In this article, you’re going to discover once and for all if it’s better to rent or buy a house.

Make sure you read until the end because I will reveal a rent or buy formula I have never shared before with anyone, and it’s going to save you a ton of money!

Here’s what not to do:

What not to do when you are going to rent or buy a house

Let’s start with an example and say we have a cost of rent of $1,500 and mortgage payments for also $1,500 per month.

| RENT | VS | BUY |

|---|---|---|

| $1.500 | $1.500 | |

| Pros: | Pros: | |

| Flexibility | Equity Appreciation |

|

| Cons: | Cons | |

| No Equity | Ownership Costs Opportunity Costs Interest |

This is what people typically hear from online gurus.

They'll tell you your pros for ownership are equity and appreciation, and your cons are ownership costs, opportunity costs, and interest.

Or, on the other hand, they will tell you your rent pros are flexibility and your cons no equity.

This is exactly what you do not want to do.

It may come as a surprise, and you can even think: “That is exactly what every single financial guru I've heard says I have to do.”

I realize it, but it's completely wrong.

From now on, you might read some things you have never before.

So… What should you do? Rent or buy a house?

Before we answer that question, you need to make a completely different analysis starting with something I like to call an R.V. ratio arbitrage.

Now, what on earth is an R.V. ratio?

It’s the monthly rent you can collect from a property divided by your cost basis or how much money you have out-of-pocket for the property.

For example:

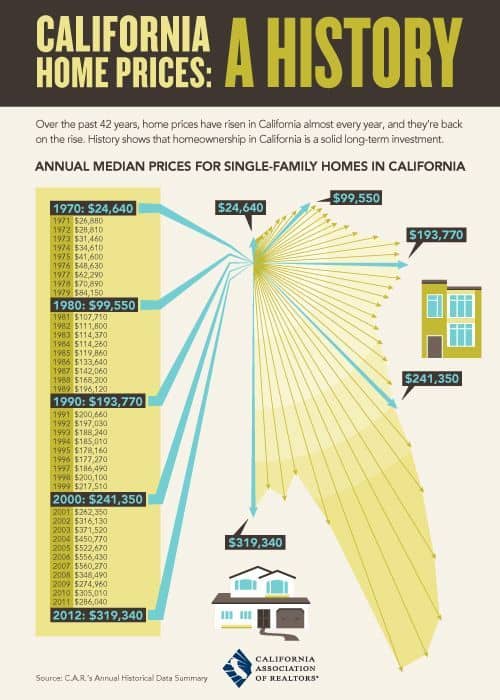

California is a state with notoriously bad R.V. ratios, but let’s say you can get a point five (0.5%) there.

That is a very bad percentage because for a $300,000 house in California you could expect to get $1,500 a month in rent.

On the contrary, in a state where I love to invest, which is Missouri, you can get about a 1% R.V. ratio.

That is a good ratio, and for the same $300,000, you could buy two rental properties for $150,000 each and collect $3,000 a month combined.

Therefore, my suggestion for the California resident is to rent where he/she lives in and buy in a place like Missouri.

His/her result will save hundreds of thousands of dollars by renting in California and instead of buying there, purchasing rental properties in Missouri.

However, if the alarm bells are going off about property management don’t worry.

I have owned rental properties since 2012 and I have never lived in areas where I own properties, but this is not the only factor going into the formula.

You cannot make your buy or rent decisions based strictly on R.V. ratios

Why? Let’s go ahead through the math and see why this California resident would save so much money renting where he/she lives and owning what he/she rents.

If you are purchasing a home in California for $300,000 you’ll have about a $60,000 down payment, which is 20%.

Over the span of 30 years, all your mortgage monthly payments will total, roughly, $402,587.

If you add your original downpayment of 60,000 you’ll have $462,000 ALL IN.

Case 1: California —— $300k/$60k —— $402k + $60k = $462k

Doing the same math with the two Missouri properties that equal $300,000, with the same downpayment of $60,000, you’ll have zero payments per month because your renters are making your mortgage payments for you.

Therefore, the next step would be adding the mortgage payments to the $60,000, but since you don’t have to, you only have $60k out-of-pocket for the down payment.

In total after 30 years, you will have spent 462,000 in case1, and in case 2, just $60,000.

Case 1: California —– $300k/$60k ——- $402k + $60k = $462k

Case 2: Missouri —–$300k/ $60k —– $0 + $60k = $60k

The original purchase price was $300,000 but real estate really just stays consistent with inflation.

So if we have $300,000 of purchasing power at year one, you are most likely going to have the same $300,000 of purchasing power at the end of year thirty, when you own the property.

Instead, you can affirm: “California real estate always appreciates.”

My response?

-FALSE!

This is a complete myth perpetuated by people who are trying to get you to buy California real estate.

Like the California Board of Realtors who look at nominal prices and incomplete charts intentionally to mislead you.

Here’s another example:

Home prices in Venezuela are appreciating by over 10.000% per year, but we do not want to buy a home there because we know this is strictly a result of inflation.

But, for some reason when it’s the same inflation making home prices go up in California we think it's totally different.

The fact of the matter is when you adjust for inflation and the size of the home, prices in California have gone up and have gone down, but they tend to mean revert to the same inflation-adjusted prices as 1970!

If we have $462,000 all in and $300,000 with the purchasing power at the end, you can see a loss, as shown in case 1.

Looking at case 2, we only have $60,000 total out of pocket.

In this case, if we have the same $300,000 of purchasing power, you can see we have a net gain of $240,000 worth of purchasing power.

Case 1: California —– $300k/$60k ——- $402k + $60k = $462k — -$162K

Case 2: Missouri —–$300k/ $60k —– $0 + $60k = $60k —— +240K

I understand this might get confusing but, you need to think in terms of purchasing power and not nominal dollars.

However, you could also think: “we have the rent.”

That is right! We would have to pay $1,500 a month to rent the place where we were living over a span of 30 years, which would equal: $540,000.

Here’s the math:

$1,500 x 12 months x 30 years = $540,000

We would also have a positive cash flow coming in from our rental properties of roughly $800 a month.

Over the span of 30 years, we would have $288,000, so if we subtract our positive cash flow from the amount we would have to pay in order to rent this house in California, we would be left with a negative -$252,000.

$1,500 x 12 x 30 = $540,000

$800 x 12 x 30 = $288,000

$540,000 – $288,000 = -$252,000

Now, if we subtract from the $240,000 gain of case 2, in purchasing power we would be left with twelve thousand dollars, a negative twelve thousand dollars.

$240,000 – $252,000 = -$12,000

Also, remember we have a negative $162,000 up here in case 1 and I have not even included the property taxes or the insurance your renters are paying in Missouri.

If I add those taxes and insurance, it’s an additional negative -$144,000 for a total of almost -$300,000

Case 1: California — 300k/60k — 402k + 60k = 462k — 162K-144k= -$300k

Case 2: Missouri —–300k/ 60k —– 0 + $60.000 = $60.000 —— 240K

The question then becomes, what is better? Which would you prefer?

Minus twelve thousand (-$12,000) or minus three hundred thousand (-$300,000)?

The rent or buy formula:

This formula will help you make much smarter decisions on whether it’s better to rent or buy in your area.

Let me use two examples, one with Kansas City and the other one with Los Angeles.

Kansas City scored a 9,5,3 and 8 for a total of 25. Los Angeles scored a 1, 2, 0, and 6 for a total of 9. We will get to what this number means in a few lines.

For now, remember:

The lower the score is, the better it is for you to rent.

The higher the score is, the better it is for you to buy.

With this, I am not saying you should just go out and buy a house.

There is a trick to it and I am going to get into it, but before, I’ll show you the whole formula.

You have to take your R.V. ratio and add the population change, the historical prices (adjusted for inflation), and the cost of construction.

Rate each one of these on a scale of 1 to 10, and then you just simply add them together like this:

R.V. + Population change + Historical prices + Cost of construction

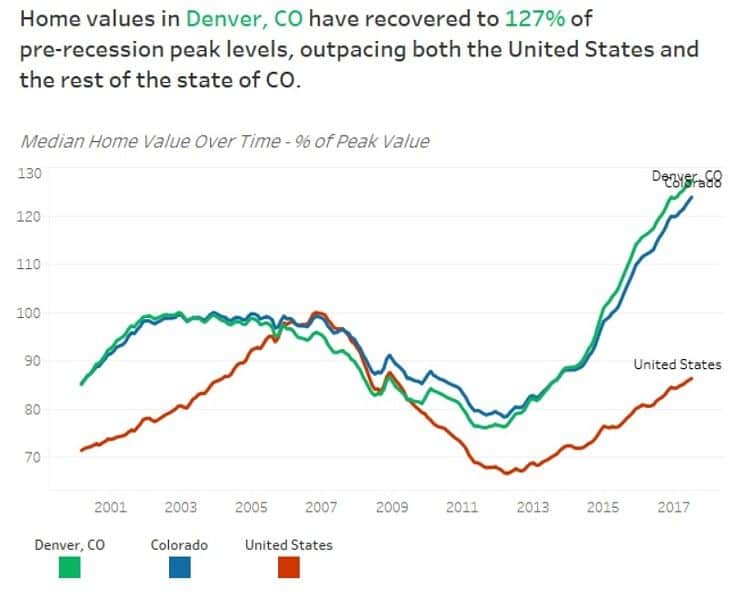

Let’s walk through Denver quickly.

Here you’ll understand the scores we gave Kansas and Los Angeles in the previous example.

Let’s say we have an R.V. ratio that's not going to be very good, so we are going to give it a score of 3 (from a scale of 1 to 10).

Population change? Denver is the fastest-growing city in the entire United States so they are going to get a score of 10.

The historical prices in Denver are extremely high, so they are going to get a zero(0).

Cost of construction? I highly doubt you can buy under the cost of construction in Denver unless you get really lucky, so on this one, they are only going to get a 3.

Discover the formula result to know if you need to buy or rent

After applying the formula, Denver's combined score is 16.

R.V. (3) + Population change (10) + Historical prices (0) + Cost of construction(3) = 16

Remember Kansas City had a twenty-five (25) score, and it’s a big difference between Kansas and Denver.

Perhaps, if you live in Denver, you know you should be renting your house and taking the down payment you would have used to buy in Denver, and instead of buying there, buy rental properties in Kansas City with the same down payment.

Because the lower the score is, the better it is for you to rent. The higher the score is, the better it is for you to buy.

It would be pretty much the same for Seattle, to take another example.

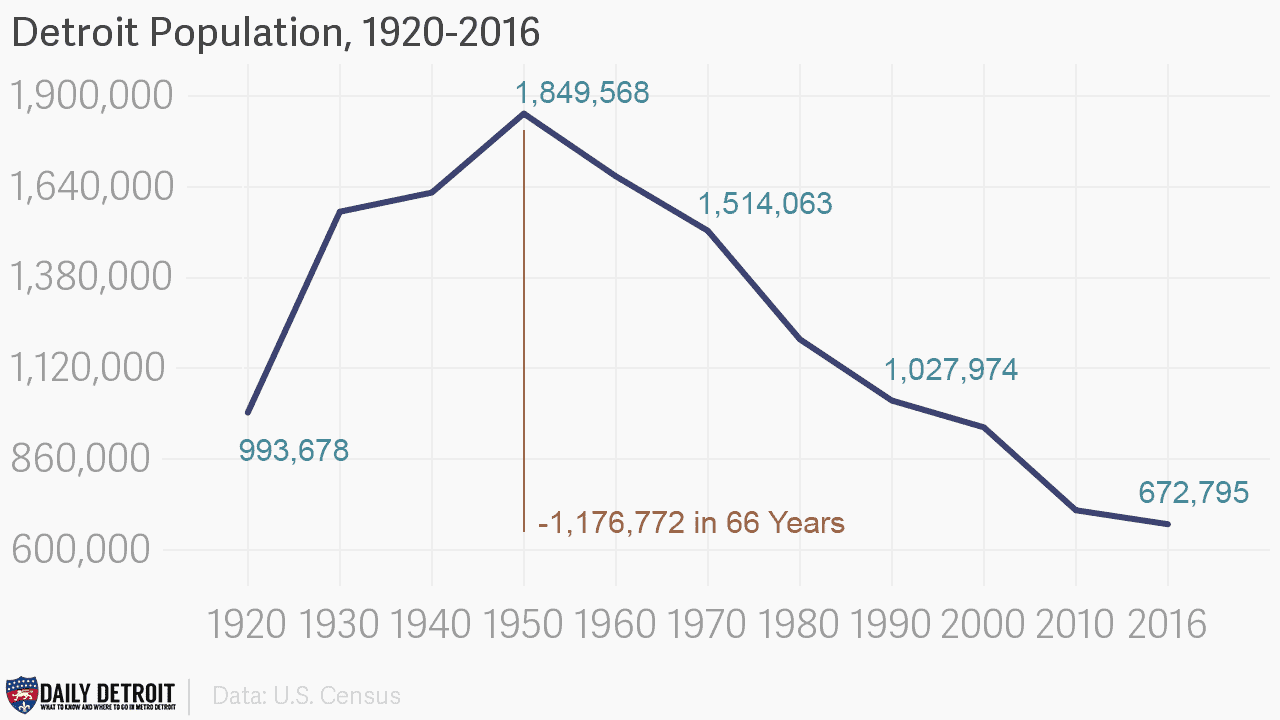

But, what about Detroit?

What do you think someone should do in Detroit?

Because the R.V. ratios in Detroit would be astronomical!

You can get 2% R.V. ratios!

Yet, Detroit doesn't score very well because the population change is terrible. They have been losing people for the last decade.

Their prices are good, way under construction, but because the population change number is so low, it cannot even come close to Kansas City.

Even if you live in Detroit and the R.V. ratios are great and the houses are cheap, it’s still better to rent and take the same money and buy in Kansas City.

If you live in Kansas City or if you live in a market that gets a great score, should you go out and buy a house as a residence?

NO! You shouldn’t.

What you should do is house hack.

If you're looking to learn about it, click here and start today. I will teach you how to become a millionaire through house hacking.

Also, if you still have more questions on inflation, you can read more about it by clicking here.

See you on the next one!

Comments are closed.