During March of this year, the stock market dropped 12% in only one week, and it was wildly volatile for a while. Sooner or later, the Fed had to stop the bleeding because, as you may know, the economy is propped up by the stock market.

If the stock market crashes, so will the economy. The question back then was: What will the Fed do if they can only use two tools?

In this article, I talk about the questions and answers we had when Covid-19 and the whole economic crisis started. I hope that by looking in retrospect, you're able to understand and better grasp our reality.

COVID-19 Reality

Will the Fed buy stocks?

That was the question we were asking during March of this year when the stock market crashed, and my answer was: Yes, and I'm going to explain why.

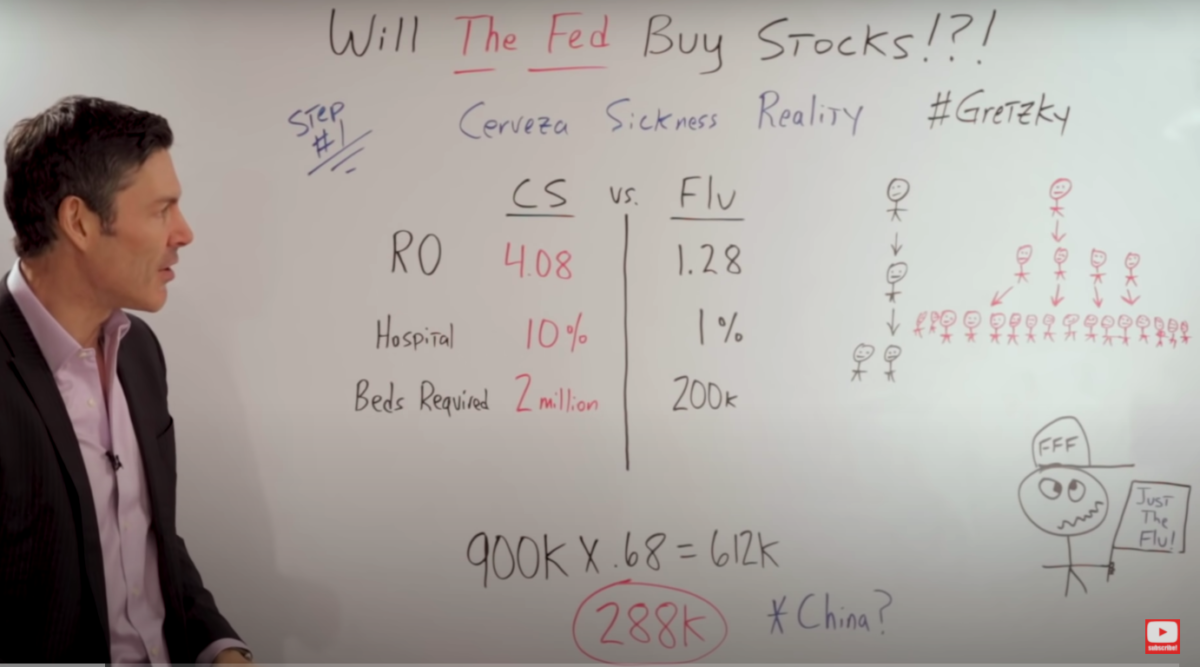

It started with the Coronavirus reality. Look at this whiteboard.

On the right, there's your friend and family member Fred who is always telling us, “Hey, this is just the flu,” but the difference between the people that get this and don't, is like a quote that I like to use from Wayne Gretzky.

I skate to where the puck is going to be, not where it has been.

-Wayne Gretzky.

The mistake your friend and family member Fred makes is he looks at the numbers as they are right now and ignores what the numbers will be in two, three-four weeks.

The data points you really need to focus on and encourage your friends to do the same are:

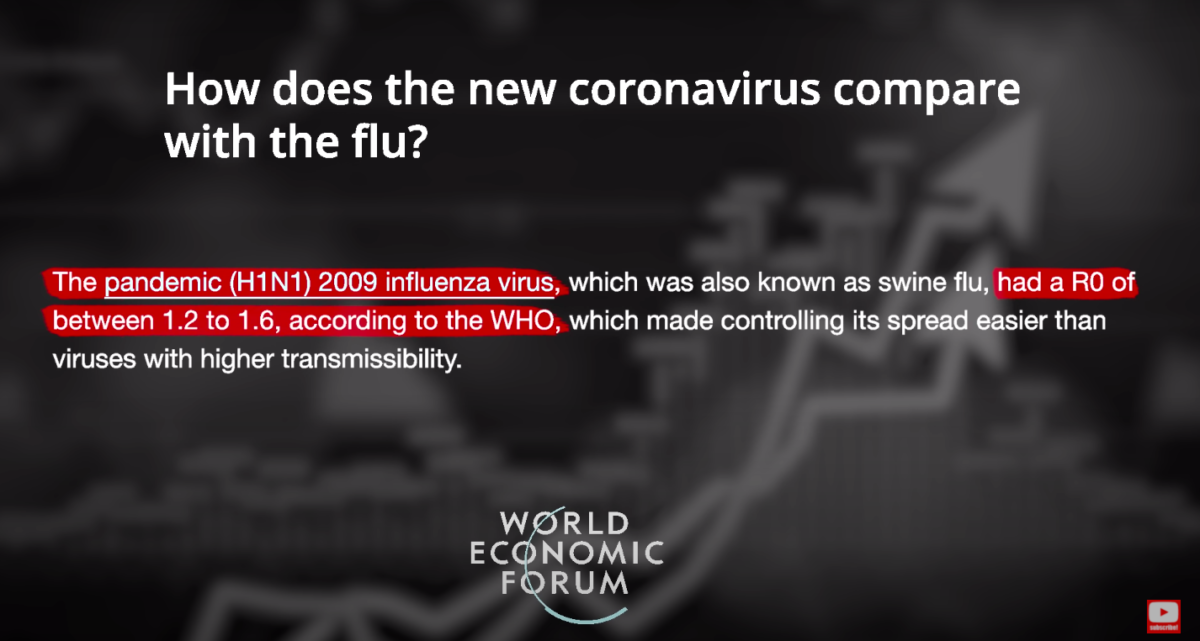

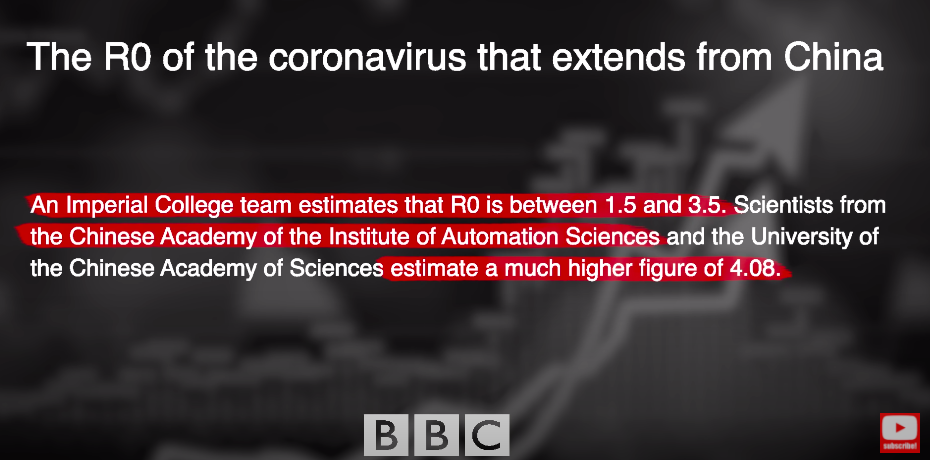

- The R0 value of COVID 19 (CS) is 4.08, for the flu, 1.28.

Why is this a big deal?

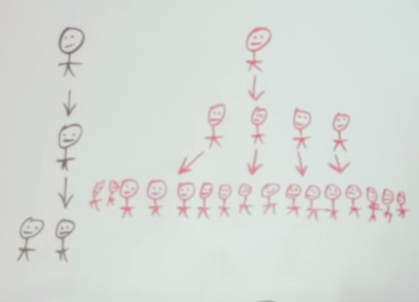

Look at my drawing, its very simple.

For every one person that has the flu, they spread it to 1.28 people. If you go through the cycle three times, maybe you have a total of four people that are infected.

If you have an R0 value of four, every one person spreads the virus to four more people. After the same three cycles, you now have 21 people infected.

You can see what happens after three to four weeks, two months, and how this grows exponentially.

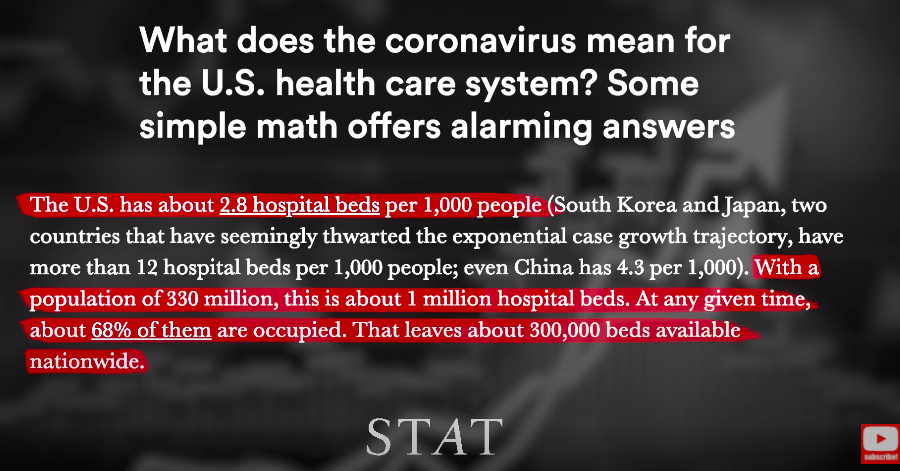

- The second key metric that's extremely important is how many people require hospital beds.

COVID 19 requires 10%, and that's being extremely conservative. The flu requires 1%.

For a moment, let's assume the exact same number of people get the COVID-19 as the flu. Generally, with the flu, 20 million a year.

The flu would require 200,000 hospital beds. COVID 19 would require two million hospital beds. Now you're starting to understand the problem.

How many hospital beds do we have in the United States? 900,000. The problem is 68% of them are typically in use with people who have other health care needs.

That leaves us with 288,000 beds available for two million people who need those beds because they've been infected with the COVID-19.

This is why if the death rate is low it doesn't really matter because if our hospital system gets overwhelmed, that death rate will go through the roof.

We also need to understand that this isn't something that happens in three days weeks, and boom, it's done.

It can last months, often the entire year, going down a little bit in the summer, but coming right back in the fall, and actually much worse in the fall than it was in the spring.

To understand this better, here is Joe Rogan podcast where he interviewed a specialist.

Michael Osterholm: When we call something an incubation period, we're talking about from the time you and I got exposed, meaning I was in a room breathing the air that somebody else who was infected with the virus was expelling out.

How long from that time period till the time period that you get sick? That's what we call the incubation period.

That's when case numbers can double or triple in every so many days. In this case, it's about four days.

You and I might get exposed to somebody who is totally asymptomatic, no symptoms, that virus would appear as not a very strong virus, but in fact, when it infects us, it could kill us.

We've seen cases of fatal disease that were exposed to people that had minor symptoms themselves.

Joe, we really have to get information out to the public. There is so much misinformation right now, and we're going to be in this for a while. This is not going to happen overnight and I worry.

I keep telling people we're handling this like it's a corona blizzard, two or three days and we're back to normal. This is a coronavirus winter.

We're going to have the next three to six months that are going to be like this.

(End of transcript)

The next thing your friend and family member Fred is probably saying is, “Look at China. They're doing all right, they had a big problem but the infection rate is really flattened out. It's smooth sailing from here.”

What he doesn't understand is:

- The numbers most likely aren't accurate. If you look at pollution reports or traffic reports, you'll see activity is still very low.

2. China took draconian measures, to say the least, to make sure this R0 value went from four all the way down to one, or hopefully lower.

Are we prepared to do that in the United States, and if we are, what that does to the economy?

Keep reading to find out.

COVID-19 Risk Factors For The US

I want to go back to the Gretzky quote, where he wants to look at where the puck is going to be, and not where it's been.

If we take that advice, we have to look at some of the risk factors nobody is talking about that are exclusive to the United States and could make this far worse in the US than we've seen it anywhere else in the world.

The risk factors we know of are old people, which have a really hard time with this, and smokers, since it's a respiratory infection.

But there's another third factor nobody's talking about and could have a huge impact on the Americans who actually get this virus. For more on that let's keep reading the Joe Rogan's interview.

Michael Osterholm: There are a series of risk factors that we worry about that if they overlay on this disease are going to cause bad outcomes

We happen to be right at ground zero for one of the major ones here in this country, and that's obesity.

We know that obesity is just like smoking, in terms of its ability to really cause severe life-threatening diseases, and 45% of our population today over the age of 45 in this country are obese or severely obese and it's men and women.

One of the concerns we have is that we're going to see more serious and life-threatening cases occur in our country because of a different set of risk factors than we saw in China.

(End of transcript)

The Economy Equals The Stock Market

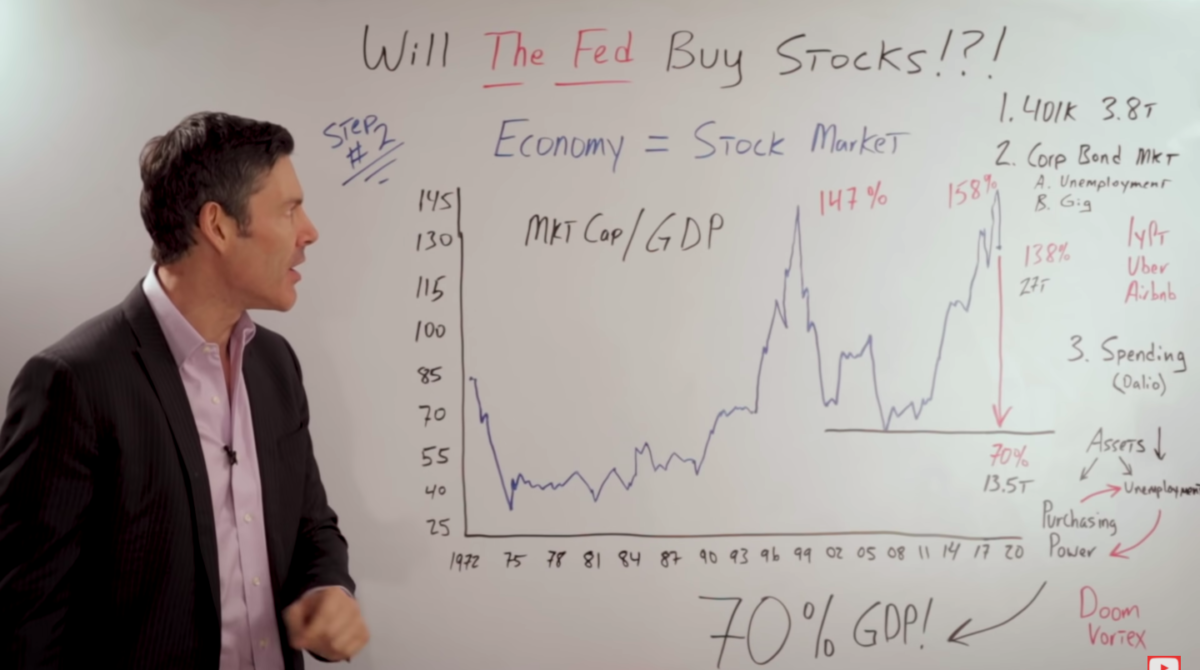

Now that we understand the severity of the virus, we have to realize the economy equals the stock market, whether we like it or not.

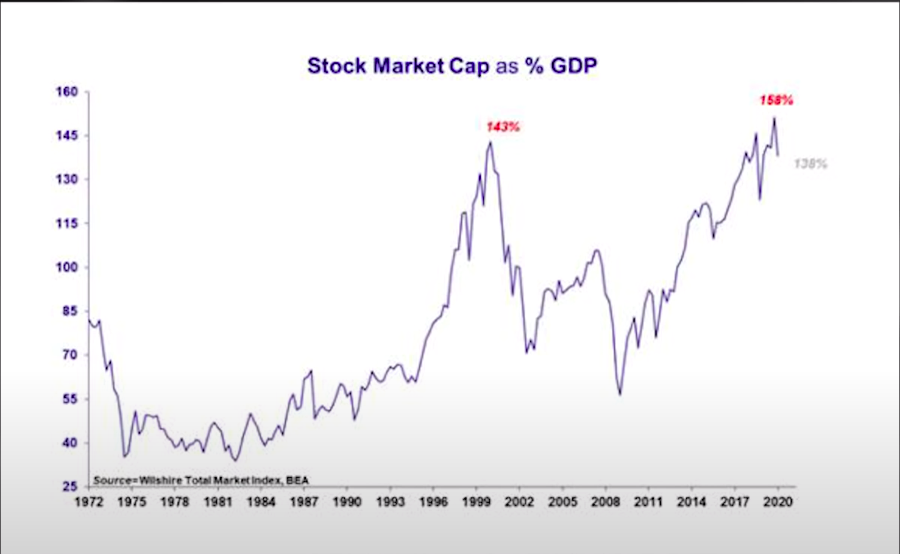

Here is a chart that goes back to 1970 until 2020. This is the market cap to GDP.

I also drew it on my whiteboard to make it more clear.

In the early '70s it crashed down and from that, till the 90s, it was really cheap maybe 55% of GDP at the most.

In the '90s, the internet boom and bubble took us all the way to 147% of GDP, but then it crashed down in 2002. After that, it went up a little bit with the housing bubble or GFC but it came right back down again.

Since then, with quantitative easing or money printing and artificially low interest rates it went back to an all-time high, 158% of GDP, but it has come down since.

As you know, during the last weeks of March, the market tanked but it was still at 138% of GDP. If it goes back down to the 2007 levels, which as most of you know is very possible, that takes us to 70% of GDP.

In other words, the market cap, or how much money people have in the stock market, how much paper wealth they think they have, goes from 27 trillion all the way down to 13.5 trillion.

Think of the amount of purchasing power that's lost by the stock market, going down to 2007 levels.

That's assuming it doesn't go down to 1981 levels, which would take us to 40% of GDP, far lower than we were even in 2007, '08, and '09.

Just in the 401ks, by March 2020 there was $3.8 trillion, but that's just talking about the asset side of the equation.

There's also the corporate bond market, which is far more important. If stock prices crash, the corporate bond market blows up.

If you don't know what I'm talking about, I discussed that extensively in one of my videos on Youtube. The corporate bond market blew up, and unemployment went through the roof.

Of course, that affected spending dramatically. Also, take into account the gig economy.

How many of your friends make ends meet by driving Lyft or Uber, or maybe renting out their place on Airbnb?

All these companies bleed money.

They go to the junk bond market and pay an X interest rate. If that bond market blows up, the interest rate they paid doubles, triples.

Most of those companies will go out of business and all your friends that make ends meet with the gig economy now have real, real problems.

It all goes back to Ray Dalio's explanation, how an economy works.

One man's spending is another man's income. Remember, spending drives the economy. This is because one person's spending is another person's income. Think about it.

-Ray Dalio

Ray Dalio does a great job of taking something extremely complex, like the economy, and simplifying it.

Although, I would point out that there is no spending without producing, and you guys know that from watching my videos, but that's a completely different topic.

The bottom line, if we have a stock market collapse, we go into a doom vortex. Lower asset prices mean higher unemployment and lower purchasing power.

The lower the purchasing power goes, the more unemployment we have. The more unemployment we have, of course, the lower the purchasing power.

This is in an economy where according to the balance 70% of GDP is consumer spending. This is why I say the economy equals the stock market.

The Fed Doesn't Have Other Choice But To Buy

We know the severity of the COVID-19, and now in 2020 the stock market equals the economy, but we still haven't answered an important question.

Why will the Fed buy stocks?

Because they don't have a choice.

To explain myself, I made the following example.

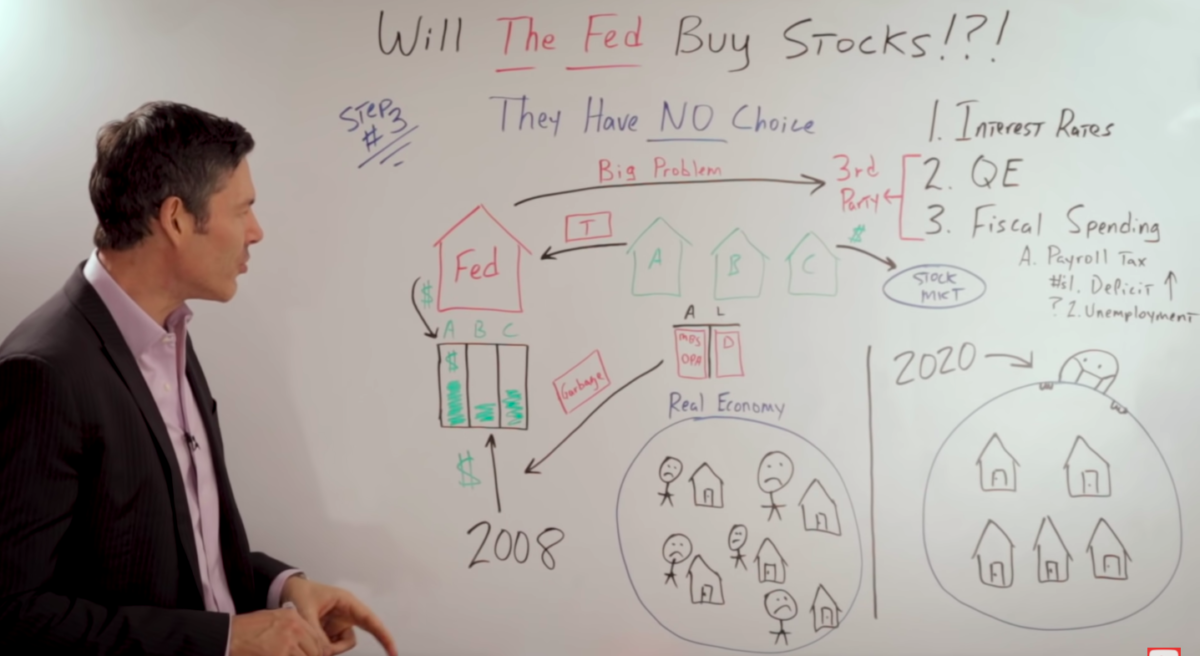

The Fed has two tools at their disposal, interest rates, and quantitative easing or money printing.

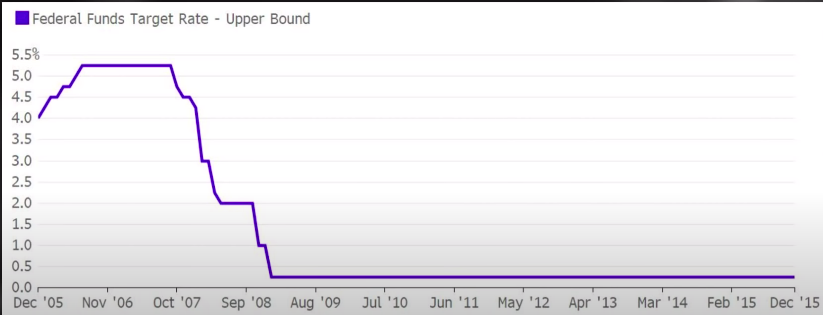

The market was in free fall and the Fed came right in and said, “Whoa, we have to stop the carnage,” and did an unexpected rate cut of 50 basis points.

The market looked at the Fed and said, “Yeah, homie don't play that.” They puked it right back up, and the market still went down 700 points.

Let's remember, the Fed by March of 2020 was at 1%, so they only had a hundred basis points left before they get to the zero bound. So we can cross interest rates off the list.

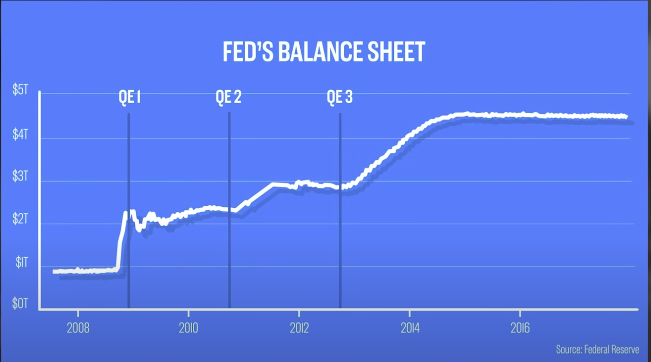

Then, Steve Liesman came in and said, “Whoa, wait a minute. We can just do quantitative easing. That's worked in the past. The Fed they're all geniuses with PhDs, we have nothing to worry about.”

Really?

Let's explore how quantitative easing actually works to see if it would have been a viable solution.

Look at the last whiteboard again.

The Fed goes to all the primary dealers(A, B, C) and the banks under their umbrella, buy treasuries, T-Bills.

To pay for the “assets”, they print up all the funny money and put it into the reserve accounts the banks have with the Fed.

In order to get the reserves into the financial economy to buy stocks, it requires the banks to make a decision.

Either they can buy those shares themselves, or they can use the reserves to lend to hedge funds and other financial institutions that will then take those newly formed deposits and buy shares, taking the stock market up.

But wait, timeout! It is important to say we know the Fed understands the problem because they were already talking about buying stocks. Look at the following interview.

Eric Rosengren had earlier said that the Fed needs to think about using additional tools. Those tools could include, for example, a wider array of asset purchases beyond just treasuries and agency-backed securities.

– Breaking news-CNBC

The point is, the Fed doesn't have a magical light switch they can turn on and off directly impacting the stock market.

Now, what about fiscal spending?

We've all heard from the administration, and Trump himself say “This is a panacea. They're going to handle the problem.”

They've projected 8.3 billion dollars in additional spending, who knows where that's going, and a payroll tax cut up to one year, from what heard.

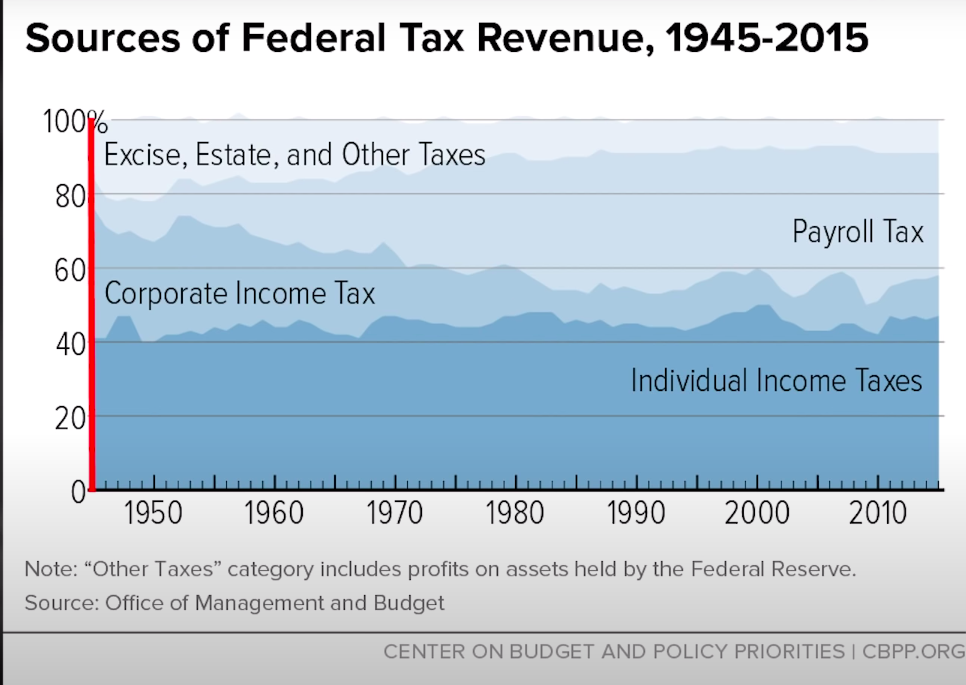

What they're not thinking through is the deficit and unemployment. To explore the additional problems we would have with the deficit if they eliminated the payroll tax, look at this chart.

This are the sources of federal tax revenue going back to 1945 to 2015. It started around 5%, 10% at the most, of the entire tax revenue pie. Moving on to the modern-day, it's over 30% of tax receipts.

If we were to eliminate the payroll tax, our trillion-dollar deficit would explode to well over $2 trillion.

But, there is one more thing I'd like to point out. The total tax receipts, as a percentage generated from individual income taxes, stayed very consistent, regardless of whether the top marginal rate is 90%, like it was in the '50s, or 25%, like it was in the late '80s.

The biggest thing affecting income taxes and how much is paid is not the highest marginal rate, but it's the direction of the stock market.

Also, there's the additional unemployment.

-

How is a payroll tax cut going to increase the spending of someone who doesn't have a job?

-

Or a business that's gone bankrupt because the stock market's crashed, the corporate bond market's blown up and decimated the real economy?

The takeaway for the Fed and the government is anything they do requires a third party to take action. They don't have total control.

You may be saying to yourself, “Yeah, George, I get it. That just sounds like libertarian crazy talk. I remember back in 2008, the Fed came and dropped interest rates, did quantitative easing. The government was bold in their approach with their fiscal spending tarp and bailouts. They saved the day. Why can't they do that again?”

What you're not understanding is how significantly different the problem is in 2020 than it was in 2008.

The catalyst to the whole financial system imploding back then was the asset side of the bank's balance sheet had all this garbage.

You remember, mortgage-backed securities, and of course our favorite, OPA, oceanfront property in Arizona.

The Fed was able to paper over this problem, put a bandaid over it, and kick that can further down the road simply by printing up funny money.

Put it into the reserve accounts of the banks, and taking that garbage off of their balance sheet. The banks were then solvent again and could move forward.

The damage to the real economy was people had less home equity, but they were still traveling, going to the mall, restaurants, going to their kid's soccer games.

Although they were doing it less, it didn't drop down to zero.

The big difference is back 2008, although people were obviously pissed because they lost a ton of home equity, at least they were outside of their house doing things.

What we might see in the next couple of months in the United States is people aren't even outside. They've locked themselves inside their house, wearing a face mask, eating canned goods, doing everything they can to avoid getting Coronavirus.

This is a completely different economic animal, and it's something the Fed nor the government are prepared to handle.

No amount of quantitative easing, interest rate drops, money printing, or government spending will handle this type of problem.

-

How are you going to get people to go out and buy stocks just because you do quantitative easing or give them a little payroll tax cut?

-

How are you going to force the banks to take these reserves and buy the stock market just because you drop interest rates?

You can't do it.

This puts the Fed into a position that instead of being the lender of last resort, they are the buyer of last resort.

That's why I'm confident that if we get into a China or even an Italy-type situation in the United States, you're going to see the Fed come in and buy the stock market.