Are stimulus checks good or bad? They definitely have a positive short term effect, but what about the long term? Do stimulus checks create an environment where the long term unintended consequences outweigh the short term benefits?

Like so many macro topics it's important to have a nuanced view. Without thinking it through carefully, stimulus checks could decrease the number of goods and services produced domestically.

It may not seem like a big deal now, especially when so many Americans are struggling and need the stimulus checks, but keep reading… There will be consequences.

First, Let's Go Over The Incentives

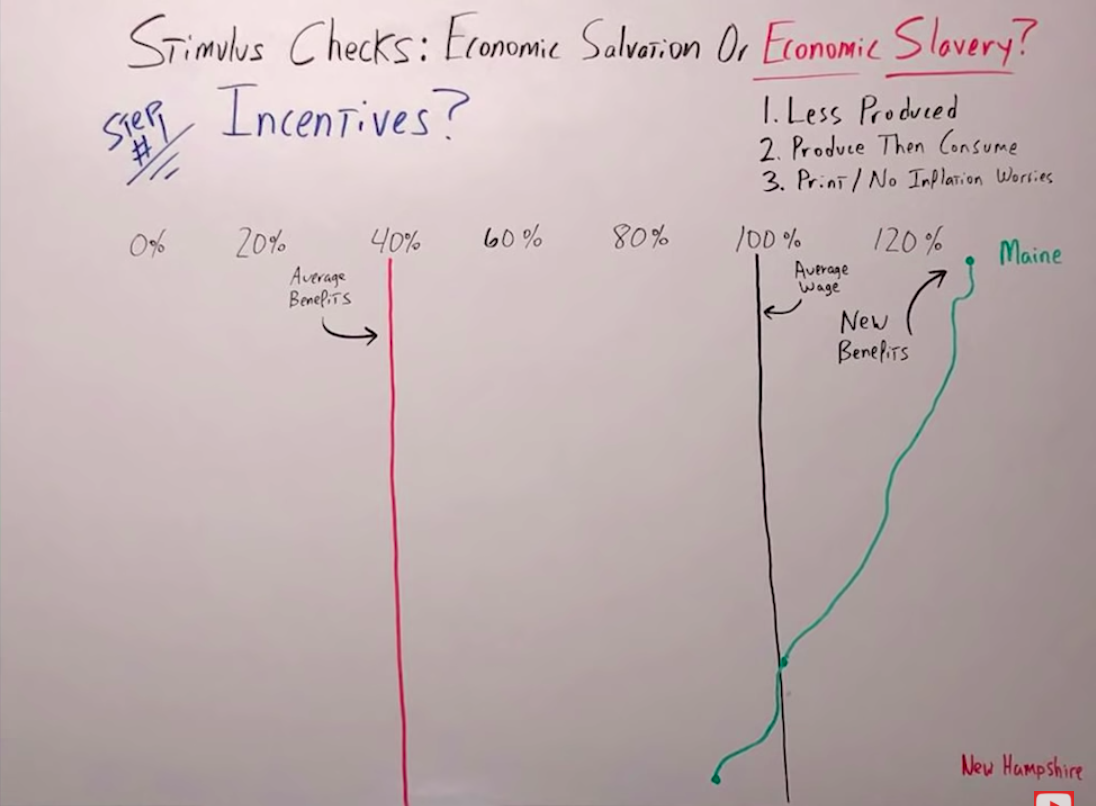

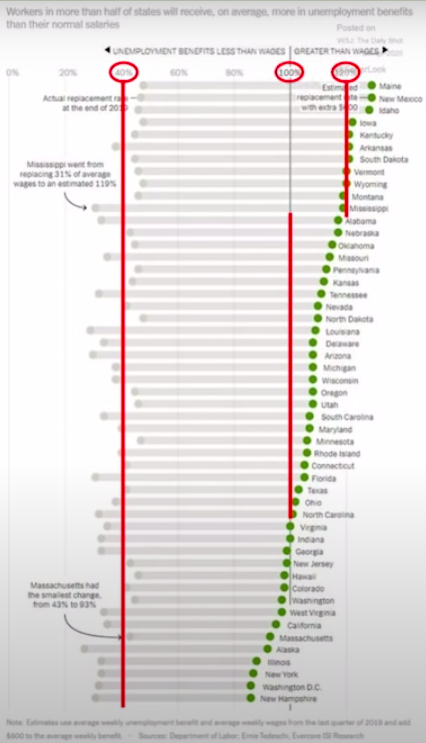

Look at the following chart, it goes from 0% of the average wages, all the way up to 120%. This is a chart of the current unemployment benefits with the CARES Act, it's increased substantially.

Before, the unemployment benefits averaged about 40% of the average wage, but now, with the CARES Act, the new benefits in some states go over 120%. In two-thirds of the states, the new benefit program is higher than the average wage.

Then, in one-third of the states, it's lower, but still, even in the lowest state, which is New Hampshire, the highest state is Maine by the way.

But, even in the lowest state of New Hampshire, it's still around 85% to 90%, up from an average of 40%.

It doesn't take an economist to figure out that this could incentivize people not to go back to work. And I don't want to make this a moral article.

It has nothing to do with that, whether you should or shouldn't take a stimulus check. That is not what this article is about.

This is just about outlining the incentives of paying people more than they would make at work, to stay home, and how that plays out on a macro level.

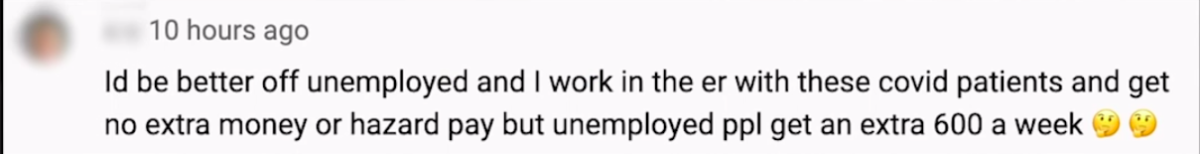

These are just statistics. There's tons of anecdotal evidence, which would also point to people flat out not wanting to go back to work because they're being paid more to stay home.

As an example, look at a portion of a recent CNBC interview transcript with Jeff Gundlach.

Jeff Gundlach: The CARES Act with its PPP aspect of payroll check protection actually gives many people a lot more money for not working than what they had when they were at their job, before they lost their job, or got furloughed.

I mean, a lot of people are making 25% more. I have family members who've pointed this out to me, who said, “This is amazing. I've lost my job, but I'm making more money by not working thanks to the $600 per week bonus in the unemployment benefit.”

That just makes the cost structure of reopening these businesses really prohibitive.

(End Of Transcript)

Not only did the stimulus checks get people asking themselves why they're working in the first place, but it also increased the cost structure for a lot of the small businesses.

I also want to throw in some of my own anecdotal evidence. I'm on an email list for ex-pats in Ecuador. Like most of you know, I own property all over the world, and that includes Ecuador.

So, I'm on this email list and I see them going back and forth talking about getting stimulus checks.

These retirees that are living on the coast of Ecuador, they're Americans, but they're getting stimulus checks as well. It's really getting crazy.

And I have gone through the comments of some other YouTubers who are doing constant videos on how to get stimulus checks to see what the general attitude is.

Here's what I found…

It's staggering to see how many people are not only making more money by being at home but also trying to come up with strategies for how they can never go back to work again.

They're trying to work the system to make sure they're getting paid without having to work.

I know this could be just a small section, most hard-working Americans don't want the funny money, instead, they want to get out there, be productive and work, but there's a percentage of the population who's going to try to work the system.

This, of course, creates unintended consequences that we'll get into. But…

The first main takeaway you have to understand is we have to produce, or someone has to produce stuff in order for us to consume stuff. The production has to come first.

Also, we're getting into this mindset where we can just print up as much money as we like, that we don't have to worry about inflation whatsoever.

Why not just print up the money, sit back, not work, import all of the stuff that we consume from other countries while we don't have to do any of the work?

When you have fewer people wanting to go to work, the cost structure of businesses increasing, and a general attitude within the population that money printing has no negative consequence, the net takeaway is that fewer goods and services actually get produced right here in the United States.

Productive People Get Rich And The Consumerists Get Poor

This is where we start to figure out if the stimulus checks are economic salvation or economic slavery.

We know someone has to produce in order to consume. But, here's the government's narrative: “In the United States, we can print as much money as we want, there is no downside. The stimulus checks will keep going out, and we will have no problem whatsoever.”

But, this creates a higher cost structure because now businesses are actually competing with the government to see who will pay the employee the most.

The net result is less there will be less production of goods and services in the United States. Yet, in order to consume, someone has to produce them.

And…This takes us to Peter Schiff pointing out that I might have missed a couple of things on one of my Youtube videos while addressing this matter.

Peter Schiff:

What George missed out on is…

What happens to a society when it can no longer import goods, right?

That's when consumer prices really skyrocket because consumer prices were being limited by all the goods that were being shipped into the economy that were not being produced.

But because those goods were there, that was increasing the supply of goods, so that was keeping some type of lid on the price of those goods.

Once those goods are no longer available, because they can no longer be imported because the currency has imploded from that economy, that's what's going to happen.

That's why our trade deficit is so important, right?

That trade deficit is what is keeping us afloat. You have to look at the other side of the deficit and that is the countries that are financing it.

The countries that are exporting the stuff and taking our IOUs.

How much longer are they going to do that?

I would say that the days are numbered.

(End Of Transcript)

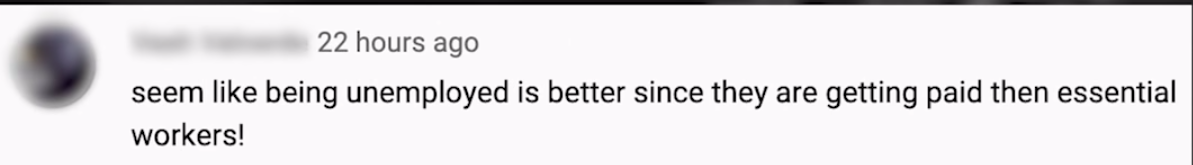

Of course, Peter Schiff nails it. So let's go into further detail and explain exactly what he's talking about. Here's an example…

Let's say the United States produces all of the goods it consumes.

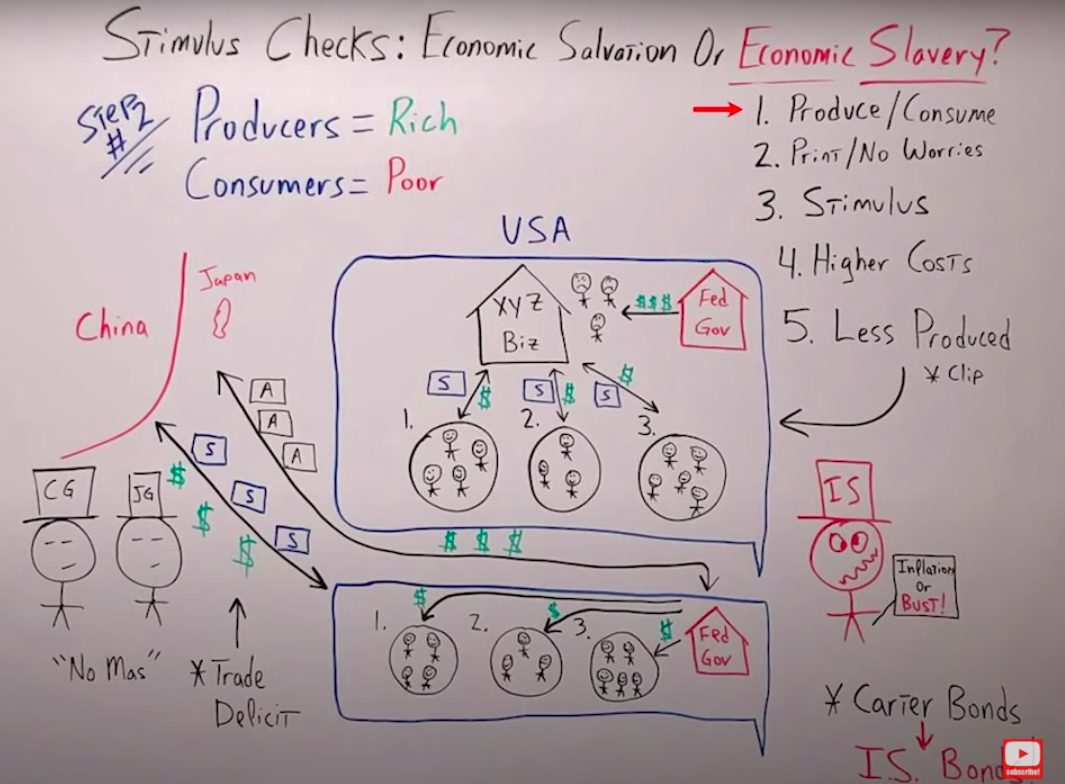

In this economy, the one I drew on the whiteboard, we have the XYZ business and communities 1,2,3, which can maybe be different cities. The XYZ business sends the goods it produces to each community, and the community sends their dollars back to XYZ business.

The problem right now is the employees at XYZ business are pissed because the government is saying, “Listen, we'll pay you more than XYZ business to stay home.”

These employees are asking themselves, “Why on Earth should I go back to my job when I can stay home with my family, enjoy life, and get paid even more.” So, XYZ's business loses its employees and goes bust.

The United States says, “Don't worry about it. We'll just get our goods from other people who are willing to produce them, maybe even at a lower cost.”

What ends up happening is community 1,2,3 still gets their stuff, but instead of getting the stuff they need to consume from XYZ business, now they're just going to get it from China and Japan.

They say, “No problem. We'll manufacture all the stuff you need to consume,” and China and Japan send us the stuff they manufacture.

So we import what we consume, and in return, all we need to do is export little green pieces of paper that we can just create by pressing a button on the keyboard. No problem.

Why on Earth would we make all the stuff that we need to consume when we've got these fools outside of the United States, in China, in Japan, that'll do all the work for us? We can just sit back and enjoy life.

The truth is we have to think about what happens to the dollars we export to other countries. They take those dollars and they don't want to just stuff them under their mattress, they are going to buy US assets.

So as the dollars go to Japan and China, they come right back to the government because the Japanese and the Chinese are buying treasuries or US-denominated debt with the dollars we export to them for the stuff we need to consume.

In other words, we're going into debt in order to consume products from other countries.

To make matters worse, they're taking those dollars and buying up not only our debt but also our equities, real estate, and businesses.

If this continues to happen for a long period of time, we will have fewer assets being owned by Americans and more and more US assets being owned by foreigners.

But this isn't where the story ends. On the right side of the whiteboard, there's our Insolvent Sam, who of course could be your uncle, and he is holding a sign that says, “Inflation or bust.”

And you can see why… Insolvent Sam has racked up so much debt that there's no way he can ever pay it back.

The only solution is to either default, which he does not want to do, or create inflation so he can pay the debt back with cheaper dollars.

But, the Chinese and Japanese guys on the left of the whiteboard look at this and say, “Wait a minute, we're holding treasuries, which are dollar-denominated assets, but if we get paid back with cheaper dollars, that is no bueno. We're not getting paid back what we lent to Insolvent Sam in the first place.”

So they look at your drunk insolvent Uncle Sam, and say, “Listen, dude, no mas. We're not taking your green pieces of paper anymore.”

Of course, you may be thinking to yourself, “George, that is absolutely crazy talk, that is never going to happen.”

But I'd like to remind you, back in the 1970s, the United States government had to issue Carter Bonds. Those were bonds denominated in currencies other than the US dollar.

Why? Because none of our creditors wanted US dollars and we became like Argentina, Colombia, Turkey, or any of these countries that have to borrow in currencies other than their own.

You can just imagine the interest rate that we're going to have to pay now, when we go from issuing Carter Bonds to issuing drunk, insolvent Uncle Sam bonds.

I also want to point out that if we continue to run these massive trade deficits, or if they increase because the stimulus checks are creating an environment where businesses have to compete with the government for their employees to produce goods and services, it could result in inflation long-term.

Why?

Because if we get to a point where the Chinese and Japanese guys just don't want to take our dollars or treasuries anymore, they will produce less stuff for the United States.

If there are less goods and services in the United States with more currency units, it's of course inflationary for consumer prices.

How Does The Long Term End Game Looks Like?

Right about now, your friend and family member Fred is reading this article and saying, “George, you don't know what you're talking about. You're just too doom and gloom and have a tinfoil hat. Foreign countries will always be more than happy to produce the goods we consume in the United States. They'll always take our dollars and they will always buy our debt.”

But, what I would say to your friend and family member Fred is, “Fred. I think you're suffering from a little bit of recency bias. You think that whatever has happened in the past will continue to happen in the future indefinitely. Maybe, maybe not.”

Let's look at some facts.

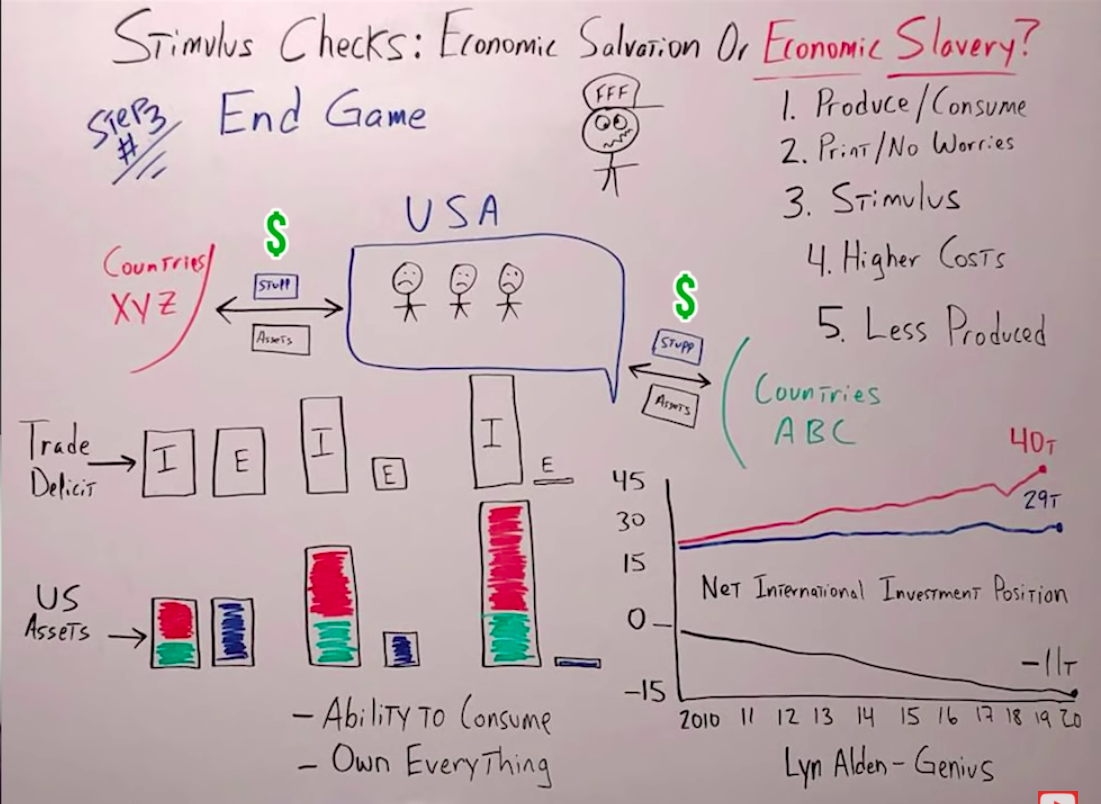

If the United States continues to consume more stuff produced from countries XYZ and ABC, those countries will take the dollars they get from the production and buy US assets.

Look at the very simple visual on the whiteboard. There is a trade deficit, imports on the left, and exports on the right.

The imports grow taking a bigger percentage of what we consume in the United States to a point where we could be totally reliant on foreigners for our consumption.

A great example right now would be medical masks or pharmaceuticals, they're almost all made in China and India.

Again, they take the dollars, buy more and more US assets to a point where they could own the majority of everything in the United States. The majority of our equities, US corporate debt, treasuries, and real estate.

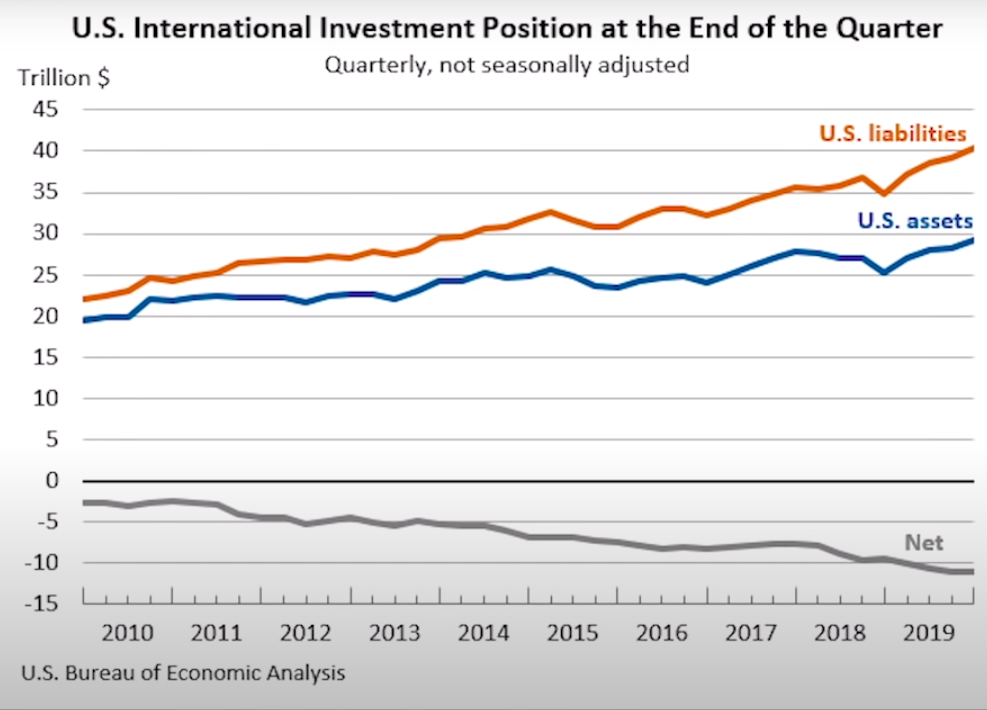

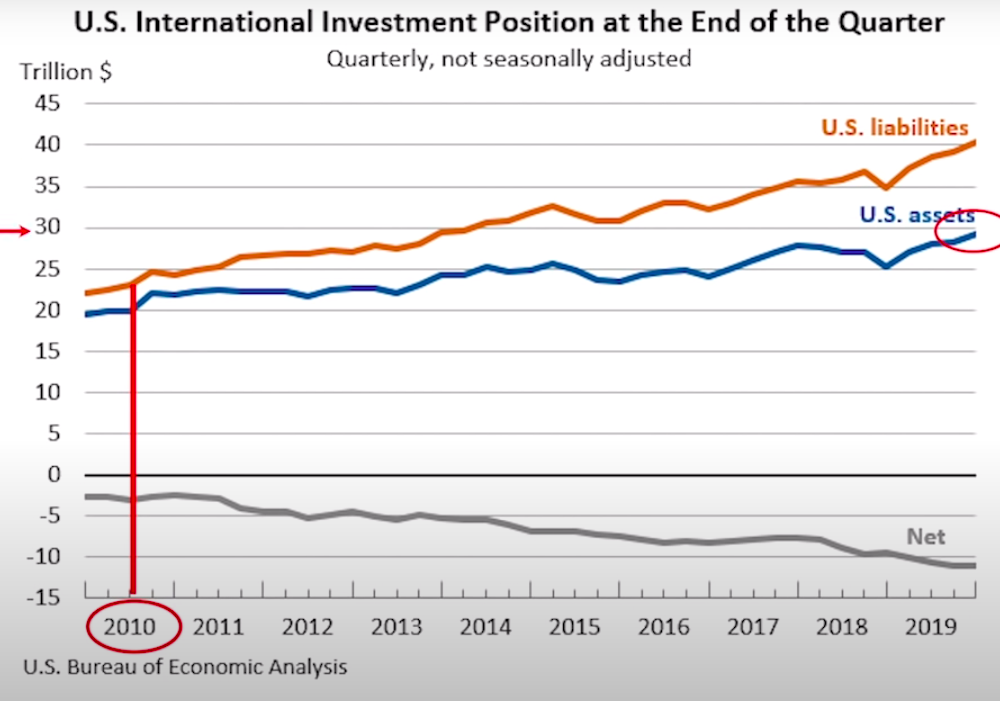

To illustrate how alarming this trend is, check out this chart from my good friend Lyn Alden. Yes, she is a genius just like Wile E. Coyote, and if you're not following her on Twitter, make sure you do so as soon as you are done with this article.

But this chart from Lyn Alden herself is the net international investment position. It's actually not her chart, let me be clear, it's from an article that she wrote for Seeking Alpha.

The NIIP, Net International Investment Position shows how many American assets foreigners own and how many foreign assets Americans own, and you can see this trend playing out. Going back to 2010, it was equal.

Now, foreigners own $40 trillion, and the US only $29 trillion. The NIIP has gone down dramatically. It's now negative $11 trillion, which is almost 50% of the United States GDP.

Here are some pieces of Lyn's Seeking Alpha article:

Due to persistent trade deficits as the world reserve currency (meaning more wealth flows out of the country each year then comes into the country), we lost creditor status and entered debtor status starting in the 1980s. In other words, foreigners now own more American assets than Americans own of foreign assets.

This takes us back to the original question…

Are stimulus checks economic salvation, or will they put us into economic slavery?

To be very specific, let's look at the definition of the word slave: “A person who is legal property of another, and is forced to obey them.”

That last part I think is crucial. If the stimulus checks create an environment where fewer people are going back to work, that means we're producing less stuff right here in the United States.

Producing less goods and services increases the trade deficit, which means we're becoming more and more reliant on foreigners for the goods and services we consume.

At the same time, they're getting those dollars and they're buying more and more US assets.

It gets to the point where our ability to consume is completely controlled by foreigners and those foreigners own absolutely everything.

So, does that make us slaves by the definition I just gave?

I'll let you be the judge.