Chaos proofing your financial future

Discover actionable insights that'll help you weather the economic storm on the horizon.

We are living in unprecedented times, the Fed has created massive inequality but continues to print funny money, the government is running multi-trillion-dollar deficits and the country is more divided than ever.

There's A LOT to be concerned with but it doesn't mean you can't continue to protect/build wealth and thrive.

You need to be aware of what's going on economically and understand the consequences for what will most likely be the government and the Fed's response.

Which of course, is debt monetization and unfathomable deficit spending.

If you're a producer, then the government will put a target on your back in the form of higher taxes.

And society may literally put a target on your business or your home.

This is not the time to whistle past the graveyard, this is the time to get prepared and have a plan B.

In this riot proof your financial future video I discuss the following:

1. Protecting your home equity.

2. Preparing for volatility AND higher taxes.

3. What YOU MUST DO TO SURVIVE!

protecting your home equity

Right now in the United States, we have social unrest, rioting, looting, potentially even martial law.

So now more than ever, it's crucial that you continue to hope for the best, but prepare for the worst.

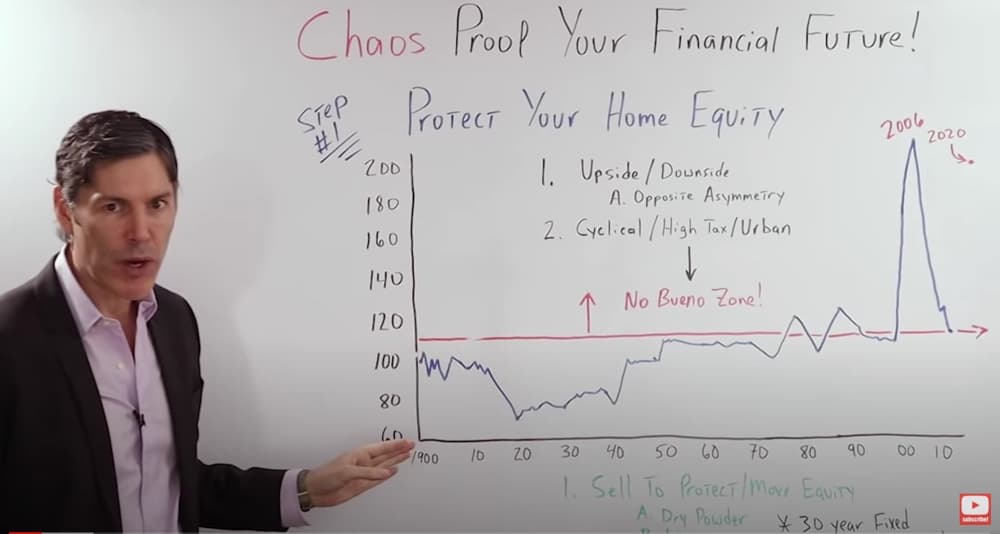

I've got a chart going all the way back to 1900. Home prices in the United States, adjusted for size and inflation. It's one of my favorites.

It goes to 2010 on the left, from 60 to 200. In 1900, it starts off right around the 100 mark stays consistent, it goes down in 1920, notice after the Spanish flu and World War I.

They stay very low until World War II.

They pop back up to about their historic average and remain consistent to 2000.

Notice for 100 years in the United States, home prices didn't go up or down. They stayed the same when you adjust for inflation and size.

Most people, I think, would be shocked by that information alone.

What happens in 2000?

Well, of course, we go into a housing bubble. Prices go parabolic, all the way to 2006. Then they come crashing down till they bottom out around 2012.

Where did they bottom out?

Of course, on their historic trend line.

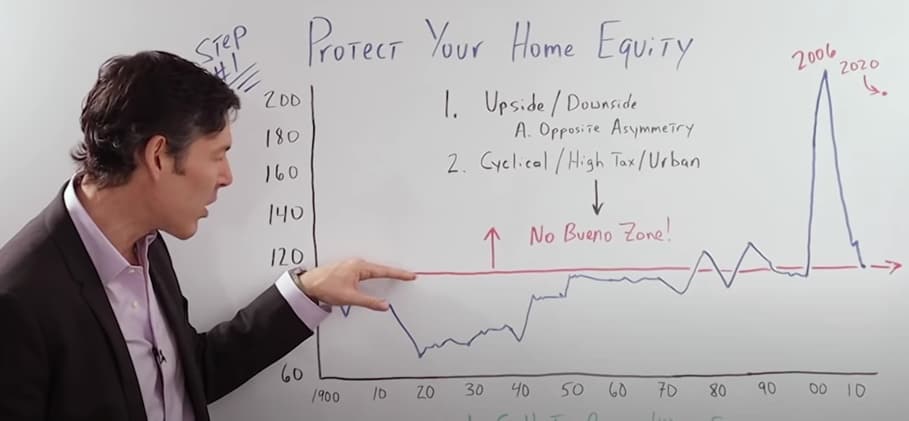

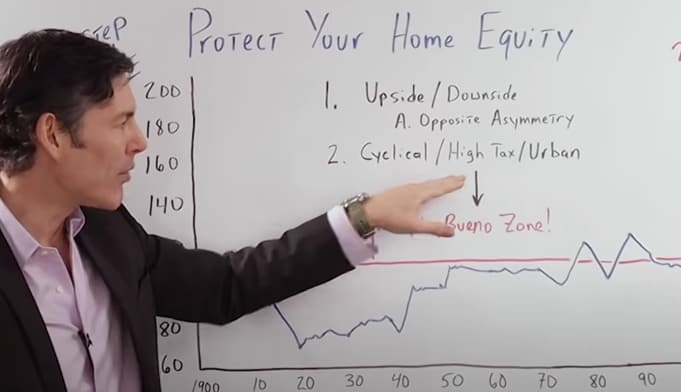

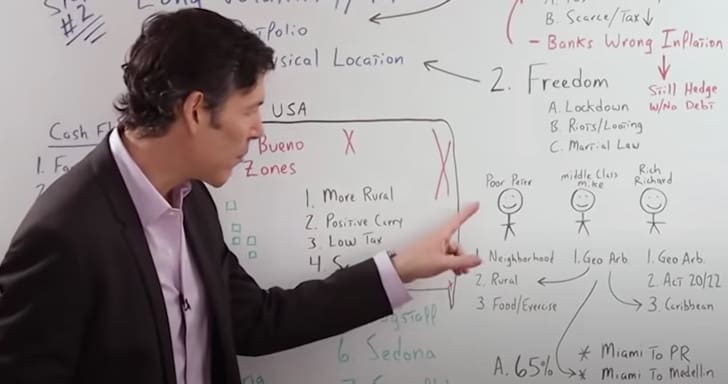

What is the no bueno zone?

I use this term a lot. Most of you know from my videos.

You can see from this red line, things really start to get expensive.

That's when we're getting into the no Bueno zone. When we get down here, prices are pretty darn cheap.

But if we're in the no Bueno zone from here up, where on earth are we in 2006? We are in the no Bueno zone stratosphere.

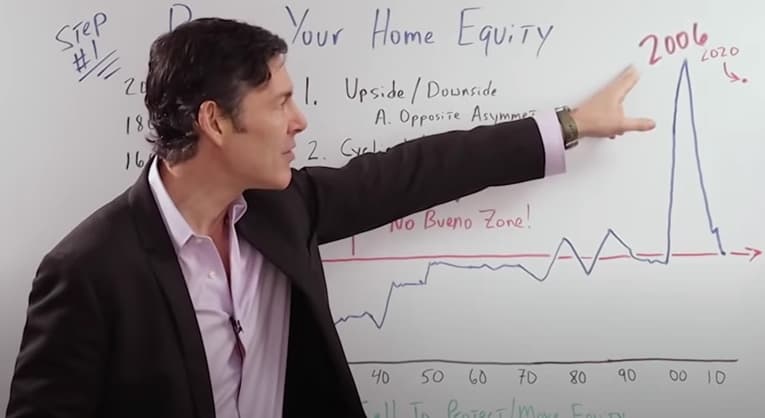

The next question becomes where are we in 2020?

Almost as high as we were in 2006. In fact, in some markets, prices are even higher.

If we were in a bubble in 2006, which I don't think anyone would dispute, how are we not in a housing bubble today? Prices are almost the exact same.

If you're trying to be intelligent with your financial future and the future of your family, you've got to look at your upside and your downside.

When we're investing or speculating, we want asymmetry, meaning very little downside and a lot of upside.

Right now, with home prices, it's the opposite. Your asymmetry is completely flipped, meaning your upside is very little and your downside is potentially massive, 50%, 60%, even 70%, when you adjust for inflation.

If you live in one of these cyclical, high-tax, urban areas, you really want to think about selling.

Right now in the United States with the social unrest, looting, rioting, do you really want to have your home equity, potentially the majority of your net worth in one of these urban areas?

Let's not forget about taxes. The states are broke. I can almost guarantee you in the future, they're going to be jacking your property taxes, putting in an additional sales tax, who knows.

They're going to get desperate and you're going to have a target on your back.

Again, my best advice is to consider selling now to protect or move your equity. If you can't sell, maybe you can take equity out in the form of a refinance.

I know it's not right for everybody, but I think it's something you need to start considering, especially if you live in one of these markets.

What can you do with the equity?

First and foremost, keep some dry powder (cash) for heaven's sakes. You might be able to move that equity to a more linear market where you can get a better RV ratio.

First and foremost, keep some dry powder (cash) for heaven's sakes. You might be able to move that equity to a more linear market where you can get a better RV ratio.

Maybe you buy some rental properties.

I've got tons of videos on that. Or buy some cheap dividend-paying stocks, something that pays you to own it.

I'm not saying, “Rush right out and buy these things immediately.”

I'm saying, “Start paying attention, protect your equity now. Get it in some dry powder (cash) and just let the market come to you. Be very patient.”

I think over the next year or two, prices are going to come to you. You don't have to chase them.

What everybody can do, regardless of whether or not they can sell, is they can at least make sure their mortgage is a 30-year fixed rate. You want to make sure that you've got a short against the US dollar.

Hopefully, if we get some inflation, which we most likely will over the longterm 10, 15 years, you'll be able to pay back your mortgage with cheaper dollars.

That's a transfer of wealth from the bank to you.

Also, think about consumer debt. You really want to eliminate as much as possible.

I don't think now is the time to go out and run up the credit card on consumption, especially because it's not a fixed rate.

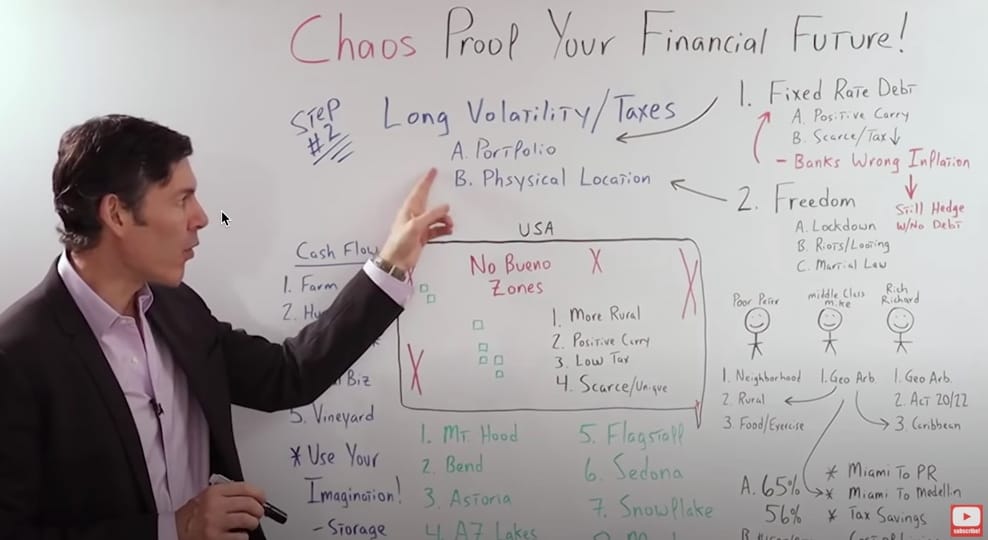

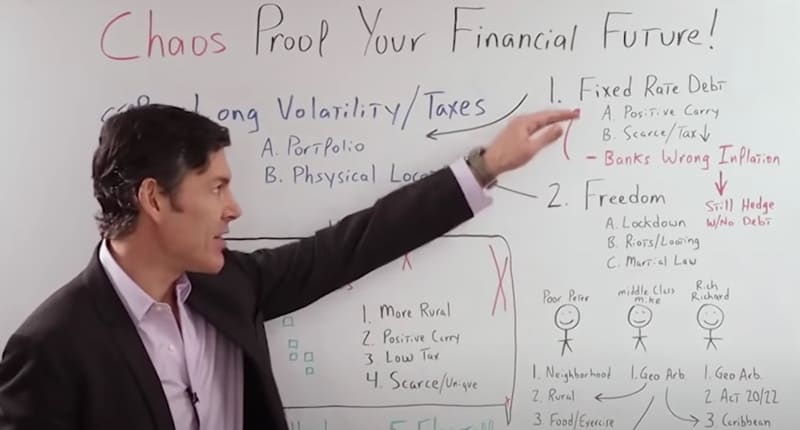

going long volatility and taxes

Go long volatility and taxes. They are most likely going up in the very near future.

I'm not just talking about going long volatility with your portfolio, but also your physical location.

To see how the pros are executing this in their portfolio and their personal lives, let's go to a clip from a recent Real Vision interview with Raoul Pal and Hugh Hendry (you'll need to click play on the video above to watch this! 6min30sec).

Hugh Hendry: But for me, last year I borrowed 5 million euros, 20 years fixed, paid 2%. 2% was the wrong figure. It should have been like 1.3.

but I Was like, “Whatever. Hit me, hit me, hit me.” So let me just say that again. I borrowed five million euros to buy a property in St. Barts, to buy a part of what, believe me, is a much bigger investment than five.

A French bank was willing to lend me a fixed. Okay. That's fairly reminiscent. That is assuming your world. That's a world where gold is going to go to 3000. It's going to go to 3000 because it's going to be difficult.

But there's enough financial lubrication that it won't be the 1930s. But it's going to be a world of zero interest rates for a long time.

I just don't think that the banks are as smart as that. I think they've got that wrong. I think they've got that wrong like their German cousins after the first World War.

I know what you're saying. “George, I can't buy property in the Caribbean. This is pointless.”

But I can promise you, this is very applicable to the average Joe and Jane right here in the United States.

But we first have to understand the concept behind why they did what they did.

First, they took out fixed-rate, longterm debt to buy a hard asset that gave them a positive carry.

In other words, positive cashflow. This asset was scarce and it was in a jurisdiction where the tax rates were very low.

Hugh Hendry points out that he thinks banks are going to be on the wrong side of history, just like they were in Germany right after World War I.

What he means by that specifically is 1920s, Weimar, Germany, hyperinflation.

As long as you buy an asset in this category, even if you don't use debt, if you pay cash for it, maybe you're a person that really doesn't like debt. I totally respect that.

I still think it's going to be a great hedge longterm. Even if we don't get hyperinflation in the United States over the next 10, 15, 20 years, the probabilities are very high that we'll at least get substantial inflation, like the 1970s.

Even the guys and gals that are dollar bulls right now, over the short term, even up to three, five years, think that the dollar is headed down in value.

In other words, we're going to get a lot of price inflation over the longterm.

But let's not forget, this strategy is also about improving your personal freedom, getting a place where you don't have to worry as much about going into lockdown, riots, looting, or even marshall law.

Actionable Ideas For Chaos Proofing Your Life

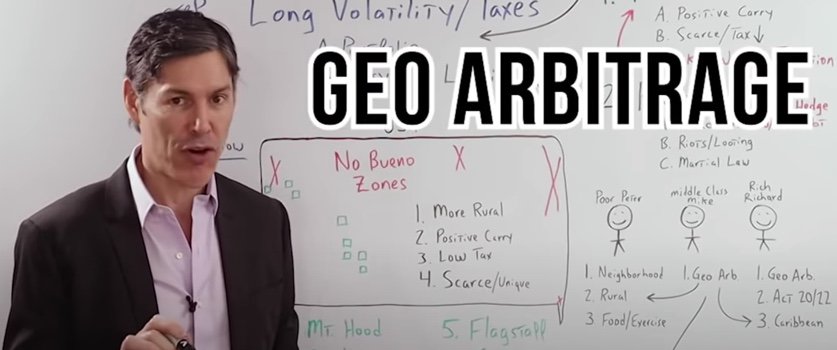

Now let's go over some specific, actionable ideas that you can put into practice. We've got Poor peter, Middle-class Mike and Rich Richard.

Now let's go over some specific, actionable ideas that you can put into practice. We've got Poor peter, Middle-class Mike and Rich Richard.

Move to a better neighborhood

For Poor Peter, doesn't have as much flexibility, but he does have some options. He or she can move to a better neighborhood.

Or maybe not just a better neighborhood, but a neighborhood where more of the people that live there actually own their property.

Why is this a good idea?

Because I would assume that people are a lot less likely to burn down a property that they actually own.

move into a more rural area

Going into a more rural area with some space where they can grow some food and at least get some exercise.

Places to avoid

Examples of this in the United States, we've got the no Bueno zones we talked about in step number one.

Those are the big cyclical markets, urban areas, high-tax zones. But there are some areas where you could find some opportunities.

2020 US cities that became hotspots of unrest

- Minneapolis

- New York

- Los Angeles

- Miami

- Nashville

- Salt Lake City

- Cleveland

- Raleigh

- Louisville

- Atlanta

- Dallas

- Washington DC

- Seattle

- Portland

The best Geographical locations for bugging out

Some of the places that came to mind for me, and again, you can apply this to whatever geographical location you're most familiar with.

- Mount Hood, Bend, Astoria, Oregon,

- Arizona Lakes, Flagstaff, Sedona, huge for tourism, Snowflake or one of my favorite places on earth, Moab, Utah.

All of these locations are going to have properties that are very scarce and unique.

But remember, it's also about cashflow. For this, we've got to get creative. It's going to be hard work, that's for sure.

There's no easy way out. It's not the 1980s where you can buy a 10-year Treasury and get a 10% yield all day long.

Cash Flow Ideas

So farming, maybe hunting, I've got friends in the Midwest who own a lot of property and they lease it to deer hunters, a bed and breakfast, or maybe an Airbnb.

My buddy, Eric with MacroVoices has a fantastic spread on the North-Eastern coast. It's kind of a bug-out place for people wanting to get out of the insanity of New York City.

Maybe a rural business, I also have friends in the Grand Canyon that bought property.

They're setting up a campground for these specialty RVs called Airstreams in Shasta. Really cool idea.

More on that in step number three.

My sister lived on a 100-acre vineyard, just sold it.

The bottom line, you've got to use your imagination.

As I was going through this whiteboard and drawing this, something really crazy, way outside the box, came to my mind.

Maybe you get a rural location and you set up a facility for gold storage, maybe silver storage, or maybe even cash storage if interest rates go negative?

Using geo arbitrage to live in abundance

But going over to Middle-class Mike, he has all the options we just outlined for Poor Peter.

But maybe he's got some more flexibility?

He works online. Maybe he's a retiree that's getting social security or has a pension fund?

He can look at what I call geo arbitrage, geographical arbitrage, hat tip to my good buddy Jason Hartman who came up with that term.

But this is when you move to a different country because you improve your freedom, lower your taxes, and increase your purchasing power substantially.

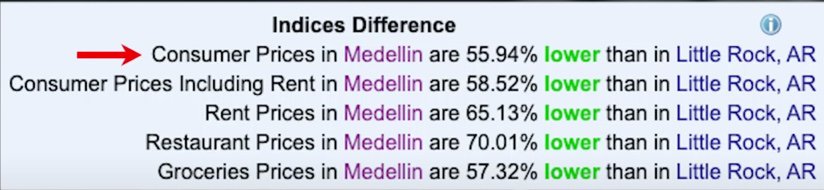

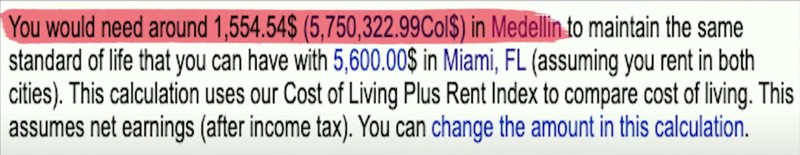

As an example, I ran some numbers comparing Miami to where I am right now in Medellín, Colombia.

The cost of living in Medellín is 65% lower than it is in Miami. I know what you're saying. “George, Miami is a really expensive place.”

Okay, fine. Medellín is 56% lower than Little Rock, Arkansas. To put this into dollars and cents so we can really understand it, in Medellín, if you had $1,500 a month, you'd have the same purchasing power as if you had $5,600 a month in Miami.

It becomes even better when you go over to Rich Richard. Yes, he's got all these options and the geo arbitrage.

Also Act 20 and 22 in Puerto Rico, which could take his tax rate to whatever he's paying the United States down to zero percent in Puerto Rico, also 0% potentially on some capital gains.

He also has the options that Raoul and Hugh were talking about for the Caribbean.

But to add some numbers to Rich Richard, let's say he's making $100,000 in the United States, his effective tax rate 20%.

That means by moving to Puerto Rico, he's saving $20,000 a year.

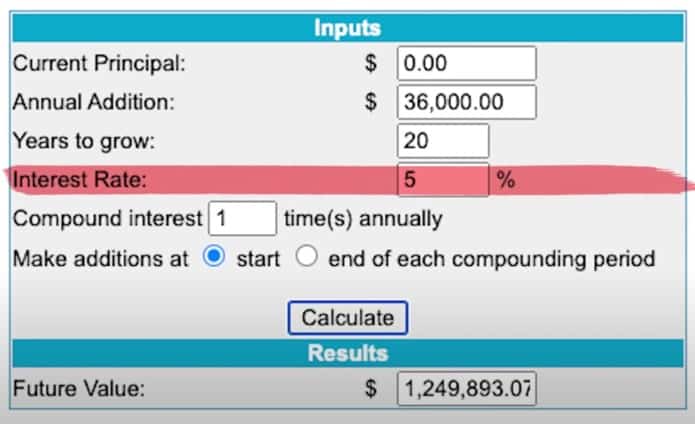

When you add that to his cost savings for the cost of living and a 5% per year return over 20 years, Rich Richard would save one point $1.2 Million.

This is why when you understand the concepts we're about and going long volatility, whether it's for your portfolio or your physical location, to improve your freedom and your security.

For Poor Peter, it's a great idea. For Middle-class Mike, it's a fantastic idea. For Rich Richard, it's a complete no brainer.

More Chaos Proofing Ideas For Poor Peter

These are the items that everybody must-have. Before we get into them, let's go right back to step number two quickly.

I forgot a couple of things for Poor Peter.

When I was looking at my notes, I realize it might not be realistic for him to buy property in Moab or Bend or Mount Hood, Sedona, something like that.

But I think there are a few things that he could do in addition to try to move to an area or a neighborhood where there are more owner-occupants.

House Hacking

First, you can house hack. It's the best financial advice I can give to anybody.

You can take the money you would've spent on rent or your mortgage payment.

You can use that to build up some savings and invest for the future.

Request a job transfer

Second is you can ask to be transferred.

Maybe you're in one of these places like San Francisco, LA, New York, Baltimore, Chicago, one of these urban areas, high taxes.

You just want no part of it. Why don't you ask your company if you can transfer to a different location?

Maybe you work for a big corporation that could transfer you up to Bend, Oregon.

Maybe Billings, Montana, Boise, Idaho, someplace where you've got a lot more peace of mind, not only from a personal-security standpoint, but a financial standpoint as well.

3 items that everybody must-have

Own Gold, Silver, and Bitcoin

Going back to step number three, you know what I'm going to talk about, of course, gold, silver and Bitcoin.

Things I definitely think everyone should own, but for many different reasons.

Those of you who watch my videos know exactly what I'm talking about.

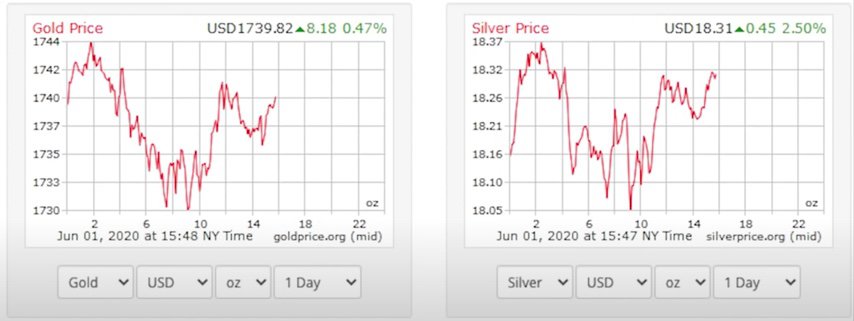

One thing I wanted to point out though, I was looking at the charts over the weekend.

Gold and silver prices

Gold, silver opened up the futures market yesterday around five o'clock yesterday, meaning Sunday.

Bitcoin trades, 24-7.

Bitcoin Price

I noticed gold and silver were up, but Bitcoin over the weekend was actually down. It was actually up today.

I'm not saying this is going to happen indefinitely into the future, but it got me thinking that gold and silver, obviously fantastic hedges against social unrest.

Especially the type of unrest where people just want to bug out and get to the country and just hang out for a while.

Maybe barter back and forth with something they know has had value for the last 5,000 years.

But Bitcoin seems to be maybe for monetary unrest, like you'd see hyperinflation in Venezuela or when they put up capital controls, like China, where they won't let you take yours out of the country.

It's just some food for thought, something to think about.

Now let's go over some items that I can promise you nobody is talking about.

You're definitely not going to hear this on Real Vision. That's for sure.

Own an RV and A Truck

I think everybody, whether it's Poor Peter, Rich Richard or Middle-class Mike, should have an RV and a good old fashioned diesel truck in their driveway.

Think about it. Why not? Wouldn't you want an RV parked in your driveway, ready to go, stocked with food.

You can hop in, drive right out to the mountains, the lake, and just watch everything happen from a distance.

Also, you can make a lot of money with these things. I've owned several Airstreams in the past.

Like I was saying with my friends, they've made a lot of money with Airstreams and canned hams, or those Shastas.

Everybody loves those things with the wings in the back.

You can actually cash flow them.

When they're in your driveway, you can rent them out nightly on Airbnb. Or there are specific websites that do peer-to-peer RV rental.

This is what's so cool about this, is it's not only a way to have some freedom, get outside of the chaos if necessary, on a moment's notice, but it's a way to increase your cash flow and make a little bit of money.

Also with the trucks. I think they're a great store of value.

If you get the right ones, those 1990s Dodge Cummins and the Ford Power Strokes, completely separate video.

Of course, you've got tremendous utility with those trucks as well.

Own A Passport

Lastly, what every American has to have is a passport. I would suggest considering getting a second passport.

One thing I wanted to point out, a lot of the countries in the Caribbean, where you can get these second passports with an investment of bonds or maybe real estate, or you can just purchase them outright, these passports are on sale right now, big time, because the islands don't have any revenue coming in from tourism, because of the Cerveza sickness.

A lot of these passports are half price.

Places like Antigua, St. Kitts, Dominica, they're all on sale.

I know they might look a little pricey, but keep in mind they're probably half of what they were even two or three months ago.

I know this isn't right for everybody, but even if you're a die-hard patriotic American, you're all about the red, white, and blue. I can totally respect that.

I think it's something you should consider.

If you had a second passport sitting in your drawer right now, you've got to ask yourself, what's the downside?

There is absolutely no downside and almost limitless upside. It goes back to step number two.

Remember, what we always like to find in our investments or speculations, asymmetry.

I don't think there's anything that has more asymmetry than having a second passport right now, especially when you consider what's going on in the United States.

Comments are closed.