in this article, his new predictions about a dollar collapse related to the Fed's actions.

I explain his point of view and stick to explain the basics so you can fully understand.

Also, a quick invitation, you can become A Rebel Capitalist Pro Today.

Do you want to take your investing to the next level?

Check out my new Online Investing Forum! I have partnered with Lyn Alden and Chris MacIntosh to bring you the best Investment Tool on the Internet Today – Rebel Capitalist Pro! Check out our 7-Day Trial Membership Promo for only $1! Visit GeorgeGammon.com/pro.

For more content that'll help you build wealth and thrive in a world of out of control central banks and big governments, JOIN our Daily Newsletter for FREE.

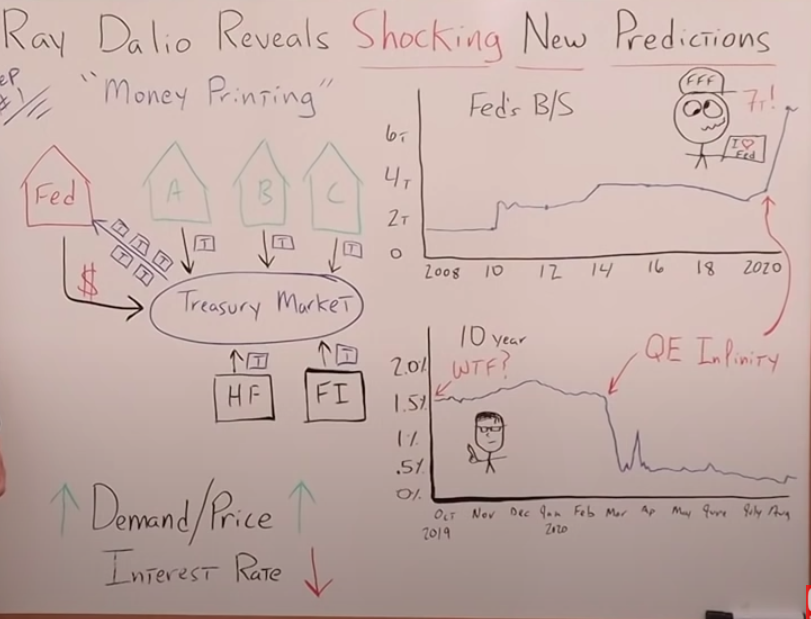

Money Printing

Let's start with money printing. We're not going to get into the details as to whether or not the Fed can create broad money, M2 money supply, or chase goods and services in the real economy.

We're going to stick with the basics:

- The Fed creating bank reserves out of thin air to buy financial assets, more specifically treasury.

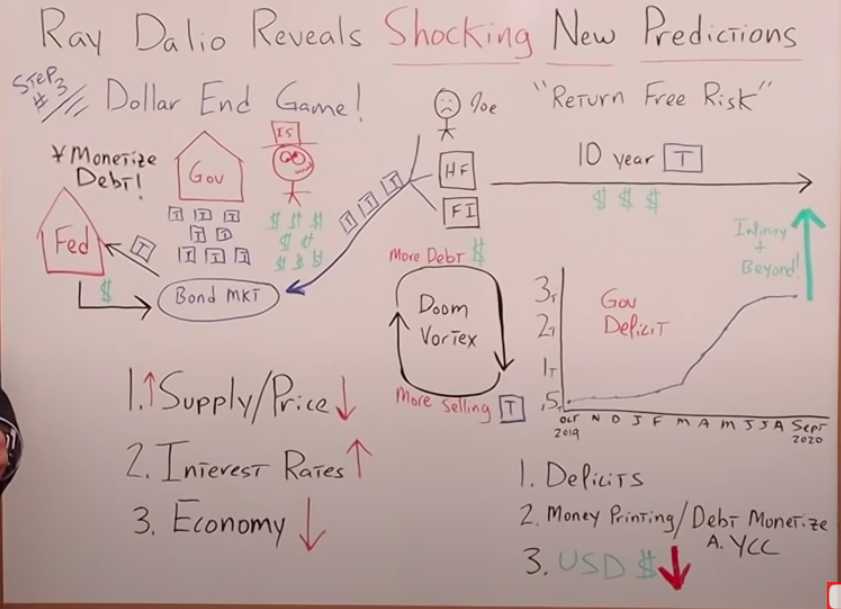

Look at the situation I drew on the whiteboard.

The Fed comes in and prints up funny money literally by going to their computers and typing additional digits in the reserve accounts of the entities they're buying the treasuries from.

They're mostly primary dealer banks, commercial banks, sometimes hedge funds, and financial institutions.

The hedge fund (HF) and financial institution (FI) might not have reserve accounts, so the transaction would be done through their commercial bank, but that's getting into the weeds a little too much for this article.

The bottom line is the Fed creates bank reserves, goes into the treasury market, and buys the treasuries from the banks to financial institutions and hedge funds so those treasuries go to the balance sheet of the Fed.

They now own those treasuries. They have created additional demand, maybe even excess demand. If demand goes up, then typically the price goes up as well and there's an inverse relationship between the price of a treasury and the yield or the interest rate.

If the price goes up, the yield or the interest rate goes down and the yield is what you're being paid to own the specific treasury. So theoretically, the lower the yield goes, the less attractive those treasuries are compared with other asset classes.

To dive into this deeper, here's a recent interview of Bloomberg and Ray Dalio.

Interviewer: Fiscal deficits and money printing, we've already seen some of the impacts in financial markets of all the massive fiscal spending and all the massive monetary stimulus.

Stock prices at record levels, negative real yields on treasuries, negative nominal yields on sovereign debt around the world.

Where does it go from here, Ray?

Ray Dalio: First, I want to convey the mechanics of that. When there's more, you run a larger deficit and there's printing and buying of financial assets.

It drives down real yields, and as a result of this, it drives money into alternative assets.

There's a supply-demand problem for bonds, but when the central banks at the end of the day print in much the same as Roosevelt did in March of 1933, that causes financial asset prices to rise and supports the economy, but diminishes the value of debt, the real value of debt.

(End Of Interview)

Now, let's look at some charts that illustrate what Ray was talking about.

-

Chart #1: The Fed's BS or balance sheet

This chart goes back to 2008 and all the way to 2020. On the right, it goes from $0 to over 6 trillion.

Before quantitative easing one (QE1) during the GFC, the Fed's balance sheet was about $800 billion, pretty consistent. Then the GFC happened, so with quantitative easing one the bs went parabolic and debt went up until it maxed out at about $4.5 trillion.

It stayed pretty consistent until 2018 when the Fed tried QT or quantitative tightening: The reverse process where they start to sell treasuries and mortgage backed securities.

They continued this process all the way until September 2019, and you know what happened then…

That was the repo market debacle where interest rates went way up over 10% and the Fed had to step in and create more bank reserves to get those interest rates down so the entire system wouldn't collapse.

Their balance sheet went up, even though they were calling it not QE.”Whatever you do, don't call it QE”, but magically, their balance sheet continued to go up.

Then, the coronavirus arrived and it went parabolic to the present, where it is over $7 trillion. In my whiteboard, I drew your friend and family member Fred and of course, he's holding a sign that says, “I love the Fed.”

This is just to remind you that mainstream media like CNBC, Bloomberg, and pretty much everyone outside of the individuals like you who are smart enough to look up the George Gammon content, think the Fed saved the day.

They think the Fed's the firefighter when we know the Fed is really the arsonist.

-

Chart #2: The 10-year treasury

This is of the 10-year treasury going back to October 2019, and all the way to August. The interest rate goes from 0% to 2%.

Back in October 2019, it was right along about 1.5% gradually going up, and then there was a decline when we started to get news about the coronavirus.

When the Fed came in and started QE Infinity in March, that's when interest rates dropped off a cliff. This would coincide with the Fed's BS chart and that's where the Fed's balance sheet goes parabolic.

What's happening is the Fed is coming in and buying treasuries, and according to Ray Dalio, that additional demand is making the price go up or the interest rate go down.

There is additional buying, demand, price, and interest rates that went down at the same time. And I want to be very clear, this is how Ray Dalio sees it. I'm explaining to you what he's talking about, and it's really consistent with how the mainstream media describes it as well.

But it doesn't mean that it's totally accurate. I don't want to get too far off on a tangent, but I want to point out that my good buddy, Jeff Snyder, would say, “No, that's not the way it works. Just because the Fed comes in, creates funny money to buy treasuries, doesn't necessarily mean that the interest rates go down.”

I don't want to put words in his mouth, he's a heck of a lot smarter than I am.

But I would guess that Jeff would point back to the repo spike in 2019 and say, “Hey, guys. Look, the Fed's balance sheet went up there and interest rates didn't collapse. In fact, they stayed steady and gradually went up.”

I don't want to go too far down that rabbit hole, but I do want to make sure that everyone reading this article knows that I'm describing the world through Ray Dalio's eyes. I'm not necessarily saying that's the way it is. That's definitely an open debate.

The first takeaway is the Fed is coming in and creating additional bank reserves, printing money in other words.

They're doing it to buy treasuries and Ray believes that creates additional demand for those treasuries, which increases the price and lowers the interest rate, making the asset class a lot less attractive relative to equities or gold.

Could The USD Dollar Lose Its Reserve Currency Status? Ray Dalio Says It Can

Let's go back to Ray Dalio's interview in Bloomberg…

Ray Dalio: We are dealing with a situation like in the 30s that could be threatening even to the reserve currency status in any way.

It diminishes the value of that which is being produced, which means money and credit, and it drives money into those assets. So it's that kind of market action.

Interviewer: Is there a real threat right now to the US dollar status as the world's reserve currency?

Ray Dalio: Yes. There is a threat. It's an evolutionary type of process. There's not yet a good alternative in the form of a currency per se.

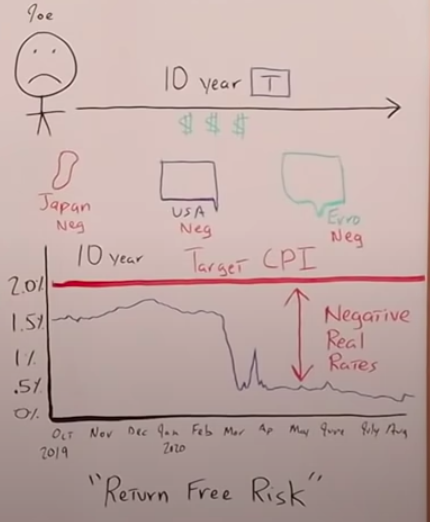

But, people are not investors, large institutional investors don't run out necessarily to alternative currency because the three major reserve currencies all have the same basic problem.

That's why they move into a new store hold of wealth, and you see that the store hold of wealth, like in 1933 reaction is equities, gold, and other asset classes that go up.

(End Of Interview)

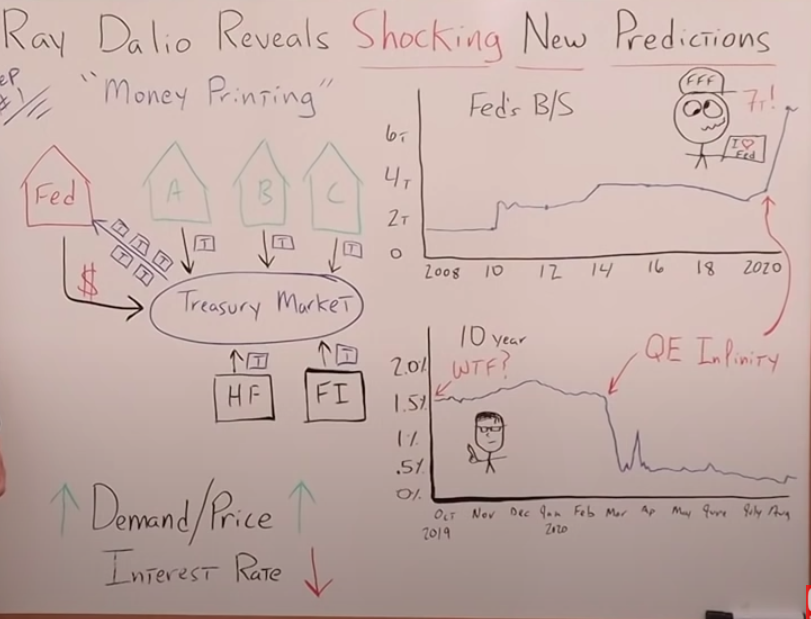

Ray Dalio is reminding us that if you're the average Joe or are a part of any entity that owns a 10 or 30-year treasury, you're owning long-dated dollars.

That's right. If you think about it, you're just owning dollars for a long period of time.

The government, your drunk, insolvent uncle Sam, is just paying you an interest rate or a yield that's decreasing due to what the Fed is doing by buying those treasuries, creating excess demand.

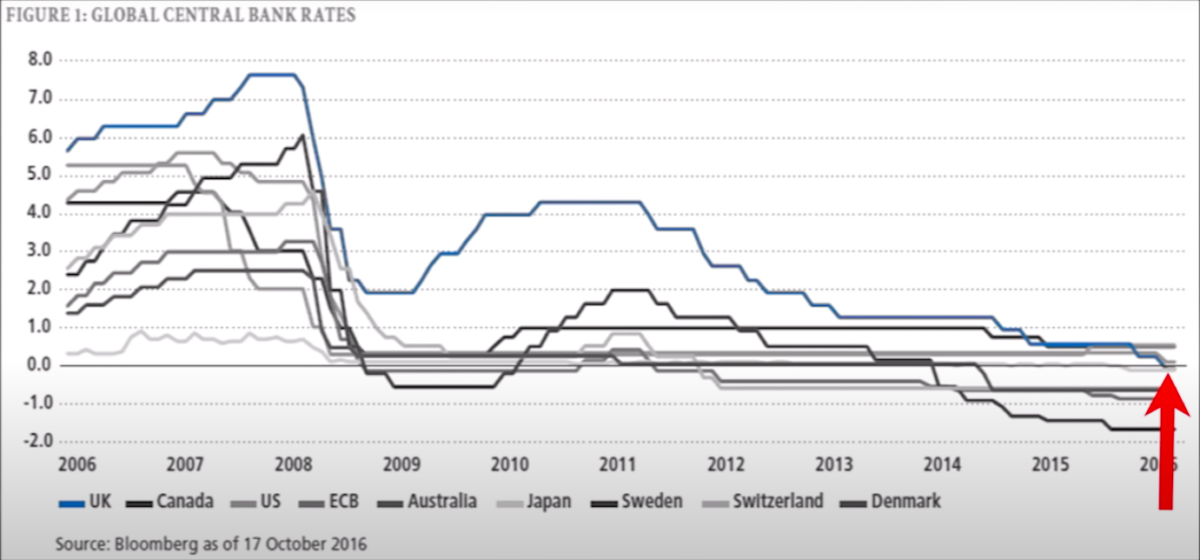

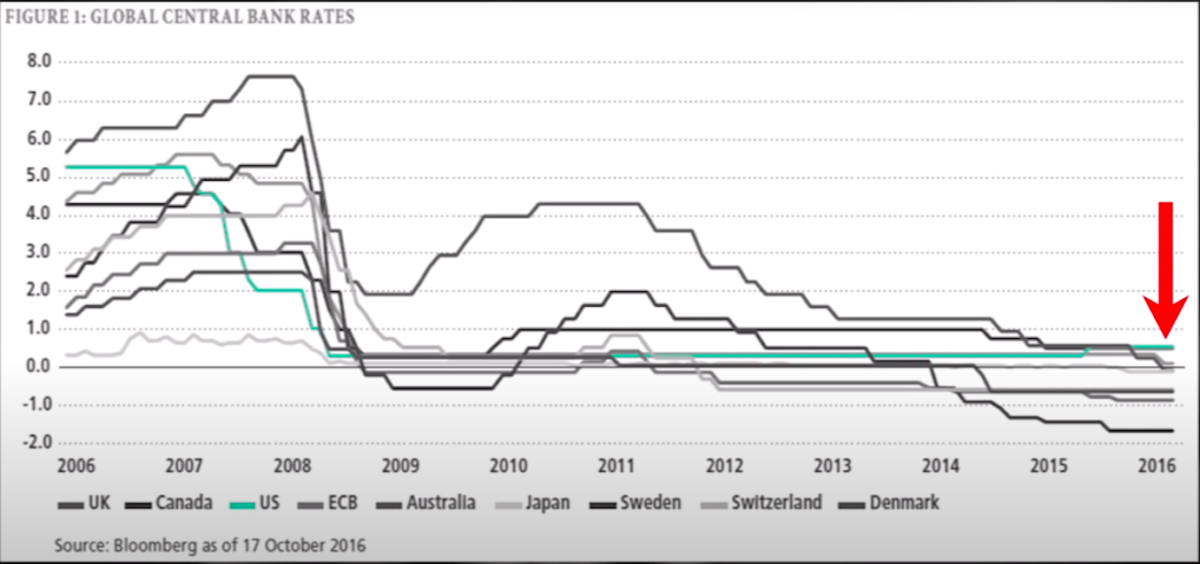

To Ray's point, if you look around the world and try to find another safe-haven asset, you're not going to find in Japan. They have negative nominal interest rates!

You're not going to do it in Europe either. They have negative nominal interest rates as well.

You come to the United States that has positive nominal rates, but when you adjust for inflation, their rates are negative as well.

So let's think this through. Going back to the chart of the 10-year treasury from 2019 to August of 2020. It started off at about 1.5%, but when they came in and did QE Infinity in March, those interest rates went all the way down to about 0.5%.

Let's keep in mind that the Fed came out and explicitly said that they're trying to achieve 2% inflation if not higher.

If you have the bar set at 2% or higher and the interest rates are 0.5%, you have a negative real rate.

In other words, if the average Joe buys that 10-year treasury and holds it to maturity, they are guaranteed to lose money.

As one of my favorites, Jim Grant says you have a return-free risk. So, the historic safe-haven asset, the 10-year treasury, doesn't look so safe anymore.

What do the investors do?

They might go into equities because it has a little less inflation risk. Or, I think you can read my mind. They go right into gold.

Look at how equities have gone up since March in quantitative easing infinity.

Gold, as you may know, has been going up even in 2019, but has gone almost parabolic since March of 2020.

In Ray's opinion, what's happening is the investors are looking at the 10-year treasury and saying, “Listen, no, thanks. The rate we're being paid to hold them is far below the target inflation rate of the Fed.”

Of course, all of us would argue that is even dramatically understated. But…

When you have inflation running higher than the interest rate you're being paid, plus the Fed is coming in, increasing demand, price, and then dropping those interest rates even further, those 10-year treasuries don't look so good.

We go into equities. More so, we go into gold.

If you believe that the Fed is going to continue quantitative easing, continue money printing, you definitely want to own some gold.

The Dollar End Game

Like I mentioned before, Ray believes the average Joe, the hedge fund managers, the financial institutions, and all these entities holding 10-year treasuries, or government debt, are going to realize that they have long-dated dollars.

They're going say, “We don't want anything to do with it when real interest rates are actually negative.”

Because that is return free risk, meaning there's no way that we're going to make money. We are guaranteed to lose purchasing power over the long run.

All of the entities are going to start selling their treasuries, and they're going to rotate into a different asset class, such as gold or precious metals. That's going to increase the supply in the bond market.

At the same time, your drunk, insolvent uncle Sam, is making it rain down on the real economy with stimulus checks and deficit spending and this puts the Fed into a very difficult position.

Let's dive again into Ray Dalio's interview from Bloomberg to understand this a bit more.

Ray Dalio: If that gets too far and its standing the risk of, it's very dangerous. It looks like a currency defense.

Another words, if those who are holding bonds, which are a lot, choose to sell the bonds because they're not providing a good return, and they're not, and because there's so much debt production and debt monetization, that puts the Federal Reserve or other central banks in the very difficult position of operating like a currency defense.

Mechanistically, as money leaves that debt, that means either interest rates would rise, which would be terrible for the economy and markets, or they're forced to buy more and more, and that is how a spiral could occur.

(End of interview)

The supply of bonds hitting the market increases, which makes the price of those bonds go down, and remember, there's an inverse relationship between price and yield.

If prices are going down, yields and interest rates are going up. But, Ray knows the economy cannot stand higher interest rates. So if interest rates were to go up, the economy would collapse.

The Fed has to come in and buy all those additional treasuries that the government is creating by your drunk, insolvent uncle Sam's deficit spending along with the treasuries that are being sold by the entities that see them now as a hot potato.

The Fed has to monetize the debt, meaning they just have to print up more bank reserves, as many as possible, to buy those treasuries and make sure interest rates don't go up and crush the economy.

This takes us straight into a doom vortex…

The more the Fed monetizes the debt, the more the marketplace sells the treasuries. The more treasuries the marketplace sells, the more the Fed has to monetize the debt.

The next question becomes: “Maybe the government deficit spending isn't going to be so bad? Maybe it's going down?”

Not even close. The deficit is going the opposite direction.

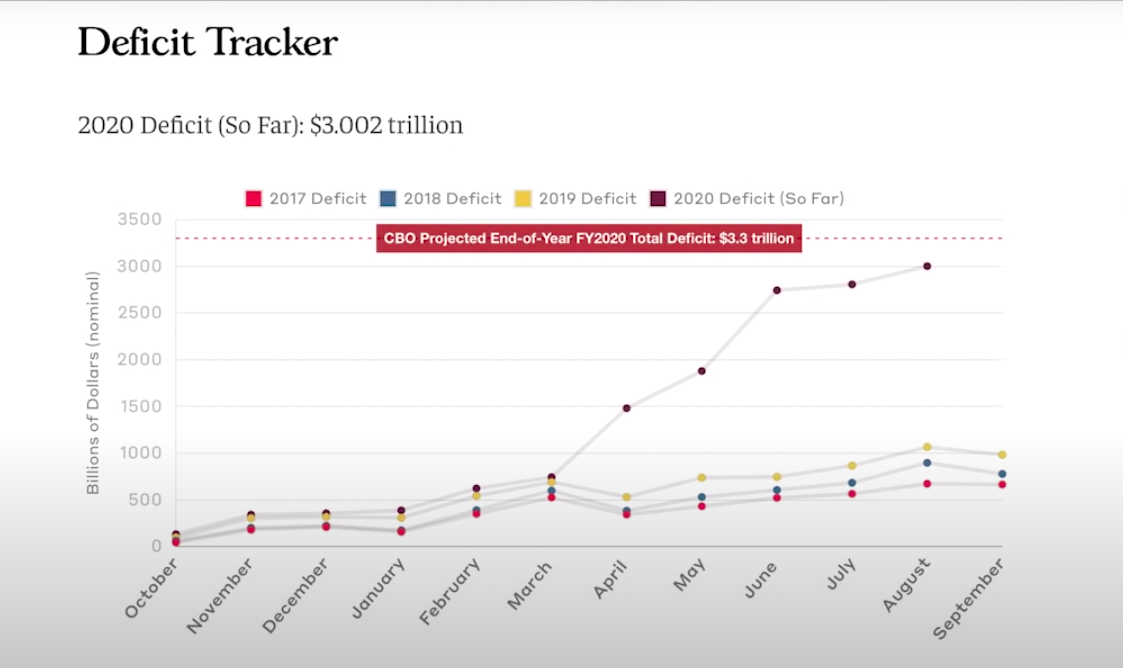

Here is a chart going back to October 2019 and all the way to September, 2020.

The expected deficit of the government is tracking right about $500 billion. This chart goes from $500 billion up to $3 trillion. In March, you can see the deficit started to go parabolic, almost straight up until it reaches where we are today.

Even the government's own projections of what their deficit is going to be, is over $3 trillion dollars and we're not done with the year.

I would expect they're going to come up with another stimulus package that's going to take the deficits to infinity and beyond, straight to Buzz Lightyear territory.

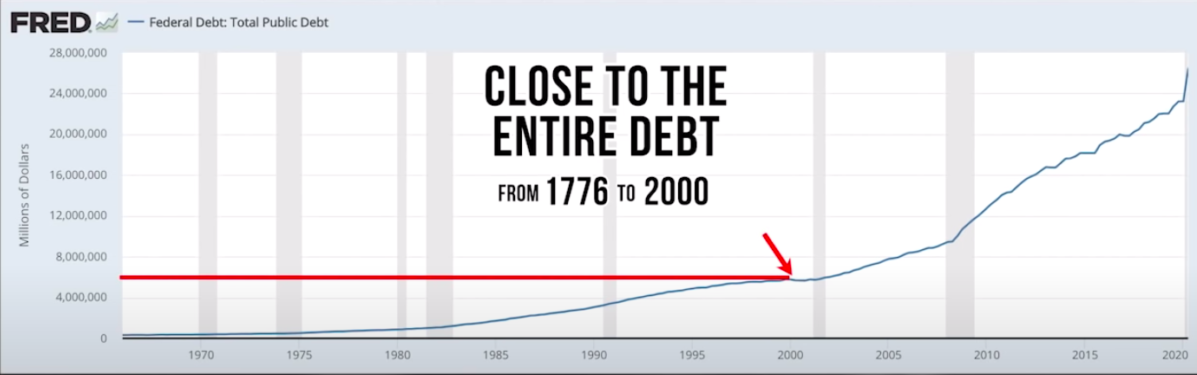

Just to give you some context, the deficit that the government will run in 2020 alone, just for this one year, is going to be close to the entire amount of debt the government accumulated from 1776 to the year 2000.

Let that sink in a bit.

The bottom line is Ray Dalio sees deficits going through the roof, the Fed monetizing and printing money to control the yield curve.

You've been hearing that a lot, yield curve control. All the Fed people are saying it in almost every speech, and the only release valve for the money printing, the debt monetization, and controlling the yield curve or keeping interest rates artificially low is going to be the US dollar.

That's why Ray Dalio sees the US dollar declining and eventually losing its reserve currency status.