Is money printing set to explode? The short answer is yes. I don't even think most people understand the magnitude of how much it's going to explode.

But, what I find is most people really don't understand what money printing actually is. They really don't even understand money, loans, or Quantitative Easing the Fed does.

So before you can figure out how money printing is going to affect your financial future, you have to understand how QE with non-banks works.

I'll explain it to you in seven simple steps in the form of a series of articles named: Is money printing set to explode? This is part 4 of 7.

The Fed Does QE With Non-Banks

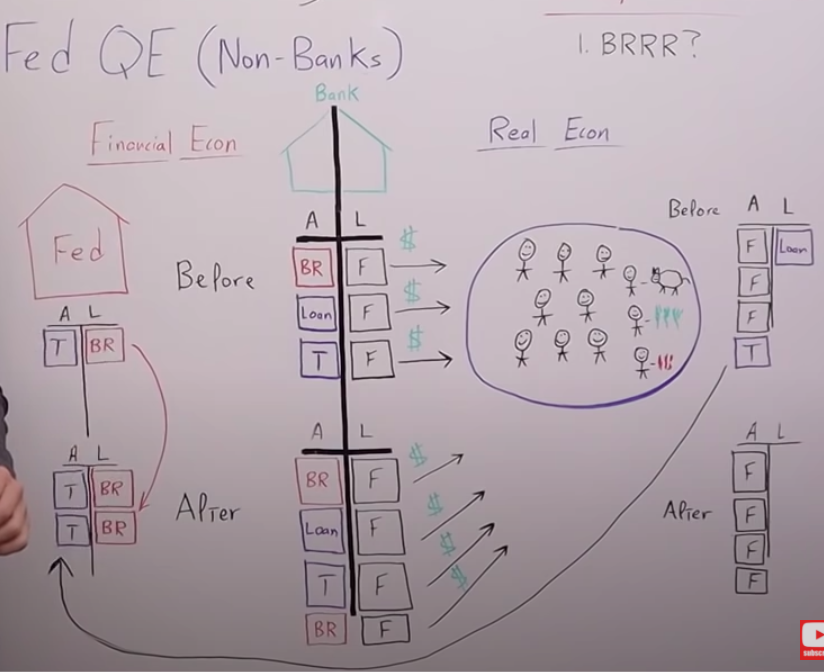

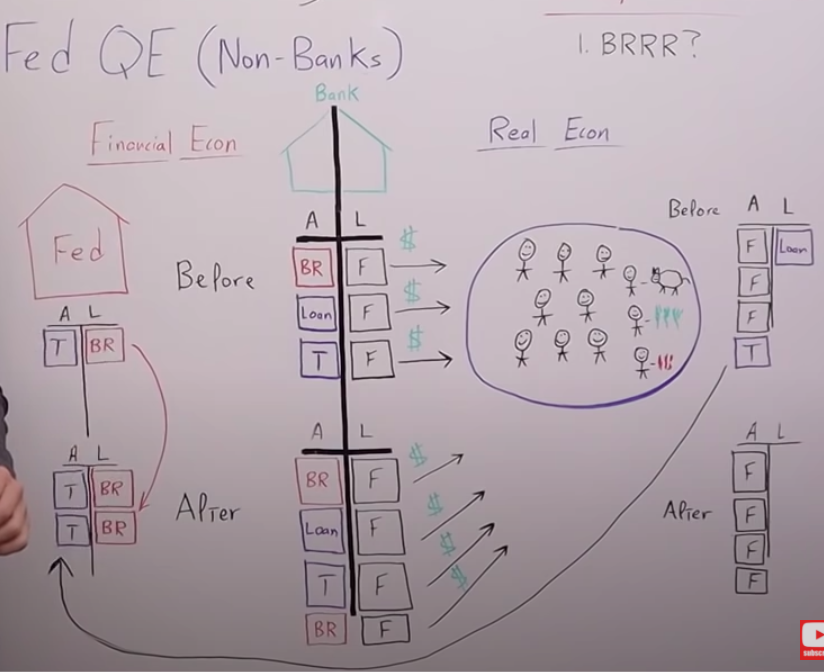

When the Fed does QE with non-banks it works a little bit differently than regular QE. To start, look at this whiteboard:

The Fed starts with a balance sheet, that has treasuries and bank reserves. I wrote before and after on the left side to keep it a little more clear.

The focal point of this step in addition to the last step, 3/7 of the series, is that there is a defined line that the banking system separates, and that is the financial economy from the real economy.

If the Fed is buying a treasury or mortgage-backed security, not from a bank, meaning the financial economy, but from a non-bank, they're buying it from the real economy.

On the right side of the whiteboard, you can see the balance sheet of the individuals, the average Joes, and Janes. They have three bank deposits, fugazis, or the IOUs from the banking system.

They also have a loan as a liability. Those fugazis are assets, but let's say they have a treasury as well.

If the Fed buys the treasury from an individual or entity in the real economy, in that case, the treasury would come all the way across the line.

It would transfer from the real economy over to the financial economy because it would come to the Fed's balance sheet.

The Fed would then print up more bank reserves or funny money that would add to the liability side of their balance sheet because they have to create another asset for the commercial banking system.

Why? Because the commercial banking system would create another deposit, another IOU, or another liability for the individual that sold the treasuries to the Fed.

Let me explain one more time so we are on the same page:

- The entity sells the treasury to the Fed.

- To pay for the treasury, the Fed has to print up funny money bank reserves just like they did in the prior step.

- That's an increase on the liability side of their balance sheet, but that would add to the asset side of the commercial bank's balance sheet.

- They would have additional bank reserves.

You might say, “Well, isn't that just giving the bank free money?” No, because it's also giving the bank an additional liability in the form of an extra deposit.

What you would be doing if you sold your treasuries to the Fed is you'd be trading bank deposits for treasuries. You'd be trading IOUs.

In other words, you'd be trading bank liabilities for the treasuries. So, the Fed couldn't just give them or instruct them to have more liabilities because then they'd be insolvent.

The assets that actually pay for those treasuries are these newly created bank reserves that are liabilities of the Fed and assets of the commercial banking system.

Remember, there's really nothing in your deposit account. It's all pixie dust. The only thing it represents is an additional IOU from the commercial banking system to the entity that sold the treasuries to the Fed in the first place.

More importantly, what does this do to the amount of currency units in the real economy chasing goods and services?

It adds to the currency units because we've added an additional deposit. It started off with three deposits, but now there are four deposits.

The asset side of the public's balance sheet is the same. They don't have any more assets. They've just traded a treasury for a deposit.

Since you can't take that treasury and buy cattle, corn, or wheat, but you can use your extra fugazi, your extra deposit, that means it's inflationary.

It can be inflationary because there are more currency units chasing the same amount of goods and services.

If we really want to get technical about it, which we actually have to, to give a probability to whether or not we think the future is going to be inflationary or deflationary, this is when the process really starts to become what I would consider money printing or what most people see in their head when they hear the word money printing.

The main takeaway is when the Fed does QE with the non-banks, we'll use the technical terms here, it creates additional money supply in the real economy, M2 or broad money. It also creates more base money.

That's the bank reserves on the Fed's balance sheet, but when the Fed does QE with just banks as I mentioned in the last article, it doesn't necessarily increase broad money, it only increases base money.