Is money printing set to explode? The short answer is yes. I don't even think most people understand the magnitude of how much it's going to explode.

But, what I find is most people really don't understand what money printing actually is. They really don't even understand loans.

So before you can figure out how money printing is going to affect your financial future, you have to understand how loans work.

I'll explain it to you in seven simple steps in the form of a series of articles named: Is money printing set to explode? This is part 2 of 7.

How Loans Work

How do bank loans actually work?

This is the next piece of the puzzle we have to think through.

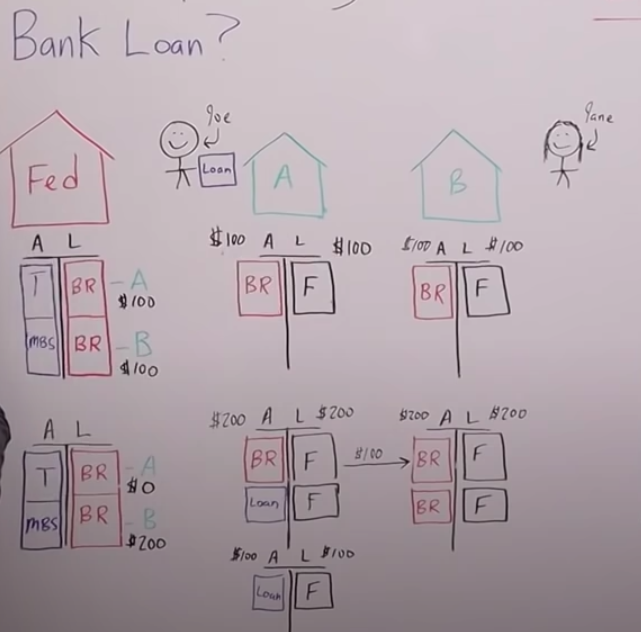

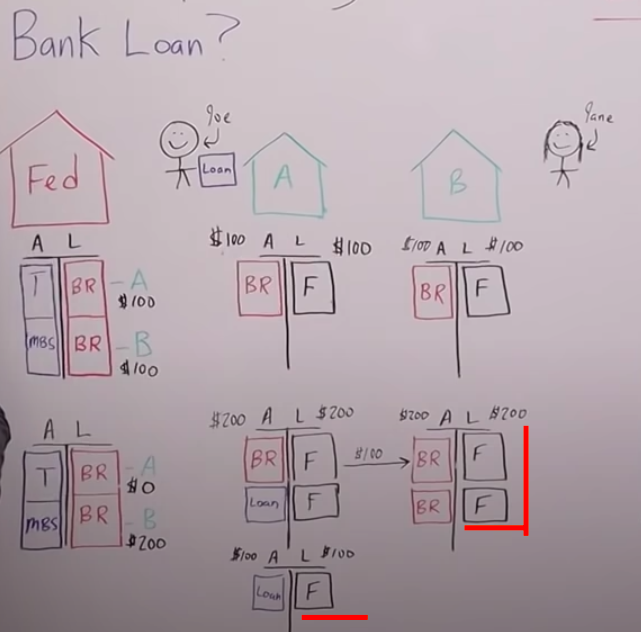

On my whiteboard, I drew the Fed, Bank A, and Bank B, the same characters I have used in this series of articles. This time no more Home Depot. Only the average Joe and Jane.

Let's say Joe is buying something from Jane, maybe a car. Imagine the car costs $100. But Joe doesn't have the $100 dollars right now. He might have 100 Fugazis.

I call it Fugazi, like Matthew McConaughey in that movie, Wolf of Wall Street. Here is a transcript for you to understands what I'm talking about.

Matthew McConaughey: It's all Fugazi. You know what Fugazi is?

Leonardo Dicaprio: No, Fugazi, it's fake.

Matthew McConaughey: Yeah, Fugazi, Fugazi. It's a waze, it's a woozy. It's fairy dust. It doesn't exist. It's never landed. It doesn't matter. It's not on the elemental chart. It's not real.

(End Of Transcript)

He might have 100 Fugazis in his account. But he has to pay rent, or buy food. This means he needs an extra 100 Fugazis, an extra 100 IOUs from the bank. So he goes down to the bank, asks for the loan, and he gets it.

-

How does this affect the balance sheets?

-

What goes on here?

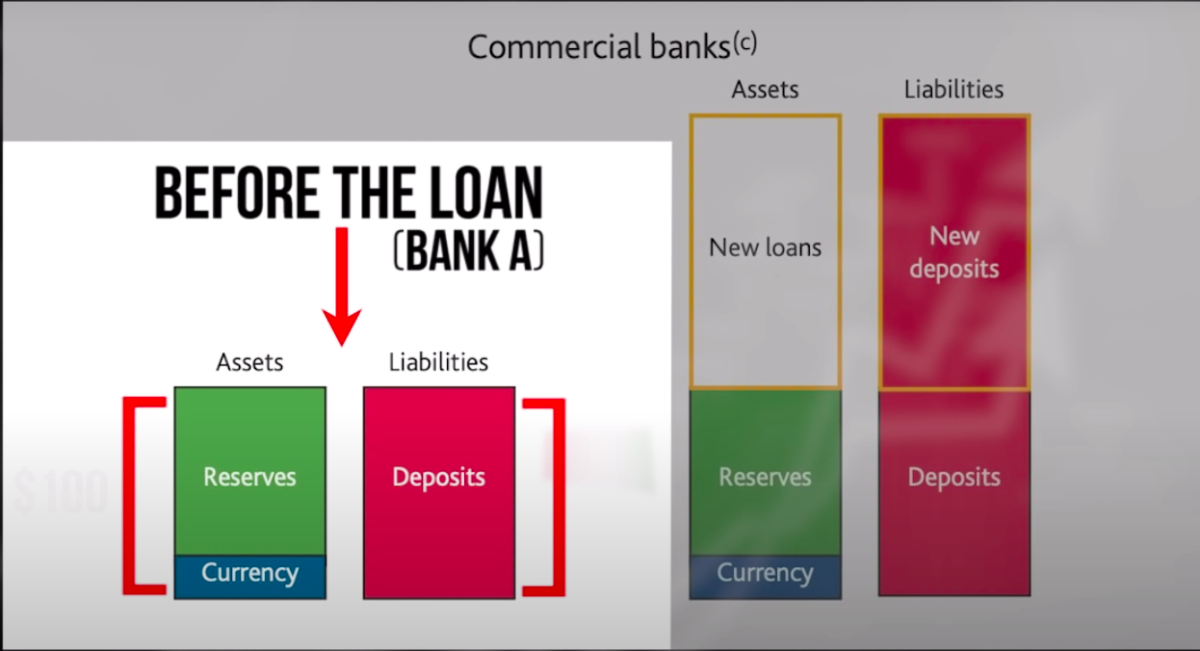

Bank A started with $100 in bank reserves and $100 in IOUs to Joe.

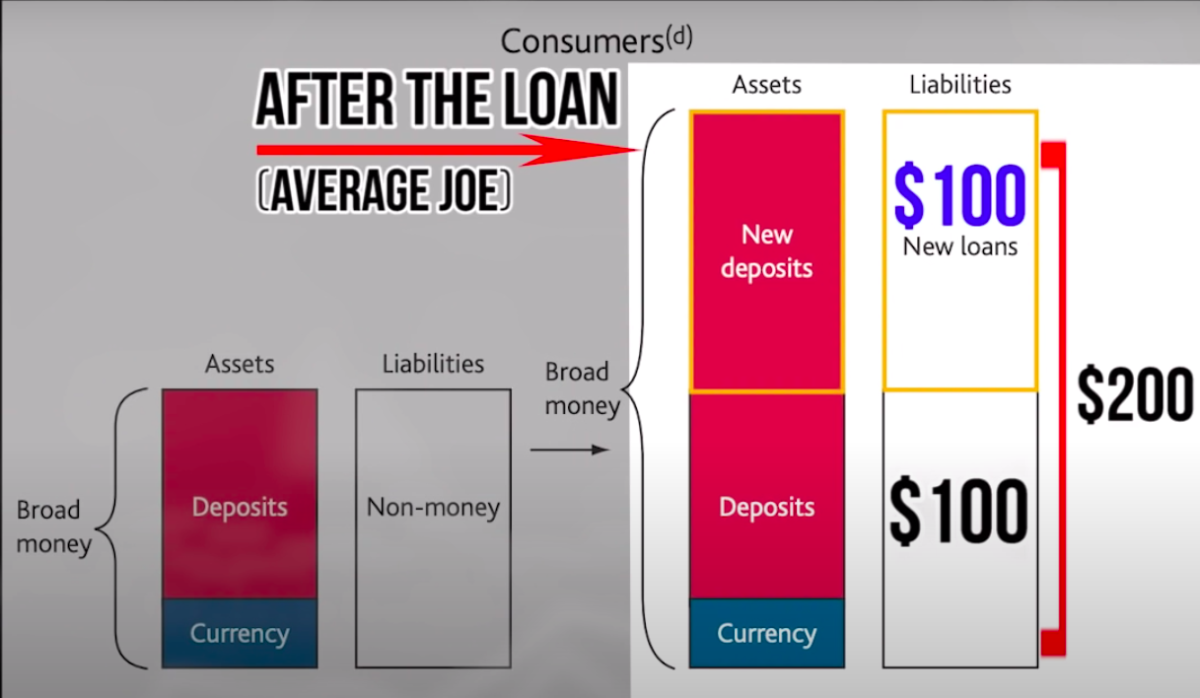

After the loan was done, Joe had $200 in IOUs from the bank, $100 that he had originally, and $100 extra dollars or Fugazis, in this case, that he got as a result of the loan.

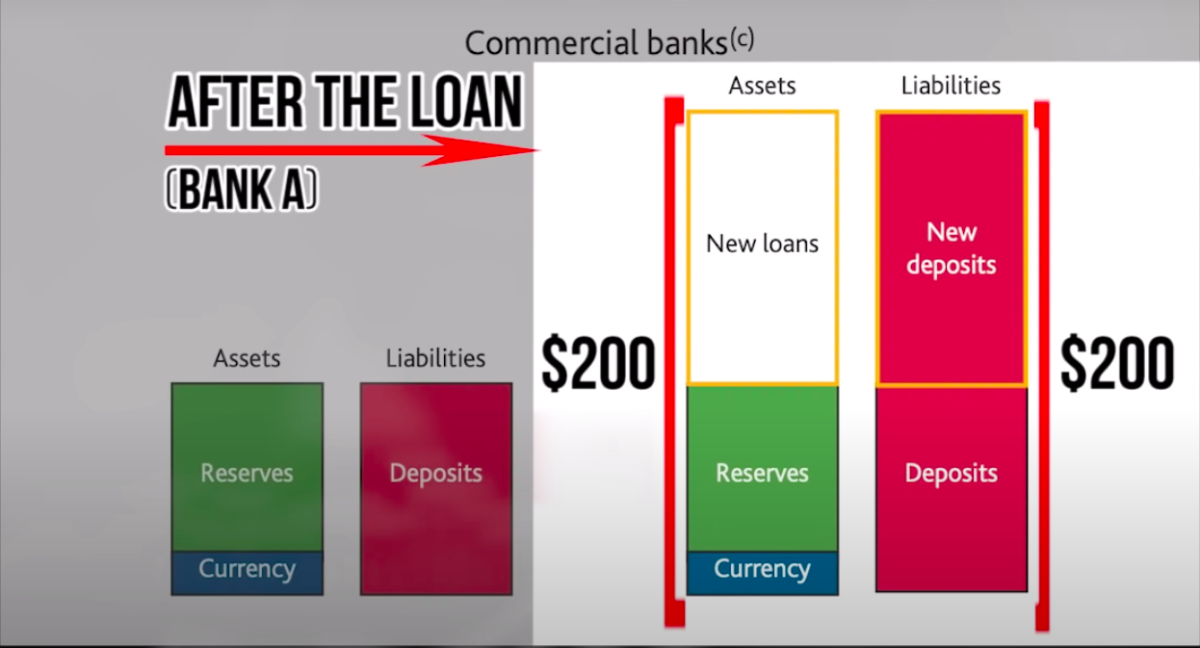

But the bank now has a loan for $100 on its balance sheet. That's an asset of the bank.

The balance sheet now has $200 in assets and $200 in liabilities. But Joe is buying the car from Jane. So, 100 IOUs go from Joe's account over to Jane's. Now, her account has 200 IOUs in it, from Bank B.

And remember what we had to do in my past article, part one of the series, we had to transfer over the assets. The bank reserves and the Fugazis, $100 to pay for the car, go from Bank A over to Bank B.

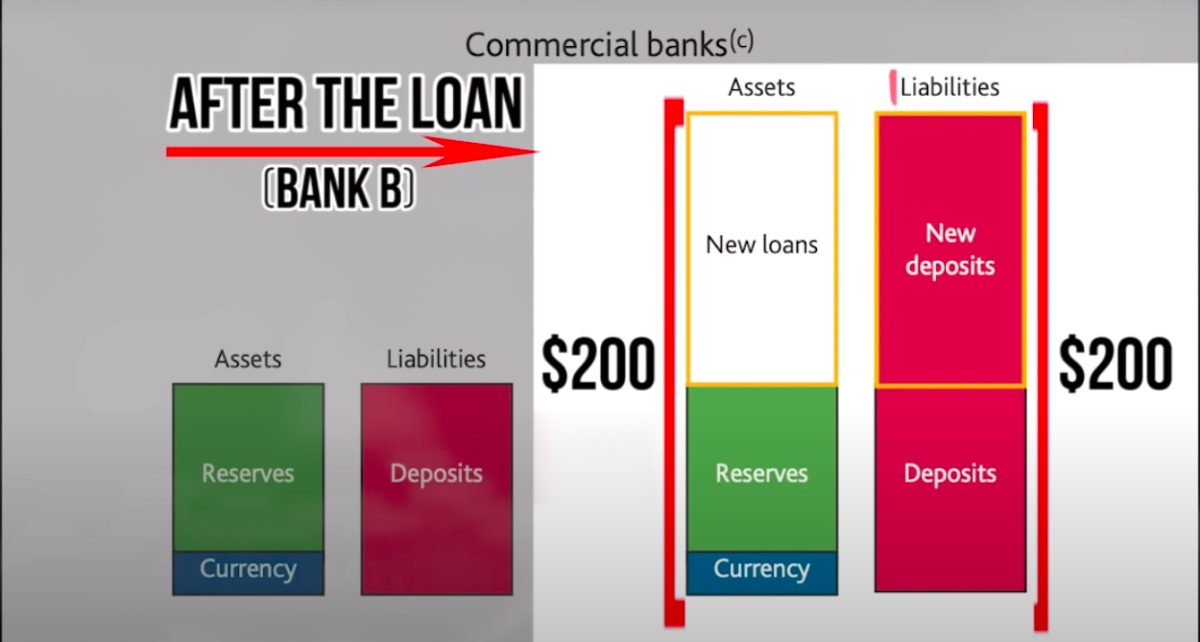

Bank B's balance sheet now has $200 in bank reserves and $200 in IOUs to Jane. Now, Bank A's balance sheet only has the $100 in loans and the $100 in IOUs, the original IOUs to Joe.

Additionally, Joe has that loan as a liability on his balance sheet, but it's an asset to the bank.

Let's walk through this one more time and then we'll take a look at what it does on the Fed's balance sheet. Joe starts off with $100 in IOUs that his bank owes him, and the bank has $100 in bank reserves.

But Joe gets a loan for $100 to buy a car from Jane. When he gets the loan, Bank A creates an extra 100 Fugazis out of thin air.

They create money so Joe can have those additional $100 of IOUs, bringing his total to $200. But now, the bank has the loan as an additional asset on its balance sheet.

The $100 of liabilities or the $100 of IOUs goes over to Jane's account to pay for the car. So Bank A transfers the $100 in liabilities, but it also transfers $100 in bank reserves over to Bank B.

Remember, the liabilities and the assets. In the end, the balance sheet of Bank A only has the loan as an asset and the $100 dollars in IOUs. Because all of the $100 of the original bank reserves went over to Bank B.

Now, on the Fed's balance sheet, it starts with $100 of bank reserves for Bank A and $100 for Bank B. Those are on the assets side of the commercial bank's balance sheet, but are a liability on the Fed's balance sheet.

After the transaction is done, after the loan is created, and then the $100 go over to Bank B from Bank A, for Joe to pay for the car from Jane, the bank reserves get transferred out of Bank A's account to Bank B's account.

When the transaction ends, Bank A has zero in bank reserves and Bank B has $200 in bank reserves, which makes sense.

It matches up with our ending balance sheets underlined in red.

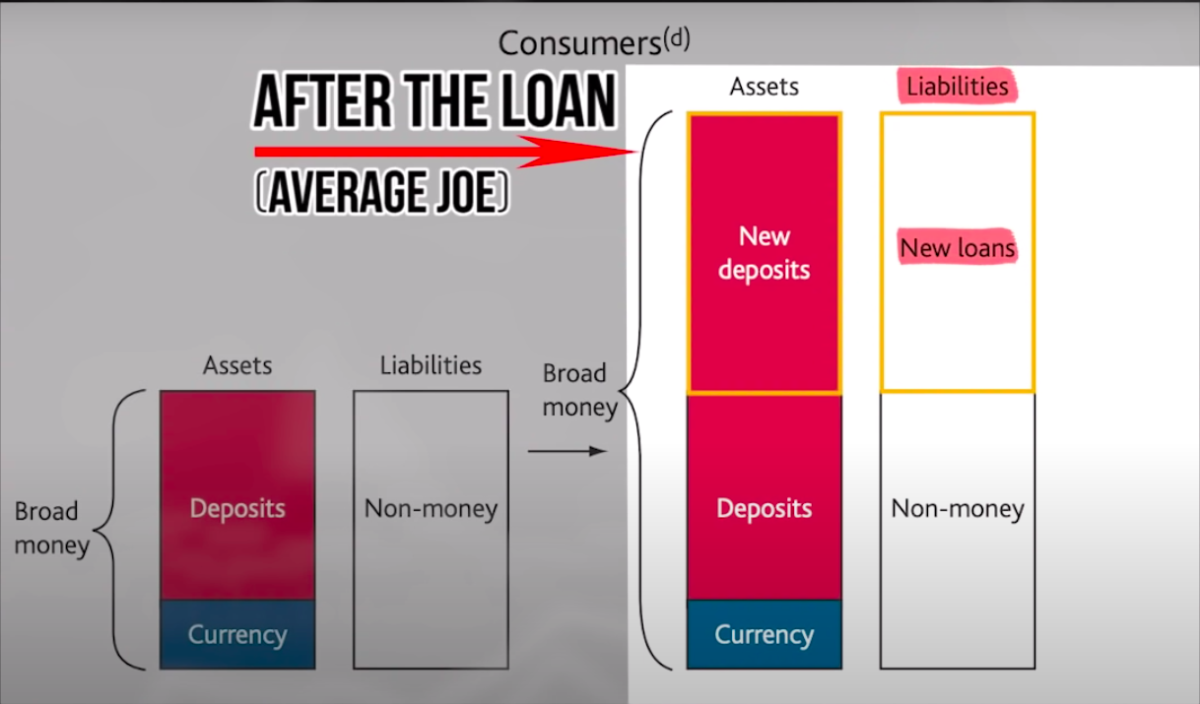

You'll notice how many IOUs, liabilities, deposits, Fugazis, pixie dust, or whatever you want to call them, were in the system, to begin with. $200 in total.

But when we finished, in the underlined balance sheets, we had $300. $100 in the first one, and $200 in the second one.

This is why we always say the commercial banking system in a normal economy creates additional money supply. They generate loans and the loans themselves create more deposits, more bank liabilities. That's what most people would define as more money, more money supply, M2, or broad money in the real economy, chasing goods and services.