Introduction

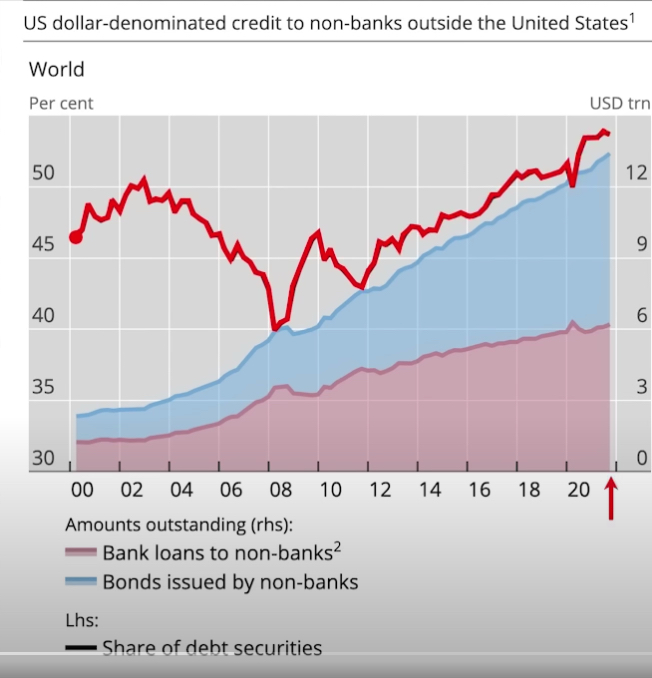

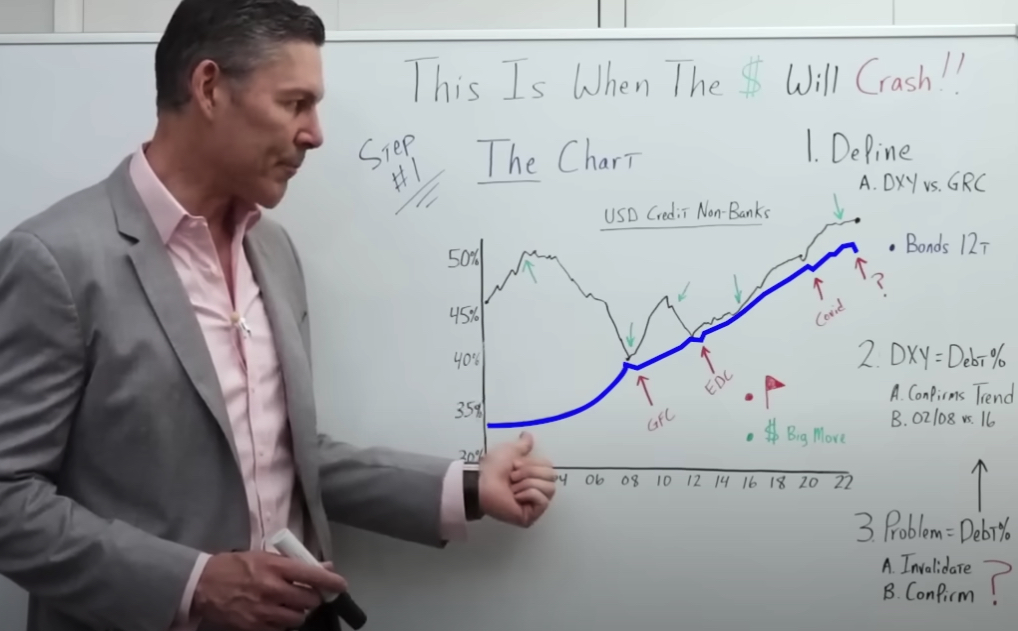

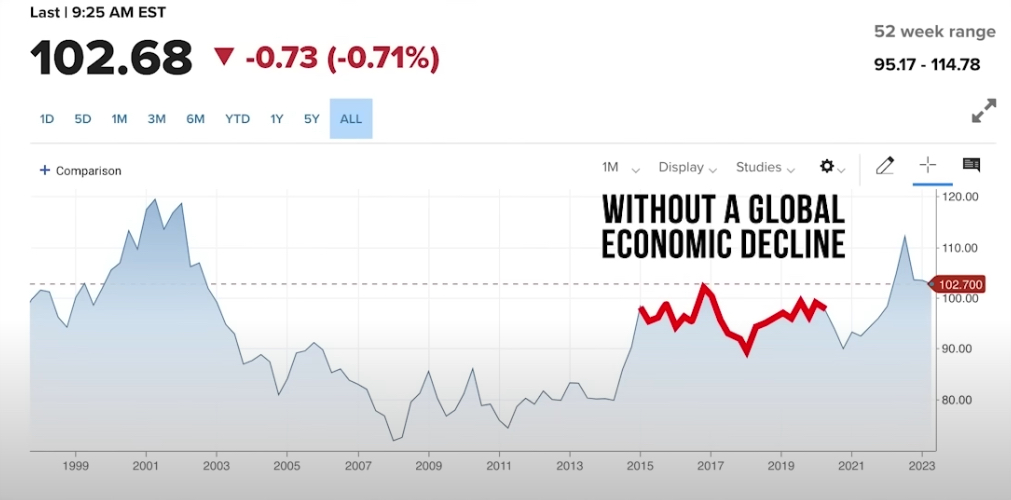

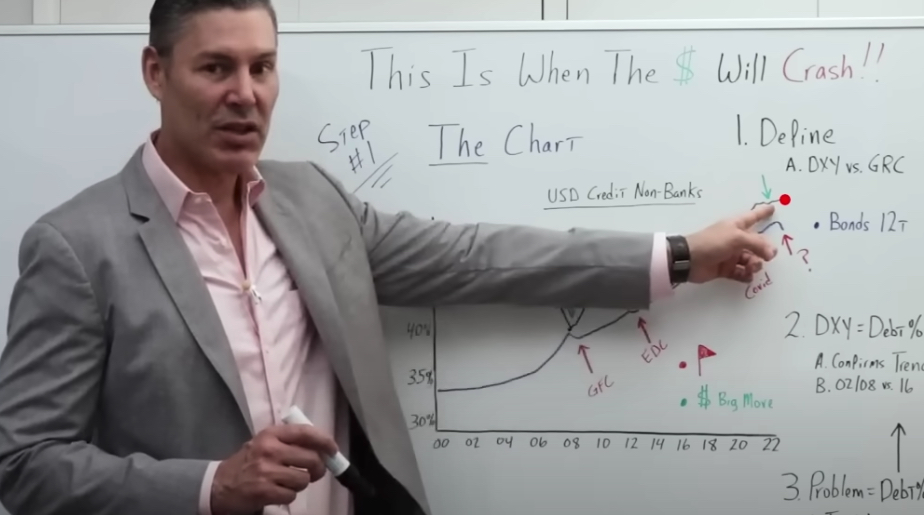

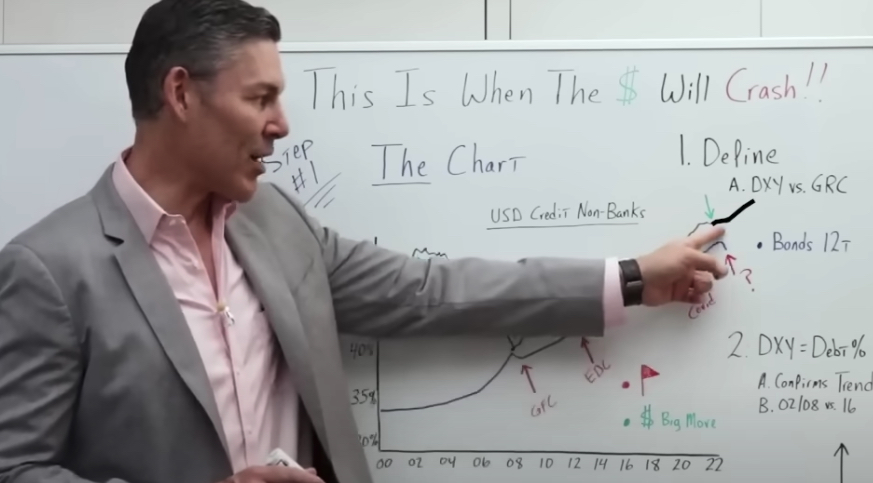

The United States dollar will crash when the dollar-denominated debt outside of the United States starts to move down (black line in the above chart). I'm going to explain why in one simple fast step and this is going to absolutely blow your mind. But before we get into this chart that explains everything, let's define what I'm talking about when I say the United States dollar will crash.

[ctt template=”3″ link=”6xl04″ via=”no” ]The United States dollar will crash when the dollar-denominated debt outside of the United States starts to move down.[/ctt]

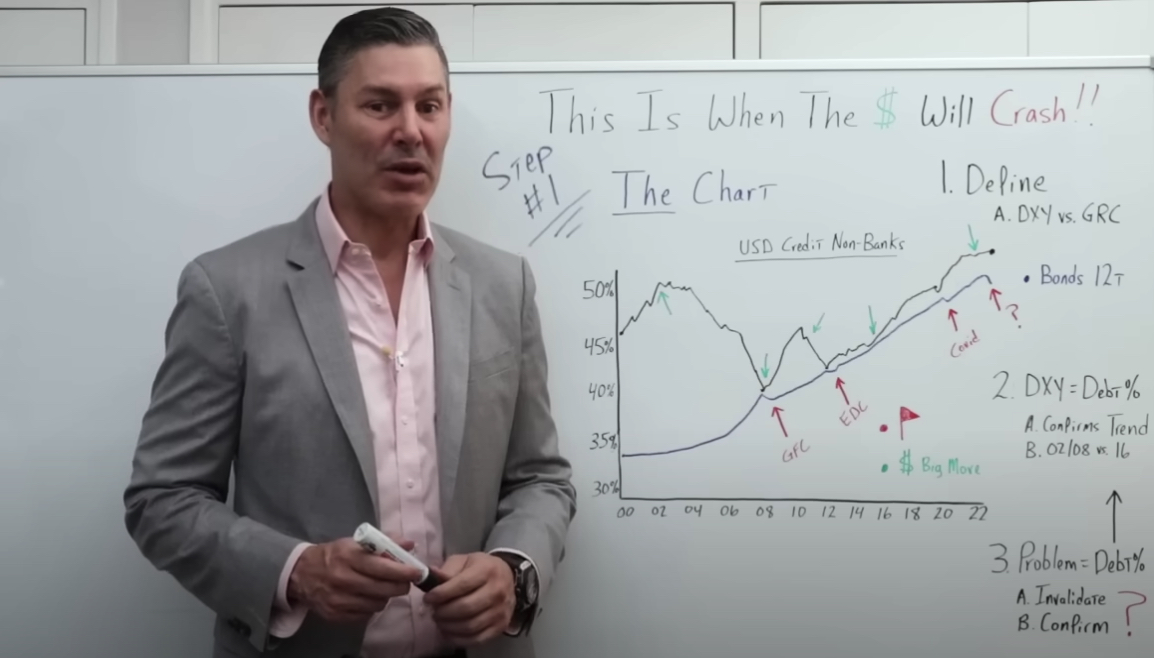

Defining A Dollar Crash

A dollar crash isn't when it loses reserve currency status.

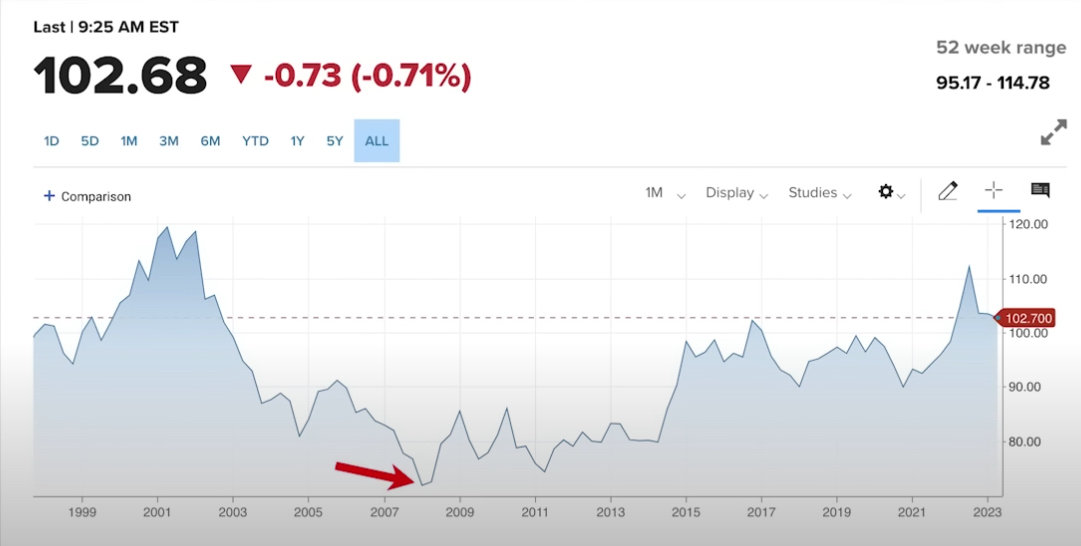

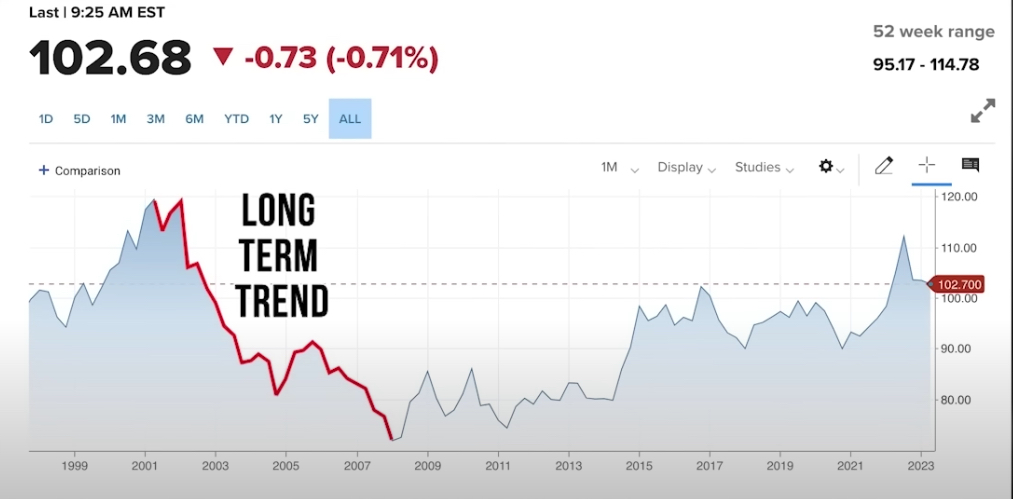

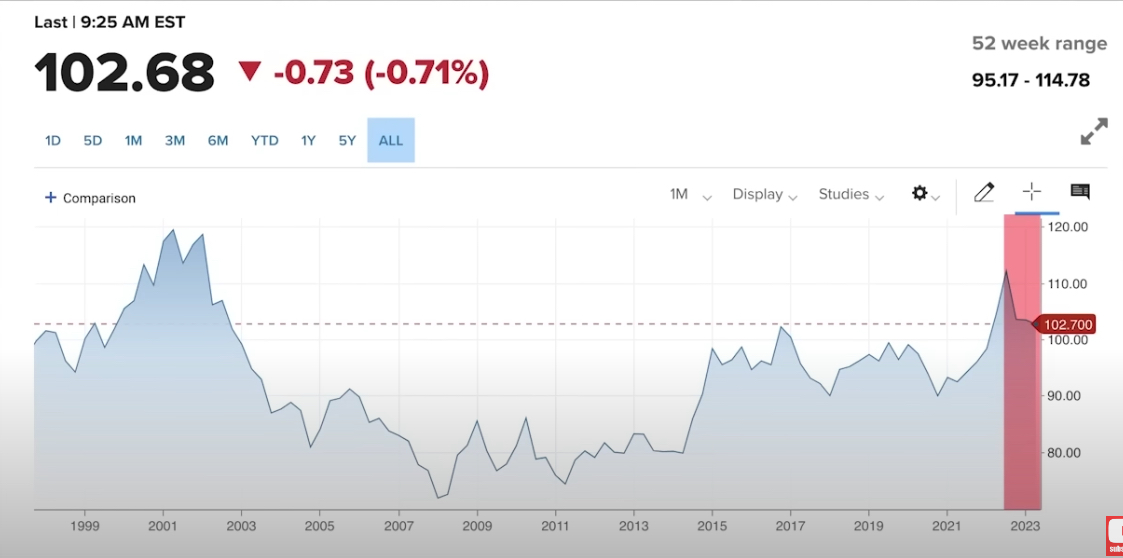

It's when the DXY pulls back to the lows we saw in 2008, roughly around 70 or 75. That would be a decline of over 30%.

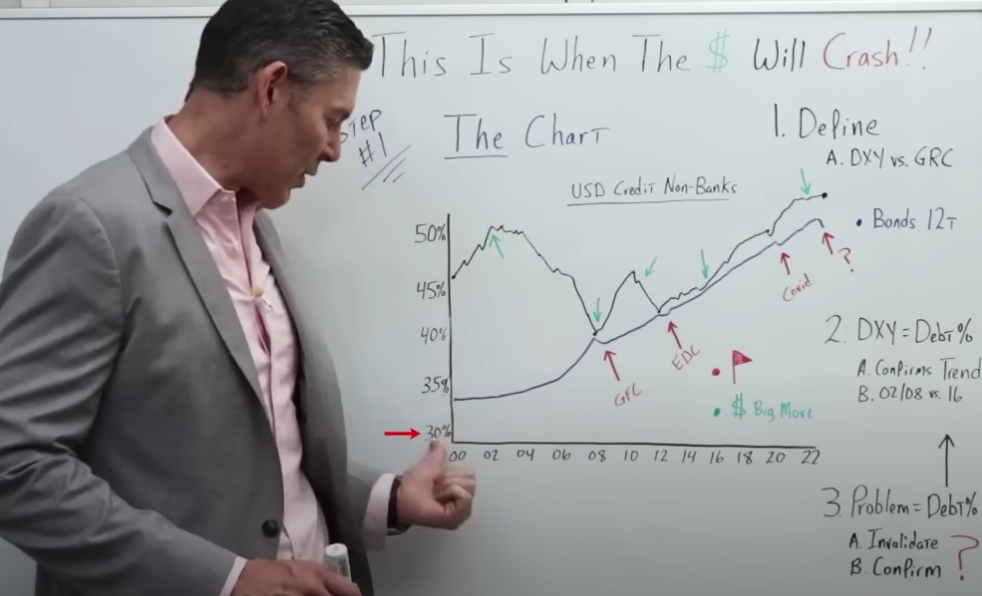

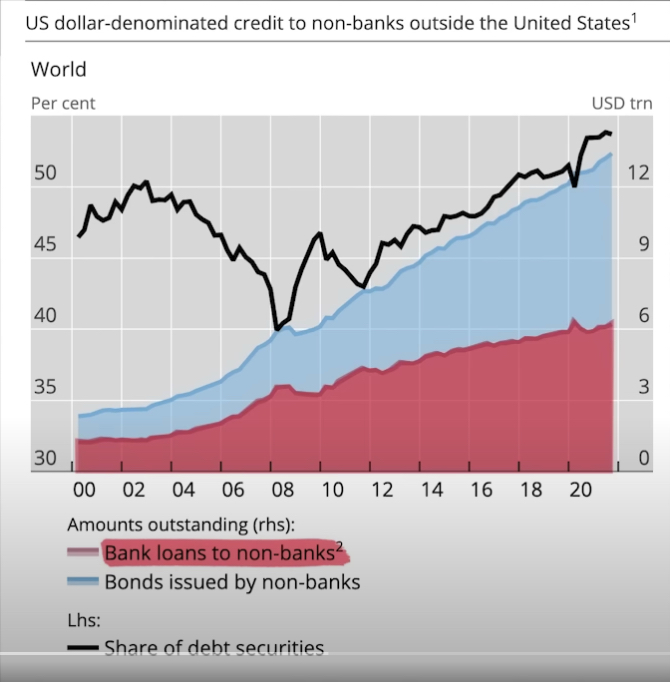

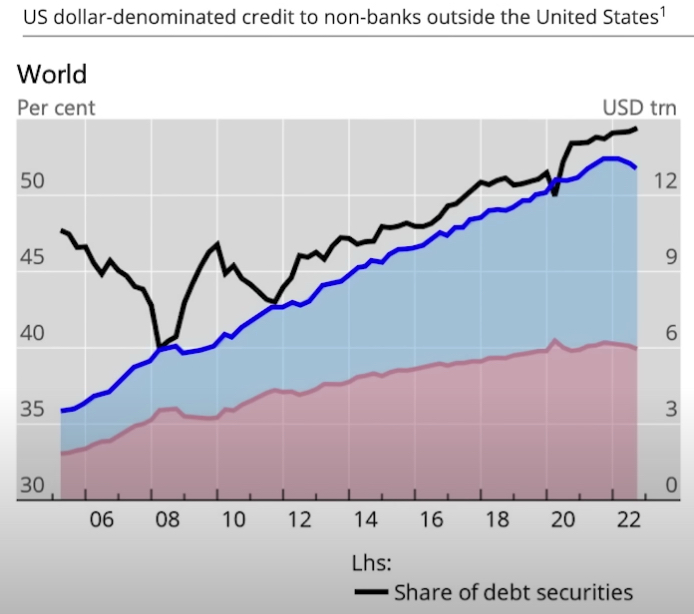

The chart above is referenced from the BIS the Bank of International Settlements, and it shows us how much dollar-denominated debt there is outside of the United States that went to nonbank entities.

[ctt template=”3″ link=”6Tebc” via=”yes” ]A dollar crash isn't when it loses reserve currency status. It's when the DXY pulls back to the lows we saw in 2008, roughly around 70 or 75. That would be a decline of over 30%.[/ctt]

Let's just assume a sovereign wealth fund, a corporation, or a hedge fund, something that's a nonbank, is getting a dollar-denominated loan, outside of the United States. That's what the bold line below represents.

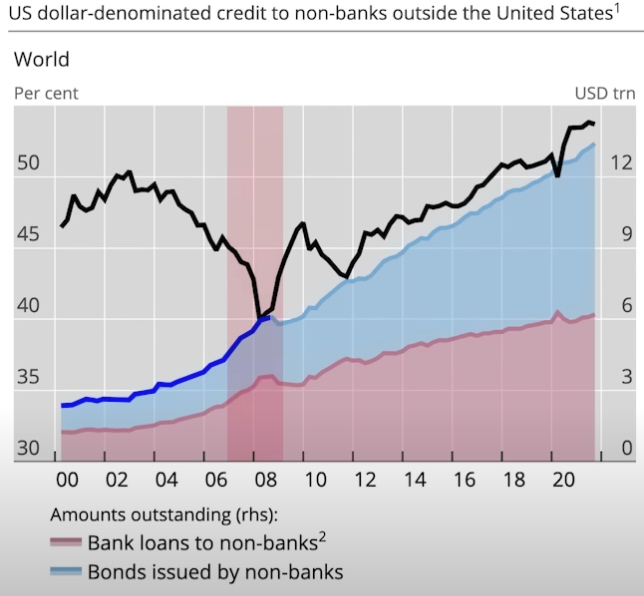

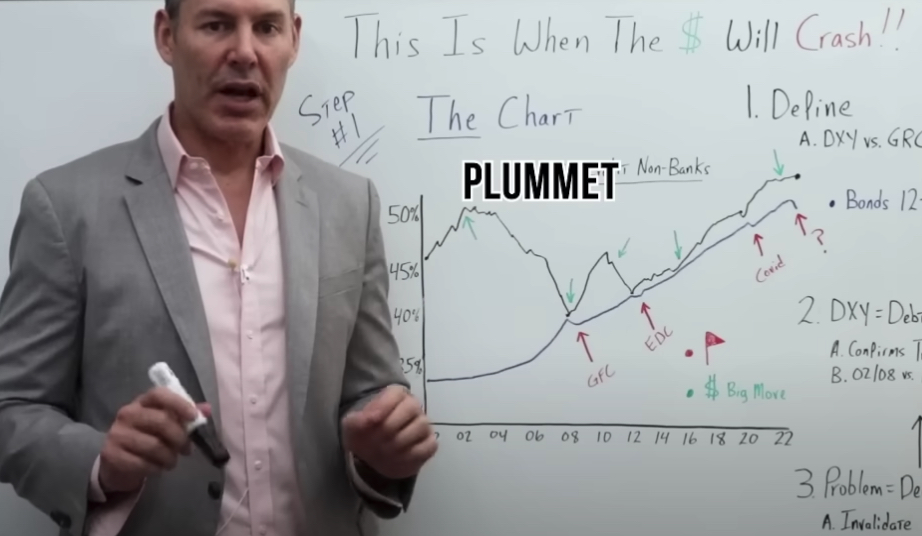

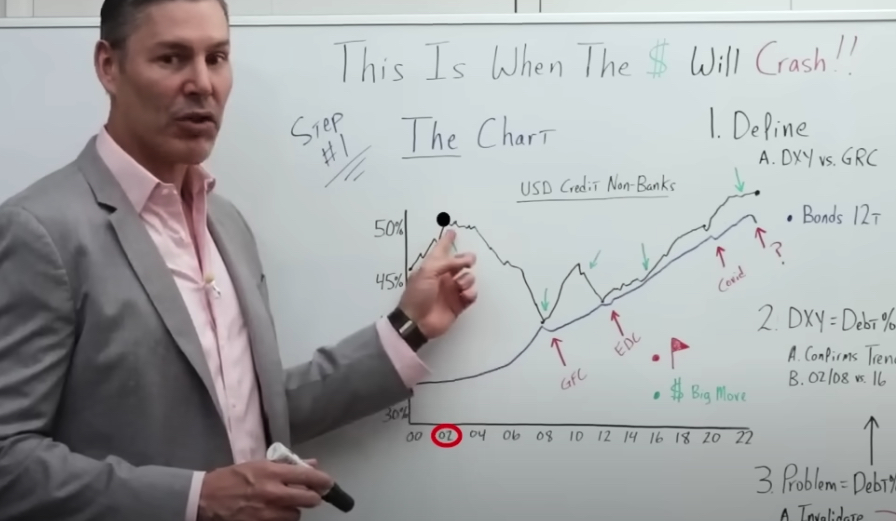

In the above chart, we go back to 2000, and debt is around 47%. We go up over 50% in 2002, but then we come crashing down to the GFC in 2008. Then debt spikes up and goes back down again. We then enter into a longer-term trend upward to where we are today.

All right, now, let's go over this blue line. The blue line represents bonds issued by non-bank entities which is also a form of debt.

We also have bank lending, represented by the red line (below).

Alright, so the blue line (bonds issued by non-banks) goes parabolic into the GFC then dips down again.

That brief dip translates to the amount of dollar debt going to non-bank entities, overall, going down. But the percentage of dollar debt going to non-bank entities (black line) starts to go right back up shortly thereafter. This is very important and we'll go over this trend in just a moment.

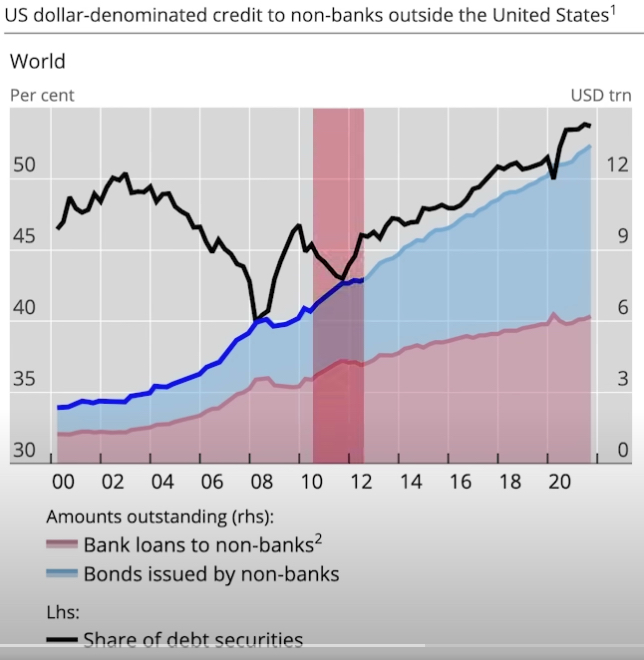

Then around 2010-2012 dollar debt dips down again when we have another kind of financial crisis. The European debt crisis.

And then it goes down again with the covid pandemic.

What is US dollar debt outside of the US doing today?

It's going down again.

Notice that every single time that the amount of dollar-denominated debt goes down – the GFC, the European Debt Crisis, Covid, and today – it always tells us that we are in some kind of global economic downturn.

[ctt template=”3″ link=”xc8cK” via=”no” ]Notice that every single time that the amount of dollar-denominated debt goes down – the GFC, the European Debt Crisis, Covid, and today – it always tells us that we are in some kind of global economic downturn.[/ctt]

Does The Current Global Economic Downturn Include The United States?

Right around 2002, the United States dollar started to plummet.

And we can see around 2002, when the dollar-denominated debt started to go down, the United States dollar went down as well.

In fact, the decline in debt confirmed that the down move in the dollar wasn't short-term.

It was a long-term trend that as we know, went all the way down to 2008 before it swung back the other way.

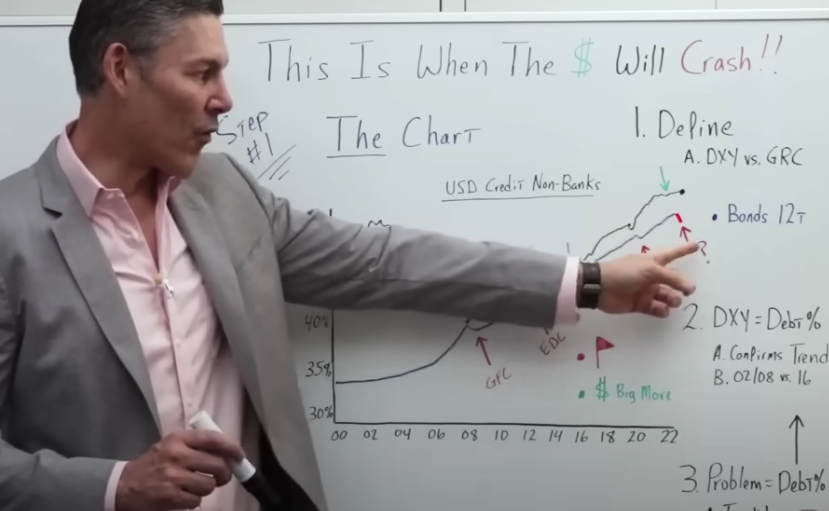

I think the catalyst to the dollar gaining strength, and the dollar debt, as a percentage of overall global debt going up, was the GFC. More on that in just a moment.

But right here, the dollar went down again, call it 2010.

Then we had another financial crisis, the European debt crisis, and then the dollar debt started to go back up as far as a percentage, and that kind of pulled the dollar up with it.

Then the same thing happened in 2016 without a global economic decline.

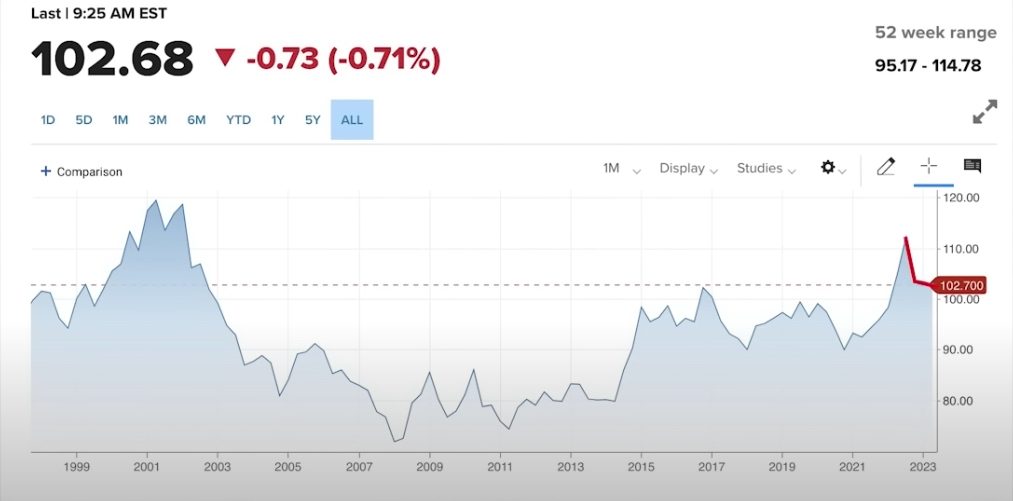

What's interesting is now, as we speak, the DXY is starting to move down again.

But the move has not been confirmed by the percentage of dollar-denominated debt, which is still going up.

And what's fascinating is right here we're in another down move in overall bonds and down move and the extension of bank credit to the nonbank entities represented by that red line.

That would lead us to believe there's a very high probability that we are going into another global economic downturn.

The question becomes, does that include the United States?

If the answer is yes, then this black line will most likely start to go back up.

If history is a guide, this would suggest this down move in the United States dollar that we've seen lately, is only temporary.

As I said earlier, if the black line that represents global dollar-denominated debt outside the US to nonbanks starts to go back down, then this would indicate, in my opinion, that it's confirming the most recent down move in the dollar.

Therefore, it isn't a short-term move, but a long-term move, like we saw from 2002 to 2008, when the dollar went from 118 on the DXY all the way down to the low 70s.

To quickly review so we're all on the same page. When the debt percentage goes down or up along with the DXY, it usually confirms the trend.

Said another way, when this black line follows the DXY, that means the DXY will most likely continue on its current trajectory like we saw from 2002-2008.

When the DXY went down in 2016, we saw that the black line didn't go down, it kept going up. So then the dollar followed suit and reversed its short-term trend. And we also know that when there's a global economic problem, usually the percentage of dollar debt goes up. In other words, that little black line.

So if that black line goes up this time as a result of this global economic downturn, that would invalidate the most recent down move and the dollar.

If this black line starts to go down again, that would confirm the down move, which would most likely take it into another long-term trend all the way back down to 70, and maybe even lower.

The moral of the story is to know when the United States dollar will crash, or if it will crash in the near term. You got to pay attention, to that little black line.

[ctt template=”3″ link=”Fr91L” via=”no” ]Pay attention to dollar-denominated debt to nonbanks outside the US. It has a history of telling us when the dollar will crash.[/ctt]