How It Started: The Early 1990s And The Solomon Brothers

This is a fascinating story: The treasury started issuing treasuries at their auction like they typically do. What was interesting is in the early 1990s, a crazy guy from the Solomon brothers had a sign that said, “I love treasuries.”

So he came into every auction and said, “I will take every single treasury you issue. I'll take them all, 100% and I'll bid higher than anyone else is willing to pay.”

This was happening in a few treasury auctions and the government didn't know what was going on (shocker). But they concluded that something had to be done. There was something weird going on in the shadows and they couldn't figure it out.

They started to put a limit on what the crazy guy who loves treasuries from Solomon brothers was able to buy.

So what did he do?

He started bidding for treasuries through customers' accounts, trying to get around the rule or this roadblock the government had put in place, and the crazy guy was giving the middle finger to the government.

So they came in, got pissed, and said, “Listen, you need to stop this immediately. If you don't stop, we're going to yank Solomon brothers license and they're going to be out of business.”

So what did he do?

More of the same. He ignored them and continued to bid for every single treasury auction.

It got so egregious that Warren Buffett himself had to step in, fire the guy or fire a group of people and make amends with the government so they wouldn't come in and put Solomon brothers out of business.

One has to ask why on earth would anyone take so much risk just to get every single treasury available to them?

The government, of course never figured this out, but this is the canary in the coal mine.

If you start to understand what was going on with this story, you would have been able to see the future. Here's what I'm talking about:

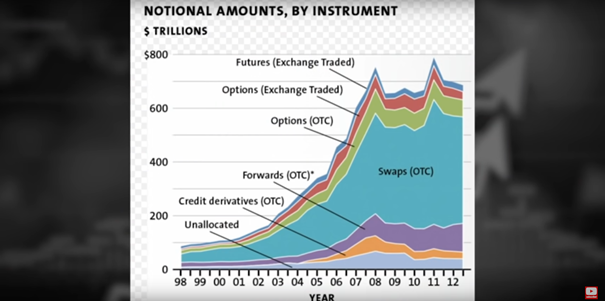

This chart of derivatives goes back from 1998 to 2012. On the left, it goes from $200 trillion up to over $800 trillion. The number could be pegged the notional value of outstanding derivatives now at over a quadrillion dollars.

Then, it took off and went exponential, parabolic, starting in 2001 and came up to the GFC in 2008 to finally crash down. Since then, it has pretty much plateaued.

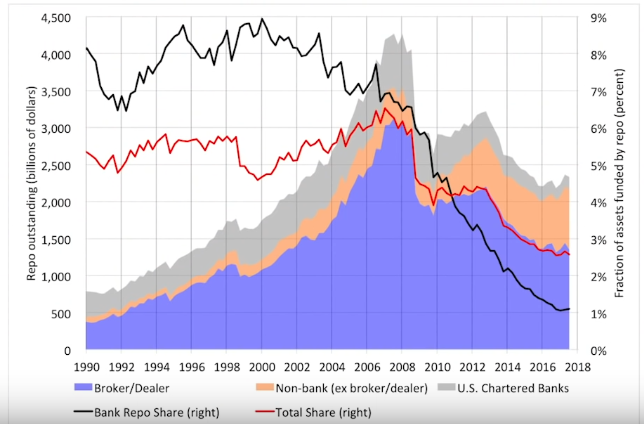

The graphic below shows the repo market from 1990 to 2018. It increased quite significantly during the time the crazy guy was trying to corner the market and treasuries at the Solomon brothers.

What he saw there was an opportunity to make a ton of money in an expanding repo market with the most pristine collateral: U.S. treasuries.

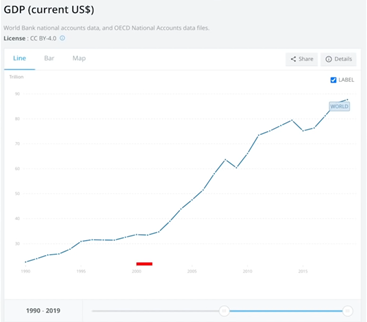

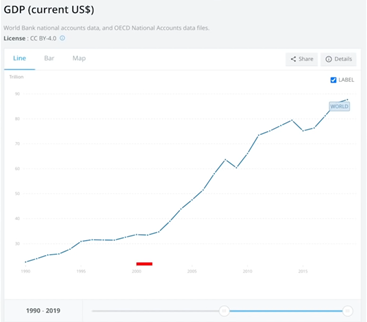

From 2000 to the GFC there was parabolic growth of world GDP as shown on the chart below. It goes from 1990 to about 2018, on the left from $30 trillion up to $90 trillion.

During this same timeframe, the chart looks identical. It goes from flat to parabolic growth. Now, if you look at the chart below of the M2 money supply (the total amount of dollars that are out there facilitating growth), you can see it holds little to no relationship with world GDP growth.

So if we look over at what's in plain sight -M2 money supply- we don't have any clues, but if we start to look in the shadows and what was going on with the Solomon brothers, we need to ask:

What did the crazy guy know that the government could never figure out?

It was that the repo market was going to explode.

What does this mean?

That the derivatives market is going to explode. This tells us that global economies are most likely going to have the capital and liquidity they need to expand rapidly.

To dive into this further, I examined one of my most recent interviews with Jeff Snider:

Jeff Snider: One of the reasons, or one of how money evolved outside of the traditional M's, which goes into the equation of exchange M1 or M2, was repo.

With the great depression, era regulations in the fifties and sixties, the banking system and even corporate customers started to experiment with different ways to get around those regulations, particularly regulation queue, which kept interest rates.

And what happened was more and more the banking system and their customers turned into the repo market to get better returns on money, but also then to use those repo balances in the real world way.

Corporations began writing checks for example, on their repo balances, which meant that even though these repo funds were outside of the M1 and M2 statistics, they were being used in the real economy in a very real way.

So if you don't notice that the repo market has become a real monetary market, you're looking at just M1 or M2 you're missing out on a tremendous amount of actual legitimate activity.

It doesn't matter what your textbook definitions are. It's what the system does. I mean, who cares if it's in your textbook, if banks are out there using these monetary forms that aren't in your textbook, then your textbook is outdated and you need to do something about that.

George: There's a portion of will call it money that's in the sunlight that everyone can see and everyone knows is there. But then there's another portion of the money that is in the shadows, that very few entities may know about, but it's almost completely unquantifiable.

Jeff Snider: You're exactly right George. There's shadow money and you said it…

Is that larger than the domestic sunshine money?

Yes.

(End of transcription)

Looking at what is in front of our faces to figure out the future is not enough. We can't look at the same data everyone else is looking at. We have to peer into the shadows, into the derivatives market, into the repo market, and more so into the Eurodollar system itself.

We have to figure out what this is telling us about global growth, inflation, deflation, the number of dollars in the entire system, but more importantly, how willing the banks are to create the loans necessary to facilitate maximum production of goods and services, which at the end of the day is how wealth is measured.

Post-GFC: The Shadows Are Here To Tell Us About The Past And The Future

By looking at the Solomon Brothers story in the early 1990s, and then looking at the repo market during the same timeframe we could have concluded that global economies would receive the liquidity they need to continue to expand.

We could have put two and two together, and then we saw throughout the 2000s to the GFC, a huge expansion, and not only derivatives, the repo market, but world GDP.

I'd like to point out that the repo market is the engine for the Eurodollarllar system.

Try to imagine the Eurodollar system is a big work truck that we need to facilitate global growth. The repo market is the engine, so the better the engine is working, the better the truck can facilitate the production of more and more goods and services across the globe.

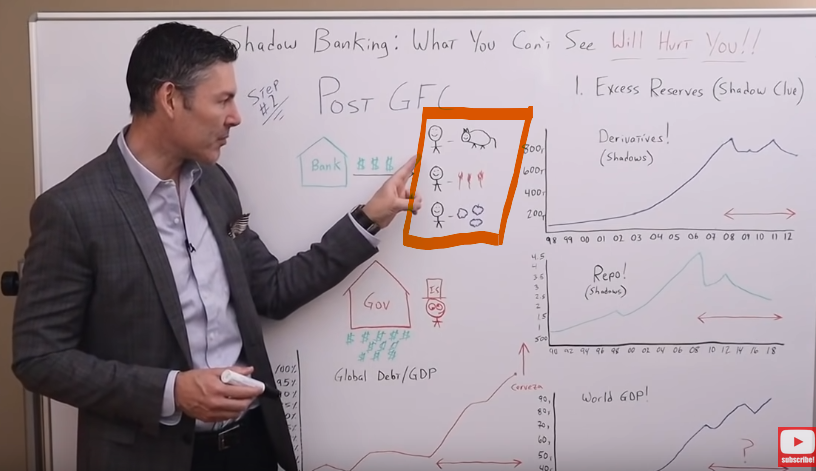

Now, let's go over the period after the GFC. The derivatives market really leveled off, if not went down, the repo market fell out of bed, went up slightly, but went down again, and it's been in a gradual decline.

The World GDP, on the other hand, dipped slightly but then went back up. It is odd the three charts below don't match up.

How did world GDP continue to go up while the growth engine was sputtering?

If the growth engine was sputtering, the Eurodollar system (the truck) was also sputtering.

How does this work?

We have to go back and think through a very simple economy.

In this example, one guy has cows, the other one grows wheat and the third one cotton. For them to become more productive, they need capital. The more productive they are, the more goods and services they create, which makes the entire society wealthier as a whole. We would get GDP growth.

Then, the bank was able to get the capital to the individuals highlighted needed to facilitate growth. That's what the Eurodollar system was doing, and that's what we can see if we look into the shadows with the growth of the derivatives market and the repo market,

This is an illustration of the private sector increasing the money supply to meet the demand for productive loans. Notice I mentioned productive loans, that's the key, but we still haven't tackled the question.

How can global GDP continue to expand when the repo market and the derivatives flatlined, if not gone down?

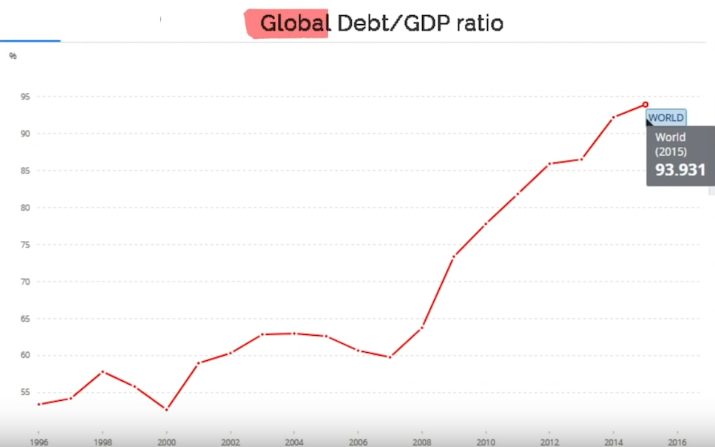

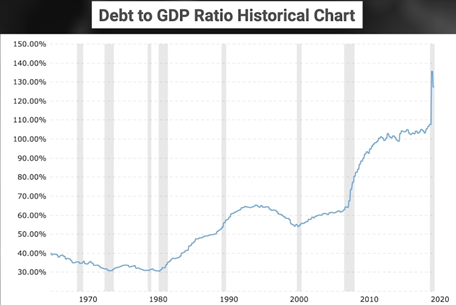

The chart above represents the global debt to GDP from sovereign governments. On the left, it goes from 1996 to 2016.

What do you think this chart looks like starting after the GFC in 2008?

As you can probably guess it goes parabolic, and keep in mind, this doesn't even include 2020 with Covid-19. It would be far higher if that number was actually on the chart.

What the shadows are telling us is after the GFC, the entire system that we just went over, broke down and what the governments had to do was spend money like a drunken sailor to fill the gap, even though they probably didn't understand the system at all.

Now the character of your drunk, insolvent Uncle Sam had to come in and make it rain on the entire economy. This becomes evident when you closely check out the chart of the United States debt to GDP.

What the shadows are telling us is:

- The system is broken.

- GDP growth isn't being facilitated by the production of more goods and services, it's only happening as a result of the government printing money and spending it into the economy, something that isn't sustainable.

Another fascinating clue we can pull from the shadows that back up the data displayed in the previous images is a chart of excess reserves in the banking system before and after the GFC.

Let's remember that the repo market is the engine for the Eurodollar system and the Eurodollar system, how healthy or not healthy it is will tell us what we can expect from global GDP growth.

The amount of reserves in the system is the liquidity that would be used for the repo market itself. If we go through the number of reserves in the system before the GFC, we'll notice how efficiently the entire system was functioning.

The number of reserves in the system was maybe $2 to $3 billion. This is what led to the growth in the repo market, the Eurodollars system, and in global GDP.

Then, in 2008, the entire system broke to our current, where the system needs over $2.5 trillion in reserves just to function the same way it did with $2 to $3 billion before the whole thing blew up in 2008.

I want to go back to the analogy of an engine before the GFC, it was running on a quart of oil. Now, the only way it'll run is if you dump gallons of oil, not only in the engine but probably on top of the engine, you need to put it in a pool of oil for it to even sputter along down the road and not even that does well.

The shadows are telling us is that our entire system has gone from the vital statistics of a marathon runner to the vital statistics of someone who is barely hanging on with life support. The Solution Is To Go Back To The Future.

After having several conversations with Jeff Snider about the current monetary system and everything occurring from the 1990s to the present, and what the shadows are telling us about the future, it becomes abundantly clear that we need a new monetary system.

-

The problem is that even if we were able to create the perfect monetary system, does society even want it?

-

Would they even use it?

-

What has happened since 2008?

Government power has increased massively. Just look at how much government control has increased in 2020 alone. Nowadays what we're seeing is a society that doesn't want to work.

They don't want to make the sacrifices required to build sustainable wealth in the first place.

And why would they?

When they can just sit home, buy Bitcoin, buy gold, or even buy commodities and watch the prices of those assets increase while they increase their standard of living, their purchasing power without having to even get out of bed.

We combine this with the venture capitalists funding not profitable businesses, but businesses that have a good story and make billions of dollars in the process and the entrepreneurs that they're funding.

Trust me. It's very difficult to build a business that has to turn a profit. It's much easier to sell a $20 bill for $10 and get rich in the process like DoorDash.

To take a deeper dive just think about the global elite. Guys like Klaus and Bigglesworth at the world economic forum, they are getting rich from the Cantillon effect.

-

Do they want anything to change?

-

Does Klaus want the riches and his G6 jet to go away?

-

Do the VCs want things to change?

-

Does the CEO of DoorDash?

How about the people that are sitting back…

Does buying Bitcoin, gold, commodities, real estate fill in the blank and getting rich instead of having to wake up at four o'clock in the morning and risk their entire life savings and sacrifice everything to try to produce goods and services that not only make themselves wealthy but society as a whole?

-

Do the governments want to go back and give up all of this power that they have been able to accumulate since 2008?

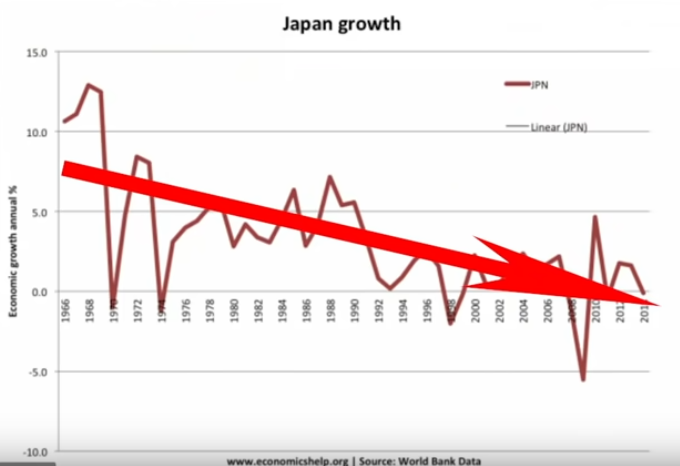

I don't think so. So if I had to use a little game theory and probabilities, I would say the probability is highest that we just continue to do the same thing we've done with the same broken monetary system. We have a gradual decline in society and our standard of living just like Rome or more recently, Japan.

The chart above illustrates how society will gradually decline, it won't change directions willingly. The only thing that will get it on a different path is if the change is forced upon it, unfortunately, that's usually through an economic collapse.