Is money printing set to explode? The short answer is yes. I don't even think most people understand the magnitude of how much it's going to explode.

But, what I find is most people really don't understand what money printing actually is. They really don't even understand money, loans, QE, or helicopter money with non-banks.

So before you can figure out how money printing is going to affect your financial future, you have to understand how helicopter money works.

I'll explain it to you in seven simple steps in the form of a series of articles named: Is money printing set to explode? This is part 5 of 7.

Helicopter Money With Non-Banks

To start, let's get our heads around what money printing is and how it works. If this is your first article of this series, please look at my whiteboard and get familiar with the characters.

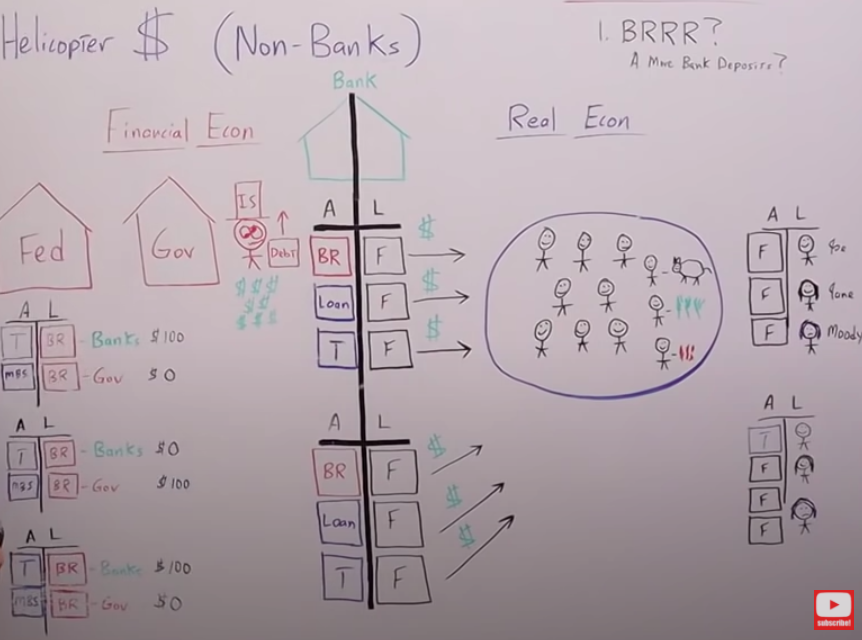

I drew the Fed, the government, and our drunk insolvent Uncle Sam. The left side of this equation is the financial economy and the right side is the real economy.

The circle represents the private sector, meaning people producing cows, corn, and wheat.

On the right side, you can see the balance sheets of the individuals and entities like the average Joe and Jane, and of course, everybody's favorite, Moody the millennial.

Before I move any further, I want to stress exactly what I stressed in the last couple of articles of the series you can read here. Part 1 – Part 2 – Part 3 – Part 4.

The commercial banking system and its balance sheet straddle the financial economy and the real economy.

What I mean by that is the asset side of their balance sheet is in the financial economy along with the Fed and the government, but the liability side of their balance sheet are the customer deposits.

Their liabilities are in the real economy just like your deposit with Bank of America or Wells Fargo is in the real economy.

So, the scene starts with you're drunk and insolvent Uncle Sam coming along and saying, “I need to buy some votes, and the easiest way to do that is send stimulus checks to millennials.”

The problem is Sam doesn't have anything in his account at the Fed. Most of the commercial banks and the treasury have an account at the fed just like you have an account with your local bank.

It's a deposit account, it's the very same thing.

Just like your deposits are a liability to the commercial banking system or your bank, more specifically, the deposits of the government and the commercial banks are liabilities for the Fed.

I mentioned in earlier articles about this just being an IOU from the commercial banking system to Joe, Jane, or Moody and it's the same thing.

Is just an IOU from the fed to the government or the commercial banks themselves. We talked about fugazis. In this case, we can really see that it's just pixie dust.

It's never landed. It is no matter. It's not on the elemental chart. It's not real.

Wolf of wall street

That's a great way to describe not only the deposits that you think you have in your account, but that really aren't there. They're just IOUs and bank reserves. Anyway, that's a completely separate rabbit hole.

So, your drunk insolvent Uncle Sam has nothing in his account so he needs to sell a treasury. Let's say Joe has saved up $100 so he buys $100 worth of treasuries from Sam.

That goes under the asset side of Joe's balance sheet but the deposit is gone, poof! It's no longer there. Those $100 of IOU's are gone from the commercial banking system momentarily.

- When Joe buys the treasury the bank reserves are transferred from the bank's accounts at the fed to the government. That is step A.

- In step B, the banks now have zero reserves. The treasury has the $100, but Sam wants to buy Moody's vote, that's what this is all about.

So he sends her a check and she goes down to the local bank and deposits it.

Now all of a sudden, that's a liability, an additional $100 liability of the commercial banking system. Those bank reserves then go from the government's account back to the commercial banking system.

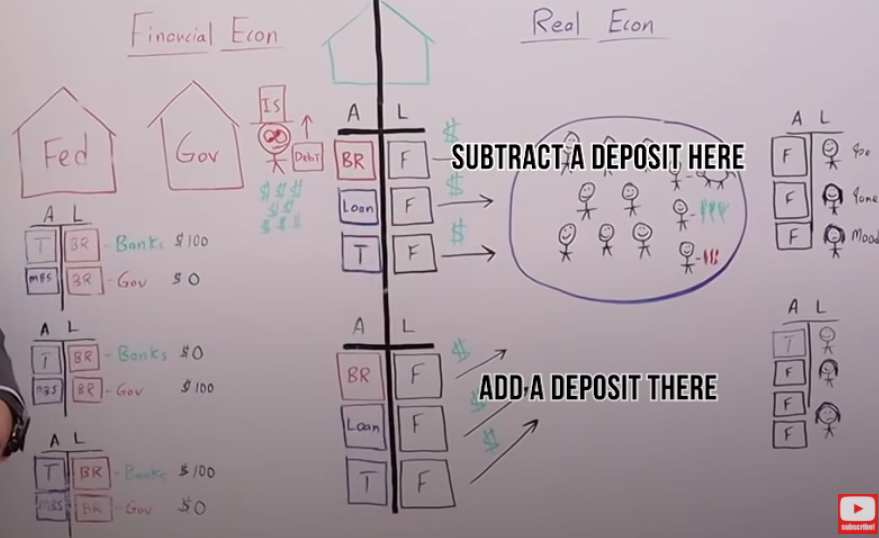

We're right where we started, and the deposit that was subtracted from Joe's account initially, or the deposit that disappeared as an IOU, as a liability of the commercial banking system is now right back in the system because that deposit was replaced by a new deposit that went to Moody the millennial.

The commercial banking systems balance sheet starts with three deposits and it finishes with the same three deposits.

The Fed's balance sheet ends up the exact same, $100 in bank reserves in the bank's accounts, and zero in the government.

The only thing that's really changed is there's an additional asset on the balance sheet of the private sector because that treasury is now in Joe's account.

But remember, there are still three deposits, the same three deposits we started with, and there's additional debt on the balance sheet of your drunk insolvent Uncle Sam.

The easiest way to think about this is $100 came out of the real economy, went into the financial economy, momentarily into this government's account, and then right back out into the real economy in the form of a check or an additional deposit.

In other words, we subtract a deposit here and we add a deposit there, as you can see in the whiteboard.

This is why the MMT people say, “Whenever you pay your taxes or buy bonds money is destroyed, and when the government sends checks, it creates money.”

Whether you want to look at it that way or you just want to look at the same currency being circulated from the real economy into the government's coffers and then back out into the real economy, it's still pretty much the same thing.

We have $100 coming out and $100 coming in. On net balance, it's a wash. There were no more currency units that were actually created chasing the same amount of goods and services in the real economy.

Therefore, I would not consider this process of helicopter money with non-banks as money printing.

To use the technical terms, broad money in the system or M2 money supply is the exact same at the end as it was at the beginning of this article. And the base money, the liabilities of the fed are the exact same at the end as they were at the beginning.