Chris Cole Of Artemis Capitalist

“We're all volatility traders whether we realize it or not” – Chris Cole

What does it mean to be a volatility trader? What does it mean to be short volatility? And where does your portfolio fit in?

According to Chris Cole, if you stop looking at assets for what they are…that is, you remove their descriptions…then you can quickly see whether you're prepared for what's coming or about to get clobbered.

For example, it doesn't really matter what you call your portfolio…whether it's a 60/40 risk portfolio, or something more sophisticated…

When you strip away the titles, your portfolio is either:

- short – growth and stability

- long – growth and stability.

If you are short volatility, then you are long growth and stability. If you are long volatility (long vol) then you feel growth will slow down and things will get more unstable in the world.

If you are a Rebel Capitalist Pro member then you know we've been pounding the table that inflation is here, it's growing, and it's going to get uglier by the day. We are long vol.

Resident Rebel Capitalist Pro, Chris MacIntosh, claims we are heading into a commodities supercycle. Lyn Alden is bullish inflation, and Chris Cole is bullish inflation but it could be transitory. So he's bullish inflation (transitory/short term) and bullish deflation (long term).

Are you positioned accordingly?

Most people are still dangerously positioned for growth and stability

We have entered a high volatility environment and investors are behaving as though the next 40 years will act like the last 40 years. They are long GDP and the expectation of stability, which couldn't be further from the truth.

Most people think they have a diversified portfolio but their usually 95% short long vol.

All of these portfolios will underperform. We have entered into an inflationary/stagflationary environment. We are there. Now.

Are you Long vol?

Long Vol assets make money during periods of change. That change could be anything from market crashes to defaulting on debt. It doesn't matter. Periods like March 2020 or the mid-late 1970s where stagflation was a problem did well for long vol assets.

Most people are not long vol but believe they are.

The Dragon Portfolio

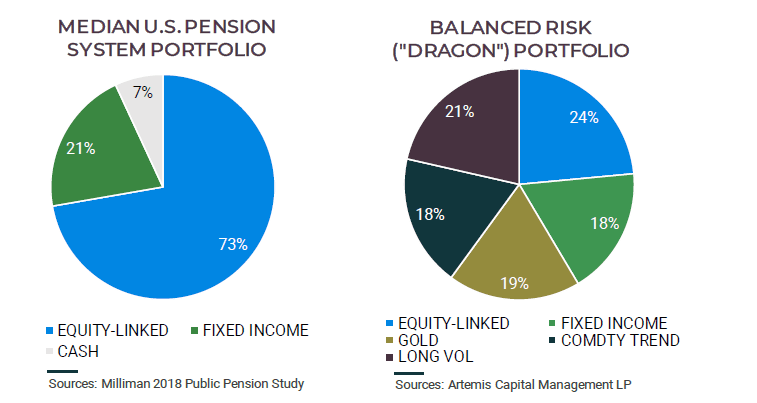

The Dragon portfolio was invented by Chris Cole, which takes an ‘all weather' approach. Chris and his team meticulously backtested 100 years' worth of market data, then built a portfolio that could profit, regardless of the conditions.

George has covered the dragon portfolio extensively. Patrick Ceresna and George went as far as to create a dragon portfolio workshop that teaches investors how to manage the long vol and commodities trend-following portion of a dragon portfolio through options.

How to go long Volatility

The Dragon Portfolio is a great portfolio but it's not everything. You can still use George's 10/80/10 and you'll still do just fine.

But the big takeaway is that it's 2021 and the pandemic has thrust our reckless governments and central banks into damage control mode. Their Keynesian Ponzi has run its course. We are at the tail end of a long and tiring debt cycle where financial creativity and phony narratives drive markets.

Volatility and instability are here! You need to be long vol.

If you feel like you are at the mercy of the fed and government and you're not sure how to invest your money for the volatile and inflationary environment that we have entered into, then stop reading and go sign up for Rebel Capitalist Pro immediately.

You need to follow Lyn Alden and Chris MacIntosh each week inside Rebel Capitalist Pro.

Both Lyn and Chris share stock picks, provide macro commentary and answer investor questions inside Rebel Capitalist Pro. It's the best way to grow your wealth while learning how to spot the asymmetric investments that can only come from inefficient and reckless governments and central bank partners in crime.

Having Chris MacIntosh and Lyn Alden guide your investment strategy is long vol!

It's either sink or swim. Big governments worry about their budgets and debts. With the help of their central bank counterparts, they'll manipulate markets to stave off default at any cost to you!