Is the United States headed for a Great Depression 2.0?

This article is part of a series that consists of two portions, this is part two. If you haven't read part 1, make sure you do here!

A huge warning to anyone who has money in a 401(k), an IRA with a robo advisor, a financial advisor, or if you just have money in the stock market.

I'm going to reveal some shocking insights and intel you can't afford to miss. I will talk about Fisher's equation, negative interest rates, and the Federal Reserve Act.

For more content that'll help you build wealth and thrive in a world of out of control central banks and big governments, JOIN our Daily Newsletter for FREE!

Fisher's Equation

Is the United States headed for a Great Depression 2.0?

First, let's define what the Fisher Equation is.

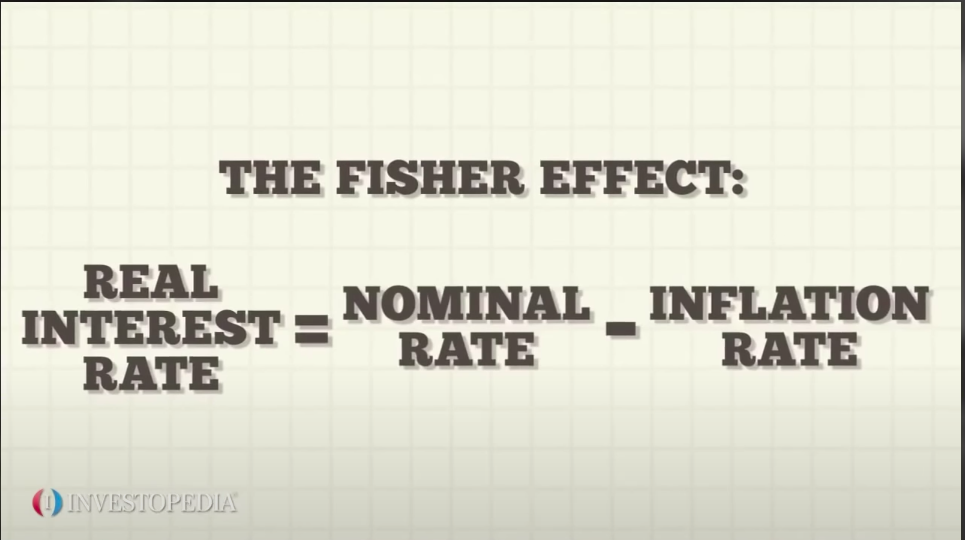

The Fisher Effect is an economic theory created by economist Irving Fisher that describes the relationship between inflation and both real and nominal interest rates. The Fisher Effect states that the real interest rates equal the nominal interest rates minus the expected inflation rate. Therefore, real interest rates fall as inflation increases unless nominal rates increase at the same rate as inflation.

– Investopedia

Pretty straight forward stuff. But it's imperative you understand this thoroughly to connect the dots in the rest of this article. To make sure we're all on the same page, here is an extra explanation.

The Fisher Effect states that the real interest rate equals the nominal interest rate minus the expected inflation rate.

Therefore, real interest rates fall as inflation increases, unless nominal rates increase at the same rate as inflation. It's important that the real interest rate be positive so that a lender or investor knows he's beating inflation.

If the real interest rate is less than zero, then the rate being charged on a loan or paid on a savings account is not beating inflation.

The lender or saver would be losing money from a purchasing power perspective.

Take the following example into account.

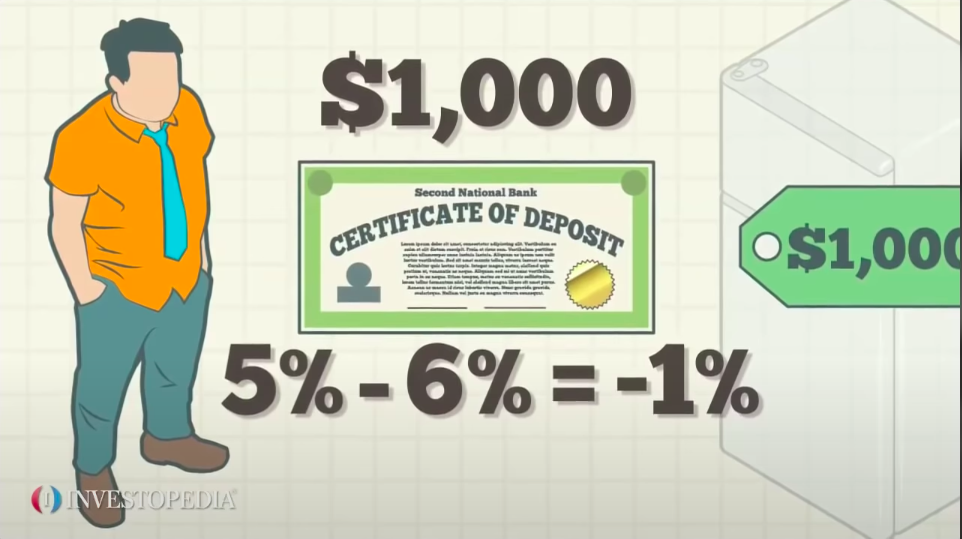

Fred, the guy with the orange shirt has $1,000 and wants to buy a refrigerator that costs that exact amount, but he doesn't need the refrigerator until next year.

Fred places the $1,000 in his bank in a one year certificate of deposit paying 5% interest. This 5% is the nominal rate.

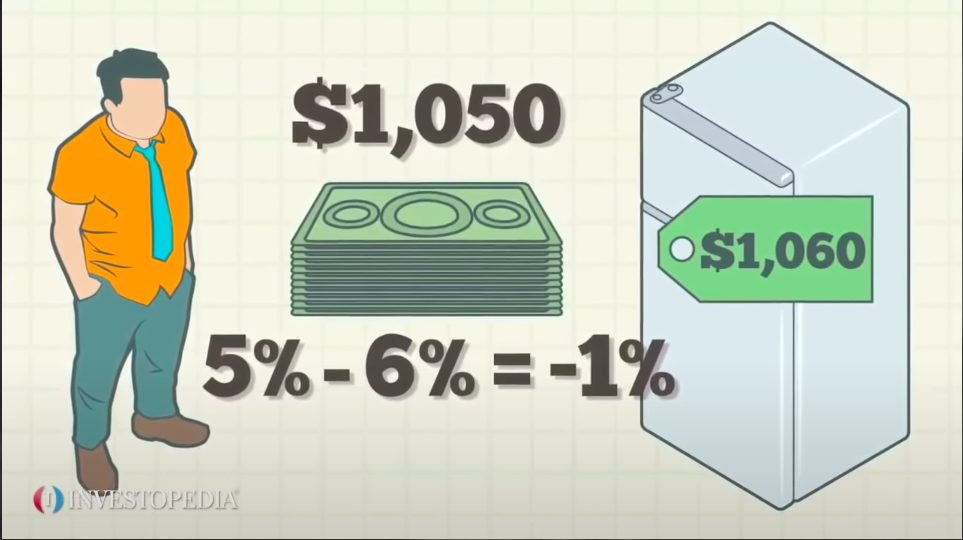

If inflation is 6%, then using Fisher's formula the real rate of interest on the CD is -1%. At the end of the CDs charm, Fred receives $1,000 plus $50 interest.

But because of the 6% inflation, the price of the refrigerator is now $1,060.

Fred's $1,050 is now not enough to buy the refrigerator. From a purchasing power perspective, Fred actually lost money over the one year term. Real rates plus inflation equals nominal interest rates.

Another way to look at it that's a little easier, and this is probably how you guys at home view it, is nominal interest rates minus the inflation rate equal real interest rates.

But I'd like to add another metric into the formula because this isn't necessarily the way that the private sector lends money. They add something called a risk premium, which makes sense.

If a bank's giving a loan for a car, house, or a business, they're going to take into consideration the risk of not only the individual borrower and the asset they're lending against, but also the economic environment.

So, the real rates plus the inflation rate, plus a risk premium equals nominal interest rates in the real economy. (R+I+RP= N)

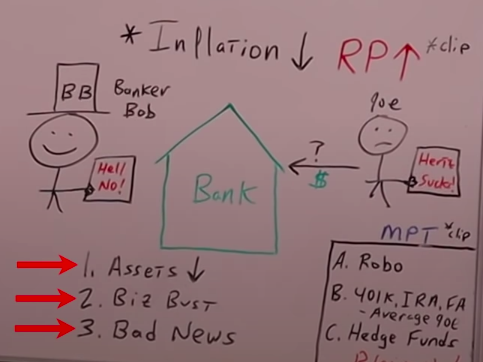

What we often see is when inflation goes down, especially if we get into deflation, the risk premium goes up.

This makes a lot of sense.

As an example look at this next whiteboard.

You can see the Average Joe on the right and who hates Hertz car rental. Obviously he's got a sign that says, “Hertz sucks.” He thinks they should have gone into chapter seven bankruptcy, not just chapter 11.

He goes to his good buddy Banker Bob. He's known him since third grade because they played high school football together. He says, “Bob, I want to start my own car rental business to revolutionize the industry.”

Banker Bob says “Hell No”. Bob looks around at the economic environment and he sees deflation, asset prices going down, businesses going bust and every time he turns on the TV, it's bad economic news.

So, he says, “Joe, I love you like a brother buddy. But I can't do the loan right now unless I charge you a huge interest rate to compensate for my additional risk because the economy is so bad right now.”

That is the risk premium and why it typically goes up if we go into deflation.

Keep in mind, the commercial banking system is usually responsible for creating the majority of the M2 money supply.

If there are fewer loans that are being created, the money supply could be contracting or at very least not growing at the same pace.

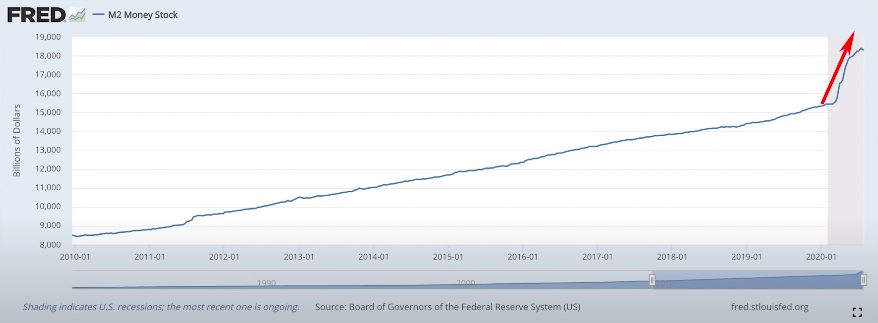

You may be saying to yourself, “Yeah, George, I get what you're saying. But if I look at a chart of money supply right now, it's going through the roof so I shouldn't be worrying about deflation at all.”

I understand your argument, but what I would encourage you to do is to keep reading. I'm going to give you a lot of information that'll really make you think.

We need to get to the doom vortex. It is definitely related, so to bridge this gap, read what Dr. Lacy Hunt has to say.

Dr. Lacy Hunt:

If the Fed holds the overnight rate and the inflation rate goes negative, at that point in time, the real treasury rates will start rising.

We'll be stuck there. We will be hunkered down close to, so if we still go to 2% negative, the real treasury rate will start rising.

Now, remember that the Fisher Equation has a counterpart for the corporate and the private yields and that is the private yields are equal to the real yield plus inflationary expectation plus the risk premium.

All right, if we go into deflation, the risk premium is going up. That's what's happened in Japan. That's what happened during the Great Depression.

At the point in time you go into a negative inflation rate, the real treasury rates rise and the private borrowing rates will rise even more because in a deflationary environment, pricing power will evaporate and the risk premium will rise.

Well, if you're working with a general equilibrium model, you're not going to achieve your equilibrium. You'll remain in a perpetual downward spiral.

(End of transcript)

We've all seen Jerome Powell come out on television and say, “I am not going to take rates negative.”

That's for the BOJ or the ECB. But right here in the good old United States, we're going to have positive interest rates. At the very least we'll keep them pegged right at zero.

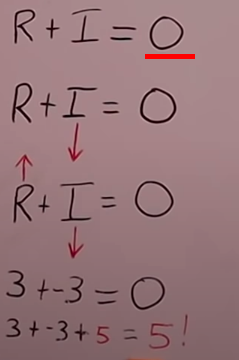

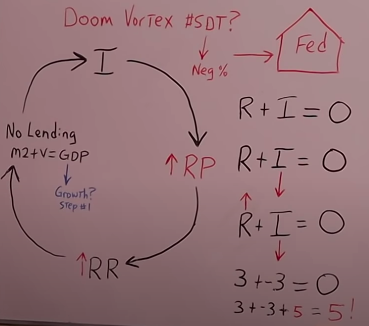

But Dr. Lacy Hunt points out the dilemma. It goes right back to the Fisher Equation. Look at the following image.

If you peg the underlined number or the nominal interest rates, and real rates plus inflation equal this number, if inflation goes down, real rates have to go up.

As an example, look at the bottom where, if the nominal rate is zero and inflation or deflation goes to negative three, the real rate of interest has to be a positive three.

Then we add on the risk premium I mentioned earlier, and if we have a negative inflation rate of three, we have to have a positive real rate of three, but then a risk premium of five.

That would make interest rates in the real economy be at 5%. When we have a 3% deflation rate, because the Fed is pegging the nominal rate at zero, this takes us straight into a doom vortex.

If you're asking yourself if it's stiff drink time right now, it's actually not.

You didn't see that one coming, did you?

We're going to get the stiff drink after we go over this doom vortex.

The inflation (I) rate goes down into deflation.

This makes the risk premium (RP) go up.

Real rates(RR) go up, and this creates less lending in the real economy and lower M2 money supply.

But let's not forget that M2 money supply plus velocity, how fast the money circulates in the economy, equals nominal GDP.

This takes us right back to what I explained before where the Keynesians believe the best solution is to grow our way out.

How are we going to grow our way out of a debt problem if we have an equation where velocity is decreasing?

The M2 money supply is potentially decreasing or not growing at the same rate that velocity is decreasing. That means negative nominal GDP. It exacerbates the debt problem we already have.

This makes inflation go down even further, which takes us right back into the doom vortex and this feedback loop that goes lower and lower.

Negative Interest Rates Could Make The Entire Economy Implode

I'm sure a lot of you are saying to yourself right now, “Well, George, in that case, Jerome Powell is just going to have to take interest rates negative. There's no other way around it.”

But there's still a huge problem. This takes us right into what you should be worried about if you have a 401(k), IRA, financial advisor, robo advisor, or any type of money in stocks or bonds.

To dive into this even further, here is a piece of the podcast The End Game, but this time its episode three with Mike Green.

Mike Green:

If the Fed cuts interest rates anytime, and risk assets take a tumble, what they're actually doing is they're creating conditions for bonds to have a negative correlation with risk assets.

Modern portfolio theory tells me that if I have an asset that has a negative correlation with risk assets, it has to, by definition, yield less than the risk-free rate.

Otherwise, the solution set to modern portfolio theory moves from a backpack problem, 60/40 portfolios, till the optimal becomes a levered portfolio and a levered portfolio by definition expands the demand for financial assets greater than the current level.

You hear people talk about risk parity as offering protection.

What they're really saying is that the 10-year bond has similar characteristics to it and I'm being paid to own that put because it has a positive yield.

If I hold it to maturity, I can't lose money. Well, if that exists, then the optimal portfolio becomes a levered portfolio.

Now, where does that end?

It ends when that asset no longer offers a positive yield. So, it doesn't matter what is happening to Boone's and JGBs.

The minute 10-year bonds in the United States offer a negative yield or at zero, then you cease to actually have that positive care input, and those portfolios have to collapse.

Now, I don't know if that's the end game, but I think that's the end game.

(End of transcript)

If Mike Green is correct, the Fed has painted themselves into a corner and there's no way out.

If they keep rates pegged at zero, the entire economy implodes in on itself.

The whole house of cards comes crashing down in a deflationary bust if they allow interest rates to go negative, and then almost every American's portfolio blows up.

This, according to Mike Green, could actually be the end game.

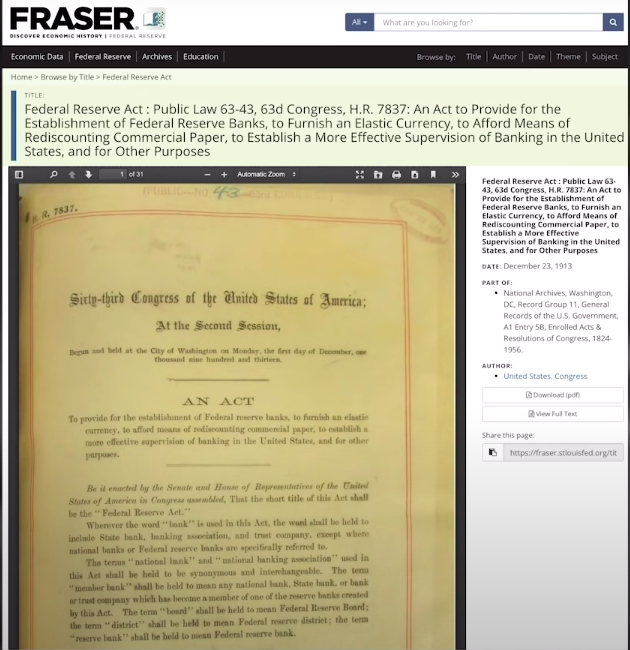

The Federal Reserve Act

This document, the Federal Reserve Act is the key to answering the main question of the series: “Is the United States headed for a Great Depression 2.0?”

You always hear people talking about this document, but you never see it. So, I'll change that right now.

Here it is in all of its glory.

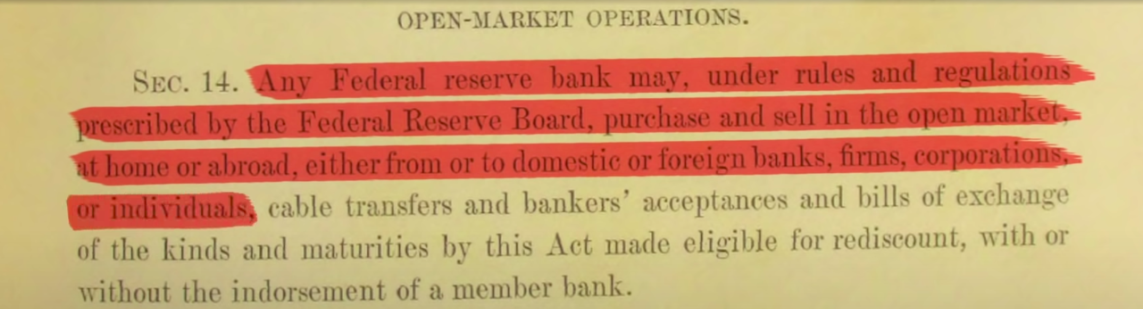

Look at page 17, section 14, where it talks about the open market operation. This is what the Fed is allowed to do.

“Any reserve bank may under rules and regulation prescribed by the Federal Reserve Board, purchase and sell in the open market at home or abroad, either from or to domestic or foreign banks, firms, corporations, or individuals.”

They can buy and sell to whomever. But what can they buy and sell? Let's go to section B.

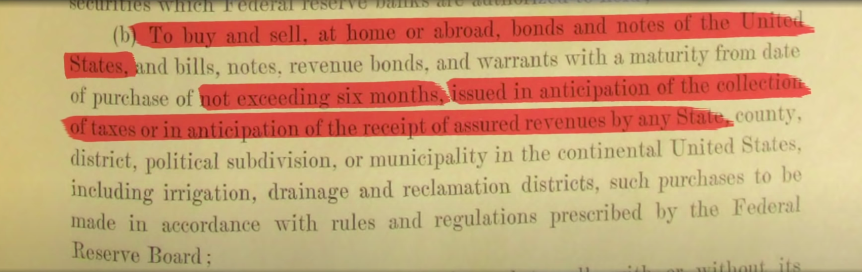

They're allowed: “To buy and sell, at home or abroad, bonds and notes of the United States.”

That's it, nothing more.

I'd also like to point out that these bonds or notes can't exceed six months. I assume this is the original Federal Reserve Act.

It's been amended because obviously they're buying the long end of the yield curve, and they're buying treasuries in addition to treasury bills.

It further reads… and I think this is really interesting: “Issued in anticipation of the collection of taxes or in anticipation of the receipt of assured revenues by any state.”

How much of the debt on the Fed's balance sheet does the federal government actually believe they'll pay back with taxes and not default through inflation?

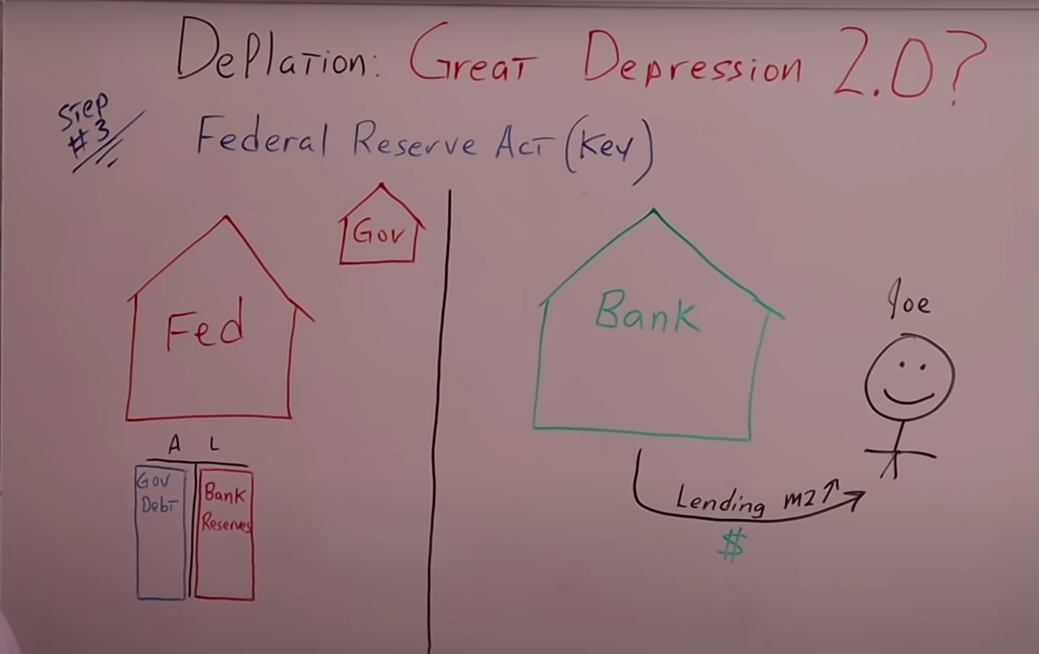

The Fed is only allowed to buy government debt and there's a big reason for this. Look at this example.

If the Fed is just buying debt from a primary dealer bank, the only thing it's doing is creating additional liabilities for itself, additional bank reserves.

It prints up funny money, puts it into the reserve account of XYZ primary dealer bank, and then the government debt goes onto the Fed's balance sheet. It's just creating liabilities for itself.

That's it. Nothing more. It's really important you understand that. I've gone over it in a few articles, if you haven't checked them out, make sure you do.

The reason the Federal Reserve Act reads the way it does is to restrict the Fed from doing this only. Nothing more. Because if it goes from creating bank reserves to actually creating additional M2 money supply, then it's a complete game-changer. It gives the government and the Fed complete control over the M2 money supply and potentially velocity as well.

The people that designed the Federal Reserve Act, whether they had malicious intent or not, they never intended that.

For the Fed to be able to take these bank reserves or liabilities and turn them into legal tender, or currency units that were circulating within the real economy, in this case, the right side of the board.

That's the job of the commercial banking system.

They used the reserves as a backstop to create additional loans going to people like the Average Joe, to start businesses, buy cars, buy houses and increase the M2 money supply.

When Joe pays the loan back, the M2 money supply decreases.

The government and the Fed should have nothing to do with this process. It should be completely market-driven.

But, Dr. Hunt points out, as you see on the whiteboard, there is a line and it divides deflation and hyperinflation. Those are his words, not mine.

He believes that if the Fed starts spending money directly into the economy, puts us on the path to hyperinflation.

Let's say by sending stimulus checks to average Joe and Jane out there, because of the COVID-19, or if by monetizing a large percentage of the government debt, which they pretty much already are

Why, you may be asking yourself? Because of something called Gresham's Law.

This states that bad money always chases out good money.

Let me give you an example of that. Going back to Roman times, when they used gold coins, governments that got too heavily indebted would try to make those coins out of different materials.

Such as copper or nickel and let's just say they painted them, or usually, it was silver coins.

Then they painted it gold, like a Chuck E. Cheese token. No one wants the coins that aren't real gold. Dr. Lacy Hunt explained this in his own words.

Dr. Lacy Hunt: There are folks who would like to make the Fed's liabilities legal tender. In other words, have the Fed directly pay the bills. Make them a medium of exchange.

If you move to the point where you use the Federal Reserve's liabilities for spending either to absorb losses for others or to purchase goods or services, the ultimate outcome would be inflation.

I don't think we're on that path yet, but we might be. There is that risk.

If that happens, either by rewriting the federal reserve act or by saying they need to do it for exigent circumstances, the whole picture would change and in very short order, you would again get very rapid inflation.

Gresham's Law would take effect. Bad money would chase out the good.

Money must have value if it does not have value, then you get very rapid inflation. We had three great empires that became extremely over-indebted. Mesopotamian, Roman, and Bourbon.

They basically could not obtain additional loans for money lenders or rudimentary banking that existed. What did they do? They issued a worthless metallic coin.

Having the Fed's liabilities legal tender would be the same equivalent. That would change the whole system.

(End of transcript)

As the government or the Fed creates more of these phony gold coins and gets them circulating in the economy, fewer real gold coins circulate.

Because average Joes and smart people like you and I would take those gold coins and they'd collect them because they know they have real value.

How does this apply to what we're talking about?

As the Fed and the government create more M2 money supply, once it dawns on the average Joe and Jane that the value of their Fiat currency is plummeting and will continue to go down, they're going to get rid of that Fiat currency as fast as they can.

There's going to be more of it circulating and they're going to buy anything that they can that has value. Such as commodities, gold, silver.

It's the bad money, the Fiat money they're printing out of thin air, chasing out the good money, commodities, gold, and silver, things that actually have intrinsic value.

I'm going to have you answer the question yourself.

Do you believe that the Fed and the government will abide by the Federal Reserve Act moving forward?

If so, then you think we're headed for a Great Depression 2.0.

Or do you think they're going to completely ignore the Federal Reserve Act and just figure out a way to circumvent the entire system and increase M2 money supply themselves?

Through infrastructure, spending, stimulus checks, you name it. If you're in that camp, then you have to believe we're headed towards stagflation, if not hyperinflation. I'll let you be the judge.