The 2023 real estate crash has started, causing home sales and house prices to decline. Even the New York Times is saying the housing market is worse than you think, with some experts comparing it to the great recession.

-

How low will prices go?

-

Why might this crash look a lot different than the financial crisis we saw in 2009? The past few years have been relatively stable, but last year's events have raised concerns about potential economic turmoil.

I'm going to explain this to you in one simple, fast step.

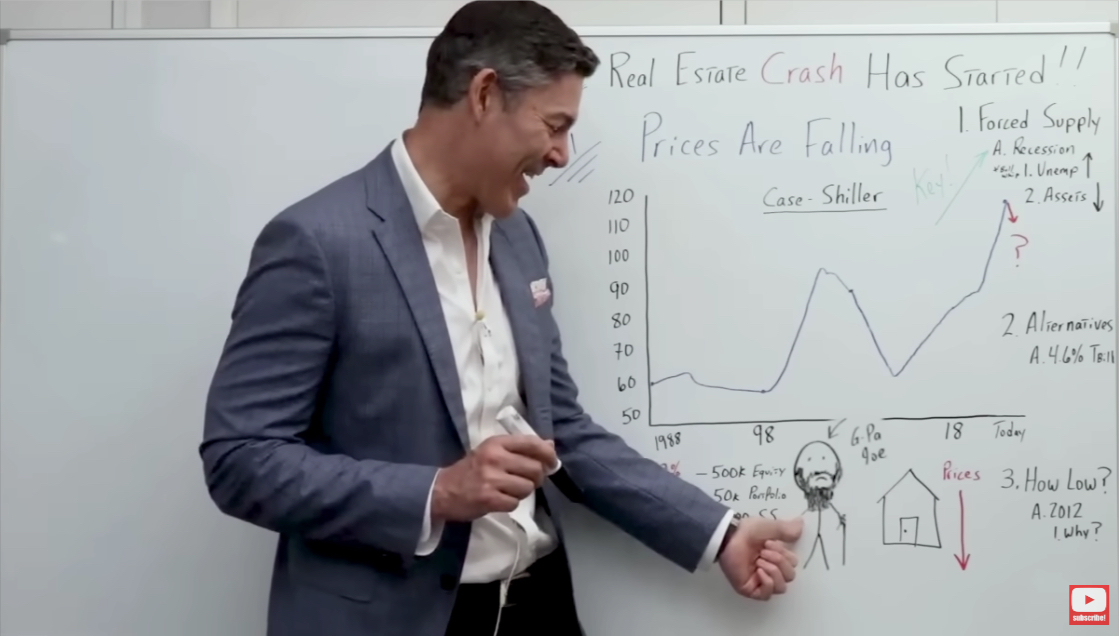

The Case Shiller Index is Predicting a 2023 Real Estate Crash

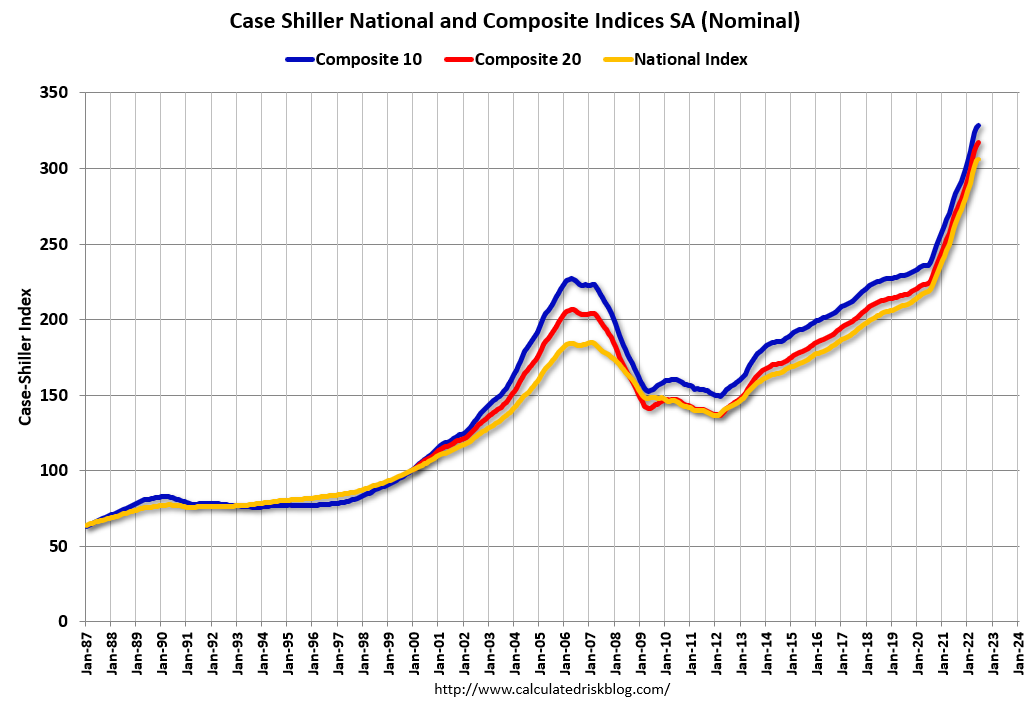

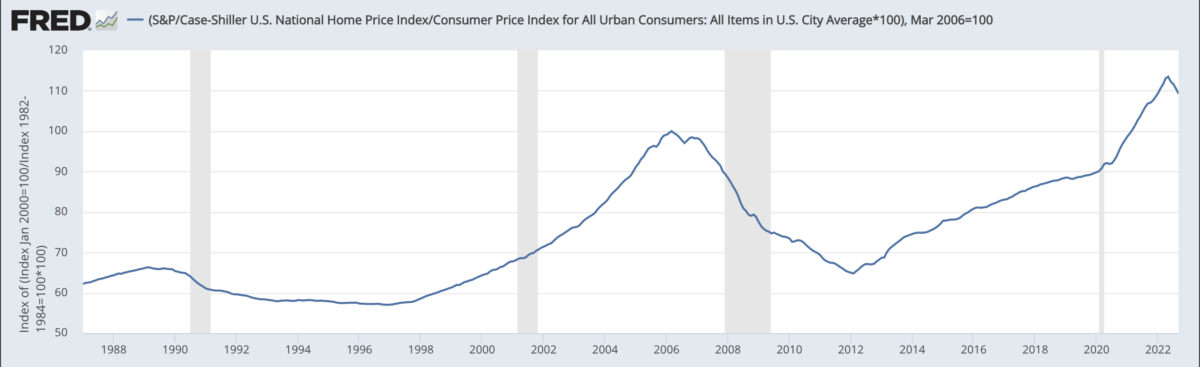

Let's get right into this Case Shiller chart of US home prices amidst concerns of a possible housing market crash and housing bubble. Homeowners are closely monitoring mortgage rates as they navigate this uncertain market.

The Case-Shiller Home Price Index is a widely used measure of US home prices. It is based on data from thousands of repeat sales transactions in hundreds of metropolitan statistical areas across the United States.

The index tracks changes in residential real estate values and home prices, using a three-month rolling average to smooth out volatility associated with seasonality. Additionally, it monitors trends in home sales and mortgage rates to provide a comprehensive picture of the housing market. Despite concerns of a housing market crash, this index remains reliable for tracking real estate fluctuations.

And we can see that prices are already falling in this housing market crash. This chart goes from 1987 to roughly today's date. On the left, it's an index. We go from 0 up to 350. Mortgage rates and the housing bubble have contributed to the decline in sales.

Around the time of 1986, which was a few years before the housing market crash, we were right around 60. Then over time, as we get into the 1990s, home prices drift down toward their historical trendline, and each year becomes more affordable.

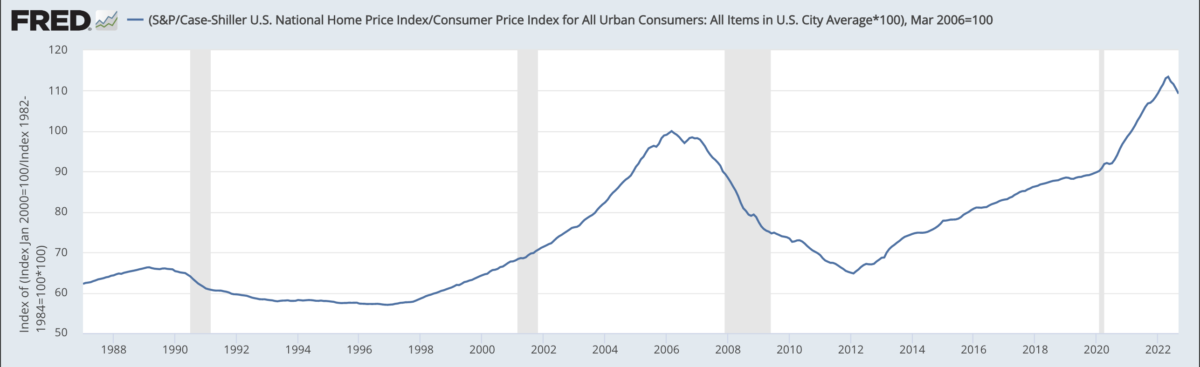

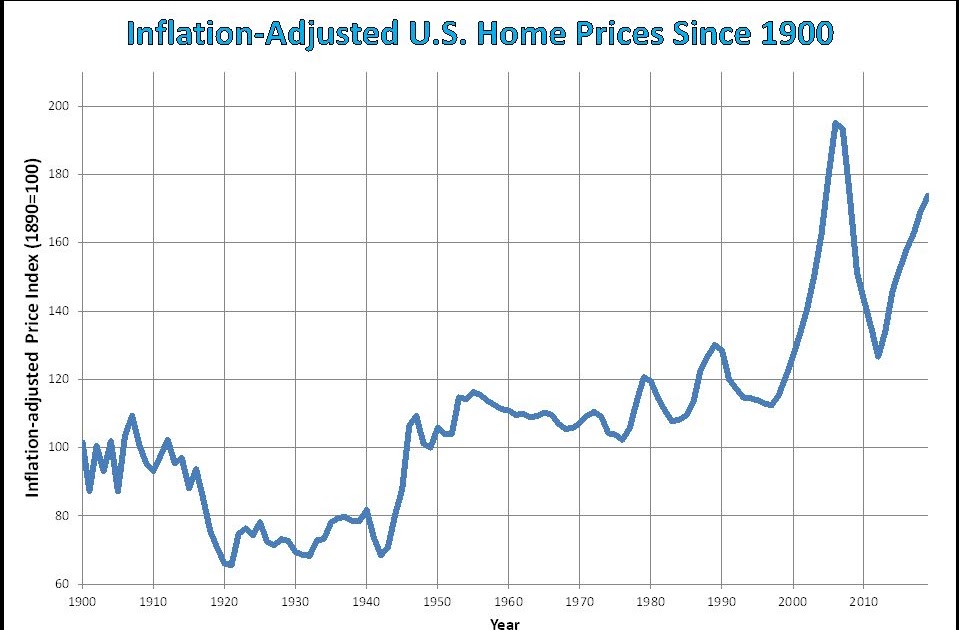

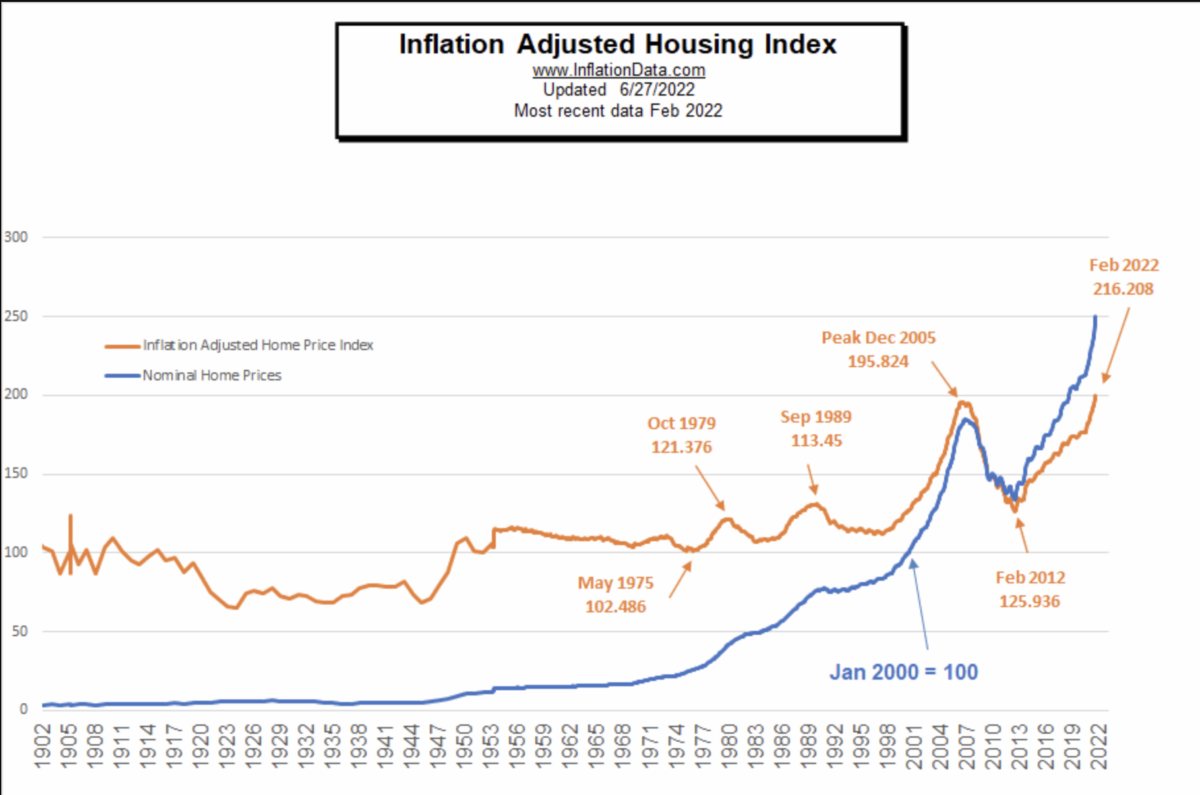

Going back to 1900, you can see that prices did not go up from 1900 to 1998 when you adjusted for inflation. However, mortgage rates have fluctuated over time, and the housing market crash of 2008 significantly impacted homeowners.

Prices did not go up from 1900 all the way to 1998 when you adjusted for inflation, despite fluctuations in mortgage rates and demand over time. However, this stability was disrupted by the housing market crash.

Prices did not go up from 1900 all the way to 1998 when you adjusted for inflation, despite fluctuations in mortgage rates and demand over time. However, this stability was disrupted by the housing market crash.

Then we go into the housing boom of the early 2000s. Mortgage rates were low, demand was high, and prices went parabolic. However, this led to a market crash.

The housing boom of the early 2000s

The housing boom of the early 2000s

Prices and rates go all the way up to 100 on this index. But then they come crashing all the way down to their historical trend line, or very near their trend line, going back to 1900. This affects the housing market as demand for mortgages decreases.

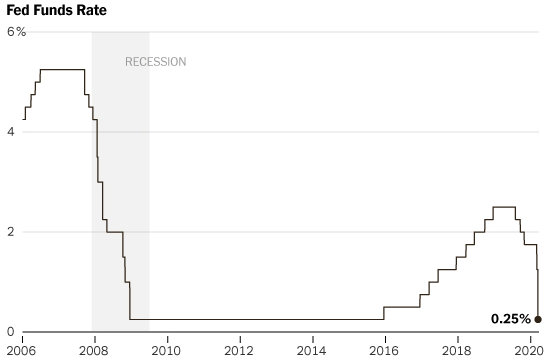

And then, the Fed comes in with quantitative easing, dropping interest rates, trying to prop up the economy.

And the housing market bottomed out in 2012 due to falling demand and high mortgage rates, causing a decline in home prices. However, the market quickly rebounds, and by the end of the year, home prices return to their previous levels.

Recently, since the cervesa sickness in 2020, and 2021, demand for housing has surged, and as a result, rates have gone even higher.

They are much higher than at the peak of the last bubble in 2006. However, experts are warning of a possible crash in the near future.

Now, let's go over some of the reasons you're not hearing in the mainstream media as to why prices in the housing market could come down even further. This is due to the possibility of a crash caused by rising mortgage rates.

Forced Supply

First and foremost, in the housing market, we've got what I call ‘forced supply' that could potentially lead to a crash in home prices.

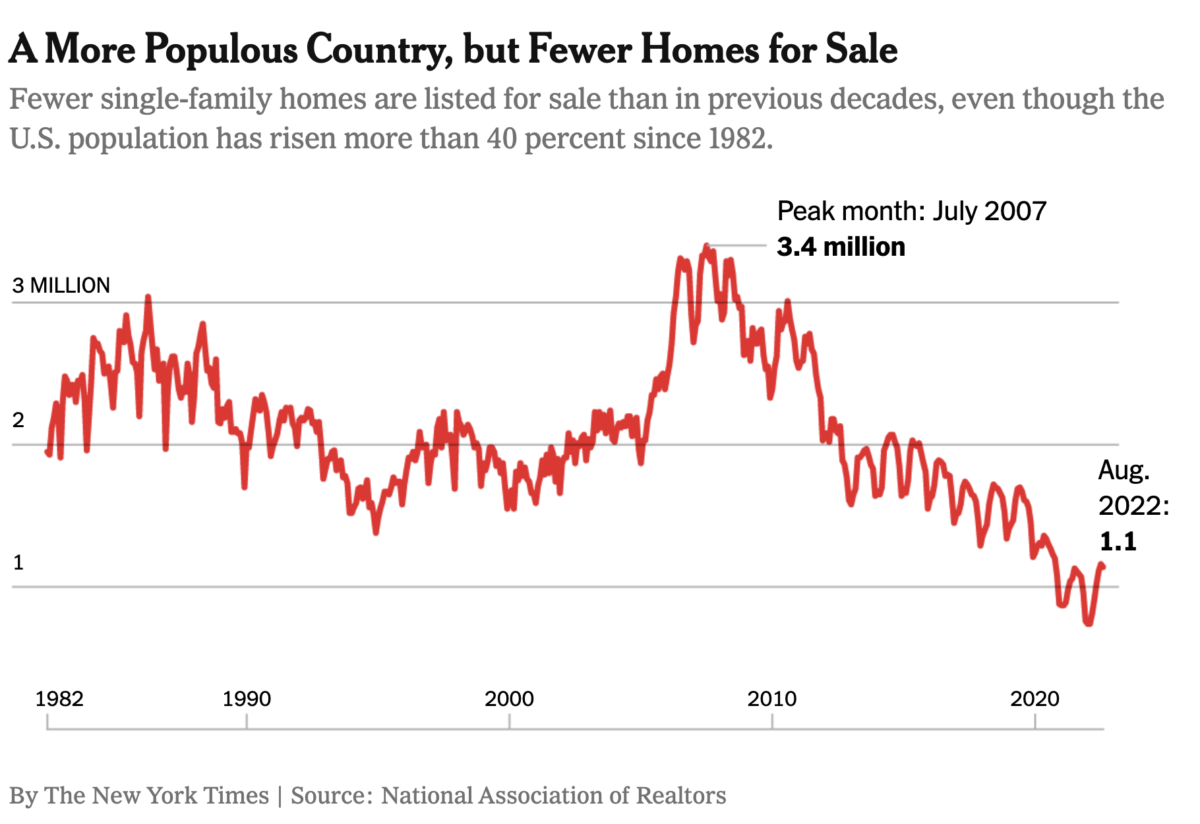

I'm sure when you listen to the news or CNBC. You always hear that the supply in the housing market is very, very low. Few people are selling their houses despite the skyrocketing home prices, and experts are worried about a possible crash.

And since housing prices are set at the margin, if there are very few homes for sale, and you still have significant demand, that's going to increase the prices of all the other homes across the United States that aren't currently on the market. However, this could also lead to a potential housing crash in the future.

Starter homes are unprofitable to build

Builders have not built starter homes because they're simply unprofitable in the current housing market. And what I mean by starter homes are the typical three-bedroom, two-bath, 1500-square-foot homes built in the 1960s, 1970s, and 1980s, which hit hard during the housing market crash.

We're not building more of those because they're not economically feasible. But this doesn't mean we can't have more supply of housing, including those homes affected by the crash, coming back onto the market. Let's think about this.

What could happen when we go into a recession?

If we go into recession, and this is key, you guys watch my videos, you know, we've been talking about the bond market and the inversions in the yield curve a lot. This inversion of the yield curve is a very powerful predictor of recession.

Are we already in a recession? Find out here.

So let's assume we go into a recession in 2023. The unemployment rate most likely goes up. And if we have a hard landing, it could go up significantly.

Also, we would see asset prices, like the stock market, go down. This could also affect the housing market.

We've already seen the bond market get crushed when interest rates, like on the 10-year, have gone from 50 basis points all the way up to now, let's say, 350 basis points—a massive increase in percentage terms.

Rates on the US 10-year treasury have increased from 50 basis points to over 350 basis points since July 2020, impacting the housing market.

Rates on the US 10-year treasury have increased from 50 basis points to over 350 basis points since July 2020, impacting the housing market.

So what that means is all of the retirees, and the average Joe and Jane's that had these bonds in their portfolio have taken a huge haircut due to the recent downturn in the housing market.

How bonds work

The yields on US Treasury bonds are inversely proportional to their price. As bond prices rise, yields fall. This indicates a growing investor demand for safe assets. Declining bond prices and rising yields indicate weaker demand in the housing market.

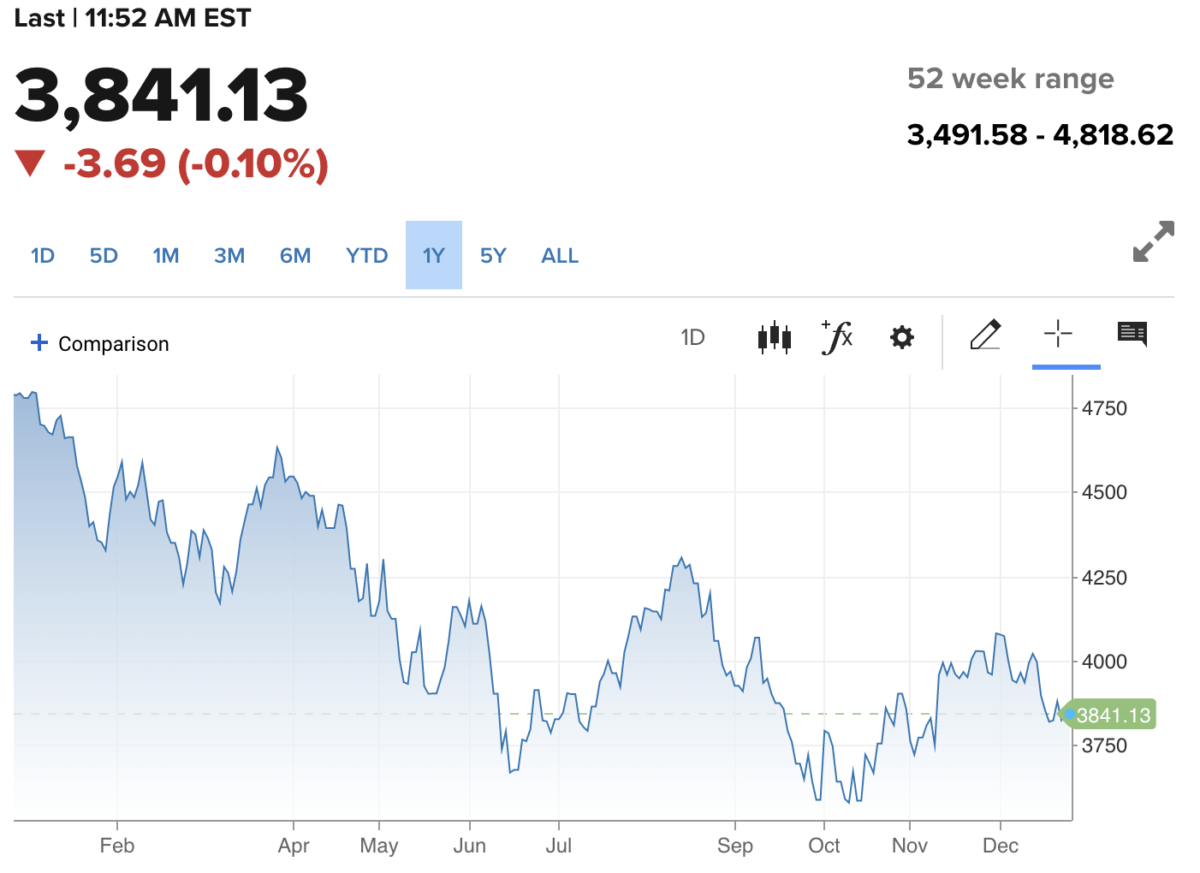

So if you combine that with the s&p 500 going down by, let's say, 30 or 40%, this is going to have a massive impact on a lot of homeowners throughout the United States in the housing market.

A 52-week range of S&P 500 experiencing a 30-40% drop in 2022, with potential implications for the housing market.

A 52-week range of S&P 500 experiencing a 30-40% drop in 2022, with potential implications for the housing market.

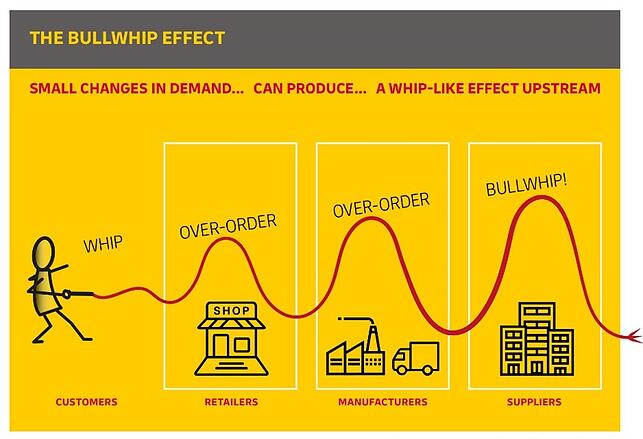

And going back to the unemployment rate, it's important to note that Michael Burry's bullwhip effect could also have an impact on the housing market.

The bullwhip effect is something we've talked about on this website extensively.

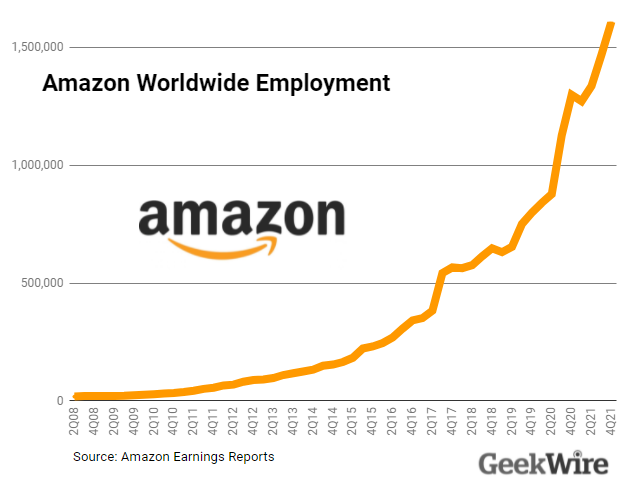

You've got companies like Amazon, which had 800,000 employees in 2019. And now they have over 1.6 million, despite the challenges faced by the housing market.

Number of amazon employees worldwide

Number of amazon employees worldwide

They hired all these additional people because of the economic sugar rush from all the stimulus checks. Well, those have now come to an end.

We could see Amazon maybe not go back to 800,000 employees. But even if they went back to a million employees, they're still having to lay off or fire 600,000 people. However, this could have an impact on the housing market.

And think about if that phenomenon happens throughout all the businesses in the United States, including the housing market.

We could see this dynamic in the housing market where people might not want to sell their houses, but they have to sell their houses. They don't have a choice.

An Example Of Forced Supply

We've got not the average Joe, the average Joe's grandfather. That's right. We've got Grandpa Joe, we'll call him. He's there with his cane. He's 75 years old, and he's retired.

The good news is Grandpa Joe has a house. And he has a significant amount of equity.

Grandpa Joe – He owns a house. He has equity. He's losing equity due to the changing market. He's worried about the housing market. He decides to equity strip and downsize his housing.

Grandpa Joe – He owns a house. He has equity. He's losing equity due to the changing market. He's worried about the housing market. He decides to equity strip and downsize his housing.

However, he's no dummy and sees housing prices going down. This is stressing him out, and he's losing a lot of sleep over this.

Let's say his portfolio right now includes $500,000 of equity in this house, maybe a $50,000 portfolio, which has taken a huge haircut because the bonds in the portfolio have gone down significantly in price due to the housing market, and then maybe he's getting $1,500 a month in Social Security.

Let's say right now he's got a 3% fixed-rate mortgage. He doesn't want to give that up. If he sells the home and buys another one, then his mortgage rate could go up to, let's say, 7%. He's motivated to keep his house.

But on the other side of the coin, he's looking around him, seeing prices coming down in the housing market. And he's reading the news about the recession. Maybe he's looking at the yield curve and how it's affecting the housing market.

And he says, “Wait a minute, here, the majority of my net worth, the amount of purchasing power that I need to get me to the end, at the end of my life, quite literally, is pretty much in this house.

I could sit back and hold the house in this volatile housing market and roll the dice, hoping the prices don't go down much further, or I could sell right now and extract that equity.

“I might have to rent a much smaller place in this tough housing market, but at least my purchasing power will last me into my 80s or 90s. And maybe even further to ensure I don't have to work at Walmart or McDonald's to make ends meet.”

This is just another example of forced supply coming onto the market because of a recession that could put downward pressure, even on nominal prices.

Alternative Investors Could Dump Their Rentals

Another thing you won't hear in the mainstream media is alternatives. From 2012 to pretty much today, all of these huge funds, like Blackstone, have been buying up housing properties all around the United States. Why? To dominate the market.

Because it was their best risk/reward, but now we've got t-bills yielding, say, 4.5-4.6%. And let's say that you get this on a six-month treasury.

Current yields on a 6-month treasury in the market as of this post, with no significant impact on the housing sector.

Current yields on a 6-month treasury in the market as of this post, with no significant impact on the housing sector.

So now you have these groups like Blackstone saying, “Well, wait a minute here, we're getting 5% on our rental properties. And we've got to deal with tenants and toilets. Why on earth would we do that when we could get 4.5% on a six-month t-bill, roll it over and have ultimate liquidity?”

And I'm not the only one that's pointing this out. My good buddy Adam Taggart recently interviewed housing market expert Nick Gerli on his show called Wealthion.

Nick Gerli: There are anywhere from 20 to 30 million single-family homes in America that are investor-owned and second-owned homes where the owner does not live. So think about that. That's a quarter of all single-family homes in America.

In terms of this logic and this thinking about what's going on in the market recession and housing.

These people can easily sell in the housing market. They don't live there. Right. And that's something we actually did not see as much in 2006, believe it or not. In 2006 we had a higher share of people actually living as primary occupants in the homes in the housing market than we do now.

And so that's something, especially in investor-driven housing markets, that I think could lead to a subprime 2.0 type of situation where the investors all of a sudden start selling.

We know already they've stopped buying in a lot of markets. But once they start selling, that has the potential to flood the market with inventory in a way that's very difficult for people to conceive of right now.

So we've gone from an environment of T.I.N.A, There Is No Alternative, to an environment where we've got plenty of alternatives, maybe a lot better than dealing with those rental properties. So what do they do?

They sell them onto the market to take that cash and buy treasuries.

Selling increases market supply, again putting further downward pressure on market prices.

So then the question becomes, okay, George, I get what you're saying here with the chart and the force supply the alternatives. This makes a lot of sense. But the main question I want to know is how low prices will go.

How Low Will House Prices Go?

Will we see home prices go all the way back to 2012? My answer is yes.

There are no certainties, only probabilities. This is my base case, but here's the catch. They might not go down that far in nominal terms. Only when you adjust for inflation.

Here's a chart of the housing market in the 1970s housing market.

An inflation-adjusted chart of the 1970s housing market

An inflation-adjusted chart of the 1970s housing market

We can see that housing prices throughout the 1970s went up nominally (blue line), although there were a couple of periods where they plateaued. So compare that to prices where inflation is removed (orange line). You get a much different picture.

Nominal vs. Inflation-adjusted

-

The nominal value of any economic statistic is measured in terms of actual prices that exist at the time. These prices include the price effects of inflation.

-

Inflation-adjusted refers to the same statistic after removing the effect of price inflation from the data.

You can see a couple of peaks, but prices at certain times actually came right back down. And this is what I think you'll most likely see throughout the 2020s.

New York Times – The Housing Market Is Worse Than You Think

New York Times – The Housing Market Is Worse Than You Think

Right now, we've seen nominal prices coming down.

And if we look at many articles out there, like this New York Times article, a lot of Experts are predicting that prices could go down in nominal terms, well, let's say 20%, just in 2023.

What If High Inflation Persists?

If we continue with high rates of inflation, at 10%, maybe 7%, or even 5% compounded year after year, it doesn't take you long, maybe three or four years before housing prices adjusted for inflation, go right back to where they were in 2012.

The next real estate crash that we could be going into right now may look a lot different than what we saw in 2009 when nominal prices came crashing straight down.

This time, they might come down slightly. They might even plateau. But when you combine that with the relatively high inflation rate, you would see the same chart in real terms, but in nominal terms, the chart would look a lot more like it did in the 1970s.